© SpaceX

Please remember that the value of an investment can fall and you may not get back the amount invested.

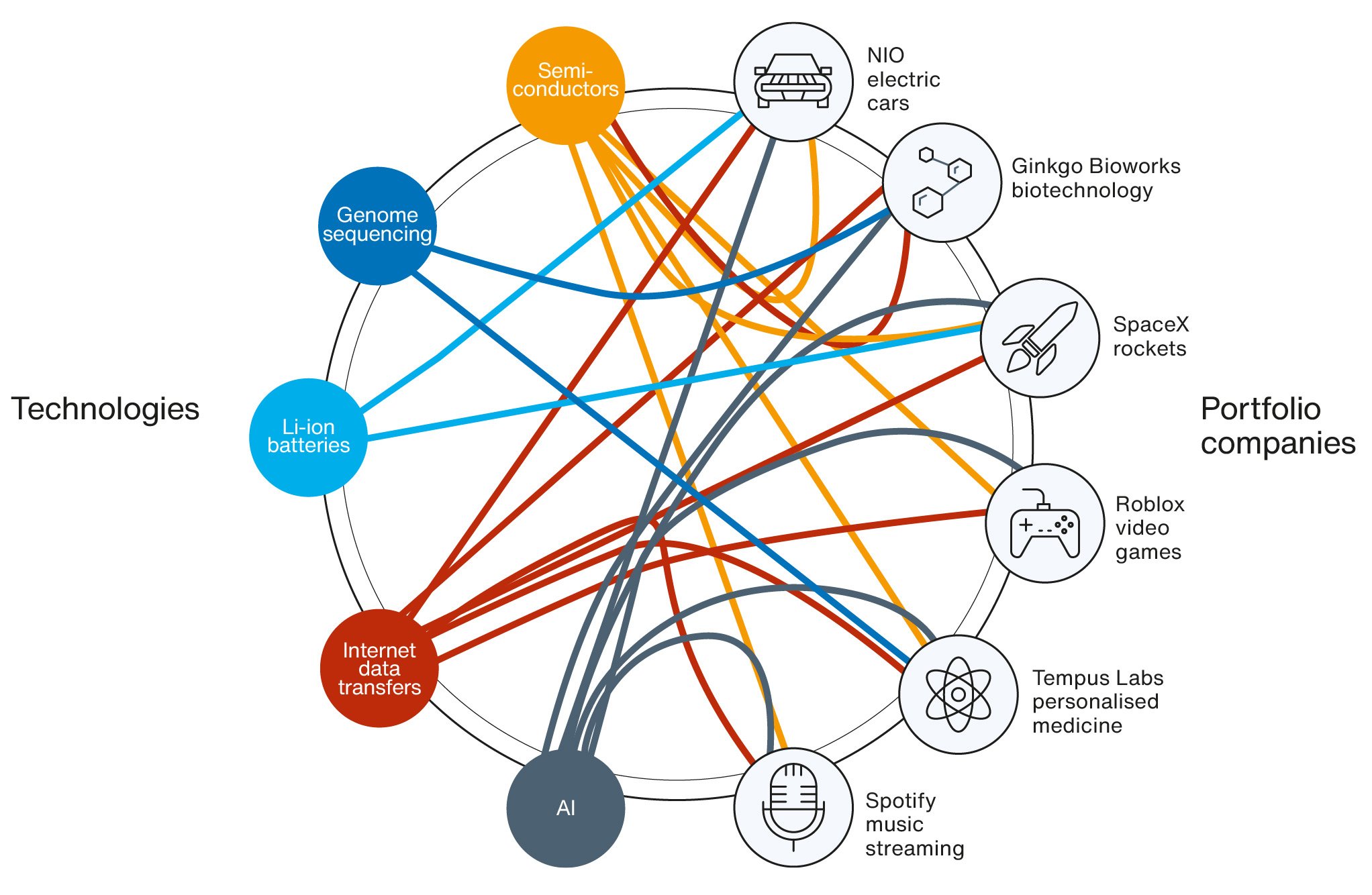

Innovators draw on past discoveries to develop their ideas. Then companies combine them to create new products.

Take Moderna’s mRNA vaccines. The firm pioneered a way to teach cells to trigger an immune response by building on earlier work. And it relies on genomic sequencing, cloud computing and other technologies to engineer its treatments for Covid, cancer and other diseases.

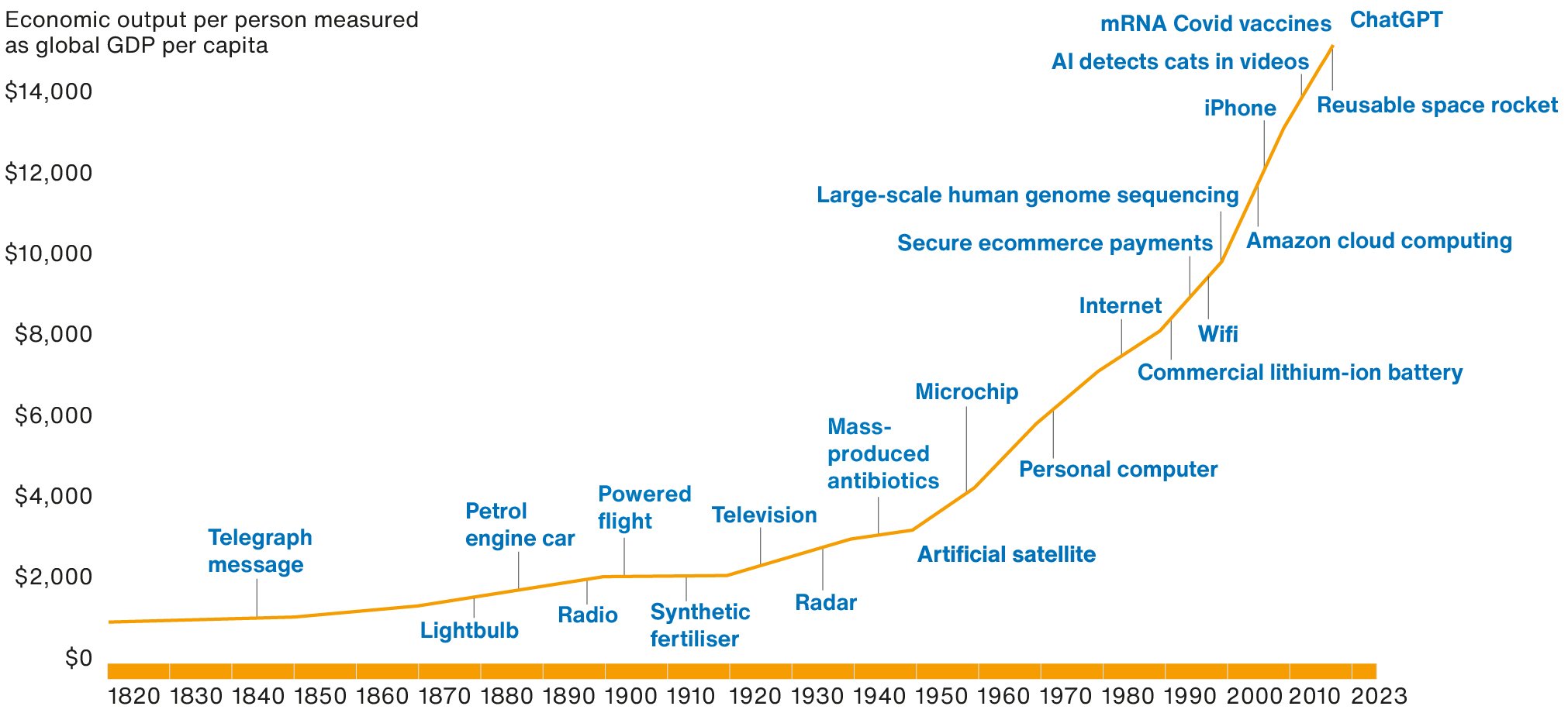

Each technological breakthrough unlocks a multitude of novel combinations, strengthening the drumbeat of innovation. And that drumbeat also benefits from the fact that some technologies advance exponentially.

For example, a regular doubling of computing power helped drive progress over the past 60 years. And artificial intelligence’s accelerated pace of development holds promise for the decades ahead. Adoption rates also appear to be speeding up, as evidenced by the ChatGPT chatbot amassing 100 million users in just two months.

Innovation’s drumbeat didn’t result from low interest rates or cheap money, and it will continue regardless of current economic gyrations. Over the long term, this should lead to productivity gains and economic growth. Baillie Gifford seeks to invest in companies that either will gain sustainable advantage from innovation-led change or have assets that will rise in value as a result.

Technologies scale over time

Semiconductors

1961: Fairchild microchip had four transistors

2023: NVIDIA GH200 Grace Hopper super chip has 200bn transistors

Global bandwidth

1969: Internet’s precursor ARPANET was initially limited to 50 kilobits per second of capacity

2023: Internet bandwidth reaches 997 terabits per second

Lithium-ion batteries

1991: First commercial li-ion battery cost $7,523 per kWh

2023: Li-ion batteries cost $152 per kWh

Human genome

2001: It cost $95m to sequence one human genome

2023: Illumina’s NovaSeq X sequences human genome for $200

Complexity of AI models

2012: AlexNet image recognition model had 60m parameters (variables controlling its behaviour)

2023: Google’s PaLM model has 540bn parameters

Sources: Alphabet, BloombergNEF, computerhistory.org, Illumina, NVIDIA, Our World In Data, Telegeography.

The alchemy of innovation

How some of our portfolio companies combine technologies

Progress powers prosperity

Global gross domestic product (GDP) per capita adjusted for inflation and differences in costs of living between countries. Data shown in US dollars at 2011 prices.

Sources: Our World In Data, Maddison Project Database 2020 (Bolt and van Zanden, 2020).

1844: Samuel Morse demonstrates the telegraph by sending the message “what hath God wrought” in code.

1879: Thomas Edison creates an incandescent carbon filament electric light bulb in his New Jersey lab.

1886: Carl Benz reveals the first car powered by a gasoline engine to the public and applies for a patent.

1897: Guglielmo Marconi sends the radio message, “can you hear me”, across the Bristol Channel, which his colleagues receive.

1903: In North Carolina, brothers Wilbur and Orville Wright achieve the first sustained flight of a powered aircraft.

1913: BASF starts making fertiliser at a German factory using the Haber-Bosch process, which combines nitrogen and hydrogen, helping farmers to increase crop yields.

1926: John Logie Baird gives the world’s first public demonstration of television in London.

1935: Sir Robert Watson-Watt demonstrates a radar-based system for detecting aircraft to the UK’s Air Ministry.

1944: Pfizer begins large-scale penicillin production in the US, making it the first mass-made antibiotic.

1957: Russia launches Sputnik into orbit, Earth’s first artificial satellite

1958: Texas Instruments engineer Jack Kilby creates the first integrated circuit, which becomes better known as the microchip.

1971: John Blankenbaker builds the Kenbak-1, which many historians later recognise as the first personal computer.

1983: The internet gets established thanks to the creation of the Transfer Control Protocol/Internetwork Protocol (TCP/IP), which gives different computer networks a standard way to communicate.

1991: Sony releases the first commercial lithium-ion battery to power its Handycam video recorder.

1994: Amazon, Pizza Hut and others debut secure ecommerce payment systems, giving customers the confidence to shop online.

1997: Wifi’s launch is marked by the release of the 802.11 protocol, providing wireless data transfer speeds of up to two megabits per second.

1999: The Human Genome Project declares the start of full-scale human genome sequencing after scientists decipher the DNA code of a human chromosome.

2006: Amazon launches its cloud computing business with Elastic Compute Cloud (EC2), which lets customers run their applications remotely on its hardware.

2007: Steve Jobs unveils Apple’s first iPhone and puts it on sale the same year, paving the way to the mass adoption of smartphones.

2012: Scientists at Google train a neural network to recognise when cats appear in YouTube clips, leading to the widespread use of AI to analyse video.

2017: SpaceX launches a ‘pre-flown’ booster – a nine-engine rocket base – into space, allowing the firm to reuse the most expensive parts of its Falcon 9 rockets.

2020: Moderna and Pfizer-BioNTech release Covid-19 vaccines based on messenger ribonucleic acid (mRNA) technology.

2022: OpenAI launches ChatGPT, sparking widespread use of its generative artificial intelligence chatbot, which can respond to a wide range of text-based queries.

At the time of publication, in addition to Scottish Mortgage, the following trusts were invested in the companies mentioned above:

Illumina – Keystone Positive Change, Monks

Moderna – Keystone Positive Change, Monks, US Growth

NVIDIA – Monks, US Growth

Roblox – US Growth

SpaceX – Edinburgh Worldwide, Monks, US Growth

Spotify – European Growth, Monks

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in October 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226. Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

77228 10040826