Key Points

- Games Workshop, the creator of hugely popular fantasy game Warhammer, has considerable growth potential

- It is primed for success in North America, Germany and Asia, and has partnerships with brands such as Sega and Marvel

- With more people searching for indoor pursuits and a sense of community, Mileva believes the company is onto a winner

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This article was originally featured in Baillie Gifford’s Autumn 2020 issue of Trust magazine.

When Milena Mileva became joint manager of the Baillie Gifford UK Growth Trust, she hadn’t anticipated spending 45 minutes on a company visit painting a miniature space marine. The company was Games Workshop. It crafts miniature figurines for table-top games based in a fantasy universe, including the grim science fiction future of Warhammer 40,000. A key attraction is assembling and painting the figurines. As well as Mileva’s chosen space marine, there are surgically enhanced warrior-monks and hideous green ‘orks’ who relish a fight and speak in cockney accents.

Mileva had never played Warhammer (see section below) until her team considered investing in Games Workshop, its creator. She was struck by the craftsmanship of the company’s game pieces.

“It’s the craft of spending time on your own to create something beautiful, along with the opposite aspect, of being in a community with others who love it,” Mileva says. The company also publishes short stories, audio dramas and novels about the never-ending battles we can look forward to in 38,000 years’ time. Its fusion of fantasy worlds is inspired by JRR Tolkien and the dark tales of sci-fi writer Michael Moorcock

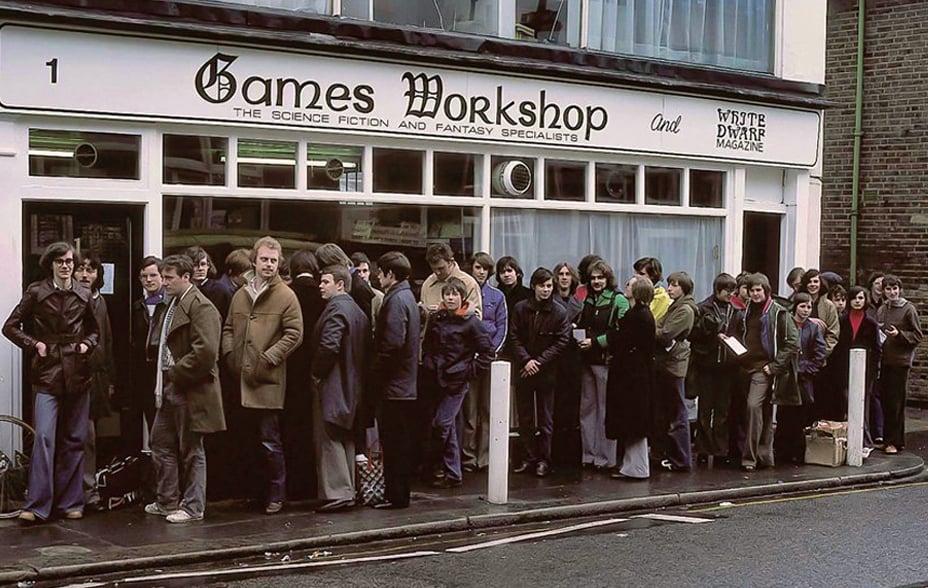

Games Workshop is both a quirky British games maker and a FTSE 250 business with tremendous potential for growth. Founded in 1975, it now boasts 517 stores globally, more in North America and in mainland Europe than in the UK. Warhammer is the focus, but it produces a Lord of the Rings-inspired Battle of Pelennor Fields boxed game, along with miniature hobbits, wizards, and a 42-piece model of Smaug the dragon. The company also makes smaller, more accessible games such as Kill Team and Underworlds: Beastgrave that act as a gateway for new players and help grow the loyal fanbase.

The business enjoyed a meteoric rise for the decade after its stock market listing in 1994, but then hit “a rather prolonged air pocket”, explains Mileva. Its current chief executive, Kevin Rountree, took over in 2015. He introduced sweeping changes that a sceptical player-fanbase greeted with surprise and joy. The gaming press called him the breath of fresh air the business needed. Over the past five years, the company’s share price has increased by more than 1,400 per cent. On 1 June 2020, its market capitalisation was higher than that of British Gas owner Centrica.

“I was intrigued when one of our researchers first explored Games Workshop in early 2019,” Mileva recounts. She visited its Nottingham headquarters and “came back feeling more confident than I have about any investment for some time”. In a “vain attempt to give myself a cold shower”, she sent one of her team’s investigative researchers to follow up. Her findings endorsed Mileva’s intuition. Further research convinced her and colleagues that Games Workshop’s recent growth was no blip.

The company has invested in itself in the last couple of years: £11m in its design studio and another £3m on tooling for new plastic miniatures. It makes these intricate figures with high-end injection moulding machines and doesn’t use outside suppliers. Last year’s new paint range included ‘ork flesh’ (light green) and ‘blood angels red’.

North America, Germany, and, in the longer term, Asia loom large as growth markets. Albeit from a low base, Chinese sales grew 67 per cent in 2018–19, a new Shenzhen store being added to five in Shanghai. Warhammer is increasingly accessible in Mandarin. Rountree’s decision to allow independent retailers to sell its products online has proved a success, according to Mileva. Games Workshop has also got better at monetising its loyal customer base, improving its relationship with hobbyists. Fans clocked up 114m visits to warhammer-community.com in 2018, double the previous year’s total. “For me, this world beautifully straddles the digital and physical – it’s a powerful combination,” says Mileva.

Games Workshop’s fast-growing royalty income is where the four decades spent constructing rich fictional worlds could help make this a very valuable business indeed. Warhammer is likely to yield more licensing partnerships such as the 2016 video game tie-up with Japanese developer Sega. Joint comic books with Marvel arrive on shelves this autumn. Work is underway on a TV series with Big Light Productions, makers of Amazon Studios’ The Man in the High Castle. The company avoided licensing deals before Rountree, but now recognises the value of royalties. Currently making up only 18 per cent of profits, these numbers could increase substantially.

Waging Warhammer

Warhammer Fantasy started in 1983 and has spawned multiple editions since. The two most popular are Warhammer 40,000, in which humans battle alien forces in space, and Warhammer: Age of Sigmar, which takes place in a bloodthirsty and brutal medieval setting.

Warhammer was the first miniature wargame to be played with proprietary characters: unlike with previous fantasy games, rulebooks and generic models were not available from other manufacturers.

The game takes up to four hours to play. Alternative throws of a die see model miniatures move prescribed distances and clash with opponents according to strictly graded power levels. Winning depends on achieving a pre-arranged condition of victory: whether exterminating the enemy or holding a strategic objective for an agreed period.

Players can represent human inhabitants of a kind of cosmic Holy Roman Empire, elves, orks and ‘warriors of chaos’. The cast is vast, “so everyone can find representation and heroes they can relate to”, according to the Warhammer Community website.

You can explore the Warhammer universe in the magazine White Dwarf, while Games Workshop’s publishing division, Black Library, produces books featuring characters, storylines and fan groups.

British actor Henry Cavill, who plays Superman, described how he spent his coronavirus quarantine painting Warhammer miniatures. Another hobbyist said online: “I love Warhammer because you get to say sentences like ‘where did I put my box of skulls?’ without being a danger to everyone around you.” The passion people have for its brand of narrative content is palpable. It’s rare for a company to inspire this kind of devotion, Mileva believes. That underpins its competitive position.

With more of us than ever searching for indoor pursuits and a real or virtual sense of community, Mileva believes Games Workshop is onto a winner. Now that Game of Thrones is over, and people are marooned indoors, living through days at times resembling a sci-fi zombie apocalypse, looking for growth in the world of zombies, orks, and wizards no longer seems the stuff of fantasy.

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Baillie Gifford UK Growth Trust | 9.9 | -1.0 | 2.9 | 31.5 | -36.3 |

| FTSE All-Share Index |

5.9 | 2.7 | -16.6 | 27.9 | -4.0 |

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in the Autumn of 2020 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Source disclaimer

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, is/are a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

A Key Information Document is available by visiting www.bailliegifford.com

If you would like to register to receive Trust magazine please visit www.bailliegifford.com/trust

Ref: 28904 10000696

Pádraig Belton

Pádraig Belton writes on a range of topics for the BBC, while completing a doctorate in politics at the University of Oxford. He’s a volunteer driver for St John Ambulance.