Key points

Milena Mileva, manager of the Baillie Gifford UK Equity Focus Fund talks about Games Workshop – a firm with a fanatical following.

Please remember that investment markets can go down as well as up and market conditions can change rapidly. The value of an investment in the fund, and any income from it, can fall as well as rise and investors may not get back the amount invested.

This article originally featured in Baillie Gifford’s Autumn 2020 issue of Trust magazine.

When Milena Mileva became manager of the Baillie Gifford UK Equity Focus Fund, she hadn’t anticipated spending 45 minutes on a company visit painting a miniature space marine. The company was Games Workshop. It crafts miniature figurines for table-top games based in a fantasy universe, including the grim science fiction future of Warhammer 40,000. A key attraction is assembling and painting the figurines. As well as Mileva’s chosen space marine, there are surgically enhanced warrior-monks and hideous green ‘orks’ who relish a fight and speak in cockney accents.

Mileva had never played Warhammer (see section below) until her team considered investing in Games Workshop, its creator. She was struck by the craftsmanship of the company’s game pieces.

“It’s the craft of spending time on your own to create something beautiful, along with the opposite aspect, of being in a community with others who love it,” Mileva says. The company also publishes short stories, audio dramas and novels about the never-ending battles we can look forward to in 38,000 years’ time. Its fusion of fantasy worlds is inspired by JRR Tolkien and the dark tales of sci-fi writer Michael Moorcock.

Games Workshop is both a quirky British games maker and a FTSE 250 business with tremendous potential for growth. Founded in 1975, it now boasts 517 stores globally, more in North America and in mainland Europe than in the UK. Warhammer is the focus, but it produces a Lord of the Rings-inspired Battle of Pelennor Fields boxed game, along with miniature hobbits, wizards, and a 42-piece model of Smaug the dragon. The company also makes smaller, more accessible games such as Kill Team and Underworlds: Beastgrave that act as a gateway for new players and help grow the loyal fanbase.

The business enjoyed a meteoric rise for the decade after its stock market listing in 1994, but then hit “a rather prolonged air pocket”, explains Mileva. Its current chief executive, Kevin Rountree, took over in 2015. He introduced sweeping changes that a sceptical player-fanbase greeted with surprise and joy. The gaming press called him the breath of fresh air the business needed. Over the past five years, the company’s share price has increased by more than 1,400 per cent. On 1 June 2020, its market capitalisation was higher than that of British Gas owner Centrica.

“I was intrigued when one of our researchers first explored Games Workshop in early 2019,” Mileva recounts. She visited its Nottingham headquarters and “came back feeling more confident than I have about any investment for some time”. In a “vain attempt to give myself a cold shower”, she sent one of her team’s investigative researchers to follow up. Her findings endorsed Mileva’s intuition. Further research convinced her and colleagues that Games Workshop’s recent growth was no blip.

The company has invested in itself in the last couple of years: £11m in its design studio and another £3m on tooling for new plastic miniatures. It makes these intricate figures with high-end injection moulding machines and doesn’t use outside suppliers. Last year’s new paint range included ‘ork flesh’ (light green) and ‘blood angels red’.

North America, Germany, and, in the longer term, Asia loom large as growth markets. Albeit from a low base, Chinese sales grew 67 per cent in 2018–19, a new Shenzhen store being added to five in Shanghai. Warhammer is increasingly accessible in Mandarin. Rountree’s decision to allow independent retailers to sell its products online has proved a success, according to Mileva. Games Workshop has also got better at monetising its loyal customer base, improving its relationship with hobbyists. Fans clocked up 114m visits to warhammer-community.com in 2018, double the previous year’s total. “For me, this world beautifully straddles the digital and physical – it’s a powerful combination,” says Mileva.

Games Workshop’s fast-growing royalty income is where the four decades spent constructing rich fictional worlds could help make this a very valuable business indeed. Warhammer is likely to yield more licensing partnerships such as the 2016 video game tie-up with Japanese developer Sega. Joint comic books with Marvel arrive on shelves this autumn. Work is underway on a TV series with Big Light Productions, makers of Amazon Studios’ The Man in the High Castle. The company avoided licensing deals before Rountree, but now recognises the value of royalties. Currently making up only 18 per cent of profits, these numbers could increase substantially.

Warhammer fantasy

Warhammer Fantasy started in 1983 and has spawned multiple editions since. The two most popular are Warhammer 40,000, in which humans battle alien forces in space, and Warhammer: Age of Sigmar, which takes place in a bloodthirsty and brutal medieval setting.

Warhammer was the first miniature wargame to be played with proprietary characters: unlike with previous fantasy games, rulebooks and generic models were not available from other manufacturers.

The game takes up to four hours to play. Alternative throws of a die see model miniatures move prescribed distances and clash with opponents according to strictly graded power levels. Winning depends on achieving a pre-arranged condition of victory: whether exterminating the enemy or holding a strategic objective for an agreed period.

Players can represent human inhabitants of a kind of cosmic Holy Roman Empire, elves, orks and ‘warriors of chaos’. The cast is vast, “so everyone can find representation and heroes they can relate to”, according to the Warhammer Community website.

You can explore the Warhammer universe in the magazine White Dwarf, while Games Workshop’s publishing division, Black Library, produces books featuring characters, storylines and fan groups.

British actor Henry Cavill, who plays Superman, described how he spent his coronavirus quarantine painting Warhammer miniatures. Another hobbyist said online: “I love Warhammer because you get to say sentences like ‘where did I put my box of skulls?’ without being a danger to everyone around you.” The passion people have for its brand of narrative content is palpable. It’s rare for a company to inspire this kind of devotion, Mileva believes. That underpins its competitive position.

With more of us than ever searching for indoor pursuits and a real or virtual sense of community, Mileva believes Games Workshop is onto a winner. Now that Game of Thrones is over, and people are marooned indoors, living through days at times resembling a sci-fi zombie apocalypse, looking for growth in the world of zombies, orks, and wizards no longer seems the stuff of fantasy.

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| Baillie Gifford UK Equity Focus Fund | – | -10.4 | 24.9 | 16.0 | 2.6 |

| FTSE All-Share Index | – | -9.5 | 19.2 | -9.8 | 18.3 |

| FTSE All-Share Index +1.5% | – | -8.1 | 21.0 | -8.5 | 20.1 |

| IA UK All Companies Sector | – | -11.2 | 22.2 | -6.0 | 17.3 |

Performance source: StatPro, FE, FTSE, total return in sterling. Returns reflect the annual charges but exclude any initial charge paid. The Baillie Gifford UK Equity Focus Fund launched on 02 August 2017.

Past performance is not a guide to future returns.

The manager believes this is an appropriate target given the investment policy of the fund and the approach taken by the manager when investing. In addition the manager believes an appropriate performance comparison for this fund is the Investment Association UK All Companies Sector.

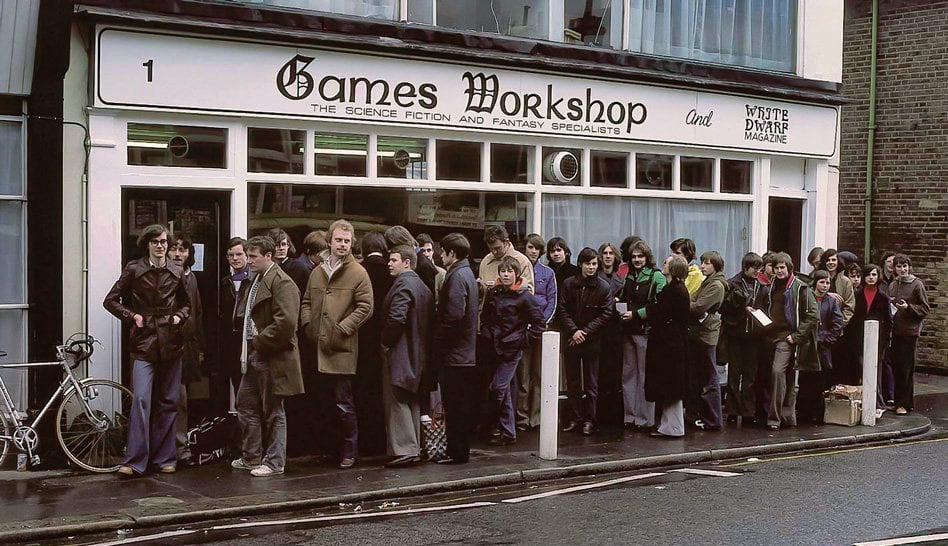

Where it all began in 1978. Games Workshop opens its first store in Hammersmith, London.

If you would like to register to receive Trust magazine please visit www.bailliegifford.com/trust

The fund’s exposure to a single market may increase share price movements. The fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the 'LSE Group'). © LSE Group 2020. FTSE Russell is a trading name of certain of the LSE Group companies. ['FTSE','Russell'] are a trade mark(s) of the relevant LSE Group companies and are used by any other LSE Group company under license. 'TMX®' is a trade mark of TSX, Inc. and used by the LSE Group under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Ref: 14230 10000700