Key points

The US Equity Team consider fund performance, market volatility and resilience following the end of the first financial quarter of 2022.

The value of an investment, and any income from it can fall as well as rise and investors may not get back the amount invested. Past performance is not a guide to future returns

The volatility since early 2020 is unprecedented in the American Fund’s 25-year history. We did not consider outperformance of 110 per cent in 2020 possible, nor did we envisage underperformance by 30 per cent in 2021, with continued weak performance this quarter. Steep share price falls have occurred recently amid a challenging backdrop of ongoing supply chain disruption and the highest level of inflation in the US for 30 years. We are horrified by the invasion of Ukraine and the tragic loss of life it is inflicting.

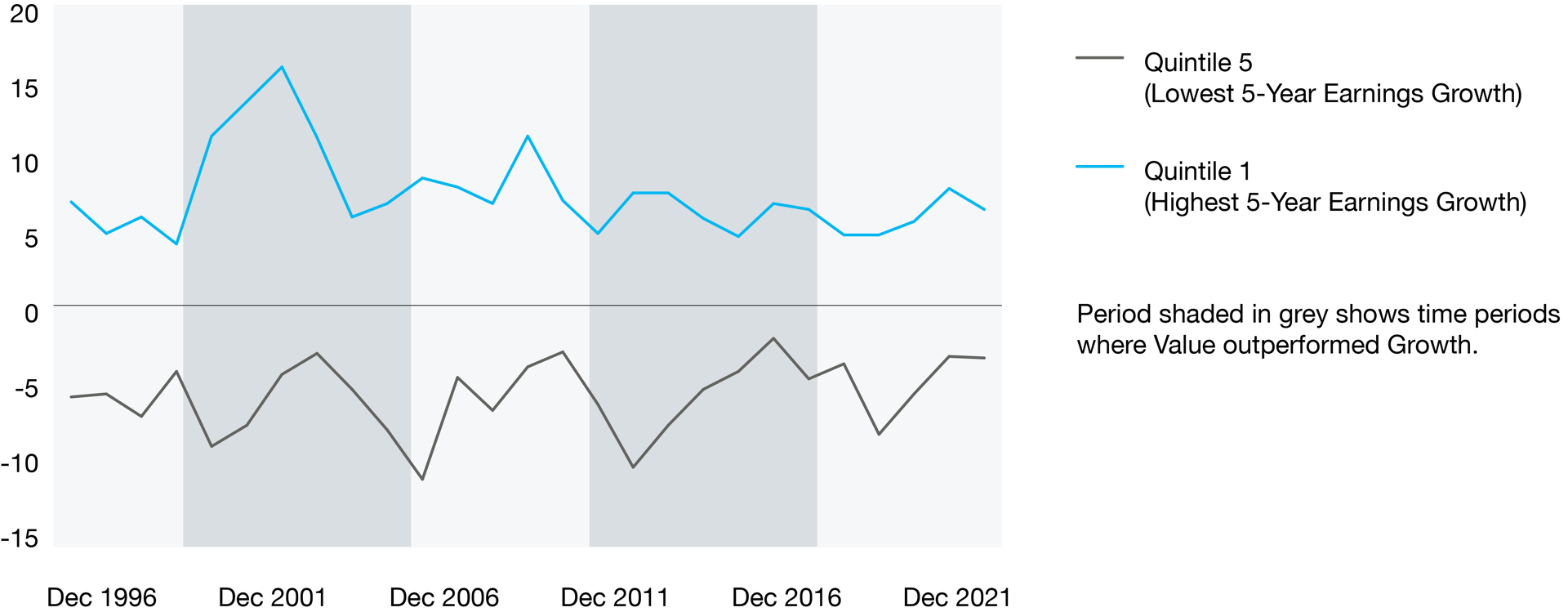

Decision making during times of stress is challenging. We are acutely aware of the pressure recent levels of underperformance place on our clients. It creates pressure to act, to believe that the world order has changed and one’s approach to investing must change as well. We have analysed the resilience of our portfolio to this environment, and our firm belief is that maintaining a long-term growth investing mindset provides the best chance of continuing to deliver strong long-term outperformance. We aim to invest in innovative, disruptive businesses which deliver broadly top quintile growth over the next five years. The chart below demonstrates that this group of stocks has outperformed in every five-year period since 1995. This pattern has persisted through periods of conflict, tranquillity, low and high inflation and during periods where growth or value has been in vogue. We draw comfort from the belief that we are exploiting a persistent market anomaly driven by the short-termism of others. This is the difference between growth and momentum investing, and we must stay the course for the benefit of long-term returns.

Five-year returns by five-year Earnings Growth Quintile

Heroes and villains

At times of heightened volatility and extreme short-term outcomes, it is worthwhile taking the time to separate the signal from the noise. Hopefully it is clear from previous communications that we view the signal as the long-term fundamental progress of the businesses in which we invest on your behalf; the noise is the market’s near-term reaction, reflected in share prices. Over our five-year investment time horizon fundamentals drive share prices.

In truth, we were neither heroes in 2020, nor villains since. It is precisely this share price noise that we must look past. Turning our attention to fundamental progress, the strategy delivered higher growth on average in 2021 than in 2020, with 40 per cent of the current portfolio delivering above 50 per cent sales growth, compared to 31 per cent in 2020. The stark difference in performance between 2020 and 2021 is largely driven by market sentiment, the difference in valuation the market assigns to our holdings.

|

Annual sales growth % |

2021 % |

2020 % |

2019 % |

|

>50 |

40 |

31 |

15 |

|

25 |

28 |

26 |

34 |

|

<25 |

32 |

43 |

50 |

Source: Baillie Gifford & Co.

Fundamental resilience

The companies we are invested in have proven resilient from a fundamental perspective to this difficult environment. Their products and services are in much greater demand, business models have adapted, the portfolio has net cash compared to a highly indebted market, and 80 per cent of the portfolio is profitable on a net income basis or generates positive free cash flow. Most of the companies are investing heavily in their future success which dampens down current profitability, but we believe increases the chance and magnitude of long-term success.

Share prices have proven far less resilient as the growth rates for many of the companies we invest in inevitably moderate from the extraordinary levels of the past two years. This adjustment is a primary reason for recent share price weakness, with holdings that were clear beneficiaries of the lockdown environment (Moderna, Shopify, Wayfair, Zoom and Netflix), and those that are dependent on consumer appetite for borrowing (Affirm, Redfin, Carvana, Vroom, Rivian and Zillow) particularly hard hit.

For the most part the combination of strong fundamental progress and falling share prices leaves us more excited about the current positioning of the portfolio. However, there is a high bar for inclusion in the portfolio, and there are exceptions to this overall picture of strong fundamental progress. Our work over the past 12 months has revealed a few holdings where the scale of future growth is less enticing. We sold Alphabet and Mastercard for this reason in preference for companies with more open-ended growth opportunities. And the unexpected pandemic growth boost has done more harm than good to the long-term investment cases for shortlisted holdings. We sold the online user car dealership Vroom amidst signs it was struggling to cope. Similarly, we sold Zillow as it found house pricing volatility too difficult to live with for its direct home buying and selling business. Peloton got ahead of itself in building for unsustainable levels of demand. It remains a holding as we weigh up the cost control medicine it is taking vs the appeal of what remains a special business model.

Outlook

Innovation and adaptability ultimately provide resilience to a challenging environment. In contrast to the prevailing sentiment, we have a much more positive investment outlook which drives portfolio positioning. The US remains the innovation capital of the world and the companies we hold ameliorate challenges as diverse as climate change, the Covid-19 pandemic and high inflation.

We could well be at a tipping point in a revolution that is being driven by technology. These revolutions have happened several times in history and each time they follow a similar path, taking around 50 years to play out. The first part of the industrial revolution involves a small number of companies harnessing a new technology to great effect. They become dominant monopolistic companies in a relatively small number of industries. In this first phase, inequality goes up, social unrest rises and regulators and governments struggle to know what to do. This can last 20 years or more. As the technology becomes better understood, it starts to be used by more companies, and in industries that are less and less connected creating a golden era. Employment rises, inequality falls, and broad benefits are delivered to society. Eventually the new technology becomes fully absorbed into our lives and we stop thinking of it as technology altogether. Like running water, railways, or the telephone.

We see parallels in the current internet and data revolution. There has been the first generation of internet giants, but we are now seeing new companies come to public markets which are harnessing the power of data, of knowledge and the ability to analyse their environment and improve, in a way never previously possible – this could gather pace for decades.

We can’t tell you when share prices will bounce back. Nobody can; stocks markets are unpredictable and in the short run are affected by all sorts of human behaviours. Panic, excitement and herding to name a few. Our investment process deliberately invests through that noise because we know that, over periods of five years and longer, market sentiment becomes much less important. Company fundamentals dominate over these longer time frames which is why we search for those rare businesses with exceptional and underappreciated growth potential. In contrast to current market sentiment, we believe that the opportunities to own businesses with outlier potential are expanding as innovation accelerates in almost every industry. The businesses driving this innovation could return several times their starting share price to patient shareholders. In times like these it becomes harder to exercise patience, but that’s exactly when our investment edge is at its strongest.

Important information and risk factors

Baillie Gifford US Growth Trust plc Annual Past Performance To 31 March each year %

|

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

Share Price |

n/a |

23.1 |

11.4 |

117.0 |

–19.9 |

|

NAV |

n/a |

26.7 |

7.3 |

123.8 |

–17.0 |

|

S&P 500 Index |

n/a |

17.9 |

–2.2 |

40.5 |

21.2 |

Source: Morningstar, S&P, total return sterling

Full performance history is not shown as inception date of the trust was 23 March 2018

Baillie Gifford American Fund Annual Past Performance to 31 March each year %

|

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

Class B Acc |

19.7 |

26.6 |

10.8 |

105.1 |

–20.1 |

|

S&P 500 Index |

1.6 |

17.9 |

–2.2 |

40.5 |

21.2 |

|

S&P 500 Index +1.5% |

3.0 |

19.6 |

–1.0 |

42.2 |

22.6 |

|

Investment Association North American Sector |

0.0 |

15.7 |

–4.0 |

42.2 |

16.1 |

Source: FE, Statpro, S&P, total return in sterling

Past Performance is not a guide to future returns.

The manager believes this is an appropriate target given the investment policy of the Fund and the approach taken by the manager when investing. In addition, the manager believes an appropriate performance comparison for this Fund is the Investment Association North America Sector.

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates. Exposure to a single market or currency could increase risk.

This communication was produced and approved in April 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated. The images used in this article are for illustrative purposes only.

This is a marketing communication and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. No reliance should be placed on these views when making investment decisions. This article does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies. Baillie Gifford US Growth Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

Product details, including a Key Information Document, the possible effect of charges on an investment, are available on request.

As at the date of this article, the fund has not been approved, notified or registered in Guernsey for marketing to professional investors. However, such approval may be sought or such notification or registration may be made in the future. Therefore, this article may only be transmitted to an investor in Guernsey at such investor’s own initiative.

The S&P 500 and S&P Global SmallCap (index) is a product of S&P Dow Jones Indices LLC or its affiliates ("SPDJI") and has been licensed for use by Baillie Gifford & Co. Standard & Poor's® and S&P® are registered trademarks of Standard & Poor's Financial Services LLC ("S&P"); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Baillie Gifford & Co. Baillie Gifford & Co product(s) is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of The S&P 500 and S&P Global SmallCap (index).

Ref: 19609 10008678