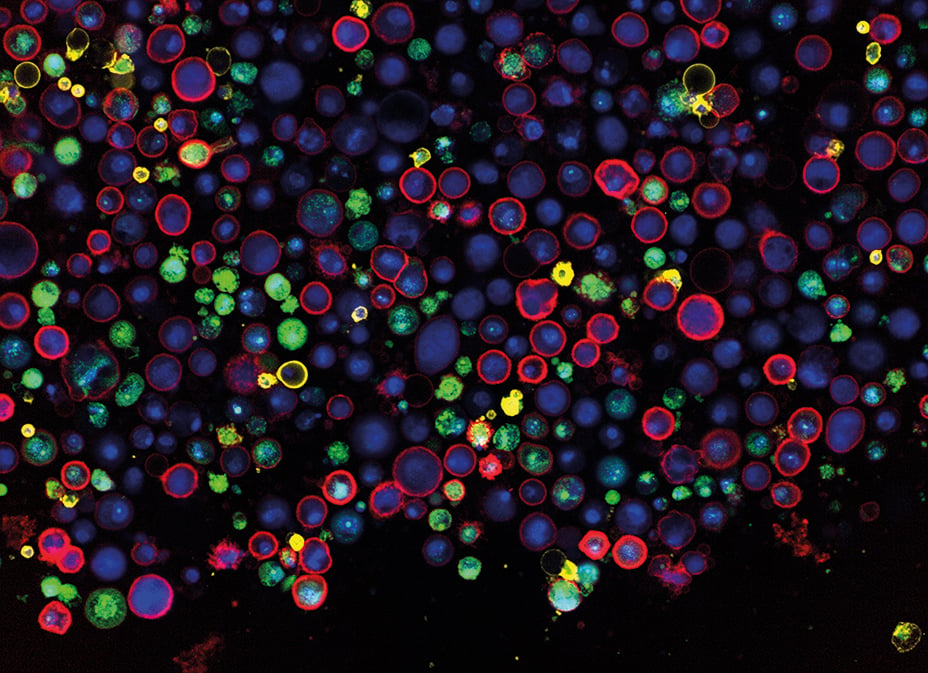

Tissue cells used by Exscientia to develop customised treatment

Please remember that the value of an investment can fall and you may not get back the amount invested. This article originally featured in Baillie Gifford’s Autumn 2022 issue of Trust magazine.

How can we best treat the estimated 40 per cent rise in new cases of bowel cancer predicted in the next two decades?

The disease is second only to lung cancer in terms of the number of fatalities. It is mainly found in wealthy countries. Existing surgical treatments involve long recovery times, which pile pressure on hard-pressed health services.

Another question: why does the cost of sending money across international borders remain so stubbornly high and why are the charges incurred so opaque? The global average cost of remittance is 7 per cent of the amount sent, more than double the 3 per cent target set as a Sustainable Development Goal by the United Nations.

Those are just two examples of the “hard global problems” that two Baillie Gifford UK Growth Trust companies – electrosurgery specialist Creo Medical and foreign exchange ‘fintech’ company Wise – were set up to address, according to Milena Mileva.

She believes that the portfolio’s up-and-coming companies, “disrupters at the leading edge of innovation”, are well placed for growth over a 10-year time horizon. Already, she says, they’re “bucking the perception that the UK is not a very exciting place to invest”.

Here Mileva picks the UK companies she believes can thrive by taking on some of the biggest global challenges

Creo Medical

The firm develops medical devices in the emerging field of surgical endoscopy – operations carried out by tiny devices inserted into the body via small incisions. Headquartered in Chepstow in Wales, its leading product, Speedboat, is a device that can be attached to an endoscope and used to cut out or vaporise pre-cancerous growths in the digestive tract before they spread.

“Creo enables medics to detect diseases and intervene earlier, giving a better chance of recovery,” Mileva explains.

“Endoscopes are traditionally only used in investigative procedures to diagnose disease. Creo’s advanced energy platform and set of surgical tools enable endoscopes to perform treatments. These procedures benefit the patient and save money for healthcare systems.”

Mileva points to Creo’s June 2022 licensing partnership with Intuitive Surgical, the global leader in robot-assisted surgery. To her, the tie-up is evidence of the broader applicability of the UK firm’s technology: “The fact that a $6bn-revenue company such as Intuitive is partnering with a small business like Creo is a strong endorsement.”

Wise

Wise has pioneered low-cost, super-transparent international money transfers.

Its key innovation is to use its own account in the destination country to pay a recipient, at a rate akin to the real exchange rate, rather than send the money across international borders and incur lots of costs imposed by intermediaries. In a further customer-friendly move, Wise is upfront about the (usually lower) fees it charges.

Founded as TransferWise by two London-based Estonians in 2010, the firm has grown rapidly, grabbing market share from banks and other incumbent foreign exchange brokers.

Banks can’t or won’t compete with the scalable technology infrastructure that makes Wise cheaper and faster

It listed on the London Stock Exchange last year and reported 38 per cent annual revenue growth in its last financial year.

“Individuals and companies transfer an estimated $18tn every year. Over 60 per cent of that is in the hands of banks, where transactions are riddled with hidden charges. It’s expensive and slow,” says Mileva.

“There’s plenty up for grabs, and banks can’t or won’t compete with the scalable technology infrastructure that makes Wise cheaper and faster.”

Exscientia

This pharma tech company precision engineers drugs tailored to individual cancer patients and those with other diseases. This involves using artificial intelligence at each stage of the drug discovery and development process.

“The company is made up of a 50-50 split between biologists and technologists,” Mileva says.

“The entire process from the AI generation of the first novel molecules within a particular project to the design of a potential therapy typically takes Exscientia around 12 months. The industry average is four and a half years.”

The firm has 25 new therapies in its pipeline, including the first three AI-designed drug candidates to enter phase one clinical trials – the first step in testing a new treatment in humans.

Headquartered in Oxford Science Park and listed on New York’s Nasdaq exchange, the company was added to the portfolio in 2021. Mileva is hopeful that “Exscientia will become the next AstraZeneca – the academic credibility of the people involved gives me confidence that it can”.

Wayve

Wayve is taking a fresh approach to using artificial intelligence to make safe and reliable self-driving cars.

Rather than trying to solve the challenge by encoding the vehicles with a complex set of rules, the firm uses ‘deep learning’ techniques that involve learning the skills from corrected mistakes and imitation.

“Unlike rivals in the autonomous vehicles field, it doesn’t use high-definition maps and expensive sensors,” adds Mileva.

“So the learning isn’t limited to the geographical areas they’ve already been ‘taught’. The aim is to teach the car to drive anywhere.”

The London-based company is still privately owned. The Trust took a stake under new provisions that let it invest up to 10 per cent of its holdings in private companies.

Mileva lists the potential benefits of self-driving vehicles as improved road safety, fewer emissions, more efficient delivery of goods and greater access to transport for millions of people.

At the time of publication, in addition to the Baillie Gifford UK Growth Trust, the following trust was invested in Wise, which was mentioned above:

Wise - Scottish Mortgage

Important Information

Investments with exposure to a single market may increase risk. The Trust’s risk could be increased by its investment in private companies. These assets may be more difficult to sell, so changes in their prices may be greater.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com