Photography by Sam Hardwick

This article originally featured in Baillie Gifford’s Autumn 2022 issue of Trust magazine.

Tony Fadell has a story to tell me. In fact, he has dozens: about the iPod, about Steve Jobs, about the Nest thermostat and why Google can’t really crack hardware, about the metaverse and why it’s a lame idea. And despite his day starting with a train from Paris to London followed by a four-hour car journey to the Hay Festival, the stories just keep tumbling out.

He’s here to promote Build: An Unorthodox Guide to Making Things Worth Making. His book is a manual on how to run a tech hardware business and a storyteller’s manifesto. Because Fadell believes that at the heart of every successful product is a compelling story, and to succeed you need to know how to construct that narrative. Not just to convince customers but to persuade investors, motivate employees, sway retailers and help you make ‘hard choices’ along the way.

So I begin by asking him to tell me the tale of the iPod, the product that brought him to Apple and transformed the company’s fortunes. “I was a DJ in the 90s and would lug around all these CDs,” he explains. “It was heavy, and I wanted to play lots of different music.”

Every hit product, according to Fadell, must be a “painkiller”. What hurt here was not being able to access music on the move. “The iPod was 1,000 songs in your pocket – before you only had 10 songs on your cassette tape or on your CD.”

Fadell had led a team at the Dutch electronics giant Philips making handheld devices such as the Nino, the first product to use Audible’s audiobooks service. “I was like, wait a second, this can be music!” But it was at Apple, where he arrived as a contractor in 2001, that he started building a music player.

Every hit product, according to Fadell, must be a “painkiller”

Fadell was watching backstage, both terrified that something would go wrong and confident that Jobs could weave his magic.

“He had been telling that story for two years,” he explains. “Most CEOs get up there and it’s the first time they’ve seen the product. It was Steve’s every waking moment for two-and-a-half years, sweating every detail – understanding how we’re going to sell it, how we’re going to market it. And he would continually refine that story.”

The other reason Fadell had faith was that inside Apple some executives had been given prototype iPhones. They quickly became obsessed. “When you saw the culture shift inside Apple because of this device and people screaming when it wasn’t working… you saw that we had something.”

In 2010 Fadell left Apple to sell his own story: a smart thermostat called Nest that cut owners’ bills and reduced strain on energy providers by fine-tuning when to turn heating and air conditioning on and off. “If I wanted to be comfortable in my home, and I wanted to save the most amount of money, I had no tools to do that,” he explains.

He pitches this as the tale of a scrappy upstart battling against Big Thermostat, the Honeywells of this world, and the professionals who would install their ugly products in your home. “You didn’t have any consumer choice on what you chose. They chose it for you.”

Nest delivered an Apple-like experience: a beautiful product in beautiful packaging with an elegant little screwdriver and simple instructions. Fadell then sold Nest for $3.2bn to Google, which promised continuing independence and the resources needed for further connected home products.

Father of invention

Tony Fadell's hits and misses

Misses

Sony Magic Link (1994)

This bulky touchscreen device combined phone, email, games and downloadable apps long before smartphones hit the mainstream. It didn't sell. Why? Fadell says it's because people didn't recognise the problems it solved until more than a decade later.

Philips Nino (1998)

The Windows CE-powered PDA (personal digital assistant) featured handwriting recognition, accepted voice commands and boasted a relatively long battery life. According to Fadell, Philips didn't market it properly, and shops confused customers by displaying it alongside laptops.

Hits

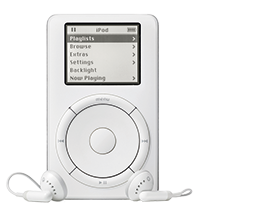

Apple iPod (2001)

The breakthrough music player that transformed Apple’s fortunes. Its spinnable scroll wheel (replaced by a touch-based version in later iPods) made hundreds of songs easily accessible on the move.

Apple iPhone (2007)

The iPhone wasn’t the first smartphone, but it defined what handsets would become. Fadell’s team engineered the hardware and core software. Its phenomenal success made Apple the world’s most valuable company.

Nest Learning Thermostat (2011)

As well as being ‘smart’, Nest designed its internet-connected thermostat to be hung on walls “like a piece of art”. Its success led to a follow-up smoke alarm and Nest’s $3.2bn takeover by Google (now Alphabet) in 2014.

Here the story gets fuzzy. Google became Alphabet and suddenly Nest faced job cuts, among other demands. There was a falling out. Fadell still insists the sale was the right move. But he contrasts Google’s culture with Apple’s, wondering whether the former’s success with advertising has made it complacent.

“We know that people don’t change their lifestyle until they’ve had a near-death experience. When you look at the two cultures, they’re born out of the leaders. Steve had gone through many [professional] near-death experiences, and [Google’s leadership] never did.”

These days, Fadell makes bets on other people’s stories as the founder of the investment firm Future Shape. So where does he see the next wave of innovation coming from? Augmented reality glasses that fuse the real and digital worlds perhaps?

Fadell says he thinks the technology has “powerful uses”. But he’s sceptical about the ‘metaverse’ – virtual worlds where we will supposedly spend our business and leisure time in avatar form. “We’re going to dance in the metaverse, and we’re going to replace meetings – even Zoom meetings – with a metaverse where we’re an animated character? I don’t buy it.”

Instead, what fires him up is global warming.

“It’s the climate crisis that I care about, the existential issue. The entrepreneurs are there, the technology’s there that can fix these problems. We just need to get them to go to scale much more quickly.”

We’re going to replace meetings – even Zoom meetings – with a metaverse? I don’t buy it

Fadell was an early backer of Impossible Foods, the plant-based food business. And he has a stake in Universal Hydrogen, which aims to make carbon-free flights common. But, unsurprisingly, he is most animated about a hardware company.

Menlo Micro’s product, the Ideal Switch, is billed as the biggest advance in 100 years in relays – switches that turn circuits on and off and are at the heart of many electronic devices.

Of course, Fadell has a story to illustrate its energy-saving potential: “In India, 6 to 8 per cent of all electrical consumption goes to ceiling fans – 6 to 8 per cent! With this one switch, if we add it into the control box, we now cut that down to 3 to 4 per cent.”

His message is one of typical Silicon Valley techno-utopianism: we can do this, and it doesn’t have to hurt. “We don’t have to live in a different way. Let’s go after the inefficiencies that we have – I couldn’t be more excited about the future.”

A cynic might say that trying to achieve net zero emissions painlessly is naïve. But Tony Fadell’s career has been all about telling convincing stories about products that went on to improve our lives. Maybe he can pull off the same trick again.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in April 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

The risk of investing in private companies could be greater as these assets may be more difficult to sell, so changes in their prices may be greater.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

10014229