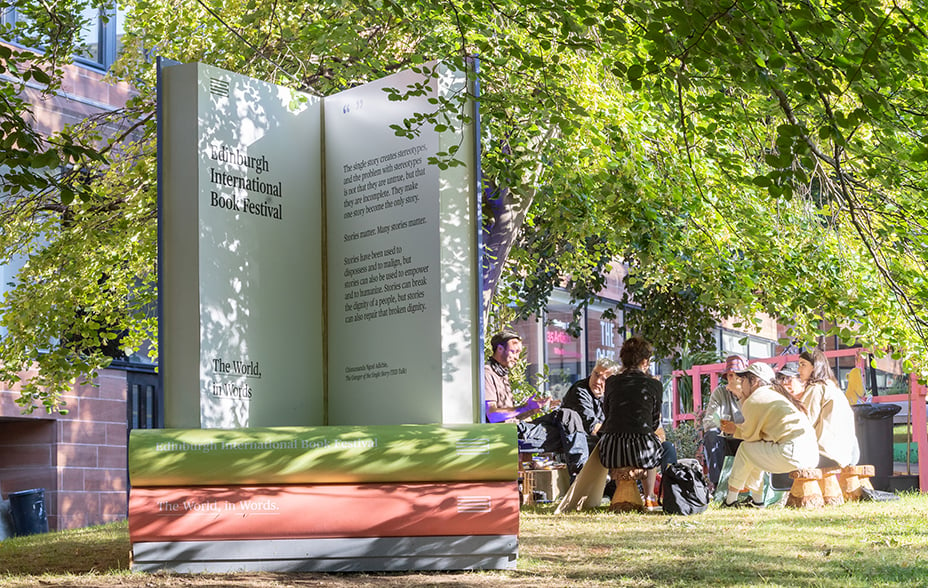

Edinburgh International Book Festival village © EIBF

Which company has made the most positive impact on climate change in a generation?

A strong case can be made for Tesla.

Its mission: to accelerate the world’s transition to sustainable energy and thus to slow climate change. Not mission impossible but – for a carmaker – certainly mission improbable.

It’s now the world’s biggest seller of electric vehicles (EVs) and has achieved this by driving down production costs. What’s more, it has dragged the industry with it, forcing the likes of GM and VW to swap internal combustion engine cars for EVs.

When we first invested in Tesla more than a decade ago, the company had made a mere 10,000 cars (0.01 per cent of the global market) in the previous year. It was tiny. Most observers were inclined to sneer, trotting out reasons why EVs would never work.

We became the second-largest shareholders in Tesla after Elon Musk, whose antics we sometimes disapproved of but whose drive and vision were Herculean. So, being Tesla shareholders was far from plain sailing, as it teetered on the verge of bankruptcy more than once and often seemed irrationally despised by the market. Short sellers circled like vultures, effectively betting on the firm to fail. Others sharpened their pens to write its obituary. At least once, Tesla may even have needed Baillie Gifford as the sole large, supportive shareholder to survive.

Tesla is a huge success story nowadays, but we keep looking for the next generation of companies that will facilitate the energy transition, and we are not afraid to back them early even when they are clearly still ‘long shots’. More on the next generation of companies later.

I talk about Tesla to illustrate our common ground with climate campaigners. Yes, we can do better, but more often than not, we are part of the solution – providing long-term capital to help support companies at the vanguard of the energy transition.

Now that some of the heat and headlines have died down, we thought this would be an opportunity to explain our approach, especially to authors considering appearing at some of the wonderful festivals we support, even if differences of opinion remain.

Why do we sponsor literary festivals?

Baillie Gifford has been proud to sponsor the Edinburgh International Book Festival for almost two decades.

As a private partnership that is more than a century old, we see sponsorship of the arts and other charitable work as part of our broader societal role as an investment management firm. After all, our own interests and passions extend well beyond the stock market. That’s why one of our maxims is “curious about the world” – not just the financial world.

It is also why we recruit graduates from all sorts of disciplines (I studied English Literature) and why we love to facilitate platforms for open and honest intellectual debate across different cultures and disciplines. The Edinburgh International Book Festival is a resplendent example of such a coming together. And it serves another purpose you might find surprising: as enlightened investment professionals, one of our goals is to be the least well-informed people on a topic in the room as often as possible. That’s when we learn the most. And each time we sit around a table with authors from book festivals, we tend to achieve that.

Beliefs and purpose

Let’s start with core beliefs. Our primary purpose is to generate good returns through thoughtful long-term investments for our clients. However, we also believe that climate change is the biggest and most complex challenge humans have collectively had to face; that it is human-made; that we must all take steps (as individuals and institutions) to mitigate its ascent; and that we must factor the implications of all this into our company research. We are aligned with you on this and have a clear plan to reduce the emissions from our own operations to net zero by 2040.

However, as an investment management firm, the bigger impact we can have is in the investments we make. At Baillie Gifford, we are well known for taking a very long-term view of our clients’ investments – we seek to own shares that will prosper over a decade, not a few months. A ‘just transition’ to net zero – meaning sharing the benefits of the shift to a more sustainable economy across society – will take years of human ingenuity, and simply eliminating fossil fuels today is not just or practical. Imagining a future powered by renewable energy, however, is realistic and offers exciting opportunities for our clients.

This means that we have been early to invest in companies that can help with the carbon transition, as we think they have a good chance to grow strongly over the long run, disrupting incumbents and making good returns for our clients. Many don’t work out, but we are prepared to accept numerous spirited failures since the few that turn into big winners make all the difference. So, we don’t “profit from climate change”, our clients, which include individuals, pension funds and endowments, profit from companies that address climate change.

© Tesla

Helping the energy transition

We’ve talked Tesla, but what about other companies? We have recently invested in Climeworks, a company pioneering carbon capture from the atmosphere in Iceland. Another potential game-changer and another long shot. And Northvolt, Europe’s best chance at making more efficient batteries for the era of electric vehicles in an industry currently dominated by China. There are plenty more examples: NIO in electric cars, Zipline in drone delivery, Solugen in green speciality chemicals, the list goes on. Indeed, one of our strategies, which has grown in popularity in recent years, is called Positive Change. It is an impact portfolio, where each of the companies we invest in must pass two hurdles: answering which world problem is it helping to solve and can it make a return for our clients in doing so. You can read about this in our impact report, which is available here.

And as a firm, we go further than that. In the way we sponsor arts festivals, we also spend considerable sums each year funding academic research around the world. Some of that research is to further our understanding of climate change and how best to respond to it. Examples include the Low Carbon College, the University of Exeter’s Global Systems Institute, the James Hutton Institute in Dundee and work by Prof Mike Berners-Lee, author of There is No Planet B. This is well beyond the normal remit of an investment manager.

‘The 2 per cent’

But what about the flipside? We have declared that 2 per cent of our investments is in companies that have some sort of fossil fuel connection. This deserves explanation as it is not quite what it seems.

Our fossil fuel exposure has trended down over time, and the 2 per cent of our investments nowadays is a very low number in most asset managers’ books. It is far lower than the oil, gas and coal exposure that index-tracking funds (passive funds) would have naturally – this would typically be more than 10 per cent of their investments. But even the 2 per cent gives an exaggerated picture of our actual exposure since it includes companies that have as little as one-twentieth of their current revenues coming from fossil fuels.

Some of these companies might surprise you. Who would have thought that the supermarket chain Tesco is classified as a fossil fuel company? It’s included because of its petrol stations. It seems unreasonable to either boycott or sell shares in Morrisons, Tesco, Asda and Sainsbury’s for this reason.

Adjusted to account for the varied sources of revenues in these companies, our exposure to fossil fuels would be less than 1 per cent of our investments. This is de minimis.

But it is not zero. Zero fossil fuel exposure today is not realistic. Fossil fuels still make up around 80 per cent of global energy use. It may also not be aligned with the principles of a ‘just transition’ and ‘differentiated responsibilities’ (the principle that countries at different stages of development should have different targets) that lie at the heart of the Paris Agreement.

Total divestment would also actually hamper the energy transition we are all looking for. Take one of the companies in our declared 2 per cent: Ørsted.

Ørsted is a Danish wind energy company, at least it is nowadays. Over a number of years, Ørsted has transitioned its business from legacy fossil fuel assets to alternative energy. We have encouraged it on this path as long-term shareholders, and now most of its revenue comes from wind power. Legacy fossil fuels is now less than 30 per cent of revenue, with a clear plan to continue to zero. But because of this, the whole of our Ørsted holding counts as fossil fuel exposure. Does it make any sense to exclude such a company from our investments? Or is it far more impactful to support its direction of travel?

The easy option would be to sell shares in all firms that don’t meet strict carbon emissions criteria. But if we sold our shares, they would be bought by someone else. That owner may not engage with the company on climate risks or ethical operations. So, it’s far more impactful to be active shareholders to influence a company’s direction of travel. Engagement trumps divestment, and the latter should be viewed as a last resort.

Three further points on these investments. First, we’ve been transparent in disclosing the small number of companies with fossil fuel exposure and have been rather harsh on ourselves in calculating it (as outlined above). Not everyone is so open. The reaction we have had to our bona fide transparency will not encourage other financial service companies to mirror it. This will be unhelpful to the climate cause.

Second, we are asking the companies we invest in to show how they will either chart a path towards net zero over the next couple of decades or manage their transition. And third, we already accommodate and respect clients who have taken the decision that it is right for them to exclude fossil fuel exposure. This has certainly been an increasing trend over the last 10 years.

Keep improving

None of what we have said about the innovative climate transitioning companies we invest in, or how de minimis our fossil fuel investments are, precludes us from trying to get better. We feel a strong sense of responsibility and accountability as a significant player in the asset management industry. After all, we may be the last generation with the ability to affect the climate outcome for future generations. Thoughtful long-term investment can play a central role in scaling solutions to the climate crisis and, in time, help these solutions to become inevitable. But we must be careful that the pessimist poles of cynicism and zero-now arguments do not discourage imperfect optimists on this journey.

We’re grateful to you for reading this far and for taking time to consider our perspective on this complex topic. We agree about the importance of addressing climate change and on the fundamental facts of the warming that is occurring, and, indeed, that we all have a role to play.

Baillie Gifford aspires to be a firm in the transparent-and-trying-hard end of the spectrum of financial services companies. In the meantime, we wish to continue providing an important platform for intelligent and thoughtful debate at the Edinburgh International Book Festival and all the other book festivals we support; they are platforms which should be celebrated, not shunned.

Risk factors and important information

As agents for our clients, their instructions to us will always take precedence, even where these instructions diverge from any views set out in this article.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in September 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 59514 10035889