All investment strategies have the potential for profit and loss, capital is at risk.

As dedicated UK equity investors, we have spent decades thoroughly investigating all corners of our home market. Our specialist approach of focusing on one region enables us to uncover a whole range of exciting growth companies that could otherwise fly below the radar. However, it’s fair to say that the UK market is no stranger to negative headlines. So, what is driving our enthusiasm for investing in our home market?

An attractive hunting ground

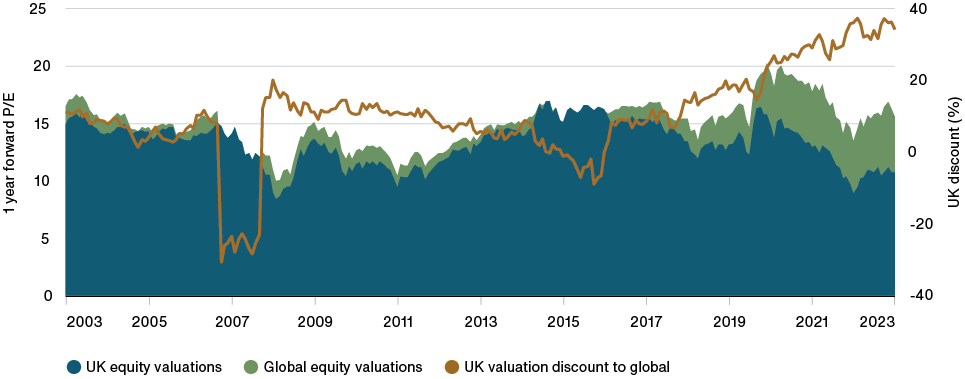

UK equities are trading at a notable discount to global peers, the biggest mark-down we have seen in our working lives. This has created a very attractive hunting ground for active stock pickers. For example, when we look at UK-listed companies, their valuations are now trading at around a 35 per cent discount to global peers.

Valuations

Source: Baillie Gifford & Co, Factset and underlying index providers, 30 September 2003 to 30 September 2023.

This is not to say that cheaper is necessarily better. In some cases, there are good reasons for UK businesses to be trading at lower valuations. But this market backdrop does create an interesting opportunity for active investors who are aiming to carefully select mispriced growth companies.

Stock selection is still key

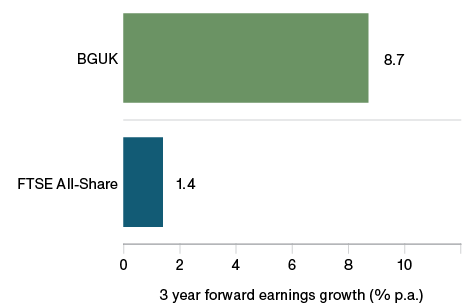

The chart on the right highlights the wide dispersion between the growth outlook for the broad UK equity market compared to the Baillie Gifford UK Growth Trust (BGUK). While we would avoid relying too heavily on spuriously precise earnings forecasts, it is encouraging to note that BGUK is invested in companies with significantly higher growth expectations than the broader market.

Why does this matter? Our investment philosophy is anchored around a core belief that share prices will follow fundamentals over the long term. Therefore, enduring growth should act as a catalyst for long-term share price appreciation. This is why we try to identify companies with superior growth characteristics and hold on to them long enough for their unique strengths to emerge as the dominant influence on share prices.

Growth expectations

Source: Baillie Gifford & Co, Factset and underlying index providers, 30 September 2023.

We can invest in regional champions at an earlier stage

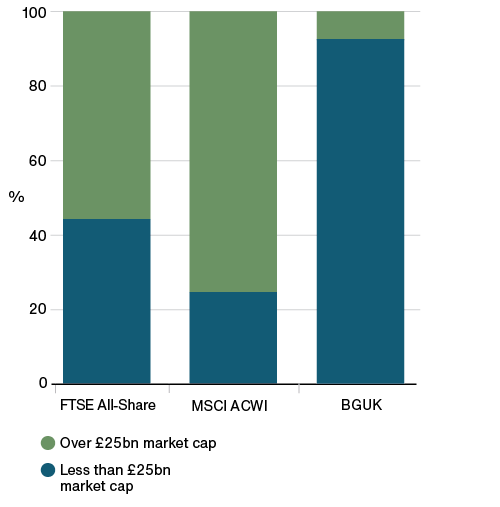

When you have a specialist investment team purely focused on one specific region, it allows you to access companies at an earlier stage of their growth. For example, over 75 per cent of companies in the broad global equity index have a market cap of over £25bn. The inverse is true for BGUK.

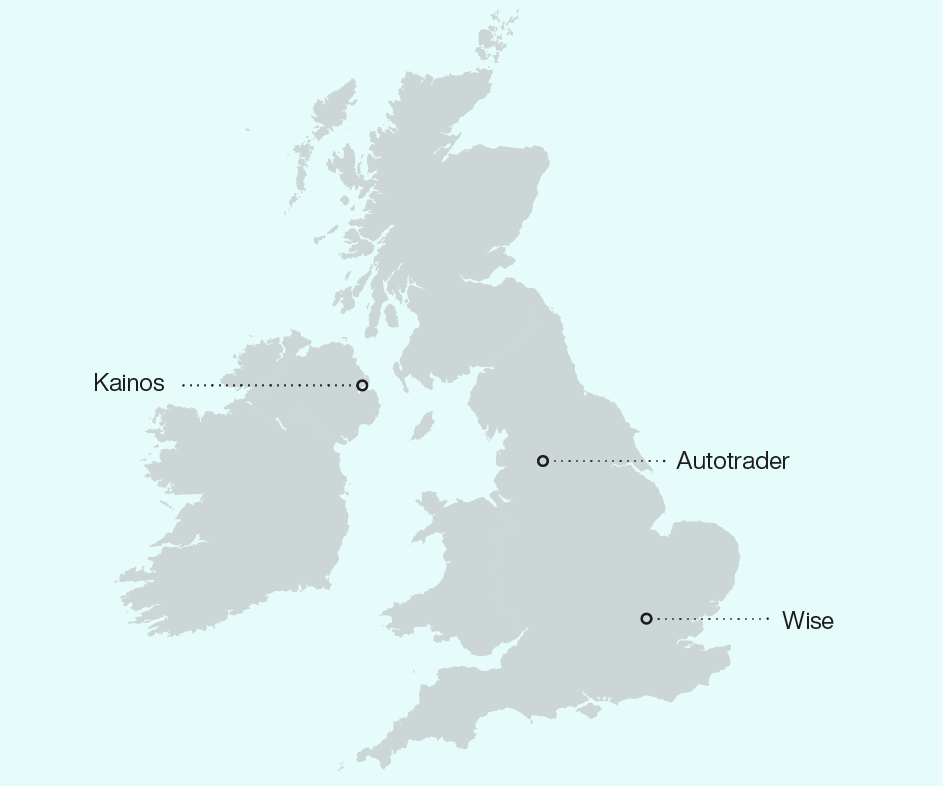

The companies we invest in are not always household names, but in many cases, they are true world leaders in their fields with enviable competitive positions that rivals find hard to match. And they are operating right across the country.

Access to earlier opportunities

Source: Baillie Gifford & Co, Factset and underlying index providers, 30 September 2023.

Regional champions

Autotrader

Dominant advertising portal for used cars

HQ: Manchester

Market Cap: £5.7bn

Key growth stat: 69% gross margins vs. 28% index

Based in Manchester, Autotrader’s marketplace sits at the heart of the UK car buying process. It employs 1,000+ people to run its platform and has a dominant market position. The company has significantly stepped up its efforts to evolve from an advertising to a transactional platform, helping to grow its total addressable market.

Kainos

Software development and consulting firm

HQ: Belfast

Market Cap: £1.4bn

Key growth stat: 5 year sales growth of 10.7x the index

An IT consultant based in Belfast that helps its customers to digitise and streamline cumbersome existing processes. Its two key business segments, digital services and Workday, both provide exciting avenues for long-term growth. Demand is driven by public and private sector digitalisation, the continued global rollout of HR and finance cloud-based software (Workday) and the development of its own in-house software.

Wise

Money transfer platform

HQ: London

Market Cap: £7.0bn

Key growth stat: active customers have grown 3x since 2019

A British fintech business. Having recognised that the process of transferring money abroad is expensive, slow, opaque and inconvenient, Wise is on a mission to improve the process for both individual consumers and businesses. Baillie Gifford owned Wise in its private company portfolios prior to it coming to market, which gave us a good opportunity to get to know management and the business before it was publicly listed in 2021.

Autotrader, dominant advertising portal for used cars.

Our local heroes operate on a global stage

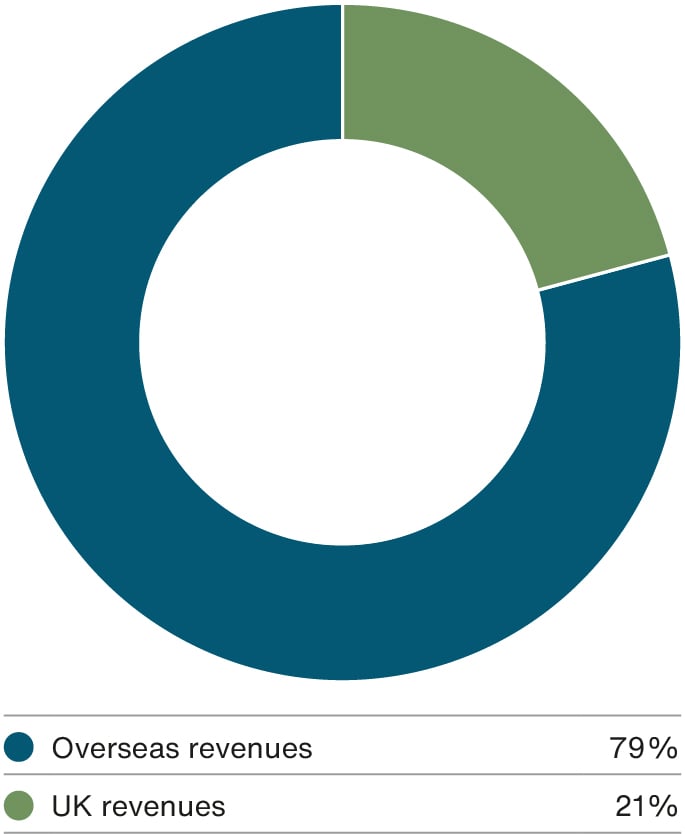

Investing in the UK equity market is not the same as investing in the UK economy. Almost 80 per cent of the revenues generated by UK-listed companies come from overseas, so these businesses are exposed to a range of global themes and international demand for their products.

FTSE All-share revenue exposure

Source: Baillie Gifford & Co and FTSE, 30 September 2023.

Access to international demand

Renishaw

94%

revenues from overseas

This is a world-class engineering company that has developed unparalleled measurement technology. Its high-precision tools are now being applied across a wide range of industries, from aerospace to neurosurgery. Despite residing in a picturesque market town in Gloucestershire, Renishaw generates only 6 per cent of its revenues in the UK. A far greater influence on its sales comes from customers in China, Japan and the US which account for over half of its revenues.

Games Workshop

78%

revenues from overseas

A manufacturer and retailer of fantasy tabletop games and miniature figurines. It has developed a leading fantasy/sci-fi franchise nurtured over decades, with a core base of passionately devoted customers. Its addressable market is expanding as the hobby continues to gain in popularity in the large US market and is beginning to develop in the Far East. The business is now more focused on monetising its deep pool of intellectual property across the broader media space.

Ashtead

92%

revenues from overseas

Founded in the village of Ashtead, Surrey, in 1947, Ashtead is now the largest equipment rental company in the UK and second largest in the US, with stores across 49 states. With a leading market position, we believe the business is well placed to benefit from a structural shift from buying to renting large expensive equipment, which provides it with a long runway for future growth. You can read more analysis on Ashtead’s growth story here.

Games Workshop, manufacturer and retailer. © ton koene/Alamy Stock Photo

The UK has a supportive ecosystem for growing businesses

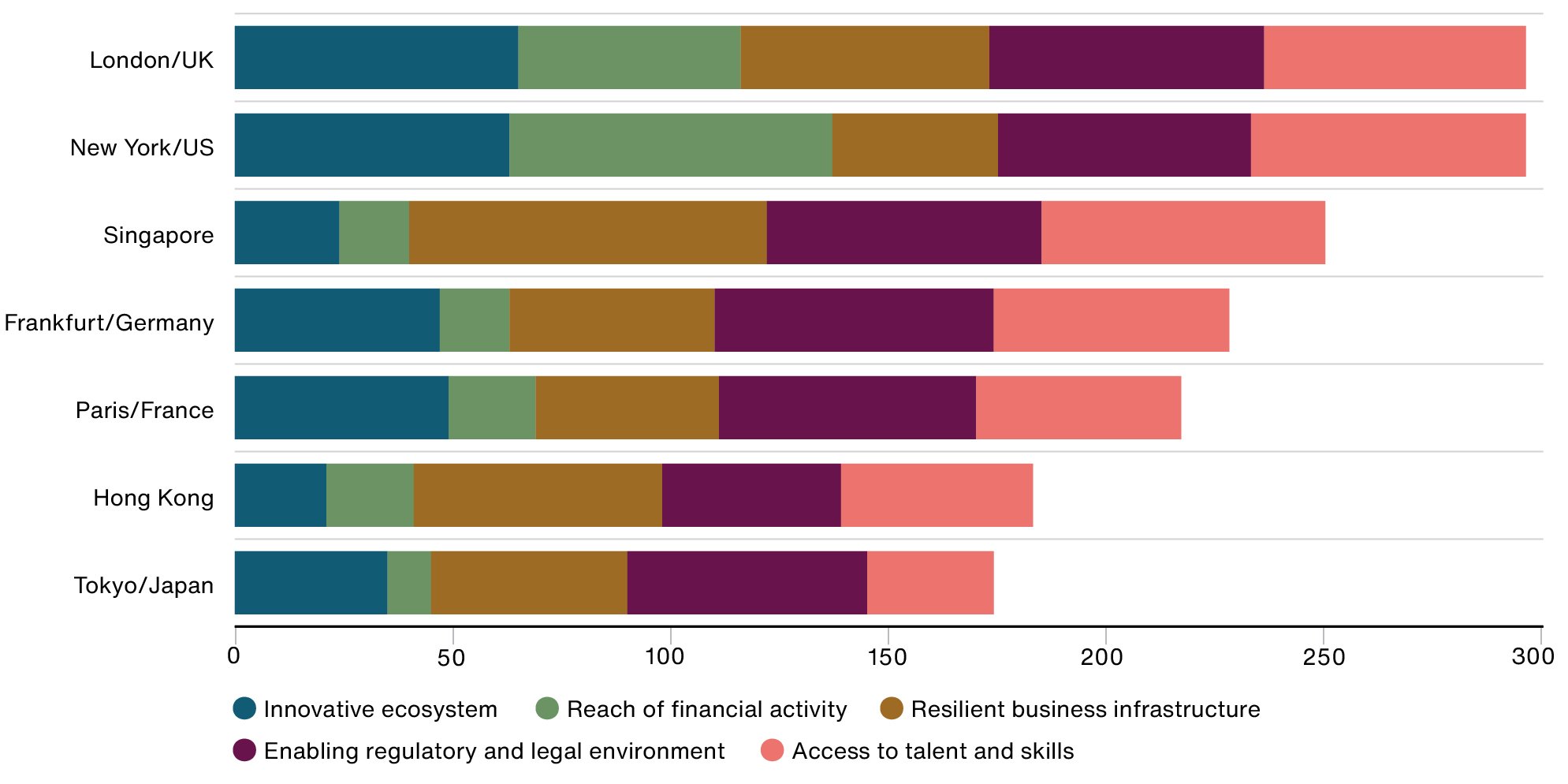

The UK is Europe’s top financial centre for fast-growing tech companies and consistently outperforms in the creation of so-called ‘unicorn’ start-ups . A recent study by the City of London Corporation highlighted several structural factors that make the region an attractive place to start and scale a company. They include innovation, financial reach, legal environment, business infrastructure and talent.

With four of the top 10 universities in the world, British businesses have access to a world-leading pool of highly qualified talent. This gives both incumbent businesses and startups access to cutting-edge research and to the talent they need for their firms to succeed.

London and the UK perform consistently well across all competitive measures

Source: City of London Corporation 2023, Our Global Offer to Business: London and the UK’s competitive strengths in support of growth.

Conclusion

The current market backdrop has created an attractive opportunity for stock pickers to invest in UK companies at relatively cheap valuations. Taking an active approach to investing in the UK equity market enables us to seek out exciting growth opportunities, invest in them at an early stage and gain exposure to a range of global themes – all within a robust regulatory framework. And we are finding these opportunities right on our doorstep.

If you would like to learn more about the Baillie Gifford UK Growth Trust, please visit bgukgrowthtrust.com.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Baillie Gifford UK Growth Trust plc | -1.0 | 2.9 | 31.5 | -36.3 | 10.3 |

| FTSE All-Share Index | 2.7 | -16.6 | 27.9 | -4.0 | 13.8 |

Source: Morningstar, FTSE. Share price, total return in sterling. Returns reflect the annual charges but exclude any initial charge paid.

Past performance is not a guide to future returns.

Important information

This communication was produced and approved in December 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned.

The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies and are not authorised or regulated by the Financial Conduct Authority. The value of their shares, and any income from them, can fall as well as rise and investors may not get back the amount invested.

Baillie Gifford & Co and Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority (FCA).

The specific risks associated with the Baillie Gifford UK Growth Trust include:

- Unlisted investments such as private companies can increase risk. These assets may be more difficult to sell, so changes in their prices may be greater.

- The Trust can borrow money to make further investments (sometimes known as "gearing" or "leverage"). The risk is that when this money is repaid by the Trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the Trust will make a loss. If the Trust's investments fall in value, any invested borrowings will increase the amount of this loss.

- Market values for securities which have become difficult to trade may not be readily available and there can be no assurance that any value assigned to such securities will accurately reflect the price the Trust might receive upon their sale.

- The Trust's risk is increased as it holds fewer investments than a typical investment trust and the effect of this, together with its long-term approach to investment, could result in large movements in the share price.

- The Trust can make use of derivatives which may impact on its performance.

- The Trust's exposure to a single market may increase risk.

- Share prices may either be below (at a discount) or above (at a premium) the net asset value (NAV). The Company may issue new shares when the price is at a premium which may reduce the share price. Shares bought at a premium may have a greater risk of loss than those bought at a discount.

- The Trust can buy back its own shares. The risks from borrowing, referred to above, are increased when a trust buys back its own shares.

- The aim of the Trust is to achieve capital growth. You should not expect a significant, or steady, annual income from the Trust.

Further details of the risks associated with investing in the Trust, including a Key Information Document and how charges are applied, can be found in the Trust specific pages at www.bailliegifford.com, or by calling Baillie Gifford on 0800 917 2112.

Legal notice: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" "Russell®", is/are a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

78431 10041171