Key points

- Positive Conversations focuses on the operational practices of our portfolio companies and how we engage with them on our clients’ behalf.

- The report incorporates our portfolio carbon footprint analysis and the promising progress being made towards net zero alignment.

- Engagement is an incredibly important part of our process. As well as providing an overview of all engagements we have undertaken, case studies provide a focus on companies such as Moderna, Illumina and Bank Rakyat Indonesia.

This article provides an overview of Keystone Positive Change Investment Trust’s Positive Conversations.

Positive Conversations, provides a snapshot of the discussions we have:

Keystone Positive Change Investment Trust doesn’t shout about its interactions with the companies in which we invest. Rather, we believe it’s about having Positive Conversations.

These are the conversations that have the most likelihood of shaping change and supporting the companies to deliver the shareholder returns and positive impact that we are looking for.

So, we prefer to spend our time building relationships and understanding where the company is coming from and how it is executing its vision.

That way, when we do have to prompt or challenge a company, they are more likely to be receptive and engage with us to effect change.

Positive Conversations gives you a flavour of the topics we engaged in over 2023. It explains the environmental, social and governance (ESG) framework we employ to get the best out of those discussions.

In our 2023 report, we update you on the portfolio’s progress to net zero alignment, provide case studies of our engagements and tell you who we engaged with, and why and how we did so.

Portfolio Footprint: Scope 1, 2 and 3*

*Includes the scope 3 emissions for the 11 holdings from specific material sectors as outlined by the guidance from PCAF. A full explanation of these terms is available in the PDF.

Click on the individual bullet points to be taken to the relevant report sections:

- How we think about business practices

- Environment

- Social

- Governance

- Engaging for positive change – company conversations

- Proxy voting

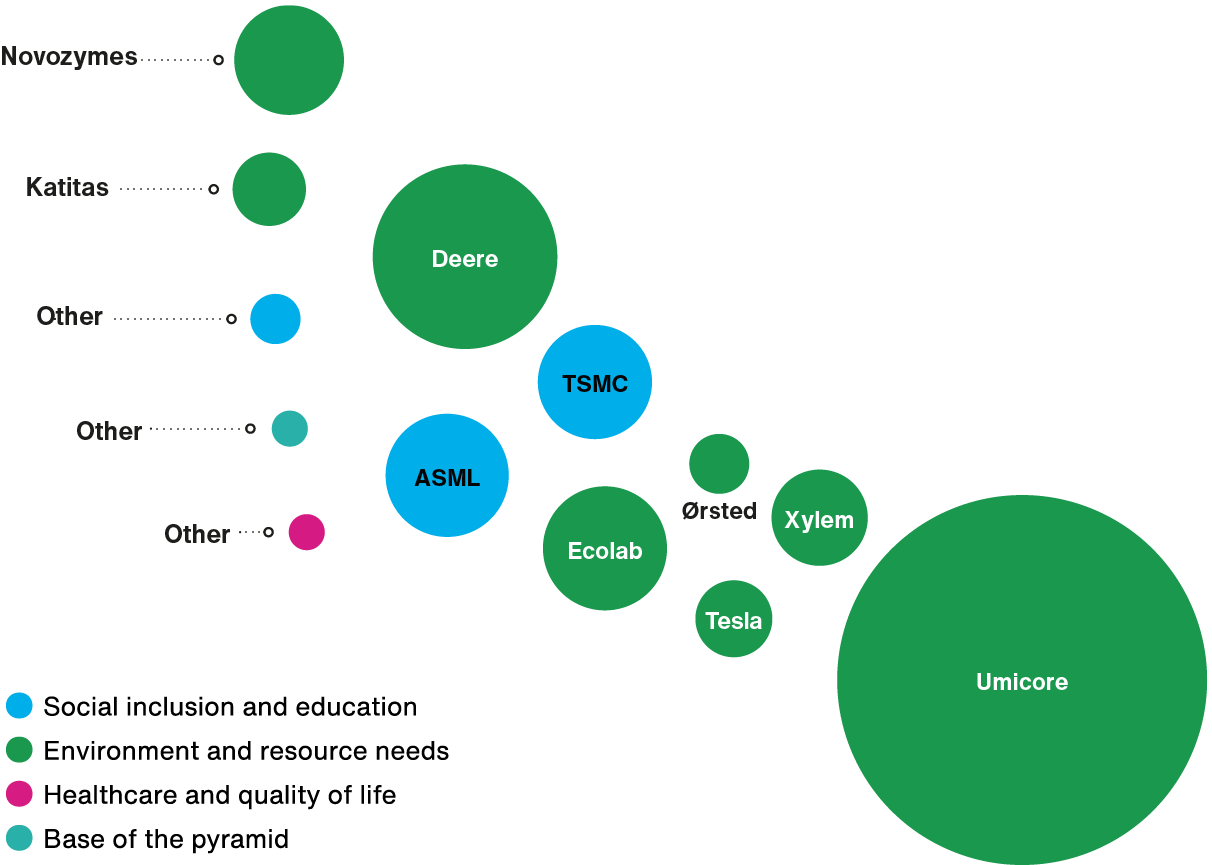

This report accompanies and should be read in conjunction with our Impact Report, which covers the impact of our portfolio companies’ products and services.

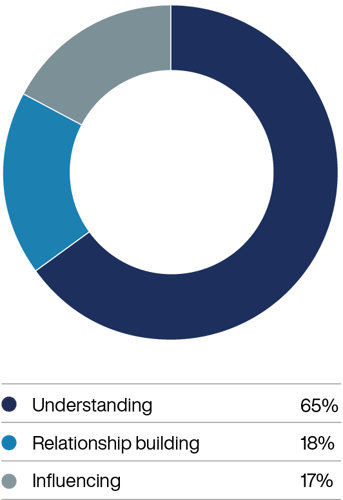

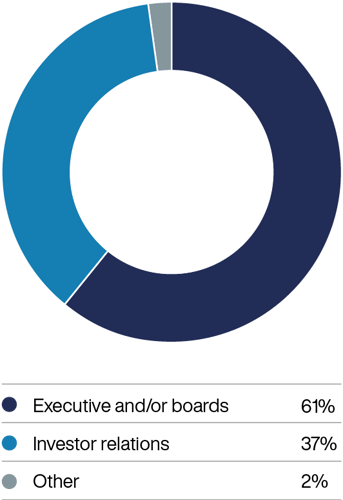

Engaging for Positive Change – company conversations

105

Engagements

Who we met

12 months to December 2023.

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in April 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This article contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research and Baillie Gifford and its staff may have dealt in the investments concerned.

The Trust invests in companies whose products or behaviour make a positive impact on society and/or the environment. This means the Trust will not invest in certain sectors and companies and the universe of investments available to the Trust will be more limited than other funds that do not apply such criteria. The Trust therefore may have different returns than a fund which has no such restrictions.

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up. The Trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

The Trust's risk could be increased by its investment in private companies. These assets may be more difficult to buy or sell, so changes in their prices may be greater.

Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies. The Keystone Positive Change Investment Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

For a Key Information Document for the Keystone Positive Change Investment Trust, please visit our website at bailliegifford.com

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients' capital may be at risk. Past performance is not a guide to future returns.

Legal notice:

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this article are for illustrative purposes only.

Ref: 96615 10045861