Please remember that the value of an investment can fall and you may not get back the amount invested.

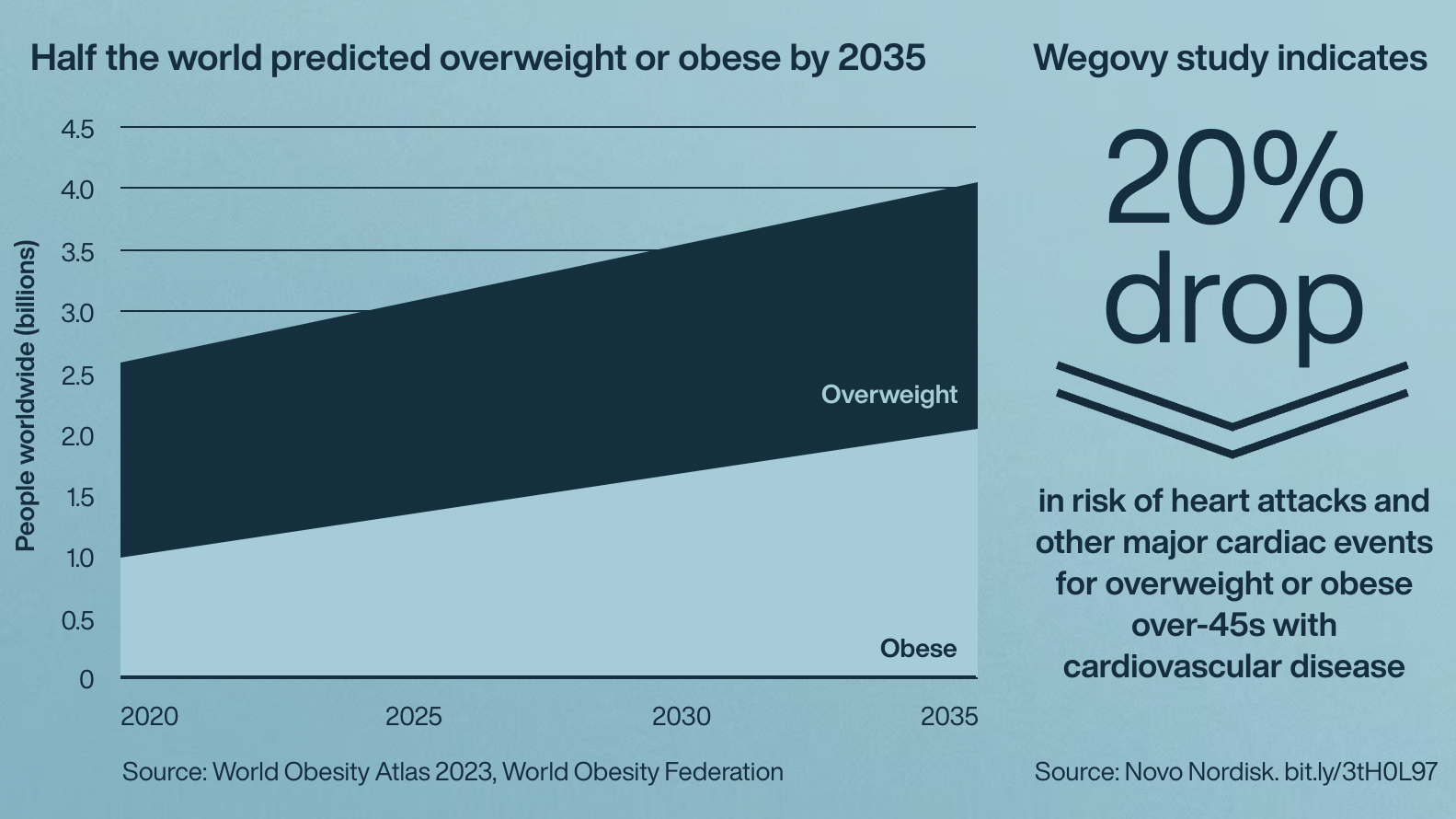

Wegovy’s power to shrink waistlines has led to it being called a wonder drug. The therapy can help patients lose about 15 per cent of their body weight. That should improve their long-term health and save society massive healthcare costs. Over 2.5 billion people are classed as overweight or clinically obese globally.

The Danish pharmaceutical company responsible, Novo Nordisk, was previously best known for making insulin, human growth hormone therapies and treatments for haemophilia. It originally developed Wegovy’s active ingredient as a diabetes medication. A recent study indicates it can also reduce the risk of heart attacks and strokes. Data additionally suggests it could benefit patients with chronic kidney disease, and there are trials to see if it could treat Alzheimer’s and a liver condition.

SAINTS first invested in Novo Nordisk in 2016, and we’ve been compounding our knowledge of its operations ever since. When the stock underperformed, work by our team’s investigative researcher into the firm’s culture reassured us of its quality and capacity for further breakthroughs. And my own conversations with management and engineers have led me to appreciate its manufacturing edge. In 2023, it became Europe’s most valuable company.

Looking ahead, the potential to use Wegovy as a springboard to create even better anti-obesity treatments, combined with the firm’s impressive track record for innovation, suggests that Novo Nordisk can maintain its competitive advantage.

Important information

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com

92901 10045341