Demand for enriched uranium is boosting Australian company Silex Systems

As with any investment, your capital is at risk.

Unsettled times have given Douglas Brodie a new focus for growth investment: stay-at-home businesses that can prosper in an era of international tension and open conflict.

EWIT’s manager explains that he always sought “companies that can solve problems better or cheaper” than rivals. Historically, that meant firms addressing worldwide markets.

However, pursuing worldwide winners is no longer straightforward. In an era of shifting politics, international markets are fragmenting. Nations and companies seek ways to insulate their supply chains from geopolitical strife.

That led Brodie to consider a new array of potential investments. Although still searching for global problem solvers, he’s increasingly open to champions of localisation – companies bringing home activities formerly carried out abroad.

“For most companies, market fragmentation is a negative or a neutral factor,” he says. “But for some businesses, deglobalisation can catalyse greater growth.”

A good example is MP Materials, a Las Vegas-based company that mines a category of ‘rare earths’: soft heavy metals that are not in fact rare but are hard to isolate.

Materials made from these low-profile substances aren’t household names – try getting your tongue around ‘neodymium-praseodymium’. But we need them to make powerful magnets and other components essential for modern life, from wind turbines and electric vehicle motors to hospital MRI machines and to smartphone screens.

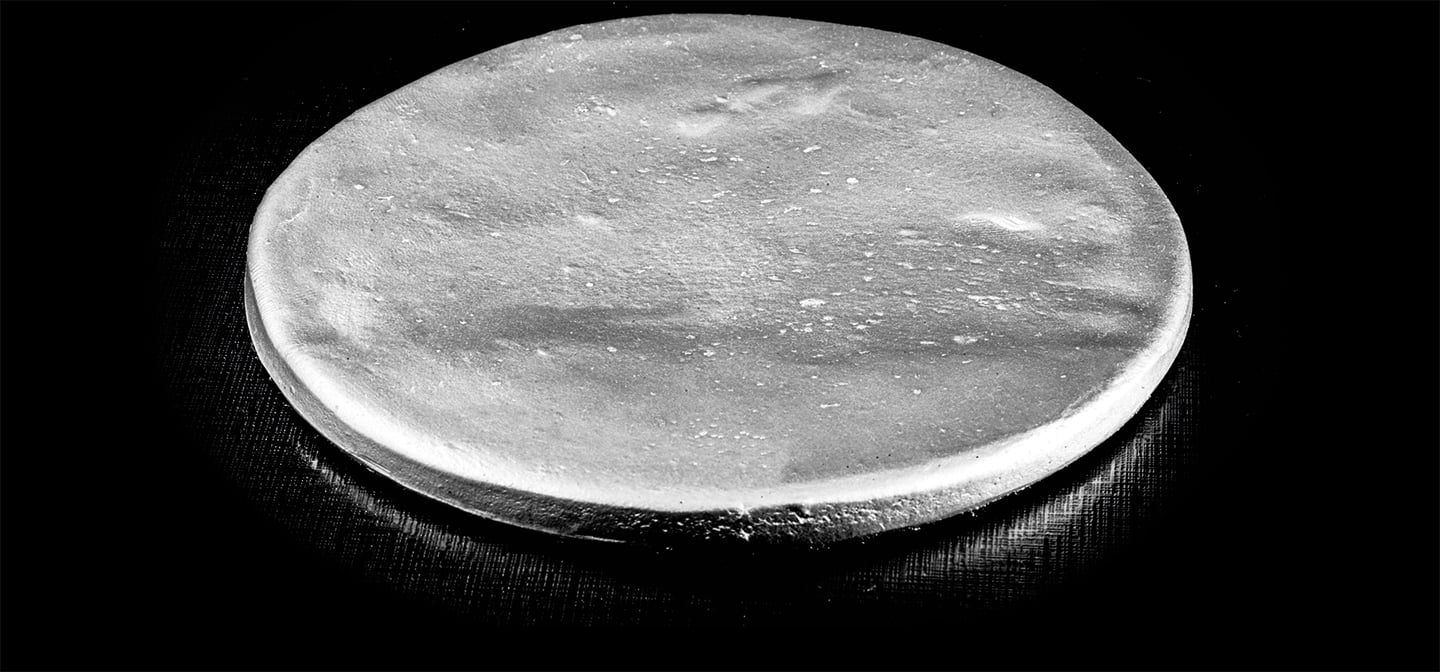

Mountain Pass mine, California: a hub of rare earth production

They’re also weapons in global trade wars, as shown by two transformative investments in MP Materials in July.

In the space of a week, both the US Department of Defense (now known as Department of War) and Apple announced investments totalling $1.4bn into MP, securing supply in the face of export restrictions by China. That country produces more than 60 per cent of the world’s rare earths.

As Washington and Beijing butt heads over tariffs, the latter’s stranglehold on this specialised market worries many western firms. Were China to cut supplies entirely to stymie strategic rivals, there would be massive disruption to the cost and speed of global manufacturing.

MP Materials mines rare earths from high-grade ore in the Mountain Pass mine in California. Even better, it uses them to manufacture compact, powerful magnets. That market, too, is China-dominated, so a US entrant is good news for North American businesses worried about supply chain security.

To Brodie’s eye, the company benefits from the intersection of two powerful trends sweeping the world. “The national security aspect has dialled up materially,” he says. “So has the pace of the shift towards rare earth-dependent renewable energy and electric cars.”

Reducing reliance on Russia

Those same trends help build the case for another EWIT investment: Silex Systems, an Australian company with innovative laser-enhanced uranium enrichment technology.

It is attracting attention because of a resurgence of interest in nuclear power. Atomic energy can generate enormous amounts of dependable power without spewing out greenhouse gases. Just as important, it can do so without relying on pipelines that run through unreliable jurisdictions.

But geopolitics remains a big obstacle to a nuclear future. Power plants need enriched uranium.

What’s enriched uranium? As you may recall from physics class, naturally occurring uranium consists mainly of an isotope known as U-238 and a smattering of another, rarer isotope, U-235 (an isotope is a variant of an element with useful special properties). U-235 is the kind that splits under the right conditions to produce energy.

To produce fuel for a reactor, refiners must boost the meagre amounts of U-235 in natural ore to produce an enriched ore with a much higher level of the precious isotope. That involves separating the two types in a fast-spinning centrifuge, an expensive and only moderately efficient process. Worse, uranium enrichment is dominated by Russia, now off-limits for obvious reasons.

Silex believes it has developed a better alternative. It bombards a uranium-based gas with lasers tuned to specific wavelengths. This excites the U-235 atoms, allowing them to be separated from the U-238 cheaply and efficiently.

“The principles of the technology are pretty well established, but the question is whether you can do it on an industrial scale,” Brodie says. Silex is now working with Canadian miner Cameco on a pilot project in North Carolina that it hopes will prove it’s possible.

Securing supplies of machine parts

Fortunately for those who skipped science lessons, not all of Brodie’s deglobalisation bets require acquaintance with the principles of geochemistry.

EWIT holding Xometry is striving to ‘reshore’ the making of machine parts. Based in Maryland, the online marketplace acts as a matchmaker, linking companies that want to buy bespoke parts with appropriate local suppliers.

The challenge in this sector is knowing where to go. The US, in particular, is home to sprawling clusters of small-to-mid-sized machine shops, 3D printers and local fabricators with diverse specialities. Xometry’s expertise lies in knowing the skills required to make various parts and who can best provide them.

Its typical buyer is a company that wants fast delivery of prototypes or a small run of custom parts. Its typical supplier is a specialised machine shop or fabricator that can deliver the products in short order.

“Think of Xometry as a strategic sourcing partner, a supply chain manager,” Brodie says. Its ability to provide fast quotes and deftly connect buyers and sellers increases the resilience of supply chains.

Finding ways to bring key activities back home is becoming a top priority for companies navigating a world now riven by trade tensions. EWIT’s localisation champions are perfectly placed to help them do just that.

Important information

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com

171200 10057490