Key points

- Baillie Gifford backs disruptive private firms with the scale and strength to succeed long-term as public companies

- It is highly selective in finding tomorrow’s winners, meeting about 1,000 companies a year, leading to just 10 investments

- Recent holdings include AI pioneer Anthropic, manufacturing outsourcer Zetwerk and the Chinese social media app Xiaohongshu (RedNote)

WATCH: Investment manager Robert Natzler (right) explores the private companies blazing a trail in fintech, AI and more in his Disruption Week briefing

Your capital is at risk.

A software developer asks an artificial intelligence (AI) assistant to tidy her complex code. Within seconds, it writes tests, identifies bugs and documents the changes for review.

An ocean away, a procurement manager watches a wind turbine gearbox move through several factories, each part time-stamped and quality-checked.

In Shanghai, an influencer posts a cafe review, tagging its location to alert others nearby. A single tap of the app lets them book a table.

Different scenes, same pattern: private companies reshaping the world long before public market investors can buy in.

In each case, they relate to recent investments that Baillie Gifford’s Private Companies Team has made on behalf of our clients. And each involves a business with the scale and momentum to support a successful listing and the staying power to thrive as a publicly traded entity.

Why timing matters

The team typically gets involved when companies have about $200m in annual revenue, with a clear path to profitability and, ultimately, public markets. In many regards, their long-term growth prospects are not dissimilar to the companies we back in the public sphere. But given that there are dramatically more privately owned companies than listed ones, Natzler and his team help to radically expand the universe Baillie Gifford can pick from.

The venture capital industry – which specialises in privates – is known for making most of its money from a small number of companies, while the majority fail or only break even. By contrast, our Private Companies Team focuses on growth-stage funding rounds at a point where the companies are young enough for there to still be a lot of upside, but have made enough progress that we can enjoy a substantially higher success rate.

“It’s at the point of being able to ask whether an emerging business can go the full distance,” Natzler says.

“We’ve deployed about $10bn of our clients’ capital to date in a little more than 160 companies.” More than 50 of those have floated, he adds, with others planning initial public offerings (IPOs) over the months to come. The Baillie Gifford difference is that, after flotation, the firm may invest at scale through its public market strategies for the long-term, rather than being forced sellers partway through the businesses’ growth trajectory.

Success in the private investment sphere, Natzler says, is largely driven by gaining access to the best deals, whether involving famous names or those more off the beaten path.

This access is earned through Baillie Gifford’s reputation for supportive long-term investing. Founders benefit from the firm’s help in preparing for listing, as well as the opportunity to build relationships with our public market teams.

“We have about a thousand meetings a year, and that leads to about 10 investments,” Natzler adds. “It all comes down to the growth rate that you see, the size of the opportunity, the strength of the competitive advantage, and the price asked.”

Where the growth is: Baillie Gifford invests in private companies across the globe on behalf of clients

Data: Baillie Gifford, September 2025

Anthropic: when AI moves from novelty to necessity

New holding Anthropic exemplifies one of the true innovators the Private Companies Team seeks out: those using new technologies to create a market that could not exist before.

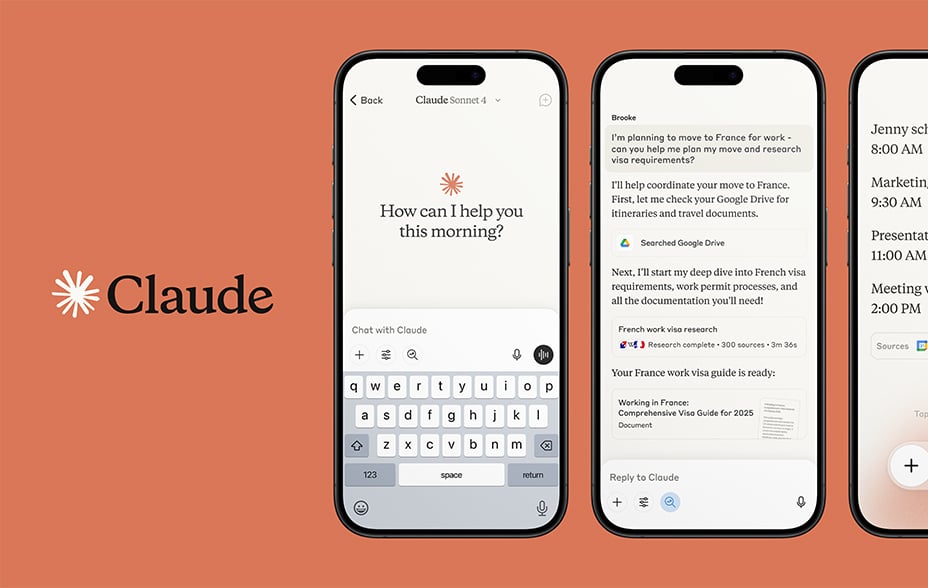

The AI lab uses its own Claude ‘large language models’ to power its own chatbot. Additionally, they act behind the scenes as the ‘brain’ for a wide array of third-party apps and customised in-house enterprise systems. Common uses include generating automatic responses to customer queries, carrying out financial analysis and helping researchers analyse clinical data.

Baillie Gifford recently invested in AI frontier lab Anthropic, whose focus on building safe, predictable AI models, such as Claude, appeals to enterprise customers.

© Anthropic

But it’s the US company’s success building a substantial business around Claude’s code-writing capabilities that has given us the conviction to invest.

“Government figures suggest that more than $360bn is spent on the coding labour market in North America annually,” Natzler says. “If you could take even 10 per cent of that – and our conversations with heads of IT suggest much more than 10 per cent is in scope – you can build an absolutely enormous business. And, in our eyes, Anthropic is the frontrunner to do so.”

Zetwerk: visibility as a manufacturing moat

If Anthropic is about software reasoning, another disruptor, Zetwerk, is about software-orchestrated manufacturing.

Natzler describes the Indian business-to-business company as “a diversified industrial, with a tech platform”.

That platform enables Zetwerk to match buyers with a certified network of factories across India, Mexico, Vietnam and other countries. It converts technical drawings into work orders and provides live-tracking through its Build-to-Print engine and operating system.

“For example, it partners with a major German supplier of wind turbines for the North Sea,” Natzler explains. “And that supplier can see every single wind turbine part as it moves through the underlying factory base.

“It’s a magnificent system for giving its clients visibility and also allowing them to be flexible in their supply chains, particularly since many now want geographical diversity beyond China.”

Xiaohongshu: where lifestyle inspiration turns into action

Open Xiaohongshu’s app – also known as RedNote – and its feed resembles a living catalogue of everything from skincare routines to city walks. The videos, text and photos are searchable and a map-based Nearby facility ties them to the user’s location, offering a bookings function.

RedNote focuses on travel, makeup, fashion and shopping. A strong majority of its 300 million monthly active users are women.

Shutterstock / andersphoto

The app is China’s de facto lifestyle search engine, with roughly 300 million monthly active users. And its ability to lead users from discovery to transaction lets it monetise engagement beside ads by charging merchants a commission for offering sales and bookings via its platform.

“We’ve seen it take market share very aggressively from China’s leading search engine, Baidu, over the past few years,” Natzler says. “It’s a monstrously good business in terms of growth rate, size and profitability.”

The app is particularly popular among female users in mainland China’s wealthiest cities, as well as Taiwan and Singapore. But Natzler believes it could achieve worldwide reach.

“We saw Xiaohongshu gain share in the US in January when there was a threatened TikTok ban, so we know it can resonate overseas. In general, Chinese social media platforms have reached an extreme degree of sophistication that only their North American counterparts rival, and we'd expect to see them globalise in time.”

Accelerated change

Baillie Gifford offers its clients the ability to invest in private companies via pure-play portfolios as well as those that blend the holdings together with publicly traded stocks.

With 13 years’ experience of investing in this sector, we’ve developed the sourcing muscle to gain access to some of the world’s most exciting and disruptive businesses. And Natzler suggests this will only become more appealing to those with the patience to achieve long-term growth.

“The public markets perform a great public service, but many of the exceptional companies with generational potential operate as private businesses and are staying private for longer. That’s where, as a firm, we need to make sure we’re showing up for our clients.”

I think we’re going to see an accelerated rate of change over the next couple of decades, so you want to position your portfolio around the business models that ambitious founders and entrepreneurs are building for this new era.

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Words by Gillian Christie

179330 10058929