Key points

- Global Alpha’s wide growth lens means that we can invest in growth in all its forms. Diversity is a strength, not a cost

- Our Research Agenda brings the best opportunities into focus, including those in the shadows of more popular themes

- This year’s Agenda spans from paradigm-changing AI to discount stores, from the genetic revolution to the emerging middle class

As with any investment, your capital may be at risk.

Summary

Our search for outstanding and under-appreciated growth companies is always informed by what’s happening in the world around us. Economic, social and technological changes can create new opportunities for great businesses to expand into.

Our Research Agenda helps us to focus our efforts each year on the most fertile ground for long-term growth investing.

Agenda point 01

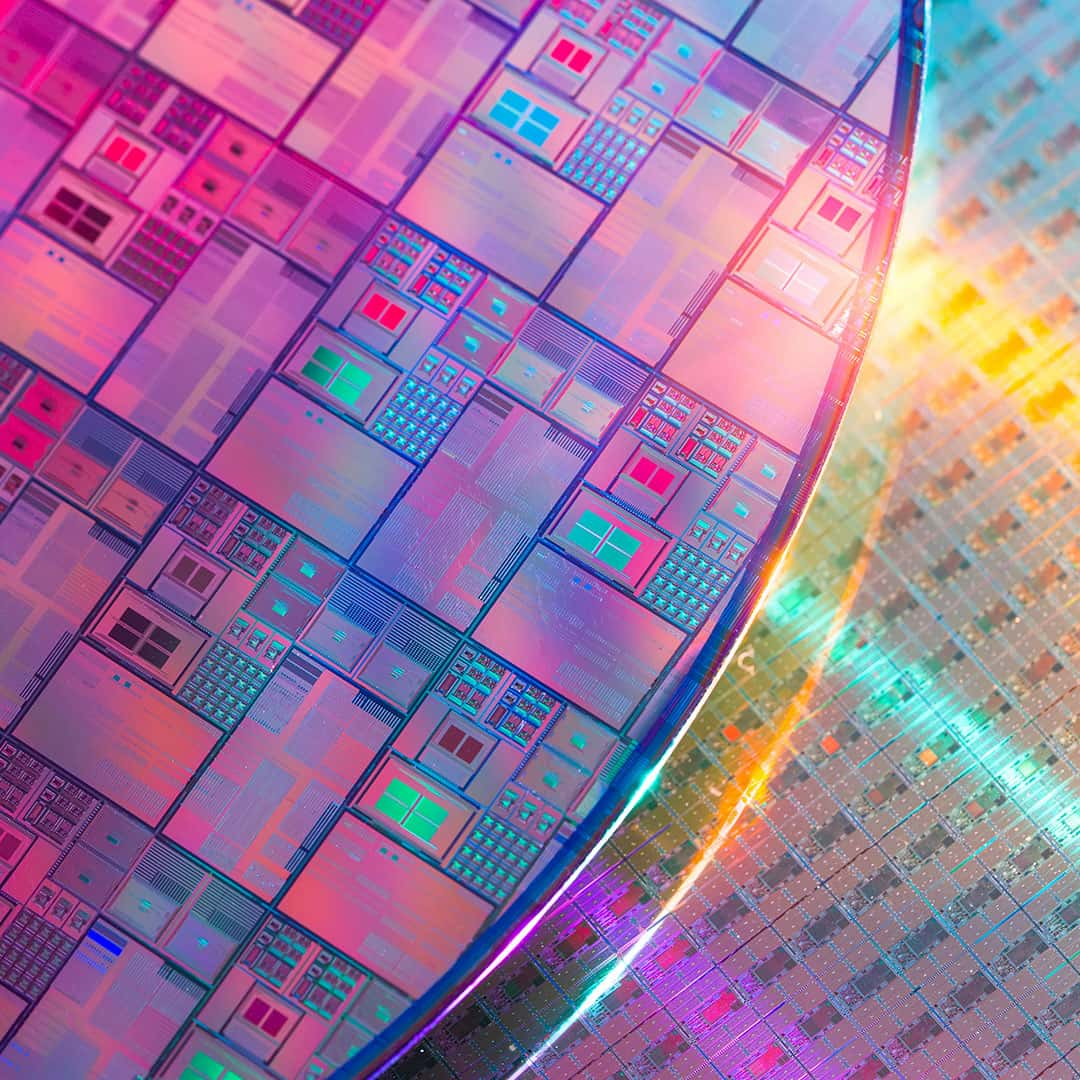

Artificial intelligence

We are witnessing the dawn of a major technology revolution. Like previous revolutions, it will precipitate profound changes across society. Unlike previous revolutions, its diffusion could be rapid.

Where might generative AI evolve as it recombines human knowledge and generates its own?

Agenda point 02

The quiet power of roll-ups and roll-outs

We must not forget that traditional forms of growth are alive and well. If the spotlights focus too narrowly, then what great businesses are growing in the shade? Where are exceptional management teams and sharp business models cutting through seemingly stagnant industries?

We’re still finding superb businesses that are growing by rolling out or by buying up the competition.

Agenda point 03

The emerging consumer

The next consumer revolution is happening on São Paulo’s streets and in Bengaluru’s kirana stores. Young, urbanising populations in emerging markets are driving digital-first consumption. Their first credit card is digital, their first shop is an app, and their first luxury brand is local.

Forget aspirational western brands. Think emerging world-class businesses.

Agenda point 04

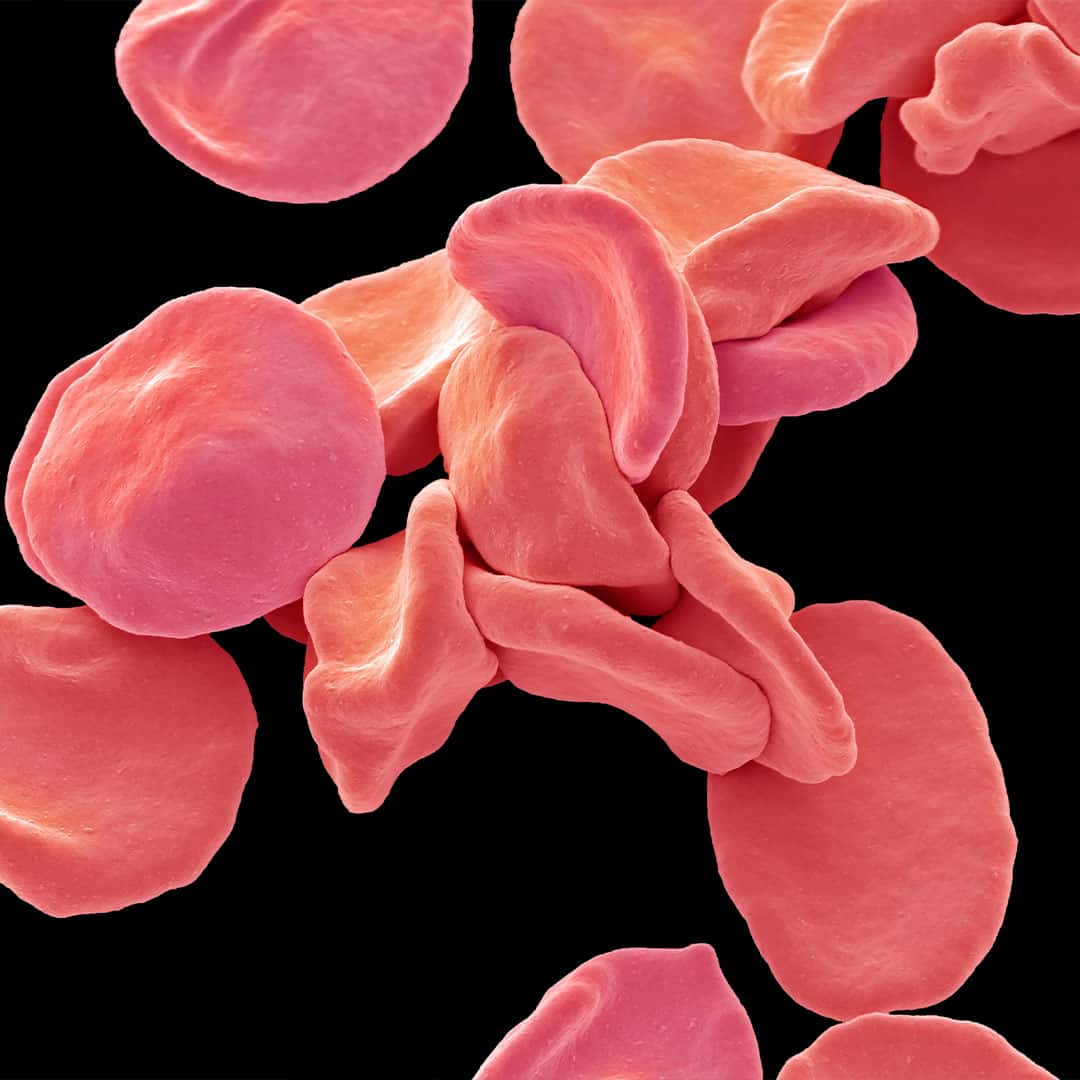

The healthcare evolution

Healthcare needs to change, and deepening genetic understanding is combining with expanding clinical progress to provide us with the tools to make it better. Funding and market sentiment have been in the doldrums, but progress is still being made.

How can we see it differently, and where are the greatest opportunities for the patient investor?

Read more about healthcare in the PDF →

Read the full PDF

What are the characteristics of the companies set to flourish in the years ahead? And what makes Baillie Gifford so well placed to find and hold them?

Important information

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.