Key points

- EWIT champions early-stage, high-potential tech assets, offering unique access to tomorrow’s innovators.

- Recent portfolio changes and market shifts position EWIT for resilient, long-term growth and outperformance

- Shareholders urged to vote, protecting EWIT’s mission to back transformative companies shaping the future

Dear valued shareholders,

We are writing to you as Saba Capital is once again questioning the entire premise and future of the Edinburgh Worldwide Investment Trust (EWIT).

Last year, you emphatically voted against Saba’s previous proposal. Despite this, they have returned. We encourage you to make your voice heard again and vote at the upcoming meeting to secure the future of your Trust.

Saba has increased its stake from around 25 per cent at the time of the last vote to over 30 per cent today. This makes your vote more important than ever. If shareholders want to keep the Company out of Saba’s hands, they must turn out to vote in even greater numbers than before.

This letter is intended as a reminder of EWIT’s history, philosophy, and purpose and why we believe this is set up to pay off handsomely for shareholders in the years ahead.

The EWIT portfolio comprises a unique spread of early-stage, high-potential assets sourced from both global public and private markets, with the latter being notoriously difficult for everyday investors to access cost-effectively.

Its portfolio offers shareholders a front-row seat to the companies shaping tomorrow, with no obvious peer in the UK.

To prevent you from being denied this opportunity, we urge you to vote your shares at the upcoming meeting.

A timeless philosophy

- Five foundational beliefs have underpinned EWIT’s investment philosophy and approach since 2014.

- Innovation and technological progress are the strongest compounding forces that drive society and stock markets forward over the long term

- The greatest changes and innovations start small. Some of the greatest returns, therefore, accrue to innovative problem-solving companies that originate lower down the market cap scale.

- The results of human ingenuity and entrepreneurial flair do not manifest themselves predictably or in a straight line. Thoughtful long-termism and a willingness to tolerate uncertainty are key to unlocking them.

- These latter attributes are increasingly in short supply in modern equity markets. Patient investors can exploit this growing market inefficiency.

- Further down the market capitalisation spectrum, a higher-than-average individual failure rate is expected. But when technological progress, commercial execution and profound scalable opportunities combine, the outcomes can be spectacular and the rewards enormous.

| Company | Holding Period Return* |

| Tesla | 2500% |

| Axon | 1050% |

| AeroVironment | 1050% |

| Dexcom | 1000% |

| SpaceX | 950% |

| Shockwave Medical | 850% |

| CyberArk Software | 750% |

| Genmab | 750% |

| PsiQuantum | 700% |

| Foundation Medicine | 700% |

Source: Revolution. EWIT since inception to 31 December 2025. Sterling *Account - security return rounded to the nearest 50.

Recent Performance

EWIT has delivered strong performance over the past 12 months, with net asset value (NAV) returns exceeding 17 per cent and comfortably outpacing the benchmark.

In our letter last year, we discussed 2024 as a turning point for performance, following the disappointment of 2021-2023, and we are pleased to have delivered on this promise on your behalf.

While the long-term track record remains below our aspirations, we emphasise that recent performance reflects three mutually reinforcing dynamics that offer sustainable momentum.

First, the conditions are in place for a shift towards small-cap equities. The aggressive rate-hiking cycle and the ‘returns to scale’ narrative that have dominated the investor psyche have significantly impacted small-cap performance in recent years. However, this has created an extraordinary opportunity.

Global small-cap stocks are trading at historically steep discounts relative to all-cap markets – the widest valuation gap in two decades. The combined market capitalisation of the five largest S&P 500 companies is now five times greater than the entire Russell 2000 index, while the Russell 2000's market capitalisation represents merely 5.5 per cent of the S&P 500, an all-time low.

However, with greater confidence in the long-term path of US interest rates and growing awareness of extreme large-cap concentration risk, market breadth is improving, and small caps are beginning to benefit from renewed investor interest.

To clarify, we are not attempting to time an asset allocation call, and these considerations do not align with our investment process. Nevertheless, this is a credible and important valuation argument for why now is a poor time to deviate from the existing investment strategy.

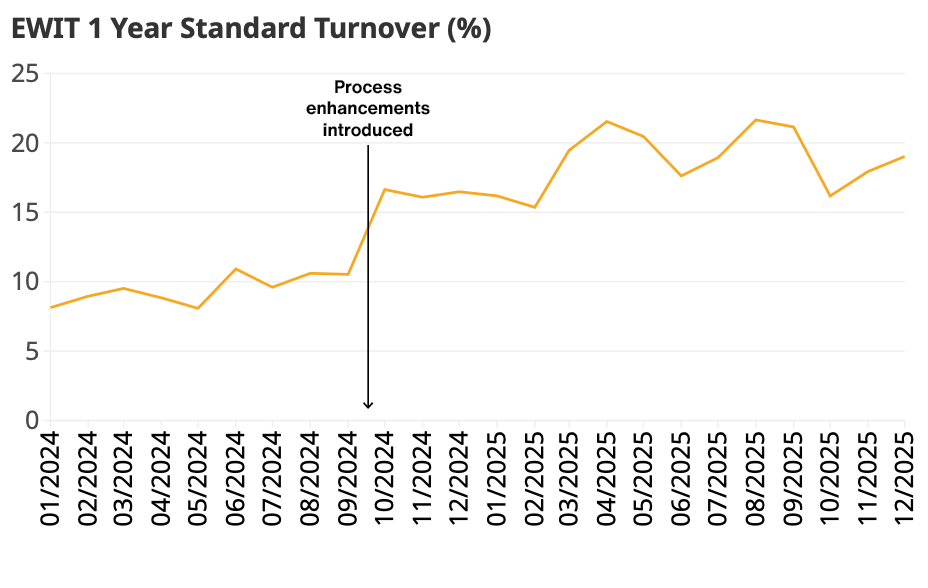

Second, EWIT’s refined investment process is bearing fruit. Over the past year, the team has expanded its decision-making capabilities, implemented a bespoke portfolio construction framework and enhanced its diversification guidelines.

These changes were not marginal adjustments but targeted interventions designed to improve client outcomes. These have precipitated the rotation of around 20 per cent of assets, involving 28 complete sales, but supported by healthy idea generation represented by 22 new purchases.

EWIT 12 month standard turnover as at 30 November 2025

The portfolio now exhibits improved industrial diversification and heightened competition for capital, particularly among the earliest-stage, most-volatile positions. There is a greater allocation to profitable, cash-generative businesses.

In short, the portfolio is better balanced and more resilient to a range of market conditions.

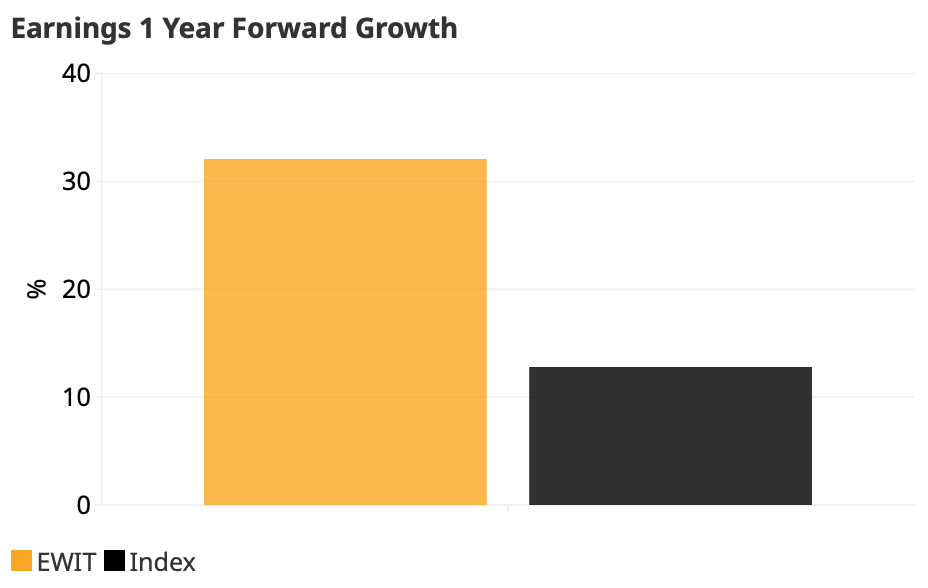

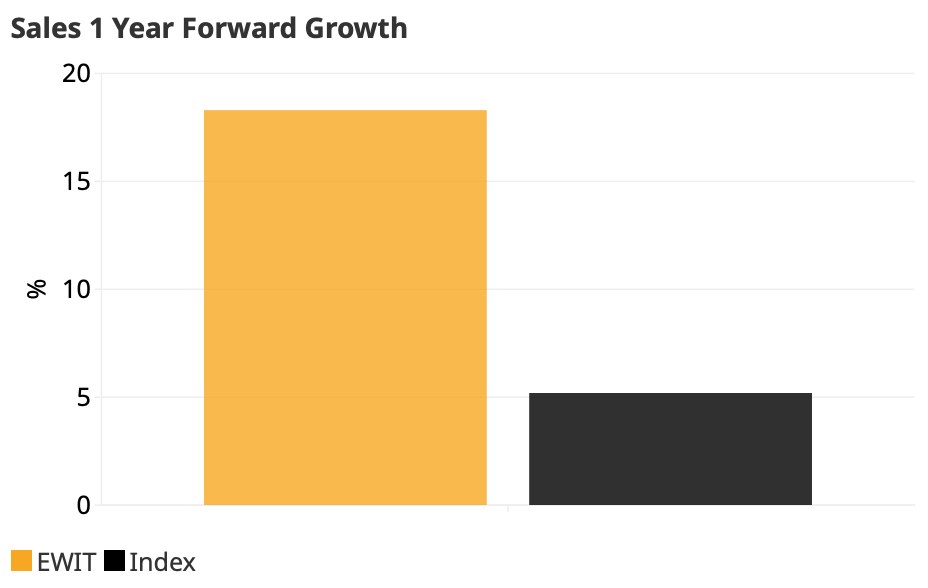

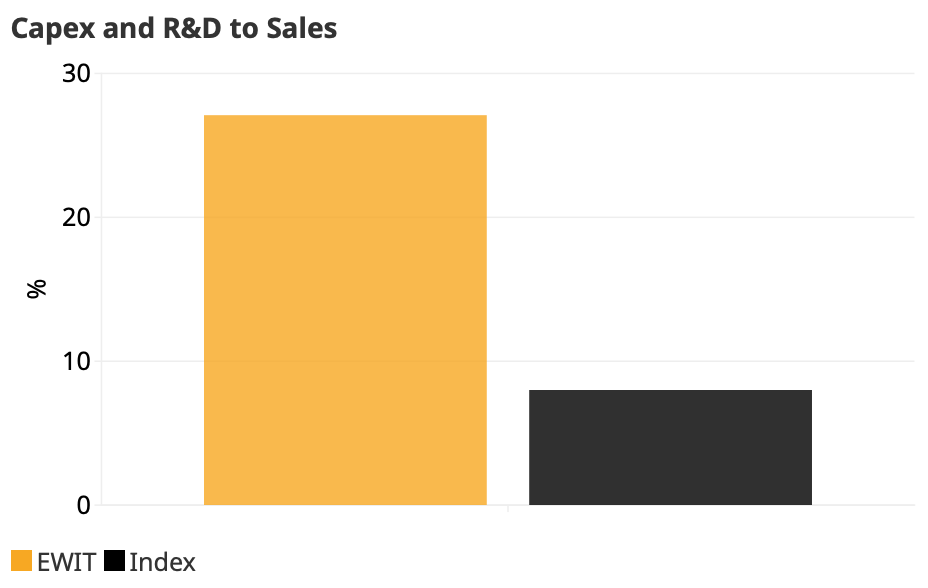

Crucially, however, this has been achieved without sacrificing the growth potential. It remains a collection of fast-growing, ambitious businesses that are taking significant steps today to secure their own futures and ours.

Source: FactSet, Baillie Gifford & Co and S&P. Sterling. Index: S&P Global Small Cap. As at 30 November 2025. 12-month forward estimates. Trust and Index figures are calculated excluding negative earnings.

Third, the strategy is currently positioned at the forefront of technology-driven structural change, in areas where economic imperatives and political priorities are creating durable growth trajectories. Let us explain this in more detail.

The new investment landscape and a moment of opportunity

After decades of benign globalisation, we are now in an era of great-power competition.

This isn’t just about tariffs, although the US average effective tariff rate on imports is now at its highest level since the 1930s. Nor is it solely about military spending, although global military expenditure reached $2.7tn in 2024, accelerating at a rate not seen since the Cold War.

Instead, we view these as symptoms of a fundamental shift in how nations approach strategic industries, with governments increasingly willing to intervene directly in economic areas they perceive as strategically important.

Consider these two key tailwinds:

1. Technology. This sits at the nexus of this shift, serving as both catalyst and beneficiary. Around the world, nations now recognise that technological mastery – in artificial intelligence, electrification, advanced manufacturing, and space technology – will determine the geopolitical pecking order for the decades ahead.

Many of these industries have large capital requirements and face a classic coordination problem: significant and stable demand is required to justify investments, yet customers are reluctant to commit without confidence in suppliers' delivery capacity. Free markets, with their focus on near-term efficiency, are ill-suited for this type of project.

2. Government policy. Across the world, governments are now recognising this and are attempting to push through the impasse with supportive legislation, direct investment, and demand guarantees. All in the national interest.

China has been acting in this manner for years. Western governments are following suit.

For investors capturing opportunities from technology-enabled structural change, this shifting paradigm marks an incredible moment of opportunity.

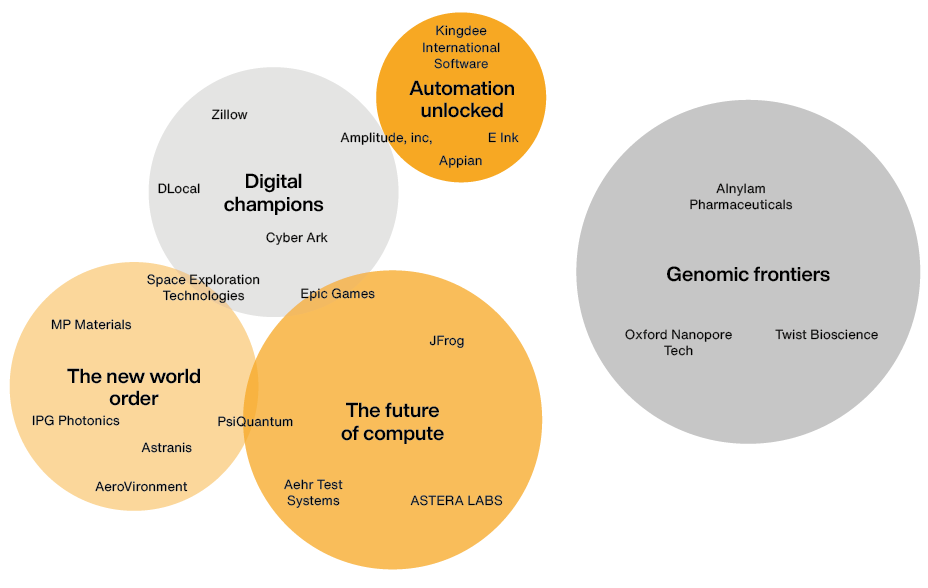

From precision medicine to leading robotic automation, from rocket technology to unlocking the quantum world, we are in the early stages of a golden age of human ingenuity and engineering prowess. EWIT’s portfolio is organised to capture these, and more:

Sizes are illustrative. Based on Edinburgh Worldwide Investment Trust. An example selection of stocks are shown. Excludes cash. Unclassified holdings: 3.8%. As at 30 September 2025.

- The new world order. Companies that cater to the current primacy on sovereignty and security. This extends into areas where technology affects aspects of national and domestic security, such as AeroVironment, Axon, Exail Technologies and MP Materials. This trend is likely to shift towards space technology over the coming decade, further enhancing the strategic importance of companies such as SpaceX and Astranis.

- The future of compute. Recognising AI’s transformative potential, we seek companies addressing value chain bottlenecks, such as Astera Labs, which sells connectivity silicon that improves intra-server rack communication, and Iren, which builds power-hungry data centre capacity. PsiQuantum is a hedge against the next great technological leap – fault-tolerant quantum computing.

- Automation unlocked. The combination of better, cheaper sensors and software that understands contextual information is enabling robotic production. Harmonic Drive supplies precision components that make robotic joints compact and accurate, which are critical for industrial robots and emerging humanoids.

- Digital champions. Digital networks continue to gain share because they save people time and reduce friction, while providing opportunities for monetisation. Zillow's dominance over US housing listings, improving discoverability and conversion, provides the basis for layering on revenue generation.

- Genomic frontiers. Advances in understanding of biology, particularly genetics, are ushering in a new wave of treatments and diagnostics that will transform the patient experience and address a profound societal need. Alnylam demonstrates that deep scientific expertise can alter the odds of drug discovery and approval. Twist Biosciences unlocks new opportunities for research and commercialisation by pushing the limits of DNA synthesis.

Most importantly, this is not speculative positioning. Growth in these areas is tangible and material. While the market is beginning to reward some of these companies, we remain in the foothills of these foundational technologies, and our conviction is that these trends will have a lasting influence on returns in the years ahead.

What we ask of you

Our mission of investing in the next generation of companies is a privilege to which we remain fully committed, personally and professionally.

To us, the true spirit of investing doesn’t reside in chasing transient pricing anomalies. It’s about participating in long-term structural change and providing capital and support to the founders and innovators with the vision and audacity to drive change.

EWIT offers a rare opportunity to be involved in companies shaping and, ultimately, owning that future.

It would be a travesty of fairness for shareholders, who have patiently held through such a challenging three-year period, to have the resulting upside potential – now starting to be realised – taken from them due to the proposed shareholder actions.

We urge you to vote against the proposals that deny you that chance.

Yours faithfully,

The Edinburgh Worldwide co-managers

Why you should vote against

Jonathan Simpson-Dent urges shareholders to vote against Saba for the trust's long-term future.