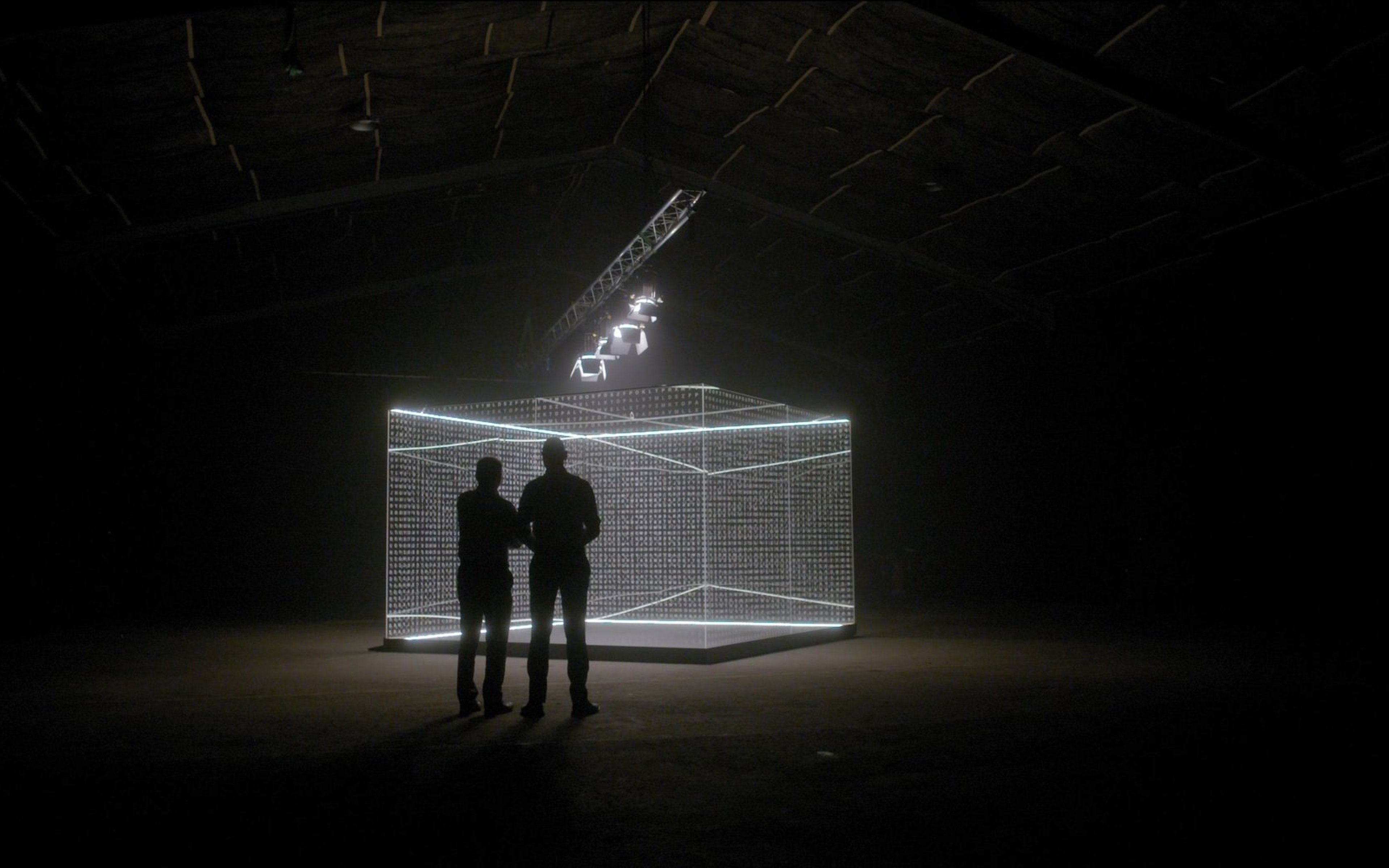

Iain McCombie in Howden’s Depot.

Photography by Duncan Elliott.

Please remember that the value of an investment can fall and you may not get back the amount invested. This article originally featured in Baillie Gifford’s Autumn 2023 issue of Trust magazine.

We’ve barely sat down before Iain McCombie slides a hardback across the table: Kitchens, or Sink.

Books with puns in the title aren’t usually recommended by investment managers, but this one’s blurb helps to explain it: “The story behind the building of the UK’s No. 1 trade kitchen company.”

In the 30 or so years since the book’s author, Matthew Ingle, founded Howdens, the kitchen manufacturer and supplier to the building business has become a FTSE 250 company. Sales exceeded £2.3bn in 2022. The company is also a top 10 holding in the Baillie Gifford UK Growth Trust, jointly managed by Iain McCombie.

“It’s not another ‘how I made my millions’ businessman’s book,” says McCombie. “Although he talks about not being academic and not going to university, Ingle’s cleverness lay in surrounding himself with experienced people.”

Birth of a business

It could all have turned out very differently for the Howdens founder. In 1994, he lost his job at Magnet, the kitchen company where he worked as a manager. At a low ebb, he jotted down an idea for a different kind of kitchen business. It would provide reliable standard joinery and kitchen fittings but with an innovative twist: prices and discounts would be agreed between the local branches and their builder customers.

Ingle sent his idea to the head of MFI, then the leading retail furniture and fittings company. He agreed to back the concept, and Howdens was launched as an MFI subsidiary.

Howdens ultimately became the group’s sole business with Ingle as chief executive when a private equity firm bought the troubled MFI for a nominal sum in 2006.

Two years later, MFI collapsed, a victim of the economic fallout of the credit crunch and competition from the likes of B&Q and Ikea. But Ingle didn’t forget MFI’s help in getting Howdens off the ground. Howdens took responsibility for the lease agreements of MFI’s stores on to its own books, while continuing to fund the fallen giant’s pension liabilities.

That sense of fair play lives on in Howdens’ corporate culture, five years after Andrew Livingston, a former Screwfix boss, succeeded Ingle as chief executive. McCombie likes that.

“The business model remains very similar. Howdens has stayed true to its principles – treating people fairly and squarely, treating employees well and giving them an incentive,” he says.

Last autumn, for instance, Howdens made a one-off payment of £500 to each employee to help cover the rise in their cost of living.

Learning from mistakes

Howdens’ management has never been afraid to admit and learn from its mistakes.

One example: shortly before the first Howdens depots opened in 1995, MFI’s marketing department sent out flyers to potential customers. The response was poor. Ingle instructed depot managers to send handwritten letters to all the local tradespeople they knew, inviting them in for a chat.

“It was a lightbulb moment for senior management, underlining why decentralisation was the right approach,” explains McCombie. “When you trust your employees and give them responsibility, they take it seriously. These are the kind of simple-but-not-easy things that businesses talk about but don’t necessarily do.”

Managers are trusted to run their depots in the way that works best for the local market. They’re encouraged to be entrepreneurial and share profits with employees. That’s partly why none of the 800-plus depots look the same. It’s also still down to each depot manager to agree the discounts that are a big part of Howdens’ appeal to its regular customers.

Helping builders thrive

As McCombie presents it, Howdens’ culture is all about “wanting the builder to win”. Happy customers will come back. And the more business they do, the greater the discount on their orders.

The firm doesn’t reveal its prices to end customers, so builders don’t have to disclose their own margins. And it bases its depots at industrial sites and minimises use of advertising to keep overheads down.

Andrew Livingston and Iain McCombie in a Howdens show kitchen

As anyone who has ever had a new kitchen fitted knows, there is often a gap between the shiny new showroom kitchen and reality. “Kitchens are notoriously complicated,” McCombie says. “Panels and hinges go missing, doors get damaged in transit.” Just getting it right counts for a lot.

Supported by James Smith, a Baillie Gifford investment analyst colleague with hands-on experience in a small family building company, McCombie has come to appreciate how attention to the practical minutiae makes the difference.

Smith describes how a builder often has to wait a week, or even a month, for a replacement if the customer’s kitchen measurements are just a few millimetres out. That means a corresponding holdup before the fitter can start tiling or installing a worktop. And time is money in the building trade. For these reasons, Howdens supplies all fittings ready-made and makes all of its cabinets in the UK from sustainable British wood.

“Having its own manufacturing capability makes a real difference to the business in terms of cost and flexibility,” says Smith. “Customers can get hold of anything through their local depot the same or the next day. If you need to order something from Italy or mainland Europe, you’re a hostage to fortune.

“That’s one of the reasons Howdens did well during Covid-19. Having everything ‘always in stock’ helps to underpin cash flow.”

That model helps Howdens do business fast, unlike much of the building trade. It’s one of the many reasons the Trust’s managers like this stock so much, along with the potential to keep on growing through increased sales.

Growth ambitions

And grow it does. The company plans to open 30 new depots this year, five of them in Ireland. Elsewhere, in Belgium and France, a relatively untapped combined market similar in size to the UK, there are already 60 outlets.

“Unlike many other British companies which aggressively expand abroad, Howdens has done so cautiously and slowly. The way it has clustered outlets around Dublin and Paris rather than scattering them throughout the country seems to work in raising brand awareness and ensuring the trade is well served by nearby depots,” observes McCombie.

As he and Smith emphasise, this focus on quality and service has endeared Howdens to the trade. Builders’ lives can be lonely and stressful, and there’s value in a business culture that sees things from their point of view.

Ingle’s Kitchens, or Sink relays plenty of good tips for business owners and managers about the importance of decentralisation and learning from their mistakes. His legacy to Howdens was an instinct for what the customer wants.

Fitting facts and figures

6m

total kitchens sold to date by Howdens in the UK

£12bn

total size of UK kitchen and joinery market

20%

Howdens’ share of UK market

430,000

Howdens’ small business customers

4hrs 10 mins

average time Brits spend cooking per week

Important information

Investments with exposure to a single market may increase risk.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com

58512 10035558