What's Happening?

Edinburgh Worldwide Investment Trust has received a valid requisition notice from Saba Capital Management seeking to remove all six independent non-executive directors and appoint three US based individuals nominated by Saba. A Requisitioned General Meeting will take place on 20 January 2026 and the Board is urging shareholders to VOTE AGAINST ALL Saba’s resolutions. Saba is relying on you not voting your shares to give them the best chance of taking effective control of your Company. Accordingly, it is very important that you vote on the Requisitioned Resolutions as the future of your investment depends on it.

Why you should vote against the Saba resolutions

The Board strongly urges Shareholders to vote against Saba’s resolutions for the following reasons:

- Saba is attempting to seize control of the Company to prioritise its own commercial interests

- Saba has no interest in alternative strategies that would benefit all shareholders

- EWIT currently offers shareholders a unique and distinctive portfolio of disruptive and transformative companies positioned for long-term growth

- The Board has taken steps to improve performance and drive long-term value creation for ALL shareholders

- The Board remains committed to maximising long-term value for all shareholders and is excited by the prospects of EWIT delivering this

- Shareholders cannot take for granted that Saba will be defeated again. Your vote matters.

How to vote if you hold shares through a platform

Your vote is very important. You are strongly encouraged to VOTE AGAINST the Saba resolutions.

If you hold shares through a platform, such as Hargreaves Lansdown or Interactive Investor, you can vote by accessing your online account. Voting is straightforward and should take less than five minutes.

If you hold your shares in certificated form voting is now open. If you hold your shares through a platform their dates may differ so you should contact them directly if voting is not yet available.

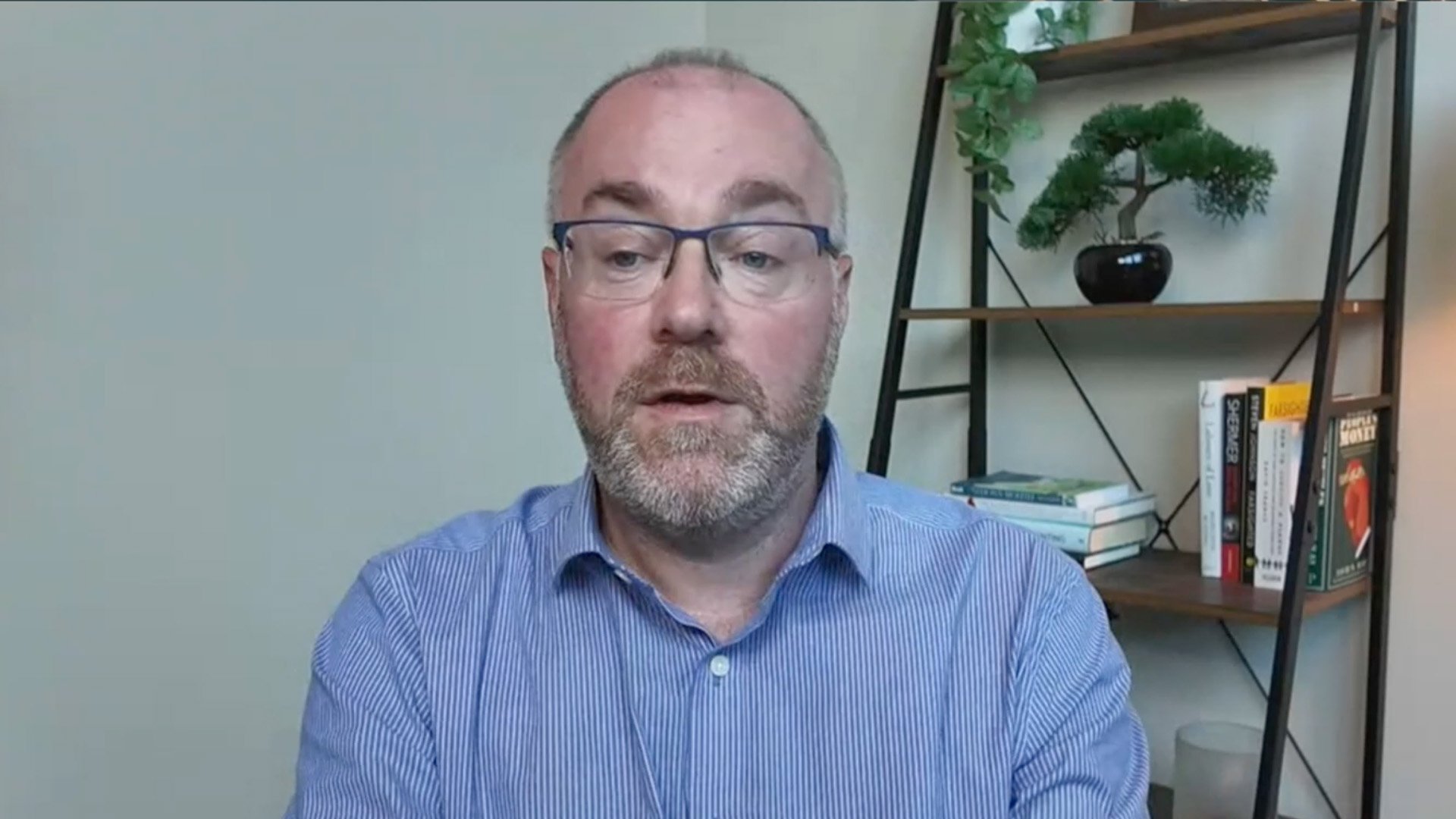

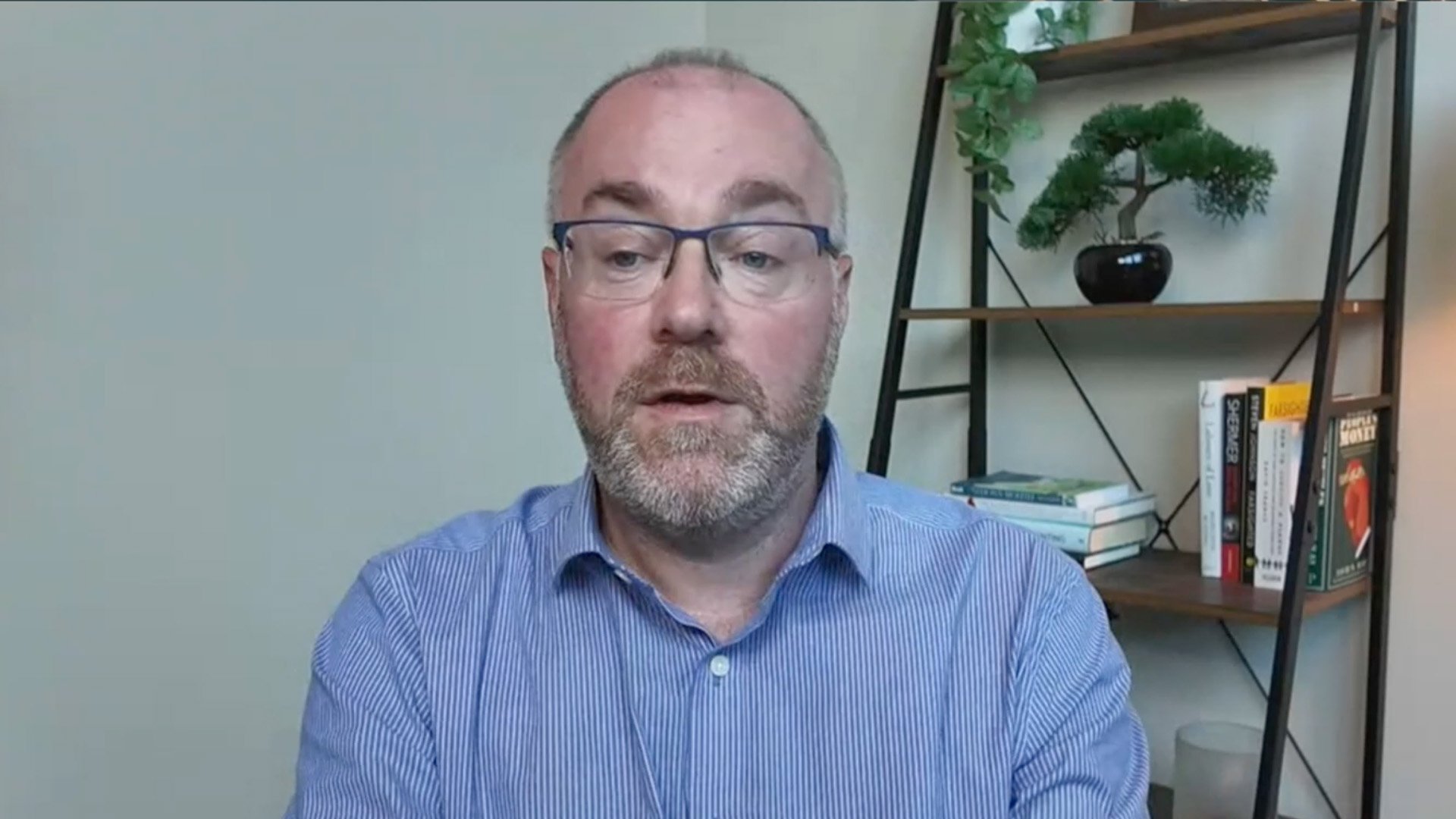

A message from the chair

In this video, Jonathan Simpson-Dent, Chair of Edinburgh Worldwide, gives his views on Saba’s proposals and why the best outcome for shareholders is to vote against Saba’s resolutions.

General meeting

12 noon on 20 January at the offices of Baillie Gifford, Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

Useful links

How to vote via a proxy

All shareholders on the main register will be posted a copy of the circular covering the general meeting along with a proxy form and instructions on how to complete this. You can also read a copy of the circular.

The Company has appointed Georgeson (a trading name of Computershare Investor Services PLC) to liaise with Shareholders to ensure that forms of Proxy are completed and submitted by the deadlines stated above. If you need further help or assistance in voting your Shares, please email EWIT@georgeson.com for more information.

- To be valid, the Form of Proxy must be completed and returned to the office of the Company’s Registrars, Computershare Investor Services PLC, The Pavilions, Bridgwater Road, Bristol BS99 6ZY so as to arrive no later than 12 noon on 17 January 2026.

- Alternatively, you may register your proxy appointment(s) electronically by visiting Computershare’s website. Electronic proxy appointments must also be lodged no later than 12 noon on 17 January 2026.

- Appointment of a proxy does not preclude you from attending the Requisitioned General Meeting and voting in person

If you have any questions relating to the completion and return of your Form(s) of Proxy or electronic proxy appointment(s), please contact Computershare’s Shareholder helpline on +44 (0) 370 703 6298 between 8.30am and 5.30pm (UK time) Monday to Friday (except on public holidays in England and Wales).

CNBC interview: Edinburgh Worldwide chair urges shareholders to back board against Saba Capital

Edinburgh Worldwide Investment Trut Chair Jonathan Simpson-Dent urges shareholders to back its board against activist pressure from Saba Capital.

Every vote will count and your vote is important

Please ensure you VOTE to have your say on the future of your company.

The Board recommends that shareholders VOTE AGAINST ALL the requisitioned resolutions at the requisitioned general meeting.

Contact us

Need help voting your shares?

Please email EWIT@georgeson.com for more information or contact the Shareholder helpline on +44 (0) 7748491929 between 8:30am and 5:30pm (UK time) Monday to Friday.

Shareholders

If you have any questions, please contact the Baillie Gifford Client Relations Team:

Email: enquiries@bailliegifford.com

Phone: 0800 917 2113. Calls may be recorded for training and monitoring purposes.

If calling from overseas, you can phone: +44 (0)131 275 3499.

Press enquiries

Greenbrook Advisory

Rob White / Peter Hewer

+44 (0)207 952 2000

ewit@greenbrookadvisory.com

Overview

ISIN

GB00BHSRZC82SEDOL

BHSRZC8Investment proposition

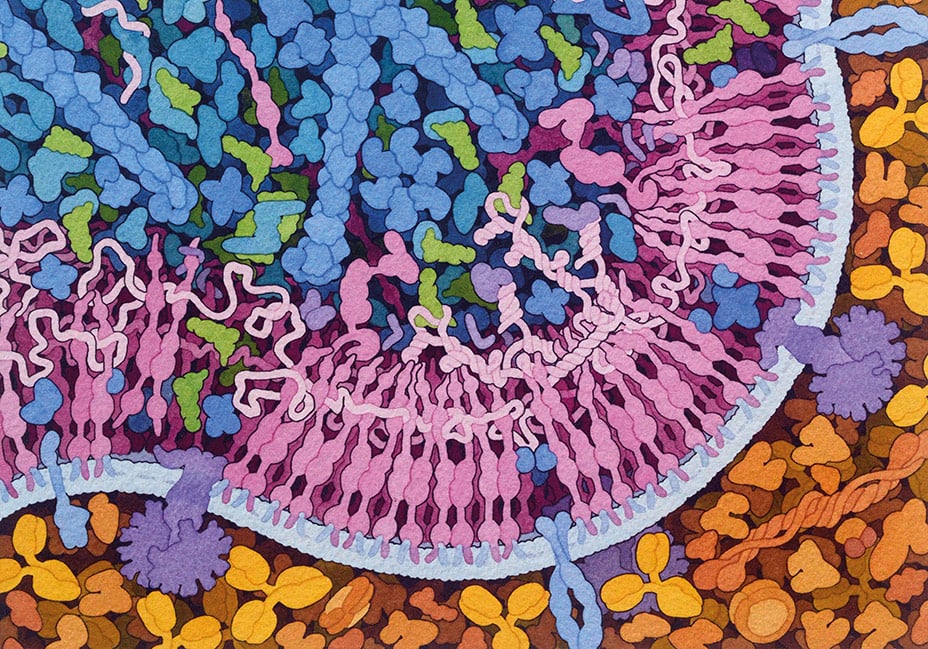

Edinburgh Worldwide offers shareholders a unique portfolio of publicly traded and private businesses operating at frontiers of technological innovation and transformation. The Trust is a global smaller companies specialist aiming to generate long-term capital appreciation by early access to emerging businesses with significant disruptive growth potential.

Share price and charges

Price

217.50pNAV at fair

231.69pPremium (+) or discount (-) at fair

-6.1%Ongoing charges*

0.76%Fund facts

Active share

99%*

Fund launch date

1998

AIC Investment Sector

Global Smaller Companies

Benchmark

S&P Global Small Cap Index

*Relative to S&P Global Small Cap. Source: Baillie Gifford & Co, S&P.

While the policy is global investment, the approach adopted is to construct a portfolio through the identification of individual companies which offer long-term growth potential.

Meet the managers

Meet the directors

Intermediary client contacts

If you’d like further information, please get in touch with the Intermediary Client Contact for your area.

Ratings

As at: 30 September 2025

Regulatory news announcements

Regulatory news announcements which are released to the London Stock Exchange can be accessed via their service.

The Association of Investment Companies

Further information on investment trusts and the investment trust sector can be found on The Association of Investment Companies website.

Risk Warnings

Risk Introduction

The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies. The value of their shares, and any income from them, can fall as well as rise and investors may not get back the amount invested. The specific risks associated with the Trust include:

Currency

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

Private Companies

Unlisted investments such as private companies, in which the Trust has a significant investment, can increase risk. These assets may be more difficult to sell, so changes in their prices may be greater.

Gearing

The Trust can borrow money to make further investments (sometimes known as "gearing" or "leverage"). The risk is that when this money is repaid by the Trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the Trust will make a loss. If the Trust's investments fall in value, any invested borrowings will increase the amount of this loss.

Liquidity

Market values for securities which have become difficult to trade may not be readily available and there can be no assurance that any value assigned to such securities will accurately reflect the price the Trust might receive upon their sale.

Derivatives

The Trust can make use of derivatives which may impact on its performance.

Smaller Immature Companies

Investment in smaller, immature companies is generally considered higher risk as changes in their share prices may be greater and the shares may be harder to sell. Smaller, immature companies may do less well in periods of unfavourable economic conditions.

Premium Risk

Share prices may either be below (at a discount) or above (at a premium) the net asset value (NAV). The Company may issue new shares when the price is at a premium which may reduce the share price. Shares bought at a premium may have a greater risk of loss than those bought at a discount.

Buy-backs

The Trust can buy back its own shares. The risks from borrowing, referred to above, are increased when a trust buys back its own shares.

Income Secondary

The aim of the Trust is to achieve capital growth. You should not expect a significant, or steady, annual income from the Trust.

Regulation of Investment Trusts

The Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

Index disclaimer

Fund performance

Periodic Performance

As at: 31 October 2025

1 Year | 3 Years | 5 Years | 10 Years | |

|---|---|---|---|---|

Share Price | 30.2% | 18.8% | -28.7% | 134.0% |

NAV | 29.7% | 11.8% | -21.0% | 138.8% |

Index* | 12.8% | 31.3% | 66.3% | 172.7% |

Discrete Performance

As at: 30 September 2025

30/09/2020 – 30/09/2021 | 30/09/2021 – 30/09/2022 | 30/09/2022 – 30/09/2023 | 30/09/2023 – 30/09/2024 | 30/09/2024 – 30/09/2025 | |

|---|---|---|---|---|---|

Share Price | 5.3% | -43.3% | -20.1% | 11.0% | 30.8% |

NAV | 12.4% | -37.7% | -17.0% | 2.5% | 25.1% |

Index* | 33.5% | -9.1% | 5.1% | 13.1% | 11.9% |

Performance

As at: 31 October 2025

Source: Morningstar, MSCI, S&P.

Performance figures appear in GBP. The value of your investment may go down as well as up, and you may not get back the amount you invested.

Comparative Index is limited to a 5 year period from the current date.

The graph has been rebased to 100.

Please bear in mind that past performance is not a guide to future returns.

Active share

As at: 31 October 2025

Relative to S&P Global Small Cap. Source: Baillie Gifford & Co, S&P.

Discount/premium history at fair

As at: 31 October 2025

Source: Morningstar. Premium/Discount of share price to NAV at fair.

If the graph shows negative figures this means that the share price is lower than the NAV at fair – this is known as trading at a Discount.

If the graph shows positive figures this means that the share price is higher than the NAV at fair - this is known as trading at a Premium.

Fund portfolio holdings

The list of top 10 holdings that this fund invests in.

As at: 31 October 2025

| # | Holding | % of total assets |

|---|---|---|

| 1 | Space Exploration Technologies | 8.4% |

| 2 | Alnylam Pharmaceuticals | 6.8% |

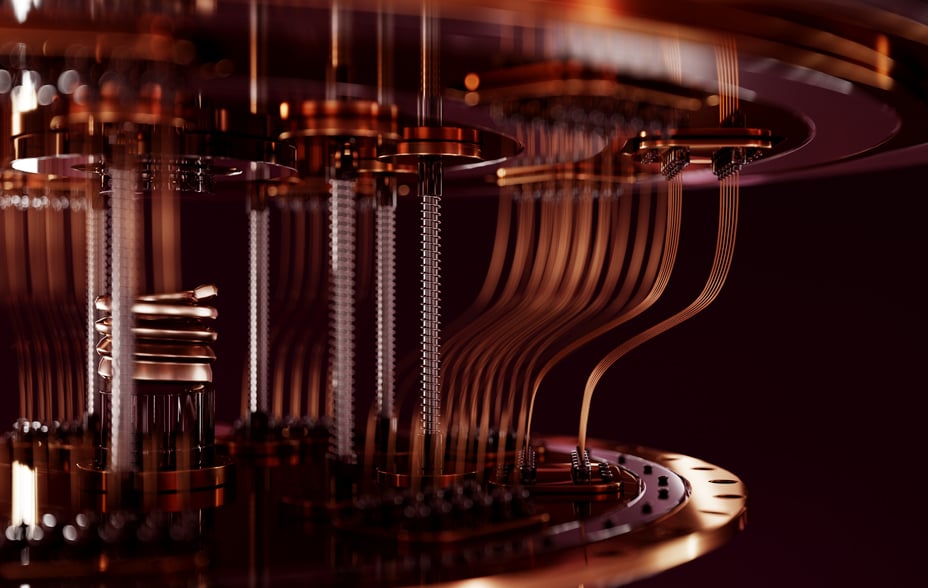

| 3 | PsiQuantum | 6.5% |

| 4 | AeroVironment | 4.7% |

| 5 | American Superconductor Corp | 3.2% |

| 6 | Axon Enterprise | 3.2% |

| 7 | Xometry, Inc. | 2.6% |

| 8 | Oxford Nanopore Tech | 2.5% |

| 9 | Zillow | 1.9% |

| 10 | Astera Labs | 1.7% |

Insights

Key articles, videos and podcasts relating to the fund:

Filters

Insights

Chair urges shareholders to back board against Saba

Edinburgh Worldwide Investment Trust Chair Jonathan Simpson-Dent urges shareholders to back its board against activist pressure from Saba Capital.

Looking at the facts

The EWIT Board highlights strong performance and recommends that shareholders reject Saba’s proposals for the trust’s long-term future.

Why you should vote against

Edinburgh Worldwide shareholders face a crucial vote. Protect the trust's future by voting against Saba.

EHang: the sky’s the limit

Why Edinburgh Worldwide has invested in the Chinese company making flying cars a reality.

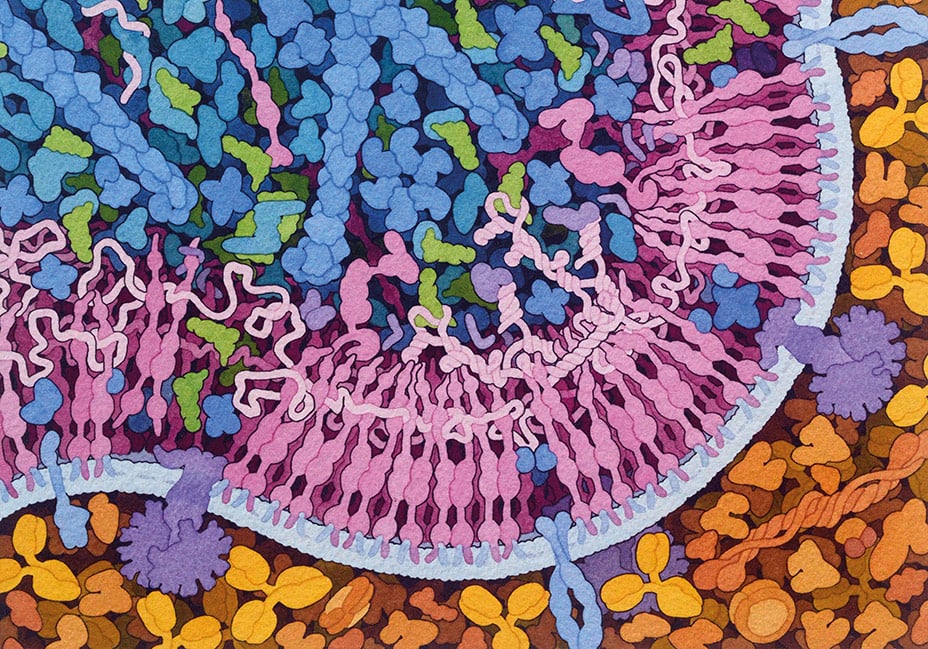

EWIT enlightenment: Alnylam

The US drugmaker pivoting from a rare disease specialist to a major therapeutic platform.

Edinburgh Worldwide Investment Trust Q3 update

Investment specialist Bill Chater reflects on recent performance, portfolio changes and market developments.

EWIT enlightenment: IREN

The US datacentre operator turning renewable power into AI profits as grid constraints bite.

Bringing it home

Meet the companies winning from deglobalisation.

EWIT enlightenment: MP Materials

The owner of the US’s only rare earth mine is set for success, after a $500m partnership with Apple.

EWIT enlightenment: Amplitude

How software company Amplitude is adapting to the AI age.

EWIT enlightenment: Astera Labs

How this portfolio holding is solving critical data bottlenecks in AI infrastructure.

The Next Chapter

Baillie Gifford trusts showcase private market focus and AI optimism at annual investment conference.

EWIT enlightenment: CyberArk

Discover how EWIT holding CyberArk is making our data more secure.

EWIT: the next generation of companies set to prosper

Investment manager Douglas Brodie discusses the exciting opportunities for the portfolio for the year ahead.

Edinburgh Worldwide quarterly update

An update on how recent EWIT are thinking about recent trade tensions.

Alnylam: Stock Story

Richie Vernon explores the revolutionary drugs transforming patient lives.

Quantum, space, fusion: the big three

How PsiQuantum, SpaceX and SHINE Technologies seek to shape the future and deliver growth.

EWIT: Manager Insights

An update on performance and investment outlook.

Your vote, EWIT's future.

Shareholders urged to protect the trust's future by voting against Saba.

EWIT: letter to shareholders

Why your vote is crucial.

Edinburgh Worldwide manager update

Portfolio managers Svetlana Viteva and Luke Ward discuss EWIT's planned evolution.

EWIT: Resetting a path for growth

A comprehensive action plan for the Trust and proposal to return up to £130m to shareholders.

Small cap strife: big opportunities

Exploring the transformative potential of small-cap companies such as DexCom, Tesla and Axon.

Private investor forum: growth on sale

Why it pays to keep faith in the company fundamentals

Our best disruptive ideas

Bill Chater spotlights three companies making world-changing breakthroughs: Alnylam, Axon and SpaceX.

PsiQuantum: the leap to quantum computing

How PsiQuantum is ushering in a new type of computer that could change the way medicines are invented and make renewables more efficient.

Five powerful tailwinds behind EWIT

Edinburgh Worldwide Investment Trust focuses on five key growth-supporting tailwinds underpinning future returns.

The case for private companies

An overview of Edinburgh Worldwide’s use of private companies.

Future growth stars back in focus

Firms with winning technology and services are getting noticed again, despite the reign of the Magnificent 7.

Stock story: PsiQuantum

How one company is finally bringing the boundless possibilities of quantum computing into reach of the wider market.

Global Discovery manager update

Hear why investors’ confidence in the Strategy remains steadfast despite challenging times.

EWIT’s vision on pioneering technologies

Dive into EWIT's vision on DNA research, AI, and tech's role in future advancements.

EWIT: Manager Insights

Lead manager Douglas Brodie gives an update on performance with three key reasons for optimism.

The case for private companies

An overview of Edinburgh Worldwide’s use of private companies.

Growing up: early-stage companies

Edinburgh Worldwide Investment Trust patiently holds high-potential, progressive businesses.

EWIT: growth companies shaping our tomorrow

Investor Douglas Brodie talks about his approach and exciting opportunities for the portfolio

A view from the frontiers

How Edinburgh Worldwide Investment Trust spots potential disruptors in turbulent times.

The hidden costs of software

A decade ago, software companies were venture-backed and capital-light. That’s no longer true.

Investing in private companies

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

How do we value private companies?

Uncover the multiple layers of governance that feed into the valuation of private companies at Baillie Gifford.

Nuclear fusion: SHINE lights the way

The cancer-fighting firm that aims to lead a clean energy revolution.

Private company investing myths

Busting three myths that could alter your view about what private company investing is.

How Alnylam nips disease in the bud

The US-based company’s technology promises to ‘silence’ genetic disorders and target some of the world’s biggest killers.

Global Discovery manager update

Investors discuss recent performance, holdings, and portfolio positioning for the Global Discovery Strategy.

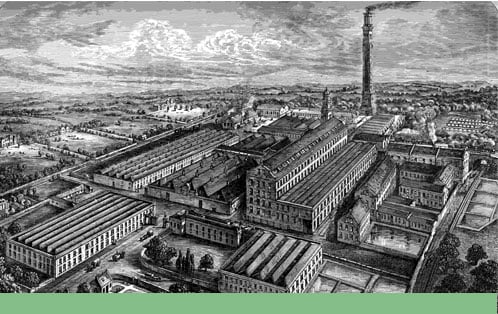

The history of Edinburgh Worldwide Investment Trust

While the investment policy and geographical focus may have shifted over 125 years, key themes link the story of the Edinburgh Worldwide Trust then and now.

What is private company investing?

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

Quoted Data research report - Edinburgh Worldwide Investment Trust

Quoted Data's latest research report. Please note that this is paid for research.

Edinburgh Worldwide: Manager Insights

How has our portfolio of early-stage growth firms changed in a year of economic uncertainty?

Baillie Gifford Global Discovery manager update

This update focuses on recent investment performance and holdings’ operational progress.

Trust trip notes: Tel Aviv

Israel is a nursery for innovative startups, sponsoring growth firms in fields from biofood to cyber security.

A decade of discovery

A focus on growth and innovation has led to exciting finds such as Tesla and Ocado.

EWIT: Growth companies shaping our tomorrow.

Douglas Brodie, investment manager of the Edinburgh Worldwide Investment Trust, outlines his thoughts on the portfolio’s holdings and why he believes they represent unique and scalable technology-led opportunities over the coming decade and beyond. Baillie Gifford explains its approach to valuing private companies in investment trust portfolios.

Baillie Gifford explains its approach to valuing private companies in investment trust portfolios.

Edinburgh Worldwide Strategy Update.

The Baillie Gifford Global Discovery strategy underpins the Edinburgh Worldwide Investment Trust. Luke Ward, Deputy Manager of the Trust, will provide an update on the strategy through the prism of Edinburgh Worldwide Investment Trust plc.

Edinburgh Worldwide: a global history.

How an international outlook was built in from the start by the investment trust’s founder Robert Fleming.

EWIT AGM: Manager Insights.

An update on green hydrogen and software development investments among other activities.

Green hydrogen’s promise.

Why using renewables to harvest the gas may be the best way for some industries to reach net zero.

Edinburgh Worldwide Investment Trust AGM.

Douglas Brodie, investment manager of the Edinburgh Worldwide Investment Trust, reflects on the past year, gives some insight into the current positioning of the portfolio and sheds some light on what could be some exciting opportunities in the future.

Space: the final investment frontier

Fifty years on from the first moon landing, entrepreneurs on the west coast of America are stepping up spending on space. To discuss how this new space race might impact investment, Malcolm Borthwick is joined by Luke Ward – space enthusiast and deputy manager of Edinburgh Worldwide Investment Trust and the Global Discovery Fund.

Chair urges shareholders to back board against Saba

Edinburgh Worldwide Investment Trust Chair Jonathan Simpson-Dent urges shareholders to back its board against activist pressure from Saba Capital.

Looking at the facts

The EWIT Board highlights strong performance and recommends that shareholders reject Saba’s proposals for the trust’s long-term future.

Why you should vote against

Edinburgh Worldwide shareholders face a crucial vote. Protect the trust's future by voting against Saba.

EHang: the sky’s the limit

Why Edinburgh Worldwide has invested in the Chinese company making flying cars a reality.

EWIT enlightenment: Alnylam

The US drugmaker pivoting from a rare disease specialist to a major therapeutic platform.

Edinburgh Worldwide Investment Trust Q3 update

Investment specialist Bill Chater reflects on recent performance, portfolio changes and market developments.

EWIT enlightenment: IREN

The US datacentre operator turning renewable power into AI profits as grid constraints bite.

Bringing it home

Meet the companies winning from deglobalisation.

EWIT enlightenment: MP Materials

The owner of the US’s only rare earth mine is set for success, after a $500m partnership with Apple.

EWIT enlightenment: Amplitude

How software company Amplitude is adapting to the AI age.

EWIT enlightenment: Astera Labs

How this portfolio holding is solving critical data bottlenecks in AI infrastructure.

The Next Chapter

Baillie Gifford trusts showcase private market focus and AI optimism at annual investment conference.

EWIT enlightenment: CyberArk

Discover how EWIT holding CyberArk is making our data more secure.

EWIT: the next generation of companies set to prosper

Investment manager Douglas Brodie discusses the exciting opportunities for the portfolio for the year ahead.

Edinburgh Worldwide quarterly update

An update on how recent EWIT are thinking about recent trade tensions.

Alnylam: Stock Story

Richie Vernon explores the revolutionary drugs transforming patient lives.

Quantum, space, fusion: the big three

How PsiQuantum, SpaceX and SHINE Technologies seek to shape the future and deliver growth.

EWIT: Manager Insights

An update on performance and investment outlook.

Your vote, EWIT's future.

Shareholders urged to protect the trust's future by voting against Saba.

EWIT: letter to shareholders

Why your vote is crucial.

Edinburgh Worldwide manager update

Portfolio managers Svetlana Viteva and Luke Ward discuss EWIT's planned evolution.

EWIT: Resetting a path for growth

A comprehensive action plan for the Trust and proposal to return up to £130m to shareholders.

Small cap strife: big opportunities

Exploring the transformative potential of small-cap companies such as DexCom, Tesla and Axon.

Private investor forum: growth on sale

Why it pays to keep faith in the company fundamentals

Our best disruptive ideas

Bill Chater spotlights three companies making world-changing breakthroughs: Alnylam, Axon and SpaceX.

PsiQuantum: the leap to quantum computing

How PsiQuantum is ushering in a new type of computer that could change the way medicines are invented and make renewables more efficient.

Five powerful tailwinds behind EWIT

Edinburgh Worldwide Investment Trust focuses on five key growth-supporting tailwinds underpinning future returns.

The case for private companies

An overview of Edinburgh Worldwide’s use of private companies.

Future growth stars back in focus

Firms with winning technology and services are getting noticed again, despite the reign of the Magnificent 7.

Stock story: PsiQuantum

How one company is finally bringing the boundless possibilities of quantum computing into reach of the wider market.

Global Discovery manager update

Hear why investors’ confidence in the Strategy remains steadfast despite challenging times.

EWIT’s vision on pioneering technologies

Dive into EWIT's vision on DNA research, AI, and tech's role in future advancements.

EWIT: Manager Insights

Lead manager Douglas Brodie gives an update on performance with three key reasons for optimism.

The case for private companies

An overview of Edinburgh Worldwide’s use of private companies.

Growing up: early-stage companies

Edinburgh Worldwide Investment Trust patiently holds high-potential, progressive businesses.

EWIT: growth companies shaping our tomorrow

Investor Douglas Brodie talks about his approach and exciting opportunities for the portfolio

A view from the frontiers

How Edinburgh Worldwide Investment Trust spots potential disruptors in turbulent times.

The hidden costs of software

A decade ago, software companies were venture-backed and capital-light. That’s no longer true.

Investing in private companies

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

How do we value private companies?

Uncover the multiple layers of governance that feed into the valuation of private companies at Baillie Gifford.

Nuclear fusion: SHINE lights the way

The cancer-fighting firm that aims to lead a clean energy revolution.

Private company investing myths

Busting three myths that could alter your view about what private company investing is.

How Alnylam nips disease in the bud

The US-based company’s technology promises to ‘silence’ genetic disorders and target some of the world’s biggest killers.

Global Discovery manager update

Investors discuss recent performance, holdings, and portfolio positioning for the Global Discovery Strategy.

The history of Edinburgh Worldwide Investment Trust

While the investment policy and geographical focus may have shifted over 125 years, key themes link the story of the Edinburgh Worldwide Trust then and now.

What is private company investing?

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

Quoted Data research report - Edinburgh Worldwide Investment Trust

Quoted Data's latest research report. Please note that this is paid for research.

Edinburgh Worldwide: Manager Insights

How has our portfolio of early-stage growth firms changed in a year of economic uncertainty?

Baillie Gifford Global Discovery manager update

This update focuses on recent investment performance and holdings’ operational progress.

Trust trip notes: Tel Aviv

Israel is a nursery for innovative startups, sponsoring growth firms in fields from biofood to cyber security.

A decade of discovery

A focus on growth and innovation has led to exciting finds such as Tesla and Ocado.

EWIT: Growth companies shaping our tomorrow.

Douglas Brodie, investment manager of the Edinburgh Worldwide Investment Trust, outlines his thoughts on the portfolio’s holdings and why he believes they represent unique and scalable technology-led opportunities over the coming decade and beyond.

Valuing private companies.

Baillie Gifford explains its approach to valuing private companies in investment trust portfolios.

Edinburgh Worldwide Strategy Update.

The Baillie Gifford Global Discovery strategy underpins the Edinburgh Worldwide Investment Trust. Luke Ward, Deputy Manager of the Trust, will provide an update on the strategy through the prism of Edinburgh Worldwide Investment Trust plc.

Edinburgh Worldwide: a global history.

How an international outlook was built in from the start by the investment trust’s founder Robert Fleming.

EWIT AGM: Manager Insights.

An update on green hydrogen and software development investments among other activities.

Green hydrogen’s promise.

Why using renewables to harvest the gas may be the best way for some industries to reach net zero.

Edinburgh Worldwide Investment Trust AGM.

Douglas Brodie, investment manager of the Edinburgh Worldwide Investment Trust, reflects on the past year, gives some insight into the current positioning of the portfolio and sheds some light on what could be some exciting opportunities in the future.

Space: the final investment frontier

Fifty years on from the first moon landing, entrepreneurs on the west coast of America are stepping up spending on space. To discuss how this new space race might impact investment, Malcolm Borthwick is joined by Luke Ward – space enthusiast and deputy manager of Edinburgh Worldwide Investment Trust and the Global Discovery Fund.

How to buy

You can invest in our funds via a number of fund platforms. Information on the range of funds available through platforms can be obtained from platforms@bailliegifford.com

Further information on the funds can be found in the relevant Key Information Documents, which are available in English and will be sent to you free of charge on request.

AGM and voting

When you invest in an investment trust you become a shareholder and have a say on how the Company is run. You also have a right to attend the Company's annual general meeting (AGM).

How to vote

The following link will take you through to The Association of Investment Trusts' (AIC) website where there is information on how to vote your shares if you hold them via one of the major platforms.

How to attend the AGM

If you hold your shares through a platform, it is not always obvious how to attend an AGM. The following link will take you through to The Association of Investment Trusts’ (AIC) website where there is information on how your platform can help you attend this important shareholder meeting. If you do not see your provider listed, please contact your provider directly and ask them to assist.

Edinburgh Worldwide Investment Trust corporate calendar

Our corporate calendar provides details of the regulatory events that occur over the year. This includes dates for reports, results, dividend payments and the AGM.

| Event | Month (each year) |

| Final results announced | January |

| Interim results announced | June |

| Financial year end date | 31 October |

| Annual general meeting | March |

| Dividends payable | N/A |

AGM

Edinburgh Worldwide's Requisitioned General Meeting and AGM was held on Friday 14 February 2025. You can read a summary of the results of the voting on AGM resolutions here.

Voting

A breakdown of the votes cast by Baillie Gifford over the previous quarter on behalf of the investment trust is available in the Proxy voting disclosure.

Registrar

Computershare Investor Services PLC maintains the share register on behalf of the Company. Queries regarding shares registered in your own name can be directed to:

Computershare Investor Service PLC,

The Pavilions,

Bridgwater Road,

Bristol,

BS99 6ZZ

T: +44 (0)370 707 1643

Documents

You can access any literature about the Fund here.

To download any document you will need Adobe Reader. Please note that we can now provide you with Braille and audio transcriptions of our literature on request. It may take up to 10 days for the transcription to be completed dependent on the size of the document.