© Barcroft Media/Getty Images

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

China’s ecommerce industry has been smartphone-centric since its earliest days. That means it has evolved in different ways from the West, arguably at a faster pace.

Having a team on the ground gives Baillie Gifford two key advantages. Members can meet the business founders and other executives involved. And they can also gain a better understanding of the various apps by seeing how they and Chinese consumers use them in daily life.

Hubei-born investment manager Rio Tu moved back to China in 2019 to establish Baillie Gifford’s Shanghai office and recently participated in the firm’s Disruption Week webinars.

“At first, I followed the same shopping habits I’d had in Edinburgh,” he recalls. “Then, I had two experiences that made me realise that ecommerce in China is much more than searching for something you already have in mind and buying it with a click.

“First, one of my friends mentioned it would soon be Singles’ Day – the annual shopping festival invented by Alibaba.

“So I opened its Taobao app, and there were lots of new features to get my head around: pre-sale livestreaming sessions where you had to pay a deposit to secure items, and discounts seemingly popping up at random.”

“Second, I visited my parents in Shenzhen. I saw a pile of parcels by the front door and asked what they were. ‘Oh,’ my mother replied, ‘just some things I bought on Douyin.’ That puzzled me as I hadn’t associated its sister app TikTok with shopping.”

WATCH: Investment manager Rio Tu discusses China’s retail revolution in his Disruption Week briefing

Three years on, he adds, neither occurrence seems odd. Moreover, they inform his thinking not just about what the future of shopping will be like in China but how it might guide retail elsewhere.

Team purchases

One increasingly common Chinese feature is social shopping, where consumers team up together to make a purchase. Sometimes those involved have never met and are assembled by algorithms.

Pinduoduo first popularised the feature. It connects groups of shoppers directly to farmers and other physical goods vendors. These sellers benefit from the resulting economies of scale and the cutting out of distributors and other intermediaries. The app initially targeted users in China’s smaller cities but is now used nationwide. It recently topped 750 million monthly active users, more than half the country’s population.

“If there’s something you want, you have two options: purchase it immediately just for yourself or initiate a ‘team purchase’ to qualify for a 20 to 40 per cent discount, depending on the merchant.

“You have up to 24 hours to rally a team. You used to need to find 10 or more others from your contacts list. But now the groups can be smaller and Pinduoduo can do the matching itself. I’ve had orders shared with strangers from thousands of kilometres away. The hit rate is quite high.”

Friends and family inviting each other to join teams help drive impulse purchases. And the app draws on these interactions to finetune its personalised recommendations. Tu believes the idea caught on quickly because many shoppers moved straight from using traditional ‘wet markets’ made up of individual stalls to Pinduoduo.

“That leapfrog effect meant they didn’t go to supermarkets or department stores and weren’t bound to their loyalty programmes,” he says.

Meituan and Alibaba’s Taocaicai app are among others to have embraced the community group-shopping model. And the range of goods they promote is growing.

“During the recent Covid-19 lockdown, I noticed there were loads of fridges being group-purchased to store extra food,” says Tu. “To see the social buying model work for large ticket items is a big step forward.”

And there could be further disruption to come.

Tu and his colleagues have met Pinduoduo’s founder a few times. Colin Huang’s long-term ambition is to disrupt the traditional model of commerce, which encourages consumers to repeatedly buy the same products. Instead, he hopes to make it possible for enough people to band together with big enough orders that it makes economic sense for vendors to provide them with customised options.

Phygital thinking

China also leads the way in ‘phygital retail’ – a phrase coined to highlight how shopping is moving away from being a purely physical or digital experience.

Take, for example, a student in Qingdao out to buy cosmetics. It wouldn’t be unusual for her to pick a lipstick from the counter and then watch a trusted influencer test it on Kuaishou’s video-sharing app to avoid having to try it on in the store.

Of course, British users might do something similar with YouTube. But Tu highlights another example that’s more China-specific.

The country’s most popular app is Tencent’s WeChat, which has more than 1.2 billion active users. There isn’t really a western equivalent. For those unacquainted with the ubiquitous ‘super-app’, it’s helpful to think of it as being a secondary operating system that runs on both iPhones and Android. It offers access to a universe of third-party Mini Programs, which you can think of as being apps within an app, piggybacking on WeChat’s digital infrastructure.

Many physical shops use the facility to provide a better experience.

“For example, a large department store I often visit has built a digital floorplan that mirrors its physical space. And on every floor, you can see the same brands,” explains Tu. “Each brand has a store manager, and each manager has a WeCom account.

“If you have a query, you can ask a question. And once you become a follower, the store owner can send you promotions and invite you to livestreaming sessions.

“You can use it to book parking and pay with a smartphone scan if you go in. And if not, you can buy whatever you want directly via the Mini Program using WeChat Pay.”

Tu adds that he and his Shanghai colleagues spoke to Tencent’s president Martin Lau a few weeks ago, shortly after a decision by luxury group LVMH to increase its efforts on WeChat’s Mini Programs. That should encourage other brands to do likewise.

Livestreaming celebrities

Livestreaming is a third area where Chinese ecommerce is breaking new ground.

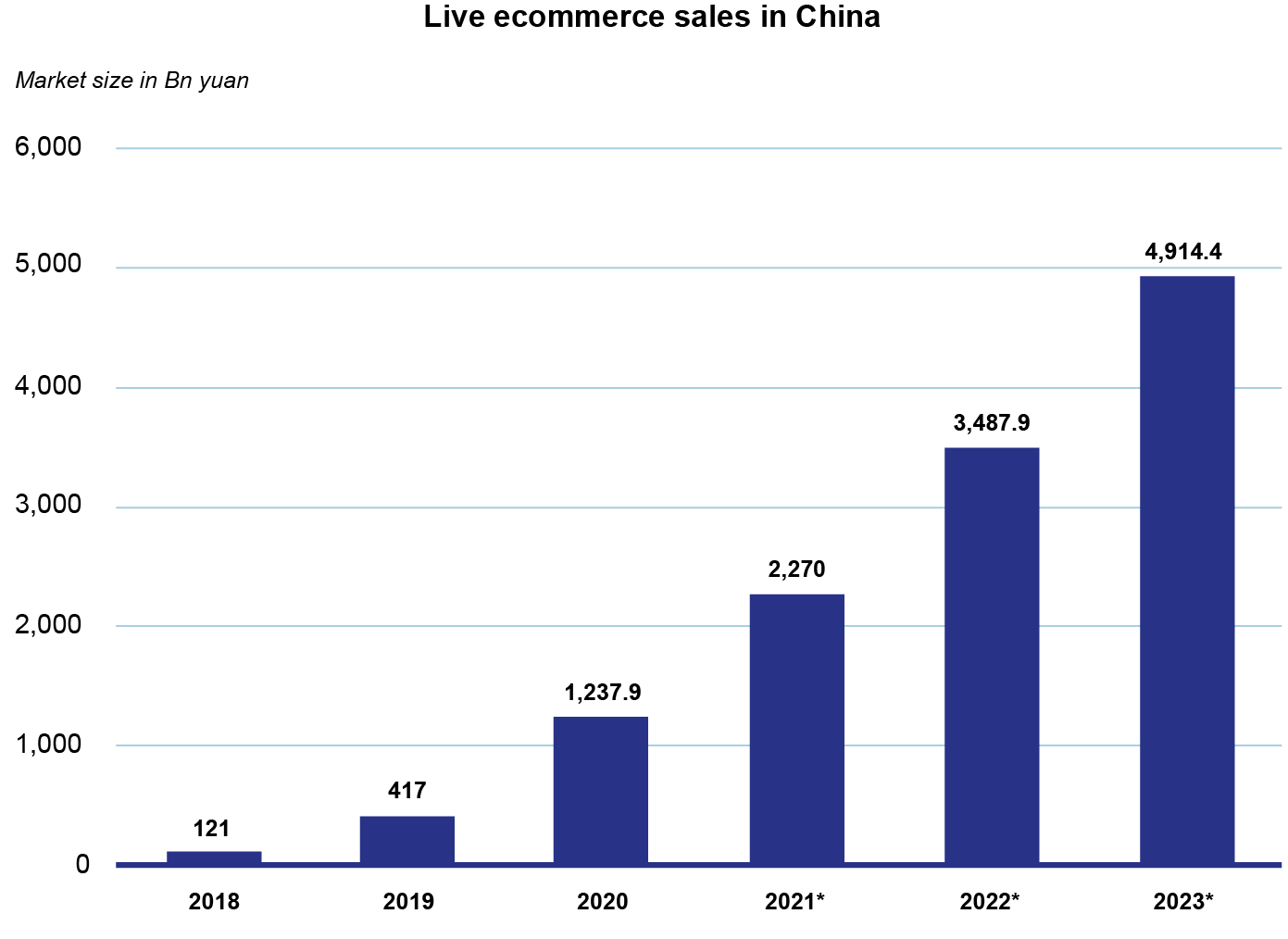

Popular presenters can attract tens of millions of followers. And related sales are forecast to reach nearly 3.5tn yuan ($520bn) this year, according to research agency iiMedia. That would be more than a 50 per cent increase over 2021.

Alibaba’s Taobao Live, Kuaishou and Bytedance's Douyin are the big three apps in terms of sales. Pinduoduo JD.Com and NetEase Kaola are among other major players.

“It’s taken livestreaming ecommerce three years to achieve the level of transaction value that conventional ecommerce achieved in a decade,” says Tu.

Part of the reason it’s so effective is the way the streams catch users’ eyes.

They might have gone on to Douyin, for example, to look at clips of trainers. The app will notice their interest and funnel a livestreamer among the clips. Even if they don’t make a purchase, they might follow the seller’s account because she was engaging. And that allows her to send them alerts next time she is online.

Meantime the content recommendation engine involved gets ever more effective.

“The system can see from a higher level what gets watched, how often, which bits get watched the longest, any likes, what’s been said to live-streamers and what sales are made within the app,” says Tu. “It’s another level of data.”

It is, however, an activity that has caught the eye of China’s authorities. In recent months they have:

- restricted teenagers from giving sellers gifts and banned them from watching streams late at night

- cracked down on fraudulent marketing

- fined some of the country’s highest-profile streamers for tax fraud

Whether this foreshadows tougher measures or helps the trade thrive by curbing bad behaviour is yet to be determined.

Either way, what China forged is now set to strike elsewhere.

Bytedance, for instance, launched TikTok Shop last year, allowing brands and creators to host livestreams and sell directly through its international app. And Flipkart is among several Indian ecommerce firms experimenting with group buying.

“Big companies have emerged and prospered in China by providing content- and social-based selling,” Tu concludes.

“We’re likely to see similar disruption and innovation elsewhere. And that will provide big opportunities for existing platforms, as well as new players.”

Words by Leo Kelion

Important information

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in June 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 23414 10012321