Key points

- Quality growth companies with high returns on capital and robust profit margins can thrive in high interest rate environments

- The investment trusts are invested in companies that are adaptable, financially strong and aligned with structural trends

- Each of the four investment trusts offers a unique approach to harnessing long-term growth potential

Your capital is at risk. Past performance is not a guide to future returns.

Coming as it does after two tough years, will 2024 be remembered as a ‘year of recognition’?

Several speakers at Baillie Gifford’s Private Investor Forum pointed to signs that share prices were at last beginning to reflect the underlying strengths of quality growth businesses.

This sense of the business fundamentals reasserting themselves was a key theme of the Forum. The market’s better recognition of inherent company strengths brings a welcome sense of normality after two unsettling years for investors: In 2022, companies scrambled to adapt to a more challenging economic environment, while 2023 was about putting growth plans into action.

James Budden, Baillie Gifford’s director of marketing and distribution, opened the Edinburgh event by acknowledging the challenges faced by active investors in recent years: notably rising interest rates, inflation and geopolitical tensions, culminating in all-out war in Ukraine and the Middle East.

But despite these factors hampering performance, Budden struck an optimistic note about the resilience and potential of growth companies. Many have amply demonstrated adaptability and financial strength in the face of adversity. For these reasons, he suggested, it was time for investors to “get back on board the growth train”.

“Quality growth companies with high returns on capital and robust profit margins are well-placed to deal with any lingering inflationary pressures,” he said. Such businesses do not simply rely on the economic cycle to excel.”

Budden pointed to the digitalisation of commerce and finance and the confluence of data and healthcare as areas ripe with investment opportunities, even in high interest rate environments. These are themes that representatives of four Baillie Gifford-managed trusts explored in more detail, starting with The Monks Investment Trust.

Monks: stationed for a new world order

Jon Henry, investment specialist for Monks, emphasised the Trust’s focus on long-term capital growth, achieved by investing in widely diverse companies with the potential for sustained cash flow and profit growth.

Monks invests in 110 stocks worldwide, leveraging research from regional equity teams. It aims for diversified growth, classifying investments into three themes: ‘growth stalwarts’, eg, digital payments business Mastercard; ‘rapid growth’, eg, South American ecommerce and payments business MercadoLibre; and ‘cyclical growth’ companies, eg, cement business CRH, which has delivered a 15 per cent compound shareholder return over the past 50 years.

Despite recent performance falling below expectations, Henry was optimistic about the Trust's prospects, notwithstanding inflation, higher interest rates and geopolitical tensions.

“Where there’s change, there’s opportunity, and the environment we’re moving into may well be more supportive of growth companies,” he said.

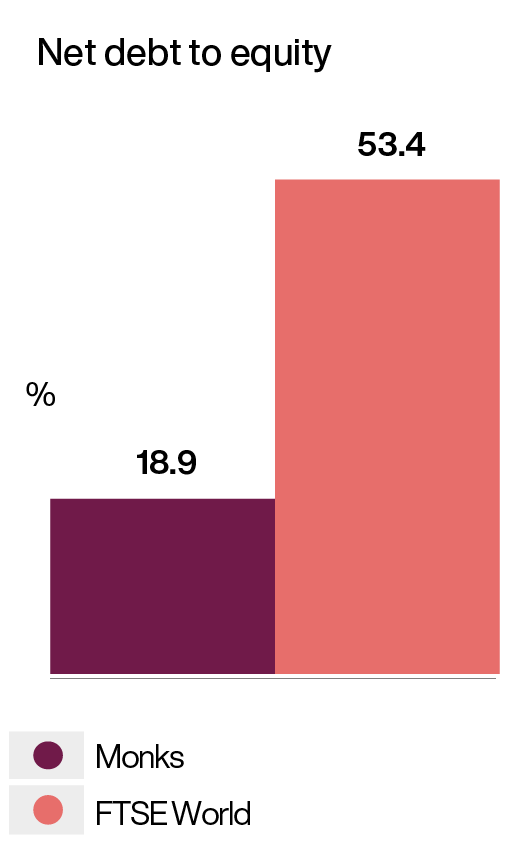

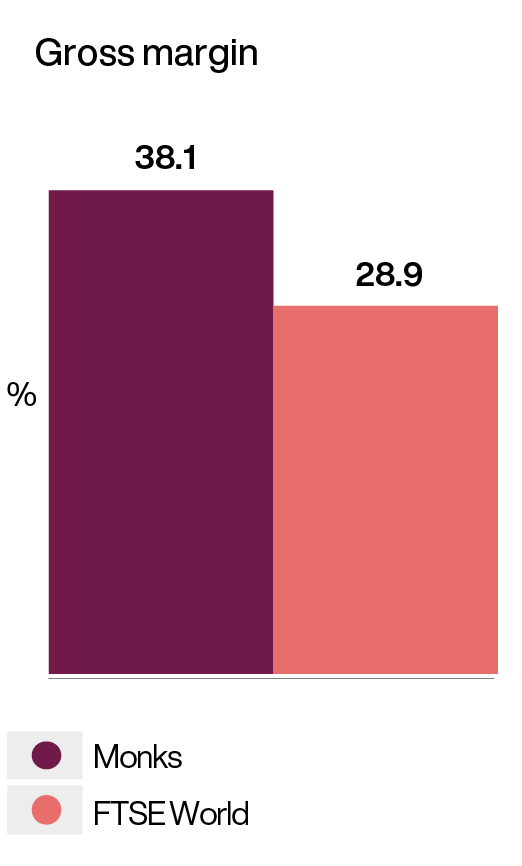

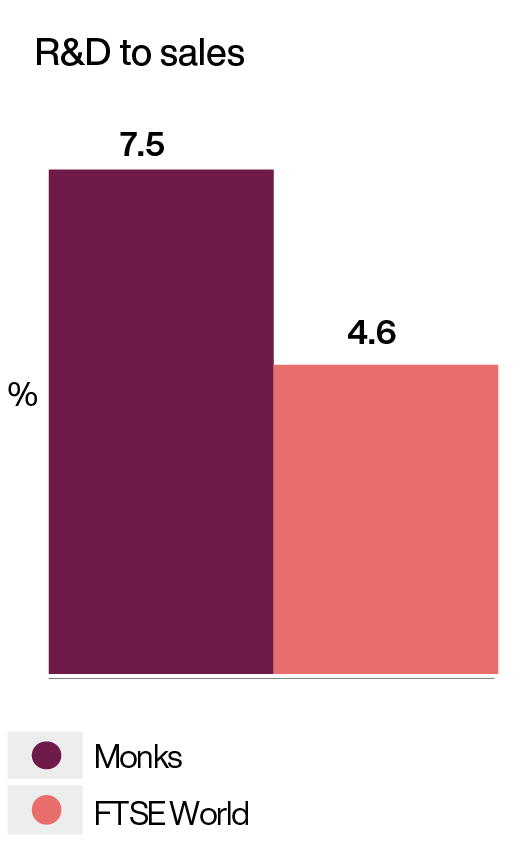

Henry sees Monks as well-positioned to profit from a new environment that will favour companies with solid balance sheets, and the ability to adapt and innovate. The Trust’s portfolio is full of companies with low debt, high gross margins and significant investment in research and development.

Equipped for a new world order

Source: Baillie Gifford & Co, FactSet, FTSE. Sterling. As at 31 December 2023.

Monks' forecasted earnings growth is more than twice the market average, driven by companies such as Ryanair, Meta and DoorDash, which exemplify financial strength, adaptability and innovation, respectively.

The Trust is also aligned with deep structural trends in both the digital realm and the world of physical infrastructure, where the need for renewal and revitalisation is pressing in the US and elsewhere. Monks has deep exposure to cloud computing, digital payments, AI and cloud infrastructure through companies such as Amazon, Microsoft, NVIDIA and ADS. These investments are expected to drive long-term returns by capitalising on the shift towards a more digital world.

Shin Nippon: light at the end of the tunnel?

The next speaker, Praveen Kumar, manager of Baillie Gifford Shin Nippon, also addressed the recent underperformance of Japan’s smaller companies but reaffirmed his belief in the Trust’s strategy:

“We are trying to identify and invest in early-stage fast-growing businesses run by young, dynamic and entrepreneurial individuals providing solutions to various problems, not just in Japan but globally,” he says.

That results in a portfolio with minimal overlap with its benchmarks and a long-term, patient investment approach needed in an environment where Japanese small caps aren’t always in favour.

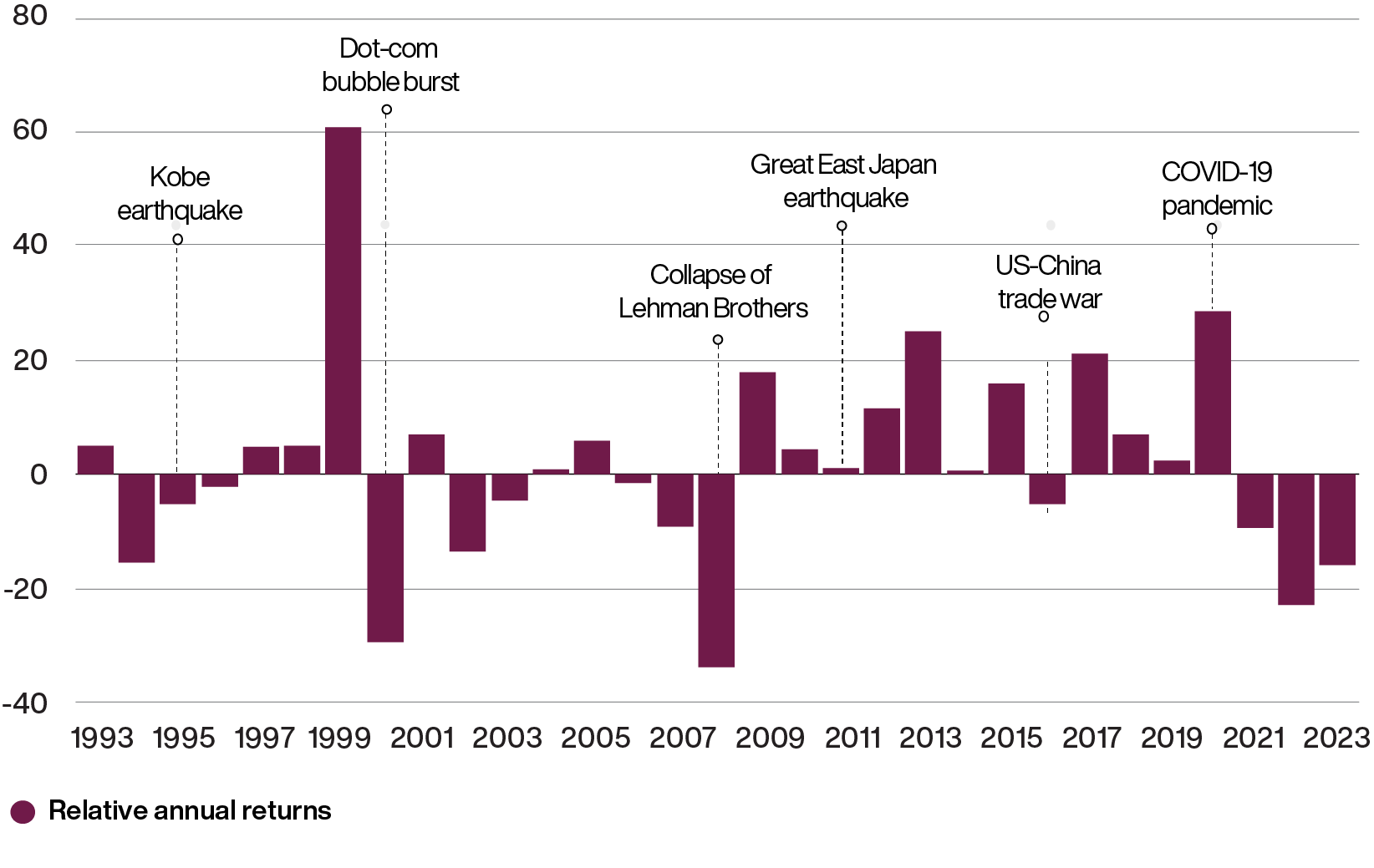

Kumar reminded the audience of the volatile nature of Shin Nippon's returns over the past 30 years. He noted that historically, Shin Nippon has outperformed its benchmark 60 per cent of the time.

We have been here before

Source: Revolution, Refinitiv, MSCI. Net of fees, relative to MSCI Japan Small Cap.

As at end December, sterling. Based on the Baillie Gifford Shin Nippon PLC.

Relative annual returns are annual periods to end December 1993 to 2023.

He noted the inherent volatility in the Japanese small cap market and emphasised the potential for significant outperformance when conditions return to favouring small caps.

Kumar’s presentation outlines several challenges facing Japanese small caps, including corporate reform pressures, changes in interest rates and currency weakness.

Faced with these uncontrollable factors, Shin Nippon focuses on what it can affect:

“We’ve been focusing on company fundamentals, and we’ve been making sure every stock in the portfolio can deliver a doubling in share price terms on a five-year view.”

In addition, he is looking to align the portfolio with long-term structural growth trends, such as increased use of artificial intelligence (AI) or Japan’s changing energy mix, or for mispriced companies where the market has failed to spot progress in sales and profits.

Kumar expressed optimism about the future of Japanese small caps, pointing to encouraging factors, such as rising wages and strong capital expenditure, particularly by IT and software businesses.

He notes that while Japan has no equivalent to a chipmaker such as NVIDIA, the portfolio holds Horiba and JEOL, two hardware companies making the critical equipment that make advanced chips possible.

Shin Nippon also contains software companies using AI tools: Bengo4.com [pronounced bengoshi, Japanese for lawyer] connects people looking for legal advice with lawyers and helps lawyers prepare their cases. Appier helps retailers better target customers by allowing them to analyse and segment their customer base.

Pacific Horizon Trust: time to look East

In her presentation, investment specialist Qian Zhang took the audience on a tour of Asian countries whose companies feature in Pacific Horizon Investment Trust.

She emphasised the region's enduring economic potential, its burgeoning middle class, technological advances, infrastructure investments and low correlation with global markets. These factors position Asia as an attractive destination for investors seeking diversification and high returns.

However, Zhang noted, “Asian markets are intrinsically volatile, and company quality varies. That can lead to debates about timing and the most appropriate way to take advantage of this . . . [which is why] we hope to share our views of why Asia now and how to approach Asia smartly within the Pacific Horizon Trust.”

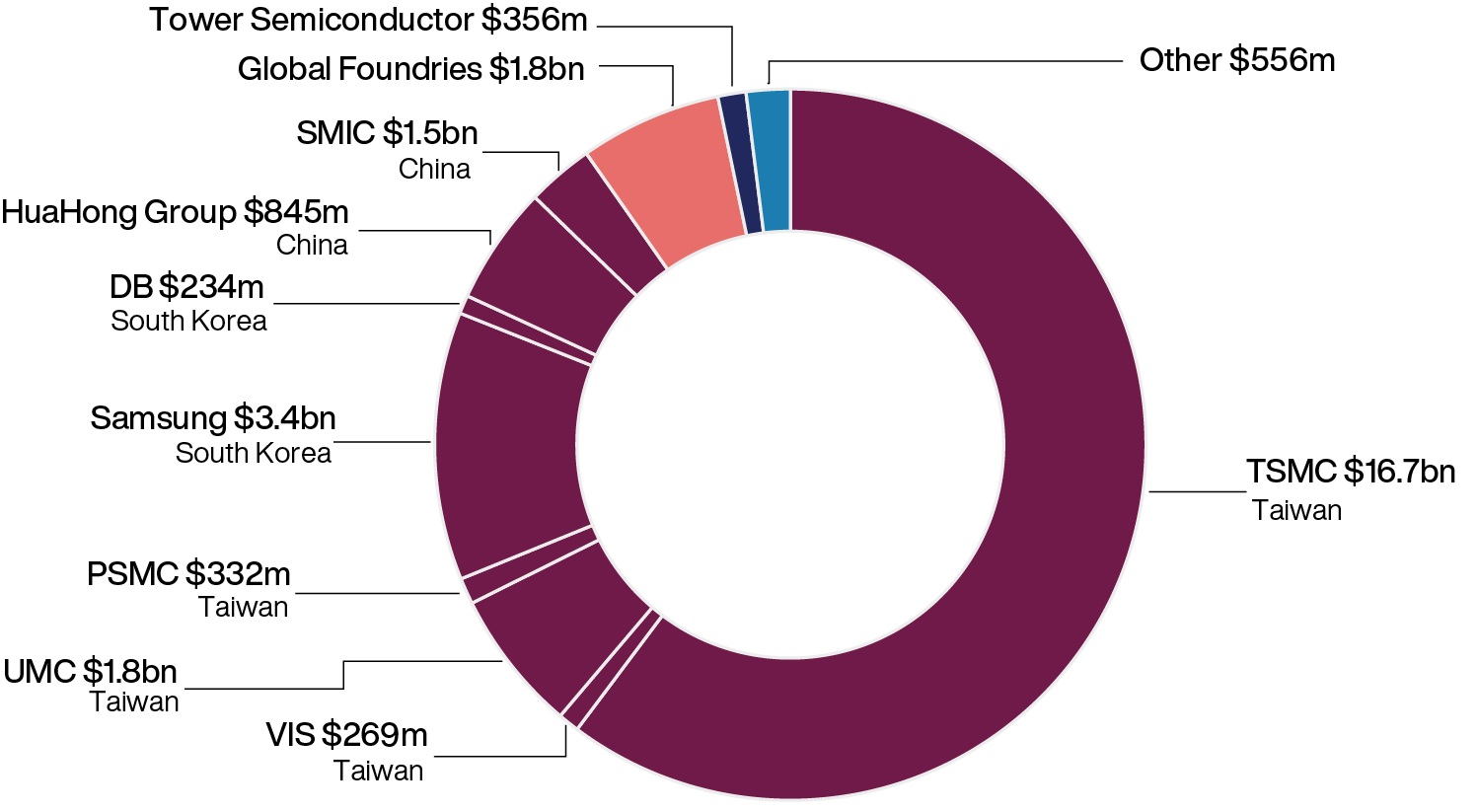

Top 10 semiconductor foundries by Q1 2023 revenue

She highlighted India as an up-and-coming market making significant progress in physical and digital infrastructure, notably in mobile internet coverage.

The latter has paved the way for new business models in digital financial services, ecommerce, and logistics. The country has seen a surge in ‘unicorns’ – startups with a valuation of over $1bn – with Pacific Horizon holding notable investments in companies such as Delhivery, a logistics partner for ecommerce, which the Trust invested in before it listed on the stock market in 2022.

Despite high expectations and some stretched valuations in some sectors, India remains a fertile ground for investment, particularly in digital businesses and large-cap sectors.

Indonesia's rich nickel resources and strategic policies, such as the ban on raw material exports, have attracted significant foreign investment from the electric vehicle and battery sectors.

The country's young, optimistic population and growing middle class, coupled with investments in materials and consumer sectors, underscore its economic potential. Zhang talked about a colleague’s recent visit to a new Indonesian industrial park bigger than the entire City of Edinburgh.

Elsewhere in the region, Asian companies, including Samsung Electronics, TSMC, and others such as Acton, making high-end data switches for data centres or EO Technics, play crucial roles in the global tech landscape.

“AI and many other modern industries simply couldn’t leap forward without these Asian companies,” she says.

And, despite China's macroeconomic challenges, the country remains a key player, with opportunities still abounding within the green transition, digital economy and consumer evolution.

Zhang noted that the portfolio’s largest overweight country is Vietnam. It is identified as a significant market, benefiting from its young labour force, quality education and favourable policies for foreign investment.

She listed three types of market inefficiencies that Pacific Horizon aimed to exploit:

- Growth duration – companies, such as India’s HDFC Bank, that can grow longer than the market expects.

- Underappreciated growth pace – companies growing faster than the market expects. About 15 per cent of Asia companies grow 40 per cent or more per annum, but less than half are captured in forecasters’ estimates.

- Growth surprise – companies that nobody else is expecting to grow. By spotting key moments of significant change, Pacific Horizon can find opportunities for profit that others might overlook. This approach led the Trust to invest in nickel a few years back, on predicting a surge in demand from China's electric vehicle market.

The presentation concluded with optimism for Asian equities, citing the region's faster growth compared to the rest of the world, companies at the forefront of structural trends and attractive valuations.

Keystone Positive Change: on track for impact

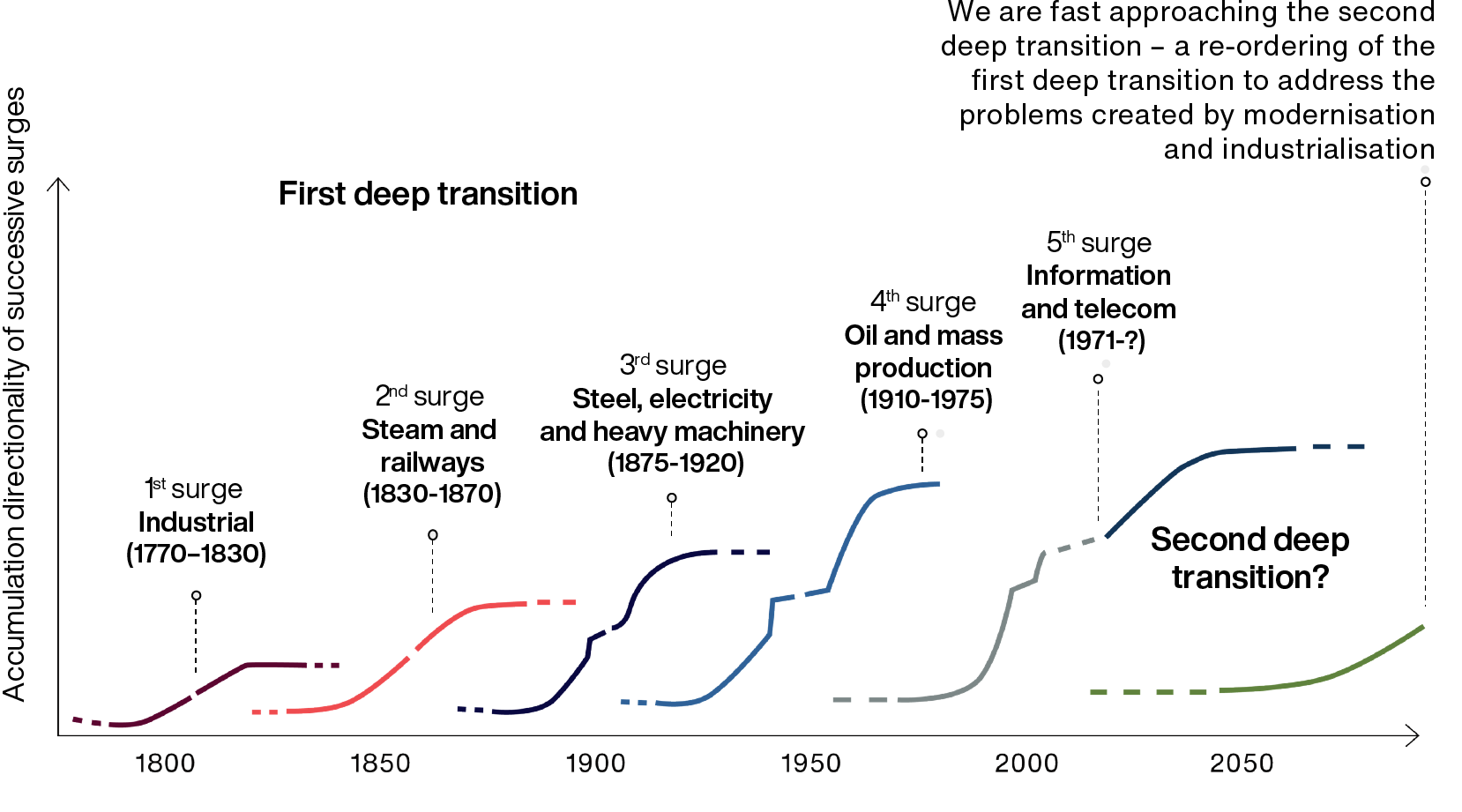

Investment specialist for Keystone Positive Change Investment Trust Rosie Rankin discussed the importance of long-term investment perspectives, emphasising a time horizon extending beyond the typical five-to-ten-year timeframe to consider the next 250 years.

She highlighted five technical surges since the late 1700s, including the Industrial Revolution, the introduction of steam and railways, the development of steel and electricity, the era of oil and mass production, and the current information and technology age.

These surges have significantly improved global living standards and led to environmental and social crises.

Travel through time, and extend your time horizon

Source: Johan Schot & Laur Kanger, Deep transitions: Emergence, acceleration, stabilization and directionality, 2018.

Rankin noted, “If defining the previous 250 years that started with the first Industrial Revolution as the first deep transition, some scholars believe that we are in the early innings of the second deep transition, and the second deep transition is in response to the problems created by the first [focusing on climate change, health issues and poverty].”

Positive Change invests in companies offering solutions to global challenges, while aiming for attractive investment returns and a more sustainable world.

This approach, called impact investing, involves a concentrated global portfolio of 30 to 60 companies across various sectors and maturity levels that can deliver financial returns and measurable social or environmental impact.

Examples of portfolio holdings include:

- NuBank – a digital bank in Brazil offering accessible financial services to a population where about two-thirds are classed as economically vulnerable

- Boston Metal – a company innovating in carbon-efficient steel production, an essential commodity for continued global growth but which accounts for 8 per cent of global carbon dioxide (CO2) emissions

- Dexcom – a firm producing continuous glucose monitors for diabetes management, where the number of people with the disease has more than quintupled since the 1980s, with 530 million adults living with it

These companies illustrate the portfolio's focus on social inclusion, environmental sustainability and healthcare improvements.

Rankin also covered the challenges of measuring impact, explaining that the portfolio uses a variety of metrics tailored to each company's contributions towards sustainability and inclusivity through its products and services.

Portfolio impact is reported annually, linking outcomes to the UN Sustainable Development Goals and providing an aggregated view of the portfolio's collective impact. This is illustrated in an ‘impact wheel’, which displays progress against 12 aggregate metrics, including, for example, the amount of water saved and the amount of CO2 emissions avoided.

Train of thought

Each of the four investment trusts presented at the Forum offered a different way for investors to harness the potential for long-term growth. All in accord with James Budden’s concluding metaphor of a growth train now raring to depart the station once again.

Despite challenges, the situation is improving after two tough years, and as Budden highlighted, share prices are beginning to reflect the underlying strengths of company businesses.

By focusing on growth companies that are adaptable, financially strong, and aligned with structural trends and positive change, investors can navigate the complexities of the market. Re-alighting the train now means a chance to benefit as it begins to pick up speed in the months ahead.

Annual Past Performance to 31 March Each Year (% Net)

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Monks Investment Trust PLC | 32.3 | 42.1 | 1.2 | -31.0 | 12.6 |

| FTSE World Index | 22.8 | 12.7 | 22.1 | -7.2 | 17.2 |

Source: Morningstar, FTSE, total return in sterling.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Shin Nippon PLC | 10.3 | 48.5 | -17.2 | -30.5 | -14.1 |

| MSCI Japan Small Cap Index | 15.2 | 3.5 | -1.0 | -0.6 | 7.4 |

Source: Morningstar, FTSE, total return in sterling.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Pacific Horizon Trust PLC | 14.0 | 128.6 | 15.5 | -32.5 | -4.9 |

| MSCI All Country Asia Ex Japan Index | 13.9 | 21.5 | -3.6 | -9.2 | 0.3 |

Source: Morningstar, MSCI, total return in sterling.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Keystone Positive Change Investment Trust plc | 23.3 | -0.8 | -4.8 | -33.5 | 9.4 |

| MSCI ACWI Index | 19.2 | -9.8 | 17.5 | -7.6 | 15.9 |

Source: Morningstar, FTSE, total return in sterling.

Past performance is not a guide to future returns.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the ‘LSE Group’). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. ‘FTSE®’ ‘Russell®’, is/are a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Important information and risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in April 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communications contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN. The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com

The trusts are listed UK companies and are not authorised or regulated by the Financial Conduct Authority. The value of their shares, and any income from them, can fall as well as rise and investors may not get back the amount invested. A Key Information Document is available from our website (bailliegifford.com).

- The trusts invest in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

- Unlisted investments such as private companies can increase risk. These assets may be more difficult to sell, so changes in their prices may be greater

The specific risks associated with the Monks Investment Trust include:

- The Trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

The specific risks associated with the Baillie Gifford Shin Nippon Investment Trust include:

- Investment in smaller companies is generally considered higher risk as changes in their share prices may be greater and the shares may be harder to sell. Smaller companies may do less well in periods of unfavourable economic conditions.

- The Trust's exposure to a single market and currency may increase risk.

- Share prices may either be below (at a discount) or above (at a premium) the net asset value (NAV). The Company may issue new shares when the price is at a premium which may reduce the share price. Shares bought at a premium may have a greater risk of loss than those bought at a discount.

The specific risks associated with the Pacific Horizon Investment Trust include:

- The Trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

- The Trust invests in China, often through contractual structures that are complex and could be open to challenge, where potential issues with market volatility, political and economic instability including the risk of market shutdown, trading, liquidity, settlement, corporate governance, regulation, legislation and taxation could arise, resulting in a negative impact on the value of your investment.

The specific risks associated with the Keystone Positive Change Investment Trust include:

- The Trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

- The Trust's risk is increased as it holds fewer investments than a typical investment trust and the effect of this, together with its long term approach to investment, could result in large movements in the share price.

- The Trust invests in companies whose products or behaviour make a positive impact on society and/or the environment. This means the Trust will not invest in certain sectors and companies and the universe of investments available to the Trust will be more limited than other funds and trusts that do not apply such criteria. The Trust therefore may have different returns than a fund or trust which has no such restrictions.

96622 10046149