Key Points

- Discussing stories about possible futures can help us to anticipate opportunities and risks that might affect the companies we invest in

- We have created a series of climate change-related narratives to help us consider the years leading up to 2050

- Topics we are considering include the energy transition’s need for raw materials, changes to people’s diets and the possibilities of geoengineering

All investment strategies have the potential for profit and loss, capital is at risk.

WATCH: Head of climate change Caroline Cook discusses ways to anticipate opportunity in her Disruption Week webinar

As long-term investors, we think about what the world might be like in the future. Not because we believe we have a crystal ball but to help alert ourselves to opportunities and risks by trying to anticipate them.

“Take the example of carbon capture,” says Caroline Cook, Baillie Gifford’s head of climate change, referring to efforts to remove carbon dioxide from the air and store it underground.

“A decade ago, nobody thought it was remotely likely to be economically efficient. But things move on, as our holdings in carbon-capture pioneers Climeworks and Aker demonstrate. And what might look weird today might be normal in another 10 years.”

Cook has recently been thinking about another geoengineering idea: spraying vast amounts of sulphur dioxide into the stratosphere. The theory is that the particles would reflect sunlight back into space, cooling things below. It sounds like the stuff of science fiction, but nature suggests it could work.

“In 1991, the volcano Mount Pinatubo erupted in the Philippines,” Cook says.

“It shot 10 million tonnes of sulphur dioxide into the atmosphere. That seems to have cooled the Earth by about 0.5C over the following two years, with the effect being strongest nearest to the explosion.”

Trying to replicate the effect wouldn’t be without its risks. It might create a new hole in the ozone layer, leading to skin cancers and other sun damage. It could mess up wind flows, intensifying wild weather. And then there’s the danger of ‘termination shock’.

“If we didn’t do anything to reduce CO2 emissions, they’d continue to build,” Cook explains. “So if one day we stopped spraying sulphur – maybe because of a war – and the shade dispersed, temperatures might shoot up, creating furnace-like conditions.”

Intervention investments

Assuming such dangers could be addressed, what might the investment implications be? Cook believes there could be opportunities for companies to monitor the effort and suggest where to add further dust.

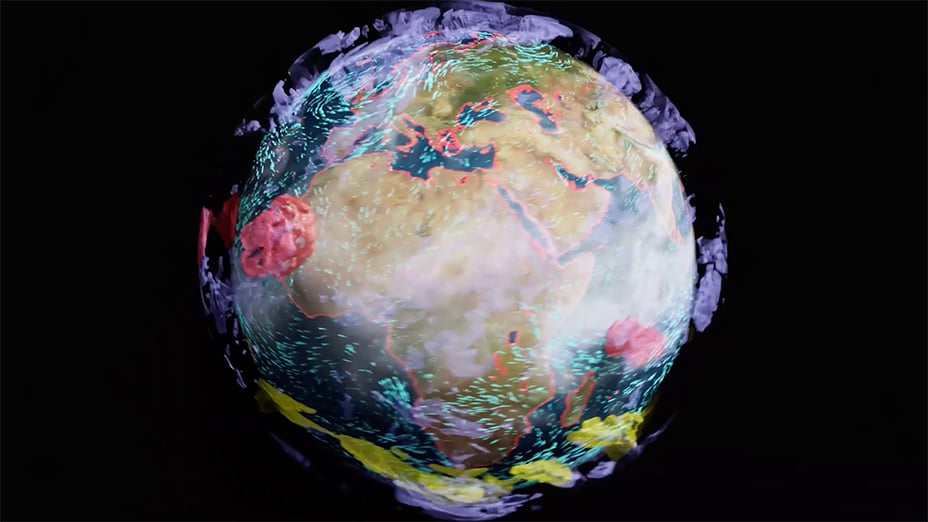

“Chipmaker NVIDIA could be a beneficiary because we’d need a lot of advanced AI to do this well,” she suggests. “It’s already working on a project, Earth-2, that creates a digital twin of the planet to improve climate modelling, which could help manage this sort of intervention.

Other holdings Cook highlights include:

- SpaceX, whose satellites could track progress from orbit

- AeroVironment, whose autonomous aircraft could do likewise from the stratosphere and other high altitudes

- Zipline, whose drones could supply data from closer to the ground

“We don’t think geoengineering is a meaningful part of the investment case for these companies,” Cook says.

“But thinking about such a possible future is a way to consider the potential market for Earth-monitoring solutions and other products that increase understanding of natural systems. It also helps us see the wider climate and energy transition picture.”

Scenario narratives

Cook was prompted to think about geoengineering by her work on a series of ‘scenario narratives’. Each aims to create a plausible, internally consistent story about the future that touches on the human and natural worlds to give a system-wide view of different climate outcomes.

Earlier this year, our investment teams began using them to hone their thinking about how climate and energy-related developments might affect clients’ holdings between now and 2050 depending on whether there is:

- a smooth, orderly transition to net zero

- a failure to tackle climate change, leading to a ‘hot house’ world

- an in-between scenario in which we ultimately hold back temperature rises but in a disorderly manner

The initiative addresses a regulatory requirement to demonstrate we take account of climate-related risks and communicate them to our clients. And it seeks to do so in a way that captures the complexity and uncertainty that don’t fit neatly into numerical models.

“We’re not forecasting what will happen,” explains Cook. “Rather, the stories are meant to help our investors understand the assumptions and sensitivities embedded in their current holdings and portfolio balance. And they should help them pose better questions to company management and spot emergent themes.”

Protein and lithium

Cook and her team initially developed the narratives at a high level, focusing on industries, regions and countries with particular sensitivities. However, when running workshops, they found it useful to take some deep dives to explore how the process of change might work out in a few key regions. One of these stretches across parts of Argentina, Uruguay and Brazil.

The storyline describes heatwaves and droughts wreaking havoc on crops and livestock in the area, encouraging a shift to growing meat from cultured animal cells and farming insect protein. It also tells of new lithium extraction techniques addressing local communities’ concerns about the environmental impacts of mining the mineral, which is in high demand for use in electric cars and other battery-powered technologies.

“Part of the original investment expectation around alternative proteins was the idea that people would proactively choose them to help reduce emissions,” says Cook.

“But maybe where they take off is when you have climate failure, causing the price of traditional foods to rise, making alternatives appeal because they are cheaper.”

This might benefit holdings, including cultured meats specialist UPSIDE Foods and synthetic biology pioneers such as Ginkgo Bioworks and Solugen, but pose challenges to others, like Nestle’s more conventional food and dairy business.

The lithium advance could help miners gain access and attract the capital they need to meet the scale of demand that we need to advance the energy transition at pace,” says Cook.

“Achieving genuine sustainability could be a key competitive advantage.”

This forms part of our regular conversations with mining company holdings, including Albemarle, FQM, Rio Tinto and Zijin Mining.

“Another company to consider is the Latin American ecommerce firm MercadoLibre,” Cook adds. “This is a whole-economy company, so its success is tied to the region’s success in the broadest sense. We’ve had some really positive discussions with management. They are very engaged on issues of climate and the energy transition, both directly for their own operations and in the messaging they send out to customers.”

Several of our strategy teams have started using these narratives as part of their investment process, and there are plans to roll them out to others in 2024.

“This is a living project,” says Cook.

“We intend to develop and revisit the narratives, with different investment teams bringing their own styles and perspectives. Then we will communicate our conclusions to clients over the months and years ahead.”

Three transition scenarios

|

Failed, ‘hot house’ world |

Volatile, disorderly transition |

Smooth, orderly transition |

|

|

Politics |

Nationalism, protectionism |

First divided, then united |

Strong cooperation and openness |

|

Policies |

Fragmented, supports incumbents, adaption bias |

Initially weak, then strong dislocating interventions |

Coordinated, supports transition |

|

Technology |

Innovation struggles, fossil fuel dependency remains, low optimisation, higher costs |

Additional late-stage radical innovation, rapid deployment |

Rapid, reinforcing adoption |

|

Investment |

Short-term, limited public spend, insurance fails |

Private finance leads, then public. Greater asset stranding |

Long-term. Blended public/private. Infrastructure focus |

|

Culture |

Individualistic, higher inequality |

Uneven development, self-reliance |

Circularity, equality, community |

|

Physical change |

Regional collapses, compounding food/water system failures |

Notable, varied, acute events |

Significant but managed, |

Hear more from Caroline Cook about the scenario narratives project by watching the video of her Disruption Week seminar at the top of the page and reading this earlier article she wrote about the initiative.

Words by Leo Kelion

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

72112 10040174