Illustration by Anna Higgie

Please remember that the value of an investment can fall and you may not get back the amount invested. This article originally featured in Baillie Gifford’s Spring 2022 issue of Trust magazine.

What’s the most striking change in India over the past decade? For this regular visitor, there’s no contest: the explosive growth in mobile data use. From roadside stalls accepting digital payments to taxi drivers glued to their small screens while waiting in the shade, smartphones are everywhere.

The spur was the rollout of the country’s 4G cellular network in the mid-2010s. Reliance, then best known as an oil refining business, spotted the potential of connecting the masses and invested $40bn in building and launching its Jio network in 2016.

As a Reliance shareholder, Pacific Horizon backed the move. The network created millions of potential consumers. Almost overnight, it brought the internet to the masses, catalysing an unprecedented wave of Indian innovation that has given the country its current 54 ‘unicorns’ – start-ups with a valuation above $1bn. That’s more than any other country apart from the US and China.

Thus the ‘old India’ became midwife to the ‘new’. Industrial stalwarts such as Reliance, carmaker Tata Motors and mining giant Vedanta still present substantial growth opportunities. Reliance has moved into retail and media, and Tata is the leading player in the country’s nascent electric vehicle market. Nevertheless, it’s the plethora of new generation technology companies that excites us most.

So much so that Pacific Horizon increased its holdings in Indian companies from 7 per cent to 28 per cent of the portfolio in the year to the end of July 2021, creating the Trust’s largest position in a single country. With our internal tracking predicting that between $200bn and $300bn of tech-based private companies are likely to list on India’s stock markets in the next two or three years, we see a vast increase in opportunities. Of the many more unicorns we expect to emerge, the majority will come from the tech sector.

It helps that India’s Ministry of Electronics and Information Technology has made access to online products and services easier through Aadhaar, the world’s largest biometric database. Meaning ‘foundation’ in Hindi, Aadhaar is a 12-digit ID number linked to digital photographs, fingerprints and iris scans which allows Indians to pay for goods and services by mobile phone.

Opening a bank account now takes as little as 10 minutes, thanks to Aadhaar. I’m somewhat envious when I contrast that with the six weeks it took me to open an account in the UK to take out a new mortgage.

Tax reforms have also helped India’s tech sector to grow. Previously, prohibitively high interstate taxes meant companies rarely expanded beyond state lines. In 2017, the national Goods and Services Tax (GST) simplified the regime, allowing regional businesses to flourish into national players.

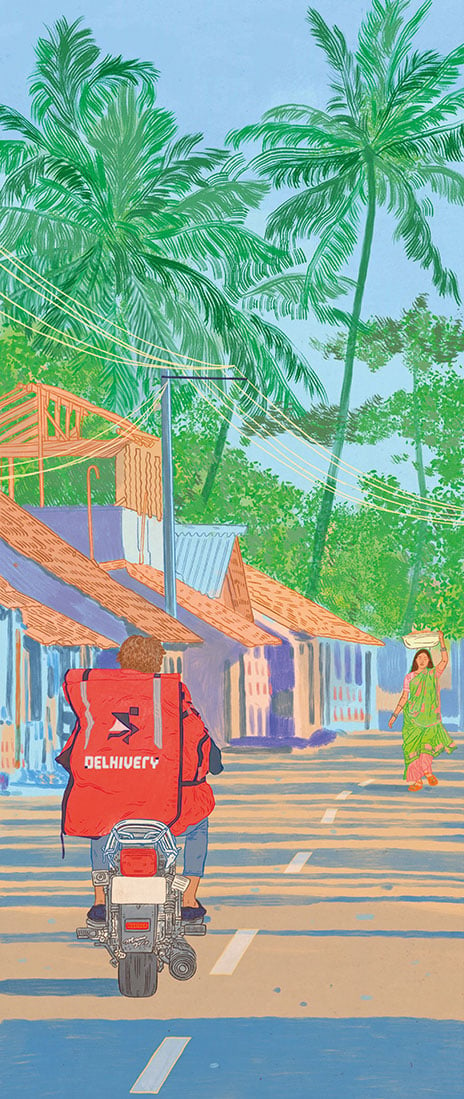

One big winner from GST has been logistics firm Delhivery. It’s the largest and best-organised private logistics company in the country, and is used by all the major ecommerce players.

Logistics in India are incredibly inefficient. The country spends the equivalent of about 14 per cent of its gross domestic product (GDP) on logistics, compared to around 7 per cent in countries such as the US. We expect Delhivery’s efficiency and national reach to make it the dominant logistics player in the coming decades.

We expect Delhivery’s efficiency and national reach to make it the dominant logistics player in the coming decades

Delhivery is led by co-founder and chief executive Sahil Barua. His vision epitomises the new generation of tech entrepreneurs in whose businesses we invest. Building relationships with founders and their management teams has been at the core of Pacific Horizon’s endeavours in the country. For example, through our relationship with Info Edge (one of the country’s leading internet companies), we met many of the tech entrepreneurs we’ve since backed. Working with private equity firms such as Sequoia Capital’s Indian operations also broadened our reach.

Relationships were also key to our investment in food delivery service Zomato. We met founder Deepinder Goyal for the first time back in 2012 when the company was the country’s leading restaurant review website. It was clear from our discussions that Zomato had far greater ambitions and would use its valuable user-generated content to build something that outgrew its existing business by an order of magnitude.

Today, our investment has been richly rewarded. Zomato transformed itself into the country’s largest food delivery company with 16 million users by the end of September 2021, a market share of about 40 per cent and backing from companies that include Alibaba and Uber.

Content is also king for the short video website Dailyhunt. It’s become the ‘TikTok of India’ since that rival left the country in 2020 over continuing trade tensions with China.

Linguistic diversity is key to Dailyhunt’s success. Some 70 per cent of Indians don’t speak English, so Dailyhunt delivers content in 14 of India’s 22 official languages.

Technology also underpins Star Health Insurance’s business. India’s largest private health insurer is an incredibly well-run business that uses internet connectivity to distribute its health and travel insurance, along with online medical consultations, giving it about 30 per cent of the market in individual health insurance. Scale and distribution of this sort present huge barriers for competitors. Given the low penetration of health insurance in the country, the company could grow for decades.

The growth of India’s middle class is crucial to our thinking. About 70 per cent of India’s population is under 40. India’s retail market is one of the fastest-growing in Asia and is tipped to go from about $800bn today to $1.2tn by 2026. Ecommerce penetration sits at only about 5 per cent of the population today. In a decade, it could reach half the population.

Not only is the retail market growing by 10 per cent a year, but the online market could increase tenfold over the next decade. Those changes create big opportunities for tech businesses and their innovative founders. Should these expectations be realised, hundreds of millions of smartphone-fixated consumers will soon have a lot more content and services to keep them busy. The stage is set for the country’s entrepreneurs to complete the transition to the new India.

This article first appeared in the Spring 2022 issue of Trust, Baillie Gifford’s bi-annual investment trust magazine. To register for a free copy, delivered to your door or to your inbox please visit bailliegifford.com/trust

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates. The Trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com