The value of an investment, and any income from it, can fall as well as rise and investors may not get back the amount invested.

Under the Radar

International Smaller Companies

Not helped by poor health, Maurits Cornelis Escher failed second grade and later dropped out of his studies. His passion was graphic design, but it took 30 years of graft to eventually make a living from it. His first major exhibition did not take place until he was 70 years old. Today, Escher’s works are globally recognised. Like many iconoclasts, his life is a tale of under-appreciated potential, but his work is a lesson in perspective. The segue into our investment approach is deliberately unsubtle.

Multi-stable perception is a pillar of Escher’s work. This is the phenomenon behind an optical illusion that causes our visual system to alternate between conflicting interpretations of an image. The conflict is unresolvable and ‘reality’ is in the eye of the beholder.

Neuroscience continues to be fascinated by this conflict, a deep curiosity which was first seriously researched by the polymath Hermann von Helmholtz in the 19th century. It arises because our minds yearn to construct a cohesive explanation about something which is, in truth, completely ambiguous. Sometimes we can see things both ways; we see the first image above as a vase but when we look hard we see the people. But, more interestingly, we often find ourselves completely fooled. Our minds are locked into just one interpretation, unable to even notice the alternative once it is pointed out to us. Some will be unable to see the old woman’s face instead of the hat-wearing woman. Stuck in their ruts, two minds can see exactly the same image yet be in fundamental disagreement. The same phenomenon applies to observations about companies, with interpretations and narratives about the future built from ambiguous inputs.

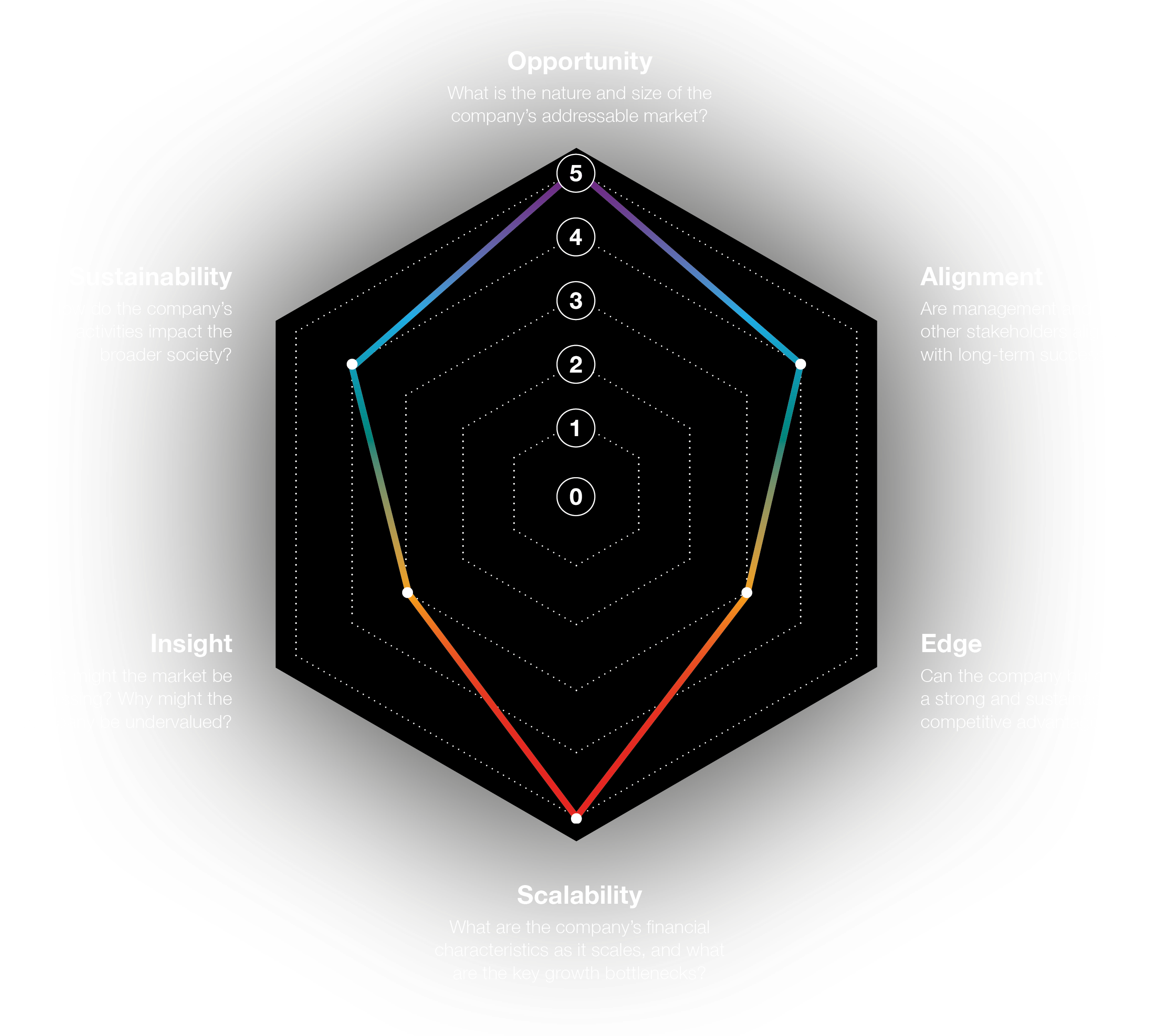

The role of insight within our framework is to remind us that a great business is not necessarily a good investment. The difference of course lies in whether its true potential is misinterpreted and therefore mispriced. Each buy or sell decision an investor takes implies a bold claim that they see the evidence in front of them about the future of the business in a way that the market does not. We think it is far better to be explicit about this key tenet of sound investing. Forcing ourselves to articulate “what the market may be missing and why the company might be undervalued” allows our claim of insight to be critically examined and instils a vital sense of humility.

The answer on insight is specific to each investment case, often hard to pinpoint and most likely an accumulation of small differences of view. But just as with the other spokes of the framework, certain companies in the portfolio stand out more than others. We think that Maytronics – the global leader in swimming pool cleaning robots – probably flies under the radar of many international investors because all of its written communications were, until recently, in Hebrew. There is no sell-side coverage of the business and we only really gained conviction in the investment case by visiting the Kibbutz Yizre’el near Tel-Aviv, the community in which Maytronics was founded in 1983 and where it remains based.

In the case of Sansan – a Japanese provider of digital business cards and a professional online network – there is a distinct probability that we see a radically different business than others do. Even before the coronavirus pandemic intervened in 2020, leasing scanners to digitise and store business cards hardly looked like a durable business model, let alone one to ignite the passion of growth investors with a universe of 25,000 companies to pick from. But we believe our interest in the software tools that Sansan is building around valuably volunteered data is differentiated. Our time horizon also allows us to envisage attempts to expand that core skillset into digitising contracts and invoices. Divergent perspectives on this, even within the team, offer a glimmer of what the market may be missing.

Each buy or sell decision an investor takes implies a bold claim that they see the evidence in front of them about the future of the business in a way that the market does not.

A longer term perspective

Although these are specific cases, an overarching theme in our approach is a belief in the power of perspective. We are certainly not arrogant enough to believe we are smarter, faster or working longer hours than others, but we do strongly believe that we often come at things differently. Underpinned by Baillie Gifford’s private partnership structure, the whole firm takes a long-term perspective which we believe can often produce insight. Under the right circumstances we are willing to take a leap of imagination into what might be, rather than merely staring intently at what is right in front of us.

A butcher looks at a cow and sees a quick buck from carving it into steaks. The milkman knows it is worth far more if he can just patiently accept the income over the years. But the entrepreneur sees organic yoghurt selling for $5 a tub in Whole Foods Market. Same cow (forgive me, I know modern agricultural genetics are somewhat more sophisticated!) but three very different perspectives. The latter involves a belief in an uncertain and far longer-term opportunity, which we think the market often struggles to fully value.

Take the case of Hypoport. This German software platform allows banks and credit unions to digitise the process of originating a mortgage, through an online marketplace that connects lenders and borrowers. The valuation has evolved with the success of the business and now prices in the potential for Hypoport’s market share to rise well beyond its current 30 per cent. But we are less sure the market is looking at Hypoport’s ongoing expansion into other financial services such as insurance and credit-broking, where a similar product and approach is sorely needed. Baillie Gifford’s experience of owning businesses that have successfully transitioned beyond their core competency helps us to look beyond the obvious. M3, for example, is a former small cap, owned since 2005, that started out as an online marketing platform for pharmaceutical companies but has parlayed its data and relationships into other ventures, from telemedicine to drug development. And when it comes to the decentralisation of responsibility that allows Hypoport to advance on different fronts simultaneously, colleagues’ research on established proponents of this approach, such as Atlas Copco (owned for over 30 years by some Baillie Gifford strategies), may be a meaningful advantage.

A second overarching theme we often think about is the potential for disguised value arising from intangible assets. Baillie Gifford has always emphasised the qualitative aspects of investing over the quantitative, one reason we recruit our investors from a diverse range of largely non-financial backgrounds. It’s highly likely that the market is efficient at copying down the numbers and incorporating past financial data into prices. We are far less sure it gives due credit to things such as company culture or the founder’s ambition which are far harder to capture with clear data.

There are countless examples in the portfolio of where such softer factors are a material part of the investment case, but a good one might be Reply. Superficially this is an unremarkable business (IT consultancy) in an unremarkable economy (Italy). However, on closer inspection, other often-ignored factors create a compelling investment case for the company. Reply has a strongly decentralised and entrepreneurial culture, overseen by eight of the nine founders (one having passed away) who continue to work in the business as well as owning half of it. Our work suggests such factors continue to be overlooked and the beginnings of its international expansion suggests there is still plenty of potential for the future.

What ties the two previous differences of perspective together is a willingness to place value on aspects that are contingent and ambiguous, such as an opinion on a CEO or the possible adjacent markets a business can expand into. Investing on the basis of such factors is hard to do and needs the right philosophy and process as well as the support of a collegiate firm with a long-term time horizon. Baillie Gifford is such a firm. ‘Reality’ is in the eye of the beholder, so colleagues need to trust you while your views are unprovable, whilst also challenging you to consider alternative interpretations. Our process supports individual conviction and enthusiasm. You need to be allowed to invest with the patience that allows such things to matter. We support each other, and the companies in which we invest, over the bumps in the road.

Conclusion

A great business is not the same as a good investment. Every investment decision carries a claim of insight about something the market is missing. You are only likely to discover that if you are willing to look at things differently. As active, bottom-up stock pickers with a long-term time horizon, we appear to be an increasingly rare breed. We also work in a firm with understanding colleagues and we hope, in time, supportive clients. This all adds up to a different approach which accepts uncertainty and values possibility. Escher eventually found fame by celebrating the ambiguities of perspective. We are merely hoping to use them to find great investment returns.

Risk factors

The views expressed in this article are those of the International Smaller Companies team and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in March 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock Examples

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this article are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the

Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States

of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited (‘BGO’) neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 20308 10009684