Baillie Gifford

Recent insights

Emerging markets in 2050

Trade shifts and underserved populations are among the factors favouring world-class stocks.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

ASML: Stock Story

Paul Taylor explores the cutting-edge semiconductor technology advancing the digital revolution.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

Europe: unique brands, hidden champions

Why a long-term approach to the continent’s growth stocks is more relevant than ever.

Why ants, scaffolding and long jumps matter to growth investors

Kirsty Gibson shares frameworks to analyse the cultures of exceptional growth businesses.

DoorDash: delivering the goods

How DoorDash’s ambitions extend far beyond restaurant deliveries.

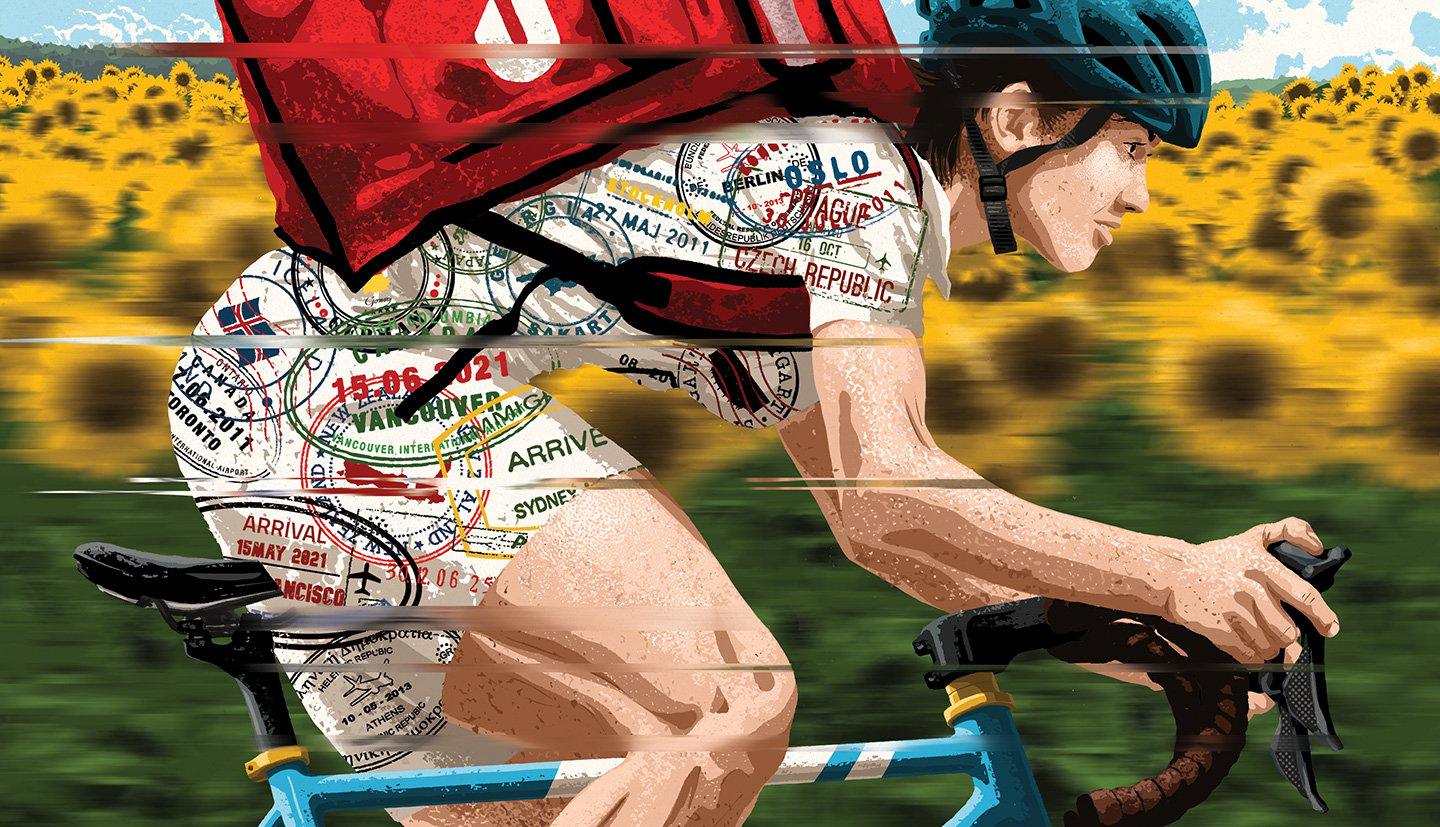

Trip notes: Kazakhstan

Sizing up super-app Kaspi.kz in Almaty.

How DSV became global freight’s top dog

Conquering trade logistics one merger at a time.

Watch this space: Tim Marshall on the future of ‘astropolitics’

Author Tim Marshall explains how space is set to become the new arena for rival powers.

Healthy returns: Japan’s assault on old-age disease

Japanese medical firms are making advances that could help fight cancer and Alzheimer’s.

Nubank: Latin America’s digital disrupter

Charting the app-based lenders’ long-term growth.

Joby Aviation readies for take-off

How a flying taxi firm could launch a transport revolution.