Capital at risk

International Growth

We aim to deliver attractive long-term returns to clients by being patient owners of exceptional growth companies. We believe disruptions are happening in many economic sectors at different speeds. We are interested in investing in two types of growth company: those able to grow very rapidly and those with durable growth prospects.

Searching for outliers

International Growth seeks to invest in outstanding growth businesses that possess a strong competitive advantage and have a culture that allows them to maintain that advantage in a sustainable way.

International Growth: our philosophy

Investment manager Tom Coutts introduces International Growth, reflecting on the exciting opportunities ahead.

Embracing the exceptional

Our objective is to outperform the benchmark by 3 per cent per annum (net of fees) over rolling five-year periods. To do so, we buy and hold shares in exceptional growth companies with a five-to-10-year investment horizon in mind.

Our diversified portfolio contains more than 50 holdings.

We embrace the concept of asymmetry of equity returns and adopt a thinking approach based on probability when building upside scenarios.

Patience in an impatient industry

Being long-term owners of companies on behalf of our clients is our main advantage in an impatient industry.

As active stock pickers, our edge also comes from being willing to get things wrong in our search for outliers and seeking wisdom from outside the financial system.

Our resulting portfolio usually displays a high active share and a low turnover.

Exceptional growth companies can thrive in even the most inhospitable macroeconomic environments by harnessing innovation.

Meet the managers

Documents

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 30 June 2024

| # | Holding | % of portfolio |

|---|---|---|

| 1 | ASML | 7.05 |

| 2 | MercadoLibre | 6.19 |

| 3 | Spotify | 5.62 |

| 4 | TSMC | 5.34 |

| 5 | Ferrari | 4.39 |

| 6 | Atlas Copco | 4.15 |

| 7 | Adyen | 3.84 |

| 8 | argenx | 3.22 |

| 9 | L'Oréal | 2.99 |

| 10 | Wix.com | 2.91 |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

International Growth: our philosophy

Investment manager Tom Coutts introduces International Growth, reflecting on the exciting opportunities ahead.

International Growth Q2 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

International viewpoints: global EV trends

Analysing market dynamics, industry challenges and future trends of EVs’ global adoption.

International viewpoints: eastern promise

What market sentiment, recent valuations and policy changes mean for us as investors in Asian growth companies.

Stock story: MercadoLibre

The company on a mission to democratise ecommerce and finance for 650 million people.

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

Ferrari: racing through time

How a car manufacturer turned luxury icon can continue to outpace the competition.

International Growth Q1 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

왜 지금 성장인가?

어려운 시기에 발휘되는 파트너십 지배구조의 강점: 급격한 변화 속에서 적응하고 성장할 수 있는 이유에 대해 분석합니다.

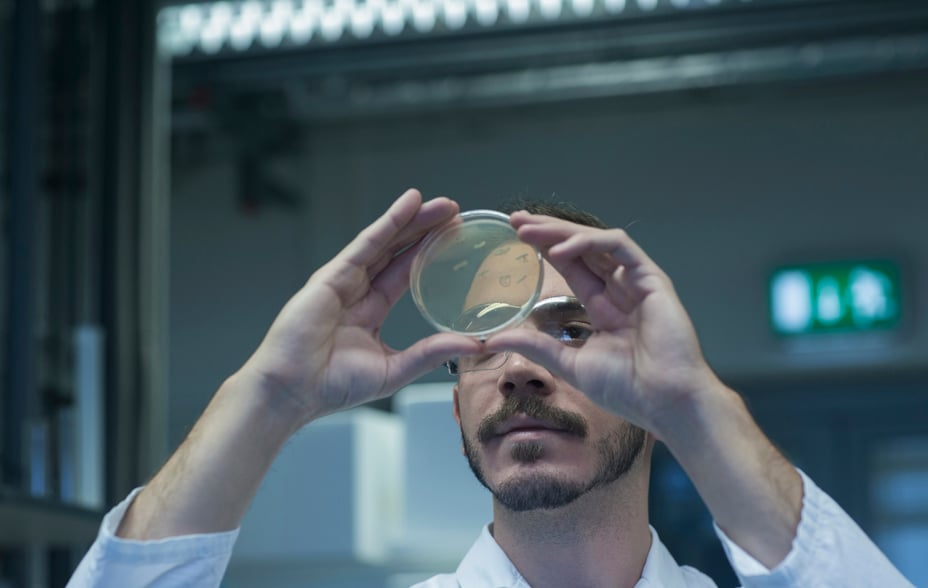

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

International Growth Q4 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

A conversation with the International Growth Team

International Growth's investment philosophy, portfolio positioning, and outlook for 2024.

HelloFresh: changing how people eat forever

HelloFresh’s CEO explains the art and science of meal kit delivery at a global scale.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

argenx: innovative antibody therapies

The future of treating autoimmune diseases.

International Growth Q3 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

International Growth Stewardship Report

Summary of stewardship activities and perspectives for 12 months to 31 March 2023.

International Growth Q2 update

The International Growth team reflects on recent performance, portfolio changes, and market developments.

Moderna’s new challenge

The mRNA technology behind the Covid vaccine is being directed against other diseases.

Adyen: pioneer of payments

The Dutch firm making everyday payments fast and friction-free.

International Growth Q1 update

International Growth Team reflects on recent performance, portfolio changes, and market developments.

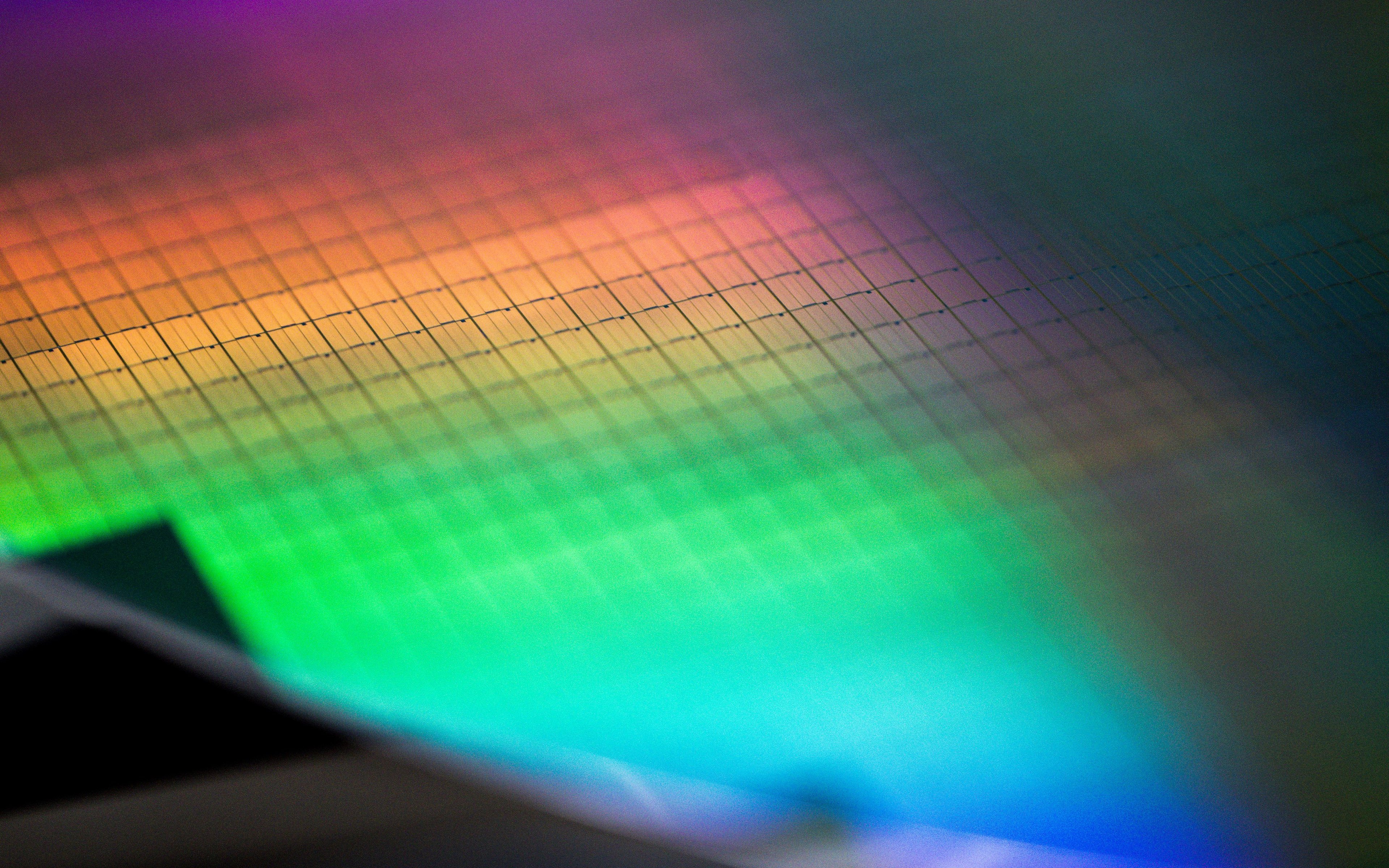

Japan’s place in the chip market

The Japanese semiconductor companies set to benefit from the rise of 5G and electric cars.

20 years of International Growth podcast

Through two decades of change, our strategy has prospered by sticking to its philosophy of patience and optimism.

Ocado’s robot revolution

The UK firm partnering with leading grocers to deploy its automated warehouses worldwide.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

ASML: advancing chips to new limits

The Dutch firm driving progress by making it possible to create more intricate computer chips.

What Picasso can teach us about investing

Investment Specialist Christel Brodie speaks to Tom Coutts, Investment Manager on Baillie Gifford’s International Growth Strategy, about his recent thought piece ‘What Picasso can teach us about investing’.

International Growth Q2 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

International Growth: our philosophy

Investment manager Tom Coutts introduces International Growth, reflecting on the exciting opportunities ahead.

International Growth Q2 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

International viewpoints: global EV trends

Analysing market dynamics, industry challenges and future trends of EVs’ global adoption.

International viewpoints: eastern promise

What market sentiment, recent valuations and policy changes mean for us as investors in Asian growth companies.

Stock story: MercadoLibre

The company on a mission to democratise ecommerce and finance for 650 million people.

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

Ferrari: racing through time

How a car manufacturer turned luxury icon can continue to outpace the competition.

International Growth Q1 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

왜 지금 성장인가?

어려운 시기에 발휘되는 파트너십 지배구조의 강점: 급격한 변화 속에서 적응하고 성장할 수 있는 이유에 대해 분석합니다.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

International Growth Q4 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

A conversation with the International Growth Team

International Growth's investment philosophy, portfolio positioning, and outlook for 2024.

HelloFresh: changing how people eat forever

HelloFresh’s CEO explains the art and science of meal kit delivery at a global scale.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

argenx: innovative antibody therapies

The future of treating autoimmune diseases.

International Growth Q3 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

International Growth Stewardship Report

Summary of stewardship activities and perspectives for 12 months to 31 March 2023.

International Growth Q2 update

The International Growth team reflects on recent performance, portfolio changes, and market developments.

Moderna’s new challenge

The mRNA technology behind the Covid vaccine is being directed against other diseases.

Adyen: pioneer of payments

The Dutch firm making everyday payments fast and friction-free.

International Growth Q1 update

International Growth Team reflects on recent performance, portfolio changes, and market developments.

Japan’s place in the chip market

The Japanese semiconductor companies set to benefit from the rise of 5G and electric cars.

20 years of International Growth podcast

Through two decades of change, our strategy has prospered by sticking to its philosophy of patience and optimism.

Ocado’s robot revolution

The UK firm partnering with leading grocers to deploy its automated warehouses worldwide.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

ASML: advancing chips to new limits

The Dutch firm driving progress by making it possible to create more intricate computer chips.

What Picasso can teach us about investing

Investment Specialist Christel Brodie speaks to Tom Coutts, Investment Manager on Baillie Gifford’s International Growth Strategy, about his recent thought piece ‘What Picasso can teach us about investing’.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

By clicking on South Korea, you have confirmed that you are based in South Korea and that you meet the following requirements.

The information in this area of the website is intended for qualified professional investors and consultants based in South Korea. It is not intended for use by any other persons including members of the general public or investors from other jurisdictions.

Please remember that all investment strategies have the potential for profit and loss and your or your clients’ capital may be at risk.

Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients. Both are authorised and regulated by the Financial Conduct Authority. Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-Discretionary Investment Adviser.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong, Telephone +852 3756 5700.

The information provided does not constitute an offer of or solicitation for purchase or sale of securities or provision of any investment services. Any general enquiries regarding Baillie Gifford should be directed to the relevant individual as noted in the Contact Us section.

The information contained in this website has been compiled with considerable care to ensure its accuracy at the date of publication. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Nothing in this information or elsewhere in this website shall exclude, limit or restrict our duties and liabilities to you under the United Kingdom's Financial Services and Markets Act 2000 or any conduct of business rules which we are bound to comply with.

This website is informative only and the information provided should not be considered as investment advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.