Overview

ISIN

GB00BMC7T380SEDOL

BMC7T38Investment proposition

Baillie Gifford European Growth Trust aims to achieve capital growth over the long term from a diversified portfolio of European securities.

Share price and charges

Price

106.50pNAV at fair

115.00pPremium (+) or discount (-) at fair

-7.4%Ongoing charges*

0.65%Fund facts

Active share

85%*

Fund launch date

1972

AIC Investment Sector

Europe ex UK

Benchmark

FTSE Europe ex UK Index

*Relative to FTSE Europe ex UK Index. Source: Baillie Gifford & Co, FTSE.

Meet the managers

Meet the directors

Intermediary client contacts

If you’d like further information, please get in touch with the Intermediary Client Contact for your area.

Regulatory news announcements

Regulatory news announcements which are released to the London Stock Exchange can be accessed via their service.

The Association of Investment Companies

Further information on investment trusts and the investment trust sector can be found on The Association of Investment Companies website.

Risk Warnings

Risk Introduction

The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies. The value of their shares, and any income from them, can fall as well as rise and investors may not get back the amount invested. The specific risks associated with the Trust include:

Currency

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

Private Companies

Unlisted investments such as private companies can increase risk. These assets may be more difficult to sell, so changes in their prices may be greater.

Gearing

The Trust can borrow money to make further investments (sometimes known as "gearing" or "leverage"). The risk is that when this money is repaid by the Trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the Trust will make a loss. If the Trust's investments fall in value, any invested borrowings will increase the amount of this loss.

Liquidity

Values for securities which are difficult to trade such as private companies may not be readily available and there can be no assurance that any value assigned to such securities will accurately reflect the price the Trust might receive upon their sale.

Concentration

The Trust's risk is increased as it holds fewer investments than a typical investment trust and the effect of this, together with its long term approach to investment, could result in large movements in the share price.

Derivatives

The Trust can make use of derivatives which may impact on its performance.

Premium Risk

Share prices may either be below (at a discount) or above (at a premium) the net asset value (NAV). The Company may issue new shares when the price is at a premium which may reduce the share price. Shares bought at a premium may have a greater risk of loss than those bought at a discount.

Buy-backs

The Trust can buy back its own shares. The risks from borrowing, referred to above, are increased when a trust buys back its own shares.

Income Secondary

The aim of the Trust is to achieve capital growth. You should not expect a significant, or steady, annual income from the Trust.

Regulation of Investment Trusts

The Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

Index disclaimer

Fund performance

Periodic Performance

As at: 30 November 2025

1 Year | 3 Years | 5 Years | 10 Years | |

|---|---|---|---|---|

Share Price | 26.0% | 24.6% | -16.2% | 79.7% |

NAV | 13.9% | 16.6% | -9.0% | 76.9% |

Index* | 23.8% | 47.8% | 62.4% | 166.7% |

Discrete Performance

As at: 30 September 2025

30/09/2020 – 30/09/2021 | 30/09/2021 – 30/09/2022 | 30/09/2022 – 30/09/2023 | 30/09/2023 – 30/09/2024 | 30/09/2024 – 30/09/2025 | |

|---|---|---|---|---|---|

Share Price | 25.2% | -47.7% | 8.6% | 9.3% | 14.5% |

NAV | 23.9% | -40.4% | 8.3% | 12.1% | 5.5% |

Index* | 23.0% | -15.3% | 20.5% | 15.3% | 15.5% |

Performance

As at: 30 November 2025

Source: Morningstar, FTSE.

Performance figures appear in GBP. Please bear in mind that past performance is not a guide to future returns. The value of your investment may go down as well as up, and you may not get back the amount you invested.

Benchmark data is limited to a 5 year period from the current date.

The graph has been rebased to 100.

Discount/premium history at fair

As at: 30 November 2025

Source: Morningstar. Premium/Discount of share price to NAV at fair.

If the graph shows negative figures this means that the share price is lower than the NAV at fair – this is known as trading at a Discount.

If the graph shows positive figures this means that the share price is higher than the NAV at fair - this is known as trading at a Premium.

Active share

As at: 30 November 2025

Relative to FTSE All-Share Index, total return. Source: Baillie Gifford & Co, FTSE.

Fund portfolio holdings

The list of top 10 holdings that this fund invests in.

As at: 30 November 2025

| # | Holding | % of total assets |

|---|---|---|

| 1 | Bending Spoons | 9.0% |

| 2 | Prosus | 4.7% |

| 3 | ASML | 4.4% |

| 4 | Topicus.com | 3.8% |

| 5 | Roche | 3.7% |

| 6 | Adyen | 3.2% |

| 7 | Ryanair | 3.2% |

| 8 | Sandoz Group AG | 3.1% |

| 9 | Allegro.eu | 3.1% |

| 10 | Reply | 2.9% |

Insights

Key articles, videos and podcasts relating to the fund:

Filters

Insights

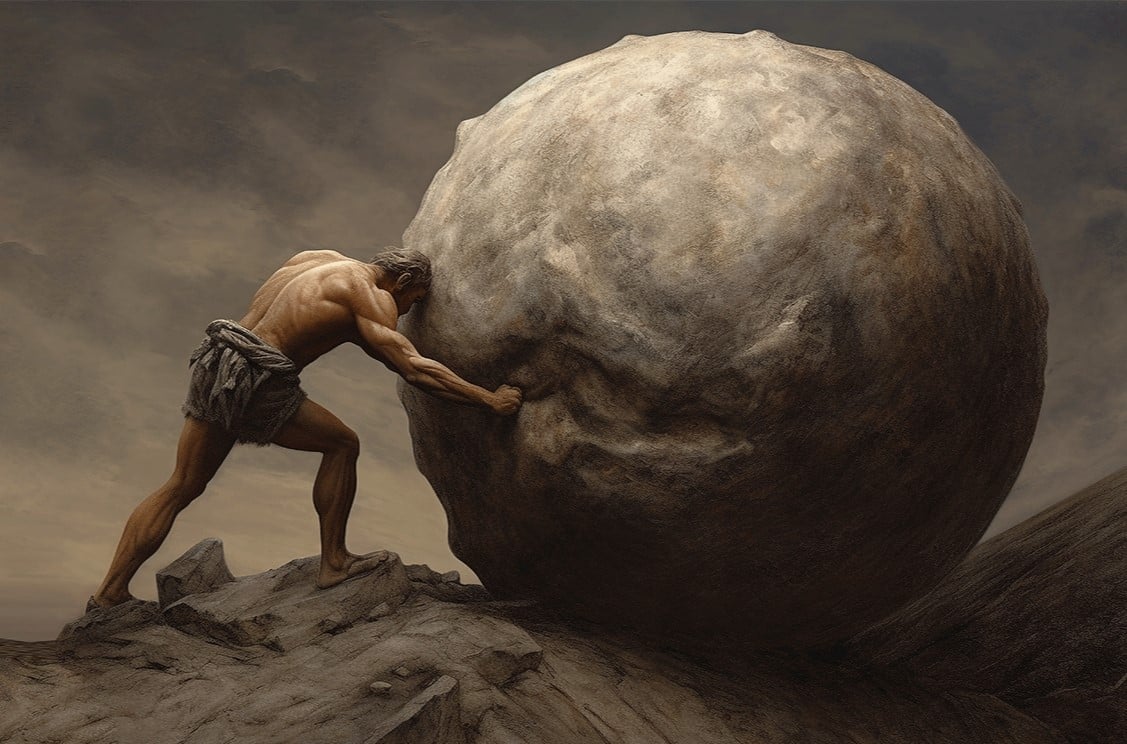

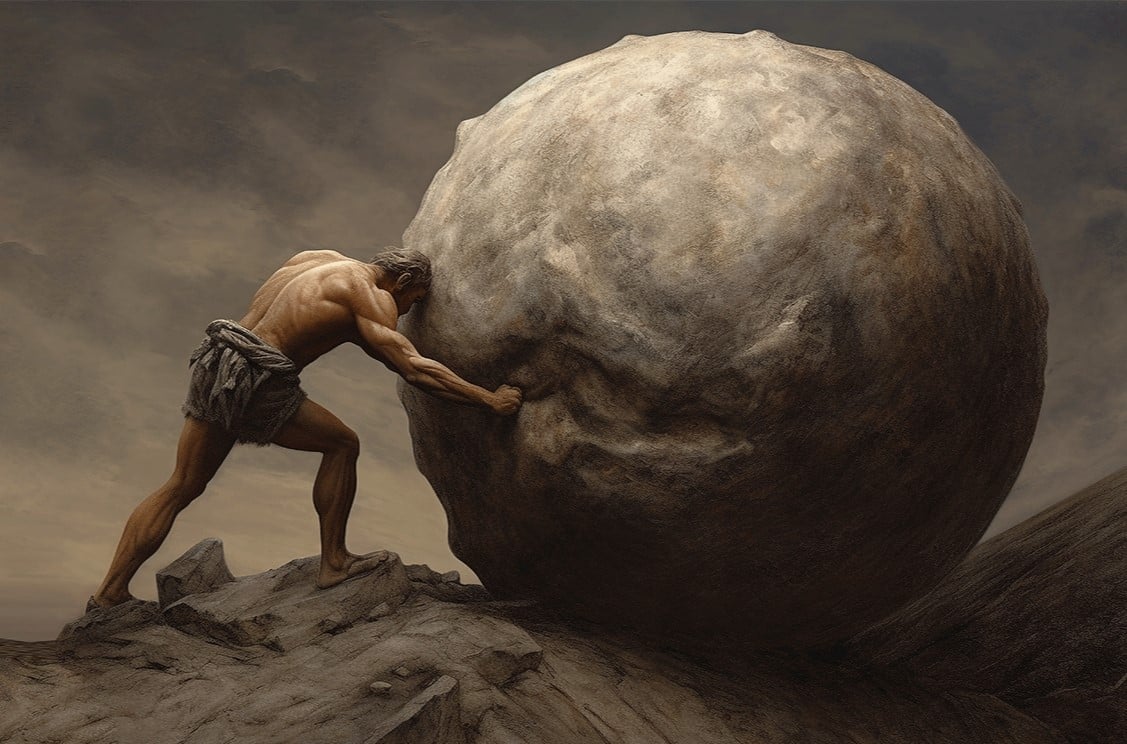

Pushing rocks uphill: the case for European equities

Is this the turning point European investors have been waiting for?

Europe’s turning point

Chris Davies, joint manager of the European Growth Trust, on Europe's economic transformation.

The Next Chapter

Baillie Gifford trusts showcase private market focus and AI optimism at annual investment conference.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

ASML: Stock Story

Paul Taylor explores the cutting-edge semiconductor technology advancing the digital revolution.

Europe: unique brands, hidden champions

Why a long-term approach to the continent’s growth stocks is more relevant than ever.

How DSV became global freight’s top dog

Conquering trade logistics one merger at a time.

European Growth Trust: Manager Insights

An update on performance, portfolio movements and investment outlook.

Our best ideas in Europe

Thomas Hodges uses Lonza, Topicus and Soitec to illustrate why Europe is more exciting than headlines suggest.

Europe's growth gems

Exploring the European Growth Trust’s dynamic companies and what sets them apart.

European Growth Trust: Manager Insights

An update on performance, portfolio positioning and why we believe our holdings remain both resilient and opportunistic.

European growth: time to bargain hunt?

Stephen Paice outlines where the opportunities lie and the trends driving value creation.

European Equities

Investment manager, Stephen Paice, discusses the Baillie Gifford approach to European Equities.

The history of the European Growth Trust

How a trust giving investors access to the European market has found grounds for optimism despite volatility.

European Growth Trust: manager insights

Despite a tough economy, we can still find valuable outliers by investing long term

Atlas Copco: Sweden’s best kept secret

Stephen Paice speaks to Matt Reustle on the Business Breakdowns podcast.

A smörgåsbord of innovation.

Sweden tops the charts for original thinking, from family businesses to founder-run companies.

Trip Notes: Helsinki.

European Growth Trust manager Stephen Paice dips a digital toe into Slush’ event for hot start-ups.

Growth Investing in Europe.

In this webinar, Steven Paice discusses why the case for owning growing, innovative companies in Europe is only getting stronger. Baillie Gifford explains its approach to valuing private companies in investment trust portfolios.

Baillie Gifford explains its approach to valuing private companies in investment trust portfolios.

European Equities Manager Update.

When the going gets tough, exceptional companies keep going. Stephen Paice on Europe’s best.

Kepler Research Report - Baillie Gifford European Growth Trust

Kepler’s latest research report. Please note that this is paid for research.

Baillie Gifford European Growth Trust AGM.

Moritz Sitte, co-manager of the Baillie Gifford European Growth Trust, gives an update on investment philosophy, portfolio activity and positioning, and outlook. sennder’s co-founder explains how its software platform helps truckers carry fuller loads.

sennder’s co-founder explains how its software platform helps truckers carry fuller loads.

Baillie Gifford European Growth Trust Webinar.

Richard Lander of Citywire hosts a webinar on the European Growth Trust and is joined by Stephen Paice, co-manager of the trust, who aims to answer the question: Are you investing in the right Europe?

Are You Investing In The Right Europe?

Client Director Stuart Dunbar is joined by Stephen Paice, Head of the European Equity Team and Moritz Sitte, portfolio manager of our European funds, to discuss the question ‘Are you investing in the right Europe?’.

Baillie Gifford European Growth Trust AGM.

Stephen Paice, investment manager of the Baillie Gifford European Growth Trust plc, gives an update on investment philosophy, performance, portfolio positioning and outlook.

European stock stories

Investment managers Stephen Paice and Moritz Sitte give some examples of European companies that tick all the boxes and show exciting growth potential.

Pushing rocks uphill: the case for European equities

Is this the turning point European investors have been waiting for?

Europe’s turning point

Chris Davies, joint manager of the European Growth Trust, on Europe's economic transformation.

The Next Chapter

Baillie Gifford trusts showcase private market focus and AI optimism at annual investment conference.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

ASML: Stock Story

Paul Taylor explores the cutting-edge semiconductor technology advancing the digital revolution.

Europe: unique brands, hidden champions

Why a long-term approach to the continent’s growth stocks is more relevant than ever.

How DSV became global freight’s top dog

Conquering trade logistics one merger at a time.

European Growth Trust: Manager Insights

An update on performance, portfolio movements and investment outlook.

Our best ideas in Europe

Thomas Hodges uses Lonza, Topicus and Soitec to illustrate why Europe is more exciting than headlines suggest.

Europe's growth gems

Exploring the European Growth Trust’s dynamic companies and what sets them apart.

European Growth Trust: Manager Insights

An update on performance, portfolio positioning and why we believe our holdings remain both resilient and opportunistic.

European growth: time to bargain hunt?

Stephen Paice outlines where the opportunities lie and the trends driving value creation.

European Equities

Investment manager, Stephen Paice, discusses the Baillie Gifford approach to European Equities.

The history of the European Growth Trust

How a trust giving investors access to the European market has found grounds for optimism despite volatility.

European Growth Trust: manager insights

Despite a tough economy, we can still find valuable outliers by investing long term

Atlas Copco: Sweden’s best kept secret

Stephen Paice speaks to Matt Reustle on the Business Breakdowns podcast.

A smörgåsbord of innovation.

Sweden tops the charts for original thinking, from family businesses to founder-run companies.

Trip Notes: Helsinki.

European Growth Trust manager Stephen Paice dips a digital toe into Slush’ event for hot start-ups.

Growth Investing in Europe.

In this webinar, Steven Paice discusses why the case for owning growing, innovative companies in Europe is only getting stronger.

Valuing private companies.

Baillie Gifford explains its approach to valuing private companies in investment trust portfolios.

European Equities Manager Update.

When the going gets tough, exceptional companies keep going. Stephen Paice on Europe’s best.

Kepler Research Report - Baillie Gifford European Growth Trust

Kepler’s latest research report. Please note that this is paid for research.

Baillie Gifford European Growth Trust AGM.

Moritz Sitte, co-manager of the Baillie Gifford European Growth Trust, gives an update on investment philosophy, portfolio activity and positioning, and outlook.

sennder: Helping Truckers Cut Costs and Carbon.

sennder’s co-founder explains how its software platform helps truckers carry fuller loads.

Baillie Gifford European Growth Trust Webinar.

Richard Lander of Citywire hosts a webinar on the European Growth Trust and is joined by Stephen Paice, co-manager of the trust, who aims to answer the question: Are you investing in the right Europe?

Are You Investing In The Right Europe?

Client Director Stuart Dunbar is joined by Stephen Paice, Head of the European Equity Team and Moritz Sitte, portfolio manager of our European funds, to discuss the question ‘Are you investing in the right Europe?’.

Baillie Gifford European Growth Trust AGM.

Stephen Paice, investment manager of the Baillie Gifford European Growth Trust plc, gives an update on investment philosophy, performance, portfolio positioning and outlook.

European stock stories

Investment managers Stephen Paice and Moritz Sitte give some examples of European companies that tick all the boxes and show exciting growth potential.

AGM and voting

When you invest in an investment trust you become a shareholder and have a say on how the Company is run. You also have a right to attend the Company's annual general meeting (AGM).

How to vote

The following link will take you through to The Association of Investment Trusts' (AIC) website where there is information on how to vote your shares if you hold them via one of the major platforms.

How to attend the AGM

If you hold your shares through a platform, it is not always obvious how to attend an AGM. The following link will take you through to The Association of Investment Trusts’ (AIC) website where there is information on how your platform can help you attend this important shareholder meeting. If you do not see your provider listed, please contact your provider directly and ask them to assist.

Baillie Gifford European Growth Trust corporate calendar

Our corporate calendar provides details of the regulatory events that occur over the year. This includes dates for reports, results, dividend payments and the AGM.

| Event | Month (each year) |

| Final results announced | December |

| Interim results announced | May |

| Financial year end date | 30 September |

| Annual general meeting | February |

| Dividends payable | February |

AGM

Baillie Gifford European Growth Trust's annual general meeting (AGM) was held on Wednesday 5 February 2025. You can read a summary of the results of the voting on AGM resolutions here.

Voting

A breakdown of the votes cast by Baillie Gifford over the previous quarter on behalf of the investment trust is available in the Proxy voting disclosure.

Registrar

Computershare Investor Services PLC maintains the share register on behalf of the Company. Queries regarding shares registered in your own name can be directed to:

Computershare Investor Service PLC,

The Pavilions,

Bridgwater Road,

Bristol,

BS99 6ZZ

T: +44 (0)370 889 4086

Documents

You can access any literature about the Fund here.

To download any document you will need Adobe Reader. Please note that we can now provide you with Braille and audio transcriptions of our literature on request. It may take up to 10 days for the transcription to be completed dependent on the size of the document.