Insights

Filters

Insights

Viewing 645 of 645

International Growth: our philosophy

Investment manager Tom Coutts introduces International Growth, reflecting on the exciting opportunities ahead.

Strategic Bond Fund: back to the future

Investment manager Robert Baltzer gives an update on the Baillie Gifford Strategic Bond Fund.

Managed Fund: update webinar

Investment manager Iain McCombie discusses portfolio positioning and performance.

Positive Change Impact Report 2023

Where innovation meets impact: logging portfolio companies’ progress in shaping a better future.

Monks Investment Trust: interview with Spencer Adair

We discuss the importance of long-term investing for outsized returns within the Monks Investment Trust.

Pacific Horizon: capturing growth

The Pacific Horizon Investment Trust shares its strategic investments in Asia's dynamic markets.

Global Alpha Q2 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Lessons from a time traveller

A journey through time uncovers the deep transitions that can reshape our world.

US Equity Growth: investor letter Q2 2024

Investment specialist Fraser Thomson gives an update on the US Equity Growth Strategy covering Q2 2024.

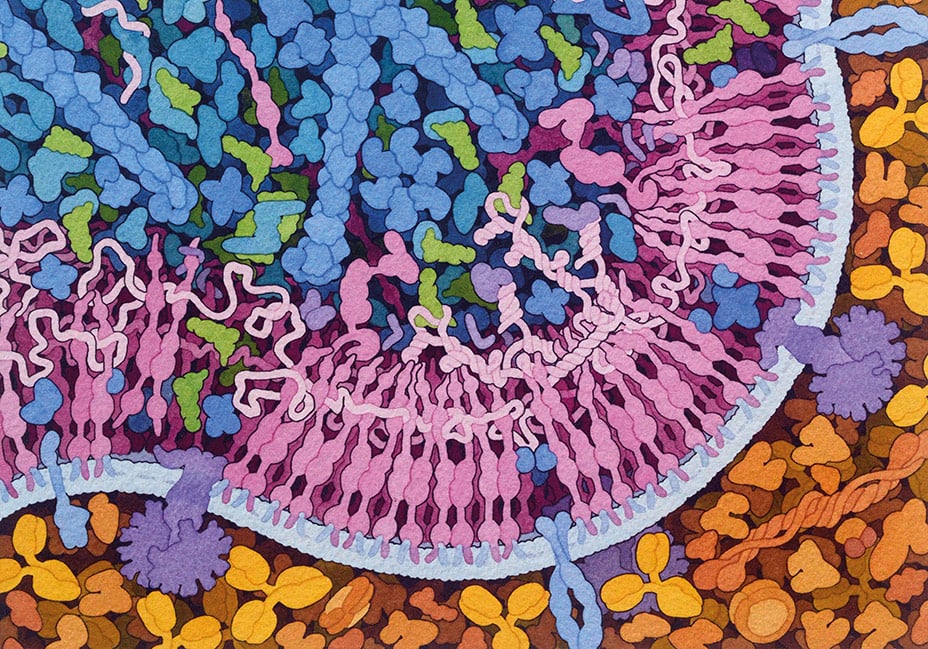

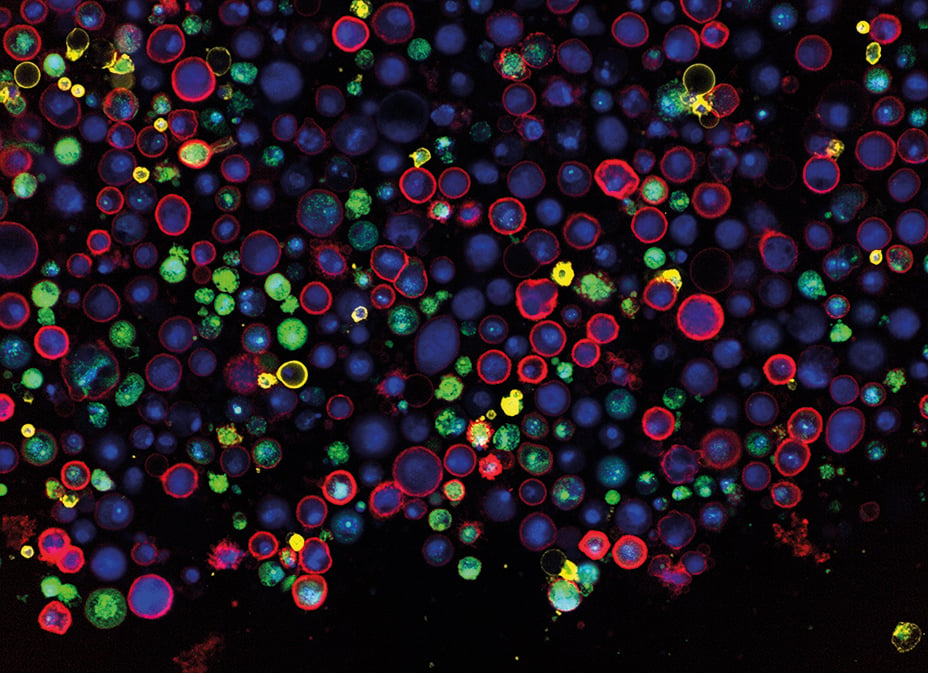

AI: driving a new healthcare paradigm

Why AI could be key to us living longer and being in better health in the future.

Positive Change: investor letter Q2 2024

Investment specialist Rosie Rankin gives an update on the Positive Change Strategy covering Q2 2024.

Multi Asset Q2 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments.

Streamlined for success

How efficiency drives at Meta, Shopify and Block could fuel their long-term growth.

UK Growth Trust: manager update

Iain McCombie and Milena Mileva on navigating growth investment in volatile markets.

Discovery Q2 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

European Equities Q2 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q2 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

Sustainable Income Fund Q2 update

The Sustainable Income Fund Team reflects on recent performance, portfolio changes and market developments

UK Core Q2 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q2 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

China Q2 update

The China Team reflects on recent performance, portfolio changes and market developments.

International Growth Q2 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

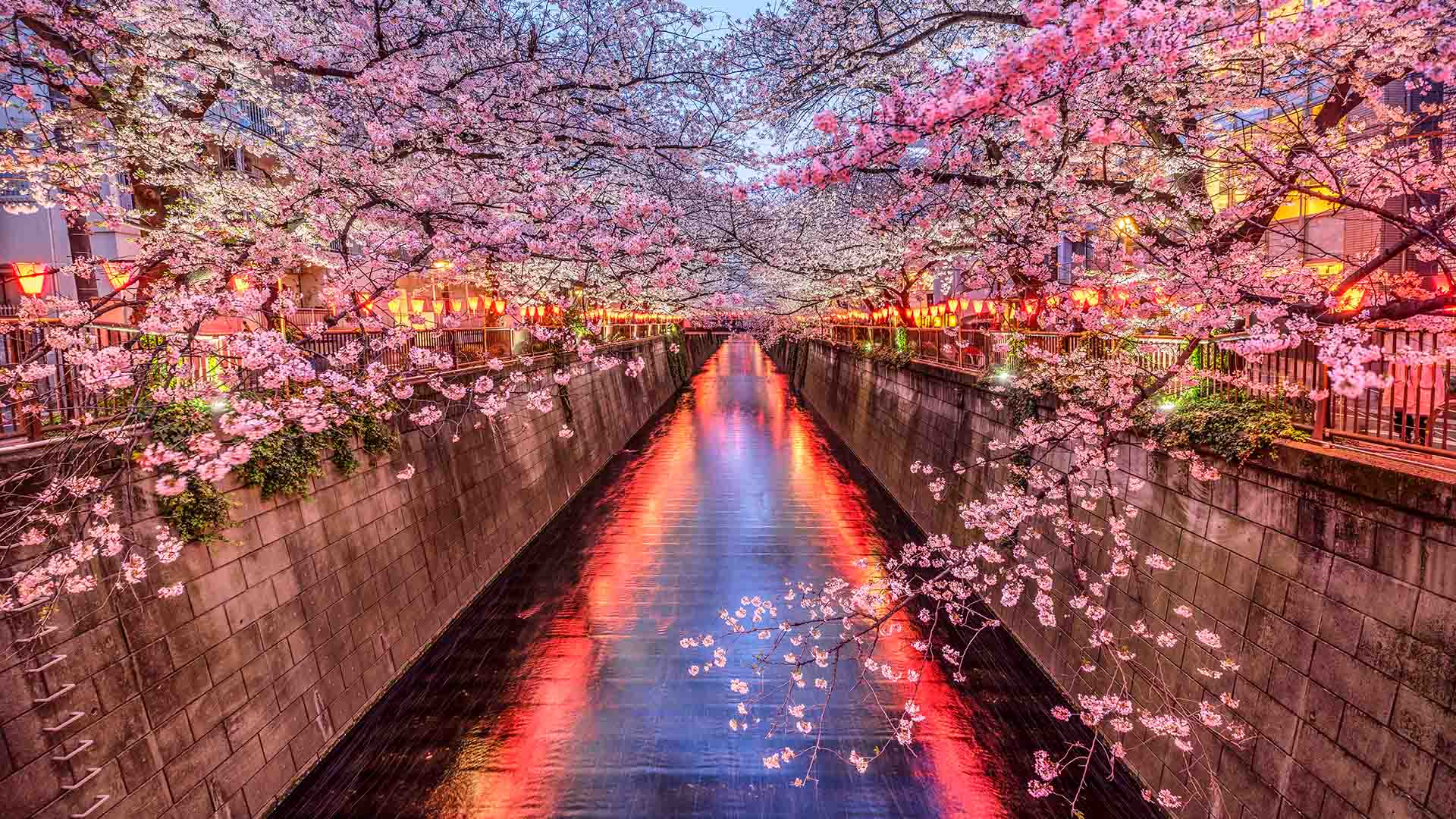

Japanese Equities Q2 update

The Japanese Equities Team reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q2 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Strategic Bond Q2 update

The Strategic Bond Team reflects on recent performance, portfolio changes and market developments

US Alpha Q2 update

The US Alpha Team reflects on recent performance, portfolio changes and market developments

Health Innovation Q2 update

The Health Innovation Team reflects on recent performance, portfolio changes and market developments.

International Smaller Companies Q2 update

The International Smaller Companies Team reflects on recent performance, portfolio changes and market developments.

Managed Fund Q2 update

The Managed Fund team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q2 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q2 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

International All Cap Q2 update

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

International Alpha Q2 update

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q2 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Managed Fund: Poised for growth

Did 2022 sound the death knell for the balanced investment approach or is it alive and kicking?

Future growth stars back in focus

Firms with winning technology and services are getting noticed again, despite the reign of the Magnificent 7.

International viewpoints: global EV trends

Analysing market dynamics, industry challenges and future trends of EVs’ global adoption.

Stock story: PsiQuantum

How one company is finally bringing the boundless possibilities of quantum computing into reach of the wider market.

Upfront: episode seven

We discuss long-term investing, delve into PsiQuantum’s investment case, and explore Monks Investment Trust.

European Fund: inflection points

Adapting to changing market conditions and focusing on dynamic growth companies in Europe.

International Concentrated Growth Q2 update

The International Concentrated Growth Team reflects on recent performance, portfolio changes and market developments.

International viewpoints: eastern promise

What market sentiment, recent valuations and policy changes mean for us as investors in Asian growth companies.

Private equities: time to turn to growth

Why high interest rates help rapid growth private companies with proven products stand apart.

Japan: the next opportunity

Explore Japan's market evolution, digitalization, and investment opportunities in unique growth themes.

Why small companies matter to us

Unlocking the potential of small cap investments.

A write up of Baillie Gifford’s responsible investing breakfast

An insight into the critical role of responsible investing in aligning financial success with sustainability efforts.

Investing in innovation

We start by asking ‘what if?’ as we search for those companies that will shape the future.

Emerging Markets: our philosophy

Investment manager William Sutcliffe introduces Emerging Markets, reflecting on the exciting opportunities ahead.

China through a Japanese lens

Japanese tech dominance is under increasing pressure in China from domestic challengers.

Manager Insights: Shin Nippon

Praveen Kumar provides an update on recent performance and explains why he remains optimistic.

Japan: the land of the rising yield

How Japan's changing economy is reshaping the Multi Asset investment landscape.

Stock story: MercadoLibre

The company on a mission to democratise ecommerce and finance for 650 million people.

Upfront: episode six

We discuss risk v reward in stock picking, MercadoLibre’s mission in Latin America and Japan’s small-cap landscape.

Webinar: Why growth? Why now?

Partners Tim Garratt and Stuart Dunbar identify signs of emerging growth.

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

Investor Forum: Onboard for growth

Optimism for the future of growth investing from four of Baillie Gifford’s investment trusts.

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

Investing in UK water

The companies transforming the UK’s water infrastructure.

Sustainable Growth Q1 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

UK Core Q1 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

European Equities Q1 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Japanese Equities Q1 update

The Japanese Equities Team reflects on recent performance, portfolio changes and market developments.

International Alpha Q1 update

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Health Innovation Q1 update

The Health Innovation Team reflects on recent performance, portfolio changes and market developments.

US Alpha Q1 update

The US Alpha Team reflects on recent performance, portfolio changes and market developments.

International Growth Q1 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q1 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q1 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

International Smaller Companies Q1 update

The International Smaller Companies Team reflects on recent performance, portfolio changes and market developments.

International Concentrated Growth Q1 update

The International Concentrated Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

International All Cap Q1 update

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

China A Shares Q1 update

The China A Shares Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Strategic Bond Q1 update

The Strategic Bond Team reflects on recent performance, portfolio changes and market developments.

Five years of health innovation

Investors take note: technology and innovation are revolutionising treatments and patient care.

Private companies and the Power Law

Author Sebastian Mallaby on the attraction of investing in game-changing firms at an early stage.

Moncler: from mountain to street

How the outerwear pioneer innovated its way into the fashion elite.

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

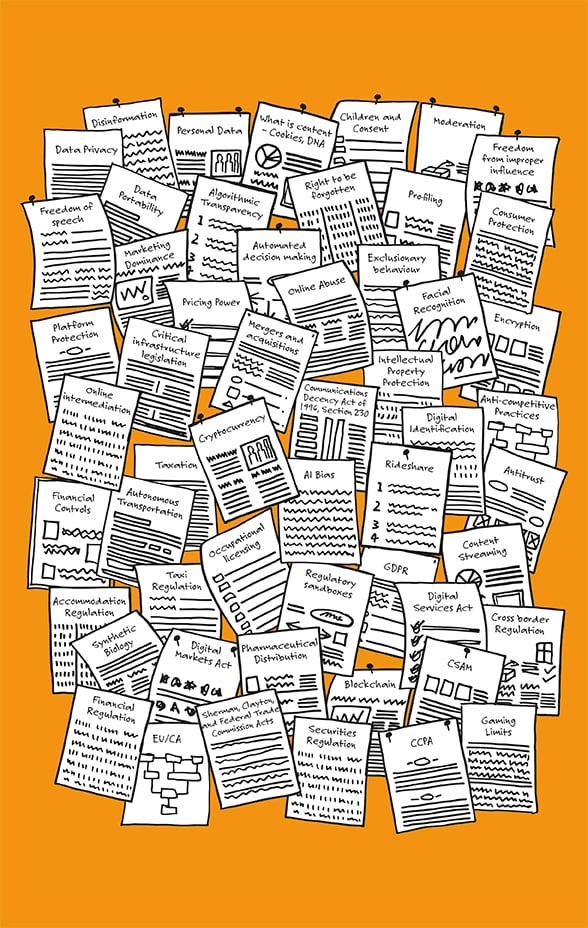

Lessons from the laws

Investment managers share some of the economic laws that guide their decision-making.

Vietnam: Asia’s rising star

Visiting Saigon, Roderick Snell explores what went right for the pro-business communist country.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

Remitly: easy global remittance

The mobile app that busts stress and high charges for workers sending money back home.

Starlink’s Space-based broadband

How the SpaceX subsidiary is turning internet deserts into online oases

The founder factor

Tom Slater on the secret sauce shared by nearly nine out of ten Scottish Mortgage companies.

ESG v sustainability

How do we look beyond the data to ensure our investments have real-world impact?

Climeworks: digging deeper for climate solutions

A small holding with a long-term climate goal.

The American Dream made real

Why the US is a fantastic place to invest in exceptional public and private growth companies.

Positive Conversations 2023

The Positive Change Team’s ESG and engagement report shows the difference talking can make.

Stock story: Pinduoduo

The innovative ecommerce company poised to take advantage of China’s large consumer base.

Upfront: episode five

We discuss innovative UK companies, Pinduoduo’s edge in ecommerce, and China’s investment landscape.

All aboard the growth train

Why do we prefer growth stocks despite the lure of shorter-term assets?

Positive Change: a review of 2023

A performance update explaining why we back firms solving social and economic issues such as Moderna and MercadoLibre.

How dividend growth signals compounding

Investor James Dow explains why dividend growth indicates a company can compound its earnings.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

EWIT: manager insights

Lead manager Douglas Brodie gives an update on performance with three key reasons for optimism.

Long Term Global Growth Q4 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

The AI paradigm shift

Being open-minded to what rapid changes brought on by AI could mean for growth stocks.

Niches, anomalies, and things to come

How can we spot large growth opportunities at the stage when others dismiss them as fads?

Lessons from evolutionary biology

Why the study of gene fitness can help us spot ambitious growth companies with huge potential.

Live long… and prosper?

How Sustainable Income aims to help you defy the retirement lottery and secure a durable income.

Enduring good

What values are important to you? And are they reflected in your investments?

European Growth Trust: manager insights

An update on performance, portfolio positioning and why we believe our holdings remain both resilient and opportunistic.

The 3 traits of great growth stocks

Why real-world problem solving, financial discipline and adaptability are critical to growth.

UK Core Q4 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q4 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Japanese Equities Q4 update

The Japanese Equities Team reflects on recent performance, portfolio changes and market developments.

International All Cap Q4 update

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

Strategic Bond Q4 update

The Strategic Bond Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q4 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

Health Innovation Q4 update

The Health Innovation Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q4 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q4 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

European Equities Q4 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

China Q4 update

The China Team reflects on recent performance, portfolio changes and market developments.

International Smaller Companies Q4 update

The International Smaller Companies Team reflects on recent performance, portfolio changes and market developments.

International Growth Q4 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

Keystone Positive Change: manager insights

An update on the portfolio and these companies’ important contributions towards a more sustainable future.

International Alpha Q4 update

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International Concentrated Growth Q4 update

The International Concentrated Growth Team reflects on recent performance, portfolio changes and market developments.

Making sense of social

Considering the S in ESG ranges from supply chain analysis to cybersecurity precautions.

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Stock story: SoftBank

Matthew Brett discusses SoftBank and considers Japan’s exciting technological future.

How Amazon pioneered a new path

The new wave of companies blending physical and digital processes together.

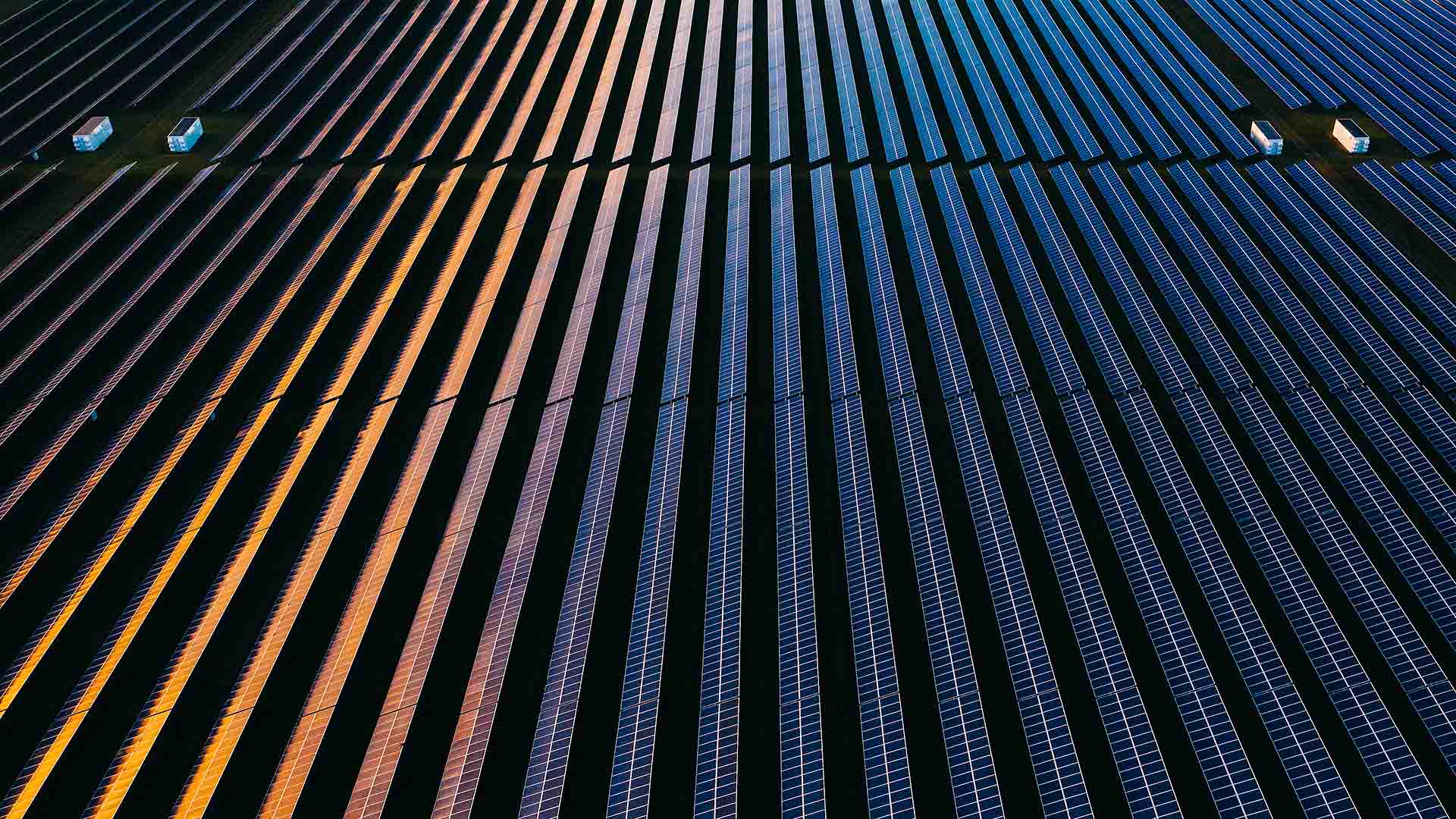

Limiting carbon, not growth

Sustainability is much too big and important a topic to be confined to only equity investing.

Japan Trust: manager insights

Your annual update on performance, portfolio changes and the opportunities we’re excited about.

Avoided emissions methodology

Climate and Environment Analyst Matt Jones considers the potential of emissions avoidance and disruptive innovation.

HelloFresh: changing how people eat forever

HelloFresh’s CEO explains the art and science of meal kit delivery at a global scale.

China: fear or FOMO?

Ben Buckler on how investors should steer between the twin poles of risk in China.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

South-east Asia’s new export stars

Unearthing growth companies in Vietnam, Indonesia and Thailand.

Small caps: Beyond the myths

Opportunities remain in small-cap investing, regardless of interest rates or market volatility.

Spotting the stars amid a surge

Rising Japanese markets are flattering old-style companies: better to look for long-term growth.

A view from the frontiers

How Edinburgh Worldwide Investment Trust spots potential disruptors in turbulent times.

Aurora: the technology company transforming trucking

The US’s $800bn trucking industry is on track for a shake up with Aurora’s self-driving technology.

Emerging markets – why bother?

Emerging markets have underperformed developed ones recently. So, why should we invest in them?

A net zero initiative update

A reflection on Baillie Gifford’s commitment to the climate transition.

When software meets steel

The ‘next wave’ of companies, mixing the digital and physical realms.

Pacific Horizon Investment Trust: manager insights

With Asia’s strong financial position, the long-term looks exciting for investors.

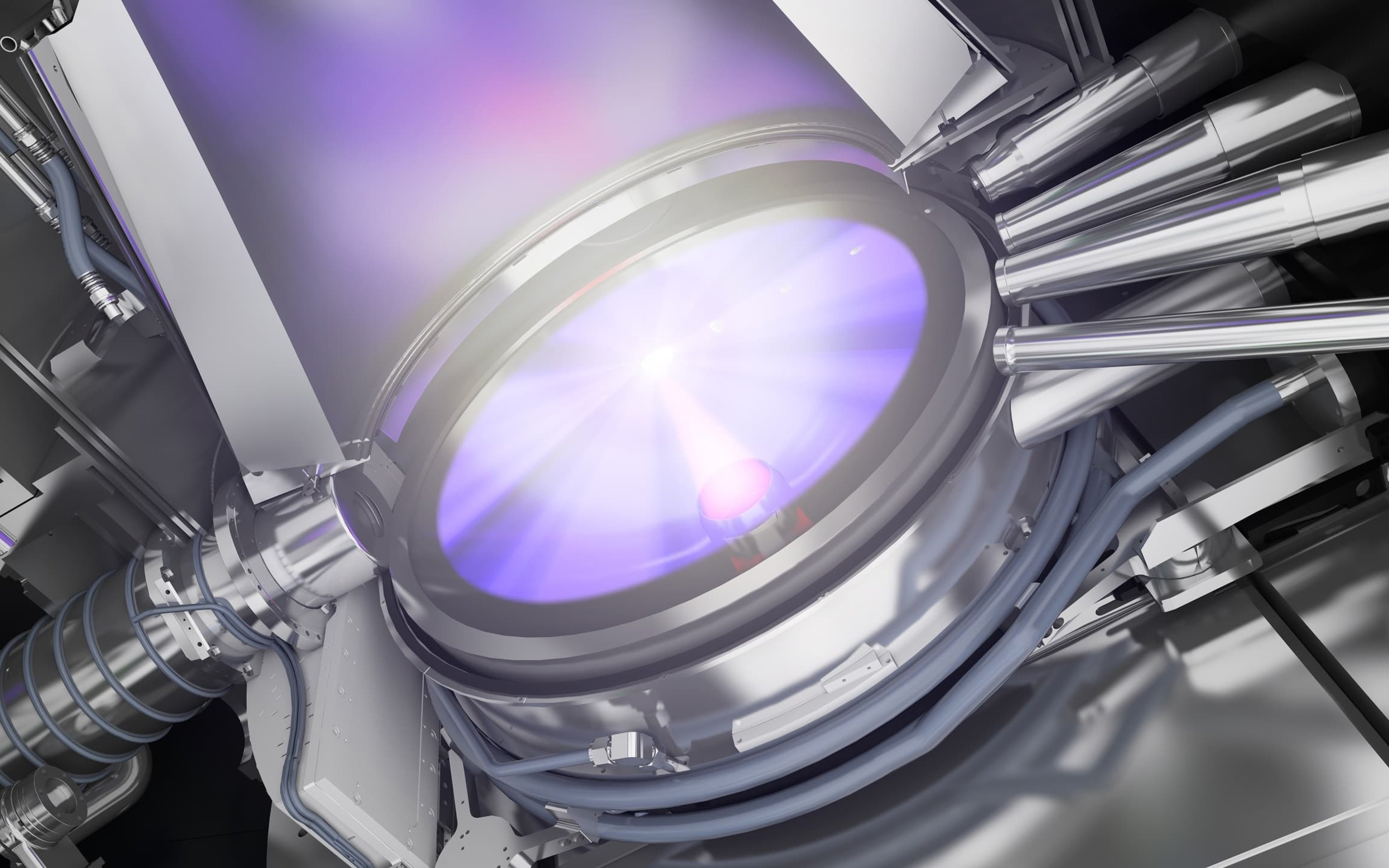

Nuclear comeback

Could smaller reactors and fusion power herald a new atomic age?

AI: a long-term perspective

Why investors must put the rise of ChatGPT and other generative AI in context.

The retirement date lottery – can it be avoided?

Sustainable Income Fund manager Steven Hay addresses three big questions facing today’s cohort of income investors.

Climate change: imagining the future

The years ahead are uncertain, but we can turn that to our advantage.

Adding value from climate change

Companies addressing climate change could create huge societal and economic value over time.

Legally bond: finding underestimated resilience

By keeping an open mind, we hope to find opportunities other credit investors might overlook.

Japan’s new growth opportunities

Seeking the entrepreneurial firms that could sustain the country’s rally.

SAINTS: the case for dividend growth

Why we believe pursuing dividend growth rather than yield is the right way to grow capital.

Upfront: episode four

Hear from us on private companies, the investment case for SoftBank and the Responsible Global Equity Income Fund.

The hidden costs of software

A decade ago, software companies were venture-backed and capital-light. That’s no longer true.

Investing in private companies

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

Climate futures: preparing for uncertainty

How can we avoid a hothouse world? Head of Climate Change Caroline Cook discusses with experts.

Managed Fund manager update

Investors reflect on the Managed Fund’s track record, recent performance and why they remain optimistic.

How do we value private companies?

Uncover the multiple layers of governance that feed into the valuation of private companies at Baillie Gifford.

Global Alpha Q3 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Can we mine sustainably?

Minerals are key to the energy transition. We believe mining responsibly will bring rewards.

International All Cap Q3 update

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

International Alpha Q3 update

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q3 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

Nuclear fusion: SHINE lights the way

The cancer-fighting firm that aims to lead a clean energy revolution.

European Equities Q3 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Health Innovation Q3 update

The Health Innovation Team reflects on recent performance, portfolio changes and market developments.

International Concentrated Growth Q3 update

The International Concentrated Growth Team reflects on recent performance, portfolio changes and market developments.

Strategic Bond Q3 update

The Strategic Bond Team reflects on recent performance, portfolio changes and market developments.

Japanese Equities Q3 update

The Japanese Equities Team reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q3 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q3 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

International Growth Q3 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q3 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q3 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q3 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

China Q3 update

The China Team reflects on recent performance, portfolio changes and market developments.

ESG: beyond the growing pains

Why considering environmental, social and governance factors helps us pursue long-term returns.

Joiners’ mate

Iain McCombie on how Howdens’ kitchens won the building trade’s trust.

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Private company investing myths

Busting three myths that could alter your view about what private company investing is.

How Alnylam nips disease in the bud

The US-based company’s technology promises to ‘silence’ genetic disorders and target some of the world’s biggest killers.

China’s urge to innovate

A nation that once adapted others’ technologies is increasingly leading in innovative products and services.

China revisited

Lawrence Burns explores the new landscape of opportunity.

Harnessing the power within

Could we use our bodies’ natural electricity to treat illness? Author Sally Adee explains.

Japan’s secret superstars

The new generation of companies that’s quietly captured key technology niches.

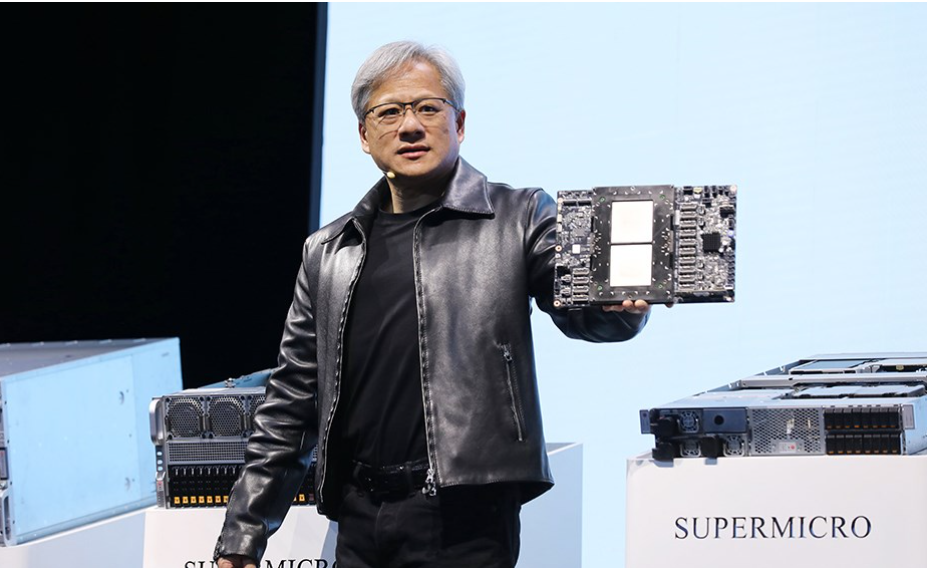

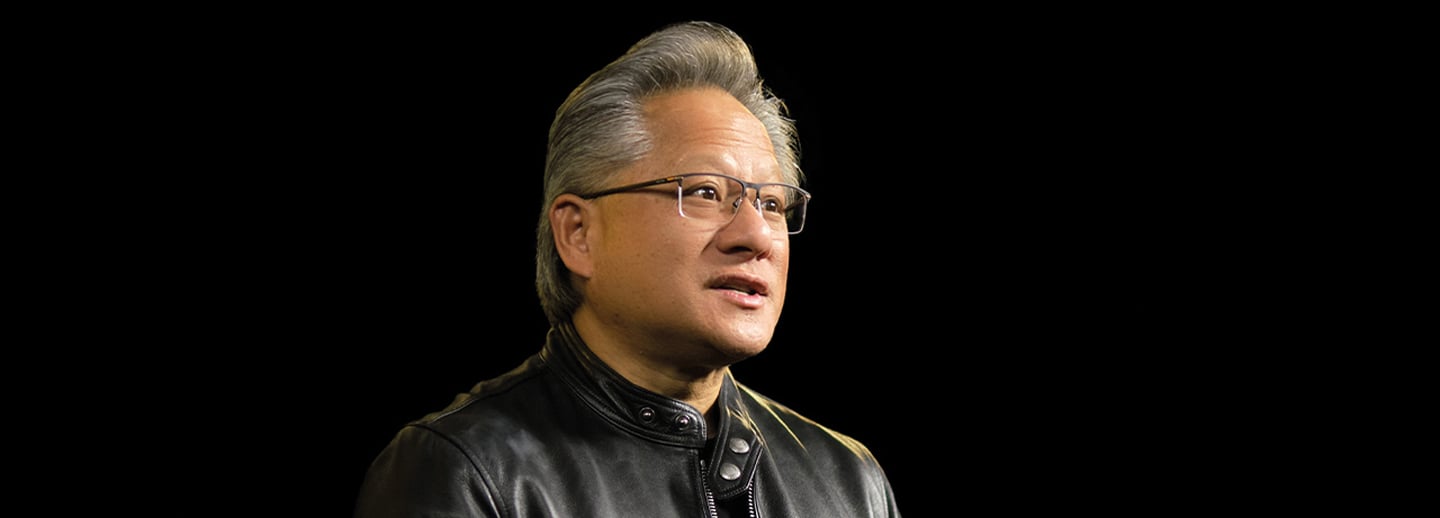

NVIDIA’s chief accelerates AI

How Jensen Huang overcame adversity to play a pivotal role in accelerating progress.

Innovation’s drumbeat

Charting how technological progress and prosperity march together.

Surfing to success

Why the waves hold the key to the pursuit of long-term growth.

How Microsoft got its mojo back

By shifting the focus from Windows and embracing AI, the firm has revitalised its fortunes.

Keystone Positive Change Impact Report

If impact and investing go together, it is important to understand the difference we make.

Three climate change scenarios

Considering different ways global warming and a transition to new energy sources might occur.

Upfront: episode three

We discuss the case for bonds, fashion powerhouse Kering and Sustainable Growth’s approach to valuations.

Disruption Week 2023

Glimpse a universe of opportunity at Baillie Gifford’s Disruption Week in November 2023.

What is private company investing?

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

UK Growth Trust manager insights

An update on portfolio performance, turnover and investment opportunities.

Stock story: Kering

Find out what makes luxury fashion conglomerate Kering stand out from the competition.

Manager insights: Monks Investment Trust

Malcolm MacColl discusses recent performance, portfolio positioning, growth profiles and AI.

Pacific Horizon Trust: webinar

An update on investing in Asia with a focus on how economic trends relate to the portfolio.

What does Moderna do?

Learn how the Boston-based life science company is disrupting the drug development industry.

The secrets of enduring growth

Toby Ross reveals the four signs that a company’s growth might endure for decades.

Change as a growth driver

We live in changing times. And that will create opportunities for long-term growth investors.

Growth investing across decades

Mark Urquhart discusses the science and art of picking growth stocks with enduring potential.

Adapting to survive – and thrive

Using a fighter pilot’s business strategy can help a company orient itself amid change.

Positive Change Impact Report 2022

If impact and investing go together, it is important to understand the difference we make.

Stock stories: Climeworks

Climeworks, the company using innovative technology to capture and store CO2 underground safely, measurably and permanently.

Multi Asset quarterly update

James Squires reflects on the current environment influencing Multi Asset portfolios.

Navigating a turbulent Turkey

Turkey may be volatile, but there’s opportunity in currency forwards and competitive companies

The real deal in property

In a challenging environment, discover a European property sector company bucking the trend.

Upfront: episode two

The UK team discuss types of growth, Northvolt’s technology and companies exciting our US funds.

Global Income Growth Q2 update

The Global Income Growth team reflects on recent performance, portfolio changes, and market developments.

International Alpha Q2 update

The International Alpha team reflects on recent performance, portfolio changes, and market developments.

Strategic Bond Q2 update

The Strategic Bond team reflects on recent performance, portfolio changes, and market developments.

International Concentrated Growth Q2 update

The International Concentrated Growth team reflects on recent performance, portfolio changes, and market developments.

Long Term Global Growth Q2 update

The Long Term Global Growth team reflects on recent performance, portfolio changes, and market developments.

Global Alpha Q2 update

The Global Alpha team reflects on recent performance, portfolio changes, and market developments.

Health Innovation Q2 update

The Health Innovation team reflects on recent performance, portfolio changes, and market developments.

US Equity Growth Q2 update

The US Equity Growth team reflects on recent performance, portfolio changes, and market developments.

International Growth Q2 update

The International Growth team reflects on recent performance, portfolio changes, and market developments.

Emerging Markets Q2 update

The Emerging Markets team reflects on recent performance, portfolio changes, and market developments.

International All Cap Q2 update

The International All Cap team reflects on recent performance, portfolio changes, and market developments.

China Q2 update

The China team reflects on recent performance, portfolio changes, and market developments.

Sustainable Growth Q2 update

The Sustainable Growth team reflects on recent performance, portfolio changes, and market developments.

Positive Change Q2 update

The Positive Change team reflects on recent performance, portfolio changes, and market developments.

UK Equity Core Q2 update

The UK Equity Core team reflects on recent performance, portfolio changes, and market developments.

Eating better to save ourselves

Tim Spector and Henry Dimbleby on what our diet says about our health and the health of the planet.

What does Northvolt do?

Learn how the Swedish battery company Northvolt is driving change in the EV industry

Why now for multi-asset investing

Who benefits from the new macro environment? Why multi-asset investing remains a viable option.

Actual investing: the test of time

Stuart Dunbar reflects on the long-term case for Actual investing.

The history of SAINTS

John Newlands reveals the roots of the SAINTS success story.

Making health insurance manageable

How Elevance Health uses its scale to smooth a path through the US health system’s maze.

Moderna’s new challenge

The mRNA technology behind the Covid vaccine is being directed against other diseases.

Discovery: a view from the frontiers

Baillie Gifford’s Global Discovery Team reflects on the lessons of turbulent times.

A century and a half of SAINTS

James Dow reflects on how the trust has changed over the decades, but stuck to its core values.

The history of the European Growth Trust

How a trust giving investors access to the European market has found grounds for optimism despite volatility.

Asia ex Japan manager update

Roderick Snell and Qian Zhang discuss current views and portfolio positioning for the Asia ex Japan Strategy.

Upfront: episode one

Hear from the UK team on AI, Moderna’s mRNA technology and what’s next for the Managed Fund.

China A Shares: in conversation

Investor Sophie Earnshaw explains how we navigate China’s complexity to boost growth potential.

Why the long-term matters

There’s safety in being one of the crowd but it could stop you from seeing potential rewards.

Asset allocation: five questions

The Managed Fund’s asset allocation reflects the view that there are opportunities ahead.

Climate change innovators

How Positive Change targets companies at the forefront of tackling carbon emissions.

Multi Asset quarterly update

Scott Lothian explains how Multi Asset is riding out the ups and downs of market volatility.

The changing face of growth

By investing in companies at the frontiers of structural shifts we can pursue fantastic returns.

The foundations for growth

How we support charity, foundation and endowment investors.

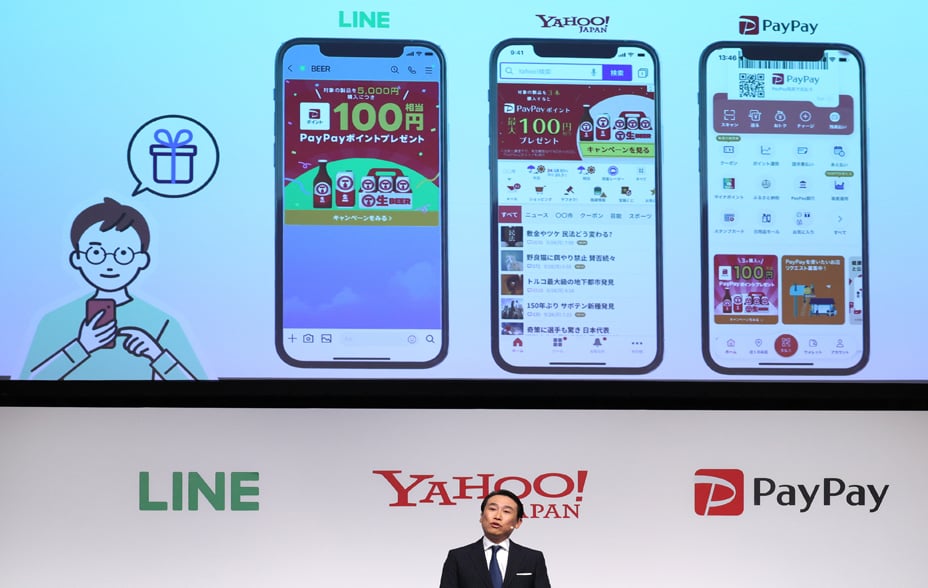

From Y to Z: Japan’s online powerhouse

How Yahoo! Japan and Z Holdings' conquest of the country’s internet realm unfolded.

Transformative investment

Why time travelling to 2050 helps us invest in companies tackling climate change and inequality.

Adyen: pioneer of payments

The Dutch firm making everyday payments fast and friction-free.

Positive Change Q1 update

Positive Change Team reflects on recent performance, portfolio changes, and market developments.

Global Alpha Q1 update

Global Alpha Team reflects on recent performance, portfolio changes, and market developments.

Long Term Global Growth Q1 investment update

Long Term Global Growth Team reflects on recent performance, portfolio changes, and market developments.

Sustainable Growth Q1 update

Sustainable Growth Team reflects on recent performance, portfolio changes, and market developments.

US Equities Q1 update

US Equities Team reflects on recent performance, portfolio changes, and market developments.

Emerging Markets Q1 update

Emerging Markets Team reflects on recent performance, portfolio changes, and market developments.

International Growth Q1 update

International Growth Team reflects on recent performance, portfolio changes, and market developments.

International Alpha Q1 update

International Alpha Team reflects on recent performance, portfolio changes, and market developments.

International All Cap Q1 update

International All Cap Team reflects on recent performance, portfolio changes, and market developments.

The sustainability revolution

Positive Change’s Kate Fox on thinking about the world in 2050 to spot opportunities today.

International Concentrated Growth Q1 update

International Concentrated Growth Team reflects on recent performance, portfolio changes, and market developments.

Keystone Positive Conversations 2022

We don’t just talk to managements, we listen. A snapshot of Keystone Positive Change’s ESG conversations.

Recursion Pharmaceuticals: finding new drugs using data science

How Recursion Pharmaceuticals is using AI to turn the hunt for new medicines on its head.

Rethinking renewables

Research suggesting faster-than-expected adoption has far-reaching consequences for investors.

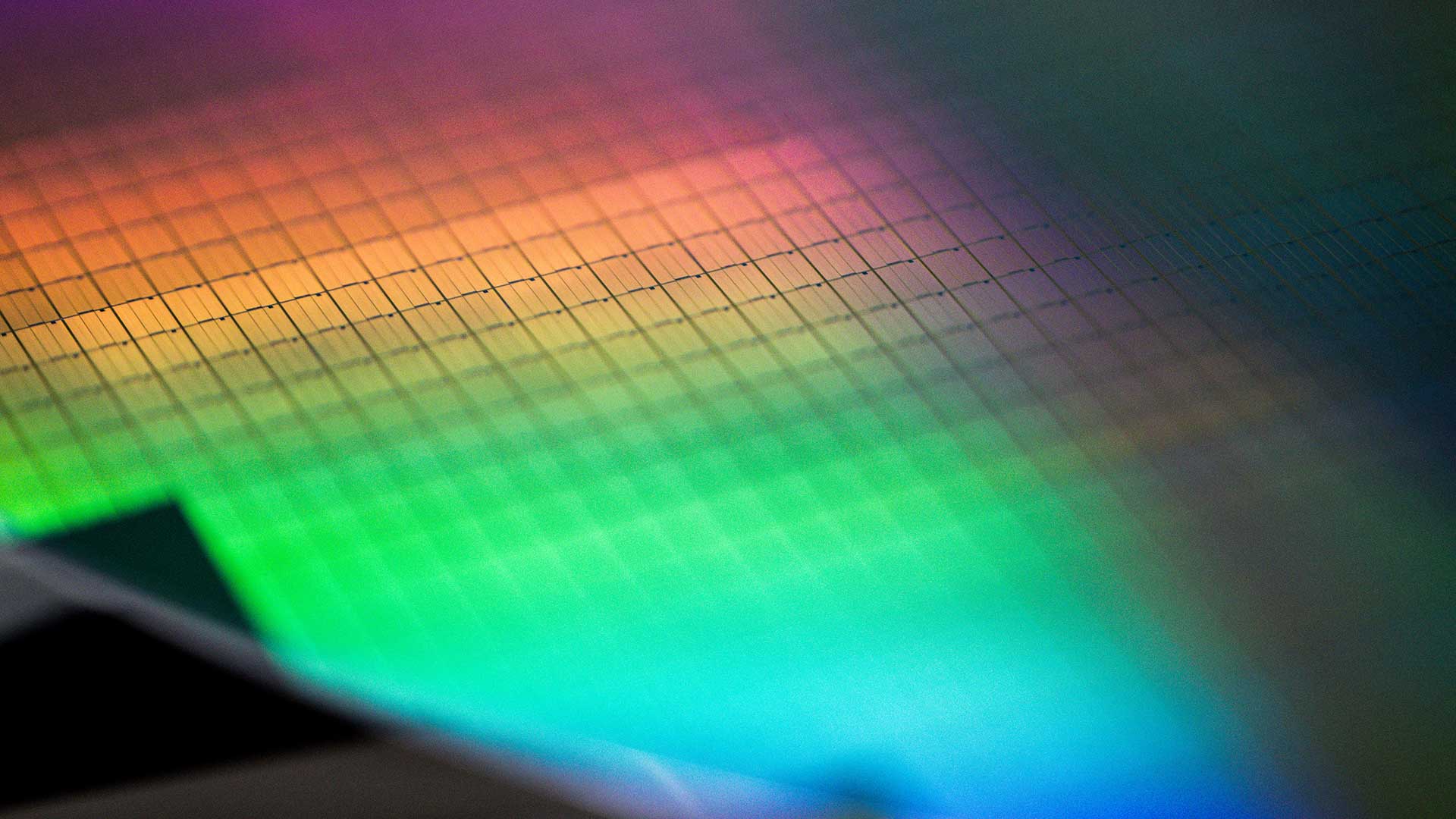

Japan’s place in the chip market

The Japanese semiconductor companies set to benefit from the rise of 5G and electric cars.

20 years of International Growth podcast

Through two decades of change, our strategy has prospered by sticking to its philosophy of patience and optimism.

Climeworks: fighting global warming

Climeworks helps us remove CO₂. We invest in it because we think it can combat climate change.

Ocado’s robot revolution

The UK firm partnering with leading grocers to deploy its automated warehouses worldwide.

Moderna’s new challenge

The mRNA technology behind the Covid vaccine is being directed against other diseases.

AI Superpowers

Renowned investor Kai-Fu Lee revisits his prophetic book, five years on.

Positive Conversations 2022

We don’t just talk to managements, we listen. A snapshot of Positive Change’s ESG conversations.

Webinar: the SAINTS approach

Co-manager James Dow explains why he believes in the Trust’s focus on sustainable compounding.

Denali Therapeutics: rising to the challenge of brain disease

Developing brain disease drugs is hard, but this company’s early results suggest it can succeed.

Four questions for growth investors

Investors must find companies with the key qualities needed to thrive in a stormy economy.

Sustainable growth: an introduction

ESG investing is broken. Changing our approach could open up opportunities for better returns.

The history of Scottish Mortgage Investment Trust

How a trust launched to finance the 1900s rubber boom was transformed into a backer of global technological change.

Positive Conversations 2022

Responsible business practices are fundamental to delivering sustainable long-term growth and addressing global challenges.

Why small is big in Japan

Praveen Kumar on the lesser-known players thriving in the shadow of the country’s big brands.

LTGG investor update – January 2023

LTGG’s Stewart Hogg and Gemma Barkhuizen on volatility, business culture, and the long-term view.

Nothing lasts forever

Why international equity markets shouldn’t be forgotten.

Teleportation: just a Zipline away

Zipline delivers instantly, whether that’s blood in Rwanda or rotisserie chicken from Walmart.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

Sustainable investing in the health sector

The Health Innovation team on ESG, the future of medicine and making a positive global impact.

Making sense of the metaverse

Author Matthew Ball on the next-generation internet and the companies building its foundations.

Japan Growth: Asia’s resurgence

Despite the turbulence of last year there are reasons to be optimistic about Japanese companies.

Monks Research Agenda 2023

How can we invest in quality companies in a changing market?

Re-awakening utilities

Utility companies which can adapt to climate change and the shift to renewables bring the best chance of returns.

Japan: setbacks or permanent change?

Our investors’ job is to tell the difference between passing phases and deeper behavioural shifts.

Beauty secrets: sharing Shiseido’s story

Masahiko Uotani, CEO of the Japanese cosmetics giant, discusses its profitable makeover with Iain Campbell.

Global Alpha Research Agenda 2023

How can we invest in quality companies with the potential to generate sustainable returns in a changing market?

Resilient growth for the long term

Why long-term growth firms such as battery-maker Albemarle and data aggregator Experian are the ones to watch.

Insights: investment research in Japan

Japan’s cultural landscape is changing, with implications for companies like Shiseido, CyberAgent and PayPay.

What’s next for growth stocks?

Baillie Gifford’s Dave Bujnowski explores the new engines powering progress.

Asia and energy transition

Exploring the emerging energy opportunities in Asia.

China’s changing automotive landscape

The rise of EVs spells opportunity for supply chain providers, from battery makers to semiconductor foundries

AI: Frightening or fascinating?

Investors discuss how AI software could transform healthcare, advertising, manufacturing and more.

ASML: advancing chips to new limits

The Dutch firm driving progress by making it possible to create more intricate computer chips.

Asia ex Japan: Portfolio manager update

Client director Andrew Keiller and investment manager Roderick Snell discuss the firm’s latest views on investing in the Asia ex Japan region.

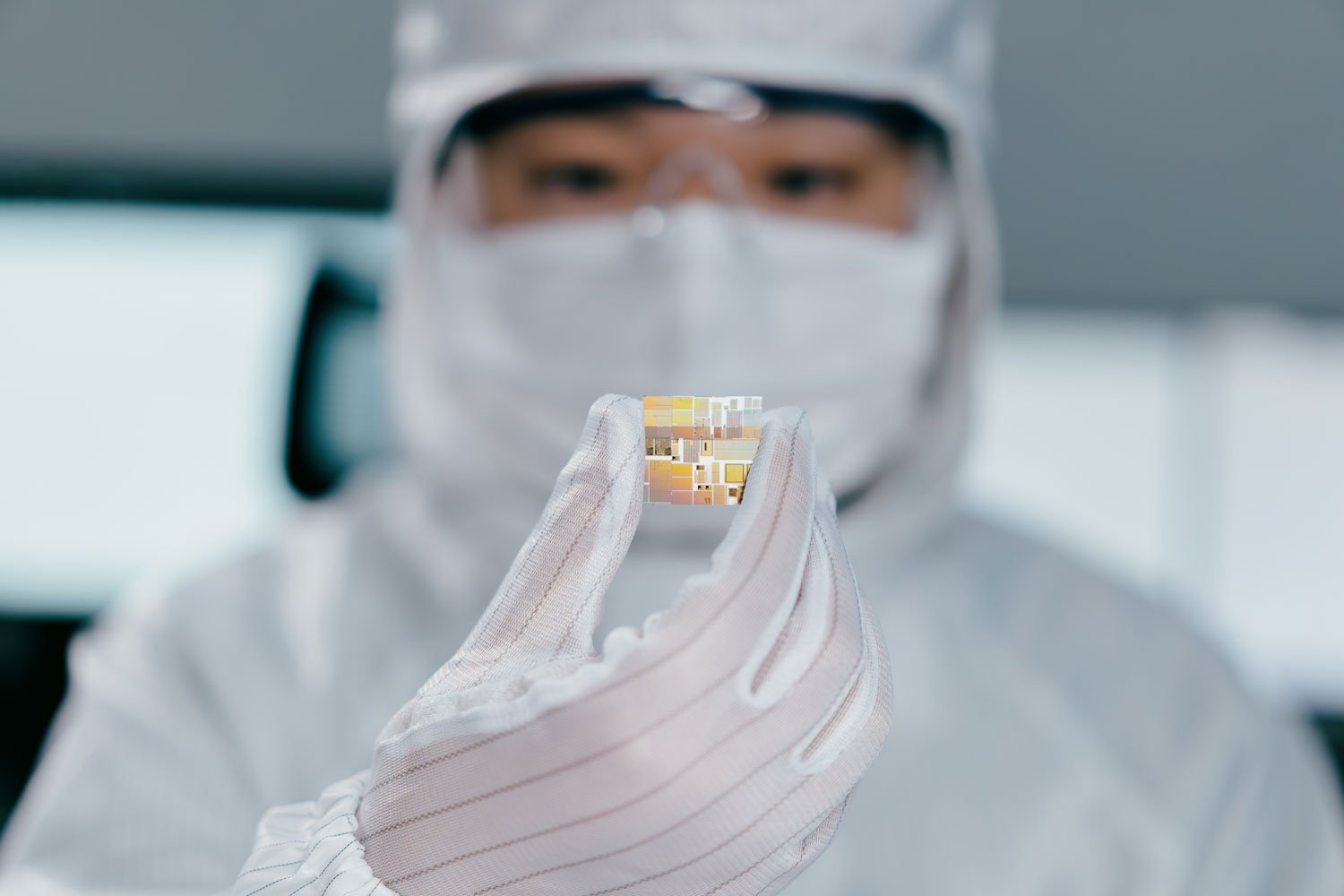

Chip War

How semiconductors bring a competitive world together.

A dose of innovation

Your money or your health. Marina Record asks if society is ready to pay for health innovation.

UK equities: Home focus

Companies solving big problems in healthcare, fintech and AI, are proving the UK is an exciting place to invest.

Managed Fund: Patient investing

Many investors are impatient, but change takes time – the best performance could come to those who wait.

The dawn of artificial intelligence

How AI is disrupting all kinds of industries, creating investment opportunities in its wake.

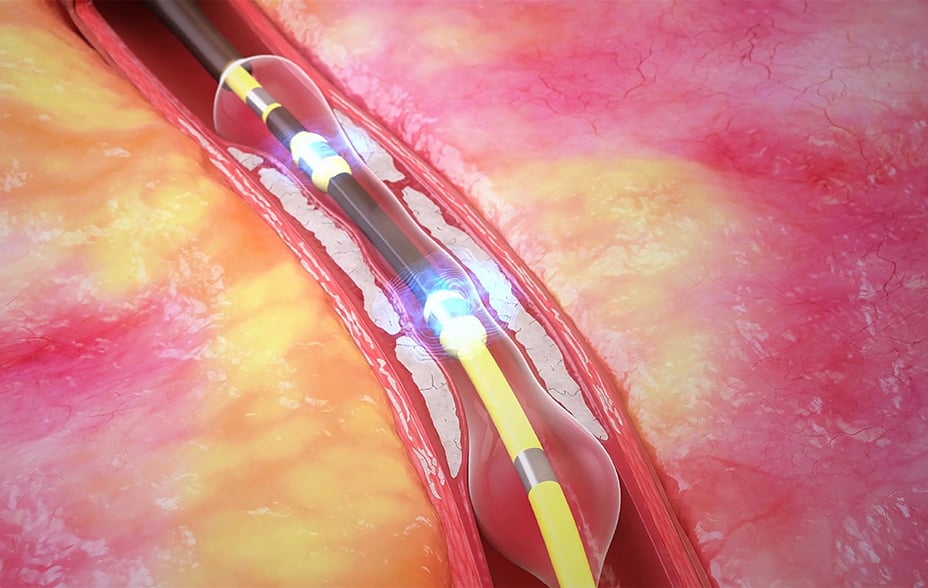

Disrupting heart disease

Rose Nguyen on the companies seeking to overcome the scourge of heart disease.

New hopes for curing heart disease

In the war against killer heart disease, technology is making huge strides in diagnosis and treatment.

Japan trip reflections

Less foreign visitors, more cashless payments. Donald Farquharson reflects on post-Covid Japan

Solving the antimicrobial crisis

If we don’t tackle the AMR crisis now, it could be the world’s biggest killer by 2050.

Manager insights: Pacific Horizon

Pacific Horizon Investment Trust manager Roderick Snell gives updates on the portfolio and investing in Asia.

Positive Change update

Investment manager Lee Qian and investment specialist Rosie Rankin discuss the positive change portfolio.

Investing in net zero

Detail of Baillie Gifford’s first set of NZAMi climate commitments and targets.

Embracing the unpredictable

The ‘what if…?’ questions are the most important of all.

Nintendo: investing in the home of Mario

Why Fusajiro Yamauchi’s business remains a fascinating opportunity for growth investing.

Seizing advantage in EM bonds

Extreme price movements in EM bonds bring potential for high returns, so investing in them could bring rewards.

A theory of radical change

Why a ‘deep transition’ may have started to deliver a more sustainable age.

Multi Asset quarterly update

Investment manager Scott Lothian reflects upon the recent drivers of performance across investment markets, how the current environment is influencing investment decisions, and the key risks and opportunities for the Multi Asset portfolio.

Rethinking where growth comes from

Partner Dave Bujnowski offers a radical new perspective on the disruptive ‘engines’ powering today’s growth.

Japanese Equities update

Fund manager Matthew Brett and investment specialist Thomas Patchett discuss growth investing in Japan.

Europe: why now?

Chris Davies is joined by Thomas Hodges to discuss why he sees reasons for optimism in European equities, and why he believes now is the time to start paying attention.

Inflation: analysing resilience

Four ways to consider growth companies’ ability to deal with rising prices.

Health Innovation: an update with the managers

Join Health Innovation Portfolio Managers as they provide an update on the strategy with Investment Specialist, Jack Torrance.

Creating impact

How the Positive Change Strategy backs firms tackling social and environmental challenges.

Tapping global brainpower

How Baillie Gifford’s mutually beneficial network of academic connections makes us see the world differently.

A simple theory: Einstein’s lesson for investors

Einstein observed that simple is best. Robert Baltzer explains why this is true for investing.

Kering: luxury created with risk

How the group gives its creatives the freedom to spark love-it-hate-it reactions.

Trust trip notes: Tel Aviv

Israel is a nursery for innovative startups, sponsoring growth firms in fields from biofood to cyber security.

Drive: rethinking motivation

What companies get wrong when trying to get the best out of their workers.

Snow Peak’s outdoor heiress

Company director Lisa Yamai is changing attitudes by proving a young female leader can boost performance.

Investing in a changing China

President Xi Jinping’s plan to reshape Chinese society means opportunities for innovative little giants.

Monks: how diversity beats adversity

Having a varied portfolio allows the trust to navigate volatile periods and focus on the long term.

Investing in the champions of Europe

Manufacturing, green tech and services entrepreneurs are enticing investors as they catch up to the US and China.

Compound interest: the snowball effect

Companies reinvesting profits to supply outperformance over decades are the market’s unsung heroes.

Growth investing: hunting the outliers

It’s not about growth or value. It’s about the few companies that drive stock market returns.

A decade of discovery

A focus on growth and innovation has led to exciting finds such as Tesla and Ocado.

Introducing: Sustainable Multi Asset

Lindsey Knight and Scott Lothian discuss the new fund and why it brings opportunities for strong, stable returns.

Small islands, lots of energy

How Orkney’s renewable energy projects can inform our investment choices.

Global Discovery webinar

Douglas Brodie discusses investing in small companies, recent performance amid volatility and opportunities.

Defining impact

The US Equities team discuss ESG and effective growth investing.

UK Growth Trust Manager Insights

In volatile times, focusing on the fundamental long-term opportunities of our holdings is key.

Snippets from the archives

Key insights from the International All Cap Strategy picked from the past 30 years.

Shimano: our strategy in one stock

How the cycle parts maker symbolises the kind of firms International All Cap is looking for.

Growth flows

Tracking our pursuit of growth companies over time.

Investing in ingenuity

Milena Mileva on picking International All Cap’s future winners.

Forging a fund

How relationship building, performance and tales of Scotland helped establish our international funds.

US Growth Trust: Manager Insights

Gary Robinson, co-manager of the US Growth Trust, explains why we stay focused on fundamentals in uncertain times.

Keystone Positive Change Impact Report 2021

The Positive Change Team’s impact report, covering our activity and plans for the future.

Monks Investment Trust Manager Insights

Jon Henry discusses changes to the portfolio, the impact of inflation and optimism in periods of volatility.

Managed Fund: Sticking to our knitting

Growth investing means staying with promising firms. Despite recent underperformance, we’ll continue to do so.

Transforming the future of healthcare

Supporting companies with the potential to transform the field of healthcare and generate attractive returns.

Sustainable Growth Sustainability Report

The Sustainable Growth team on climate change, carbon emissions and sustainable growth companies.

Cultivating change in the meat industry

Demand for meat is growing, but traditional production is costly. Could in vitro agriculture be our panacea?

Positive Change Impact Report: 5th Year 2021/22

The Positive Change Team’s latest impact report, covering our activity over the last five years and plans for the future.

Trust history: Pacific Horizon

How Baillie Gifford’s Asia-focused investment trust rode the tiger of growth.

Responsible Global Equity Income webinar

In the context of high inflation and market volatility, portfolio managers James Dow and Toby Ross discuss current views and explain how focusing on long-term income growth remains critical to facing these challenges.

Reaching for resilience

Positioning for the long term and backing resilient companies can offer strong yields – even in troubled times.

Why are Swedish companies world leaders?

Sweden tops the charts for original thinking, from family businesses to founder-run companies.

A smörgåsbord of innovation.

Sweden tops the charts for original thinking, from family businesses to founder-run companies.

Sir Isaac Newton’s folly.

How the 18th-century mathematician lost a fortune to groupthink.

Digital Disruption and the future

Online infrastructures and digital developments in the education, energy, and transport sectors make for an exciting future.

Emerging Markets: Five Questions.

How does the BG Managed Fund view prospects, ESG and regulation in relation to Emerging Markets?

The search for ‘jumper-stretching’ stocks

Tim Garratt considers how we value exciting businesses and reflects on what we lose when we fail to imagine.

Why patience matters

Endurance and imagination are key ingredients for quality growth investing.

Investing in decarbonisation

Spotting companies with potential in the renewables, energy storage and carbon reduction sectors.

China’s leapfrog shopping apps

Smartphone-centric retailers drive innovation.

Study guides

Academic partnerships that generate new ideas

What makes companies resilient to inflation?

Baillie Gifford’s Risk Team has been considering how firms can reduce their vulnerability to rising prices.

The fight for your free time

Disruptive change within the entertainment world creates a wealth of opportunity.

Why it’s not over for growth stocks

Growth stocks have crashed down to earth. Has growth had its day or will it come back stronger?

China’s energy paradox

How should you consider the country – carbon culprit or climate saviour?

Investment Stewardship

It’s not that we do ESG, but how we do it. The ESG Team list 2021’s key stewardship activities.

Pole position.

Tyre maker Bridgestone is poised to benefit from next-generation road vehicles.

Trip Notes: Helsinki.

European Growth Trust manager Stephen Paice dips a digital toe into Slush’ event for hot start-ups.

International Smaller Companies: Under the Radar

Part 6 - Alignment.

International Smaller Companies: Under the Radar

Part 5 - Insight.

International Smaller Companies: Under the Radar

Part 4 - Scalability.

International Smaller Companies: Under the Radar

Part 3 – Sustainability

International Smaller Companies: Under the Radar

Part 2 – Competitive Edge.

International Smaller Companies: Under the Radar

Part 1 - Opportunity

International Smaller Companies: Under the Radar

Introducing the Radar

Asia ex Japan: Portfolio Manager Update

Join Roddy Snell and Ben Durrant to discuss current views and portfolio positioning for the Asia ex Japan strategy and learn why we continue to believe this is the most attractive region globally for growth investors.

ESG v sustainability

The questions we should consider to avoid being led astray by ESG risk scores.

International Concentrated Growth: manager introductions

Radical companies may seem risky, but they’re building the future. Paulina McPadden, Spencer Adair and Lawrence Burns discuss how investing in firms with extraordinary potential is a simple approach to long-term wealth creation.

Impact, Ambition and Trust

If ESG scores are not the answer, how does Global Income Growth Team’s ESG approach measure up?

MercadoLibre: the Latin liberator

Lawrence Burns discusses the fintech disrupting Latin America’s banking and retail industries.

Resurgence of European ambition – Europe’s outliers

Join Stephen Paice, head of the Baillie Gifford European Equities team, as he discusses his research on the European companies that have increased in value 10x or more, delving into their history, common characteristics, and where they are likely to occur in the future.

How education escaped from the classroom

Online courses have upended the economics of education, Thaiha Nguyen explains.

The future of education.

For digital learning companies that can balance accessibility and profits, the opportunities are vast.

India’s data-driven growth stocks.

Pacific Horizon spots investment opportunities in a smartphone-transformed nation.

US Equity Growth: webinar highlights

Investment Managers Tom Slater, Gary Robinson, Kirsty Gibson and Dave Bujnowski share their thoughts on the investment environment, explain why they believe there is scope for upside from here, and discuss their search for transformational growth companies.

The long view

The enduring power of Moore’s Law and other factors that might matter in the next decade of investing.

Shin Nippon Manager Update.

Praveen Kumar, investment manager of Baillie Gifford Shin Nippon PLC gives an update on the performance of Shin Nippon over the past year and shares the team’s views on the long-term outlook for Japanese smaller companies.

Emerging Markets: the possibilist

Understanding the difference between pessimism and possibility in Emerging Markets.

US Equity Growth Webinar: The Long View

Join Investment Managers Tom Slater, Gary Robinson, Kirsty Gibson and Dave Bujnowski as they share their thoughts on the investment environment, explain why they believe there is scope for upside from here, and discuss their search for transformational growth companies.

Transformational thinking

Scottish Mortgage’s departing joint manager James Anderson talks to its deputy Lawrence Burns.

Smaller companies, big disruption.

How Baillie Gifford’s Smaller Companies Fund’s ‘radar’ picks up tomorrow’s game-changing growth businesses.

International All Cap – Consistency in uncertain times

Join Portfolio Construction Group Member, Joe Faraday and Client Service Manager, Andrew Daynes, as they discuss the importance of maintaining consistency in uncertain times.

Casting the net wider.

Monks seeks profit and resilience from its diversified growth stocks portfolio.

India’s data-driven growth stocks

Baillie Gifford spots investment opportunities in a smartphone-transformed nation.

Reflections: A look back on Q1

The LTGG team consider recent performance and the long-term outlook for the fund.

Influencers

James Anderson credits the great minds who shaped his theories about the evolving world.

Future impacts.

Four ways Keystone Positive Change’s holdings can benefit the environment and society.

China’s move to renewable energy

Solar power and cheap green energy makes for a promising future.

Up to speed with property

A growing digital economy means opportunities for those providing the real estate to support it, and a reliable income stream. Investment manager Jon Stewart tells us more in this instalment of the Actual Income series.

Buying into private companies.

Baillie Gifford’s approach to private companies? As we’ve always invested, for the long term.

Positive Conversations 2021

Responsible business practices are fundamental to delivering sustainable long-term growth and addressing global challenges.

Why private companies matter more

SpaceX, Epic Games and Stripe: the list of the unlisted continues to grow. How can investors benefit?

SAINTS: A year in review and looking ahead.

The Scottish American Investment Company share an update on performance and ESG.

Global Alpha 2022 Research Agenda

In their Research Agenda for 2022, the investment managers consider the benefits of deep work in helping them find growth opportunities.

European Equities Manager Update.

When the going gets tough, exceptional companies keep going. Stephen Paice on Europe’s best.

International Smaller Companies is growing up - a three-year anniversary.

Join Brian Lum, Charlie Broughton & Richard Gall as they reflect on the first three years of the Smaller Companies strategy.

International Growth Webinar Summary.

In this webinar summary, Nick Thomas and Christel Brodie, investment specialists, cover growth investing during difficult periods and highlight the long-term growth drivers in the International Growth portfolio.

The history of Baillie Gifford Shin Nippon

The smaller companies trust has thrived by seeking out Japan’s disruptive innovators.

A dream within reach

New technologies, plummeting costs and our own changing behaviours all promise progress in the energy transition– just don’t expect it to come in a straight line.

International Growth: A conversation with the portfolio management team.

Nick Thomas hosts a discussion of the investment landscape with his Portfolio Construction Group colleagues, Tom Coutts and Julia Angeles.

Actual ESG

Investing in great growth companies to make a big difference.

Long-term investing and market volatility.

James Budden on holding your nerve through short-term setbacks and supporting exceptional growth companies.

The evolution of Japan Income Growth.

Fund Manager Karen See and Investment Specialist Thomas Patchett explore Japan’s evolving opportunity set.

A private companies approach to ESG

The special considerations at play when we invest in high-growth, late-stage unlisted firms.

US Equities: manager insights

Gary Robinson, investment manager at Baillie Gifford, responds to questions on inflation and valuation.

Long Term Global Growth: Team evolution

Scott Nisbet interviews the Long Term Global Growth decision-makers discussing volatility, inflation, interest rates, China and portfolio holdings: Roblox, SEA, Moderna and Coupang.

Growth or value: it’s not a black or white choice

Operational performance is a better indicator of growth than inflation. Malcolm MacColl shares why.

ESG collaborations

Looking before we leap into industry initiatives.

Sustainable companies, global challenges.

Learn about the up-and-coming sustainable companies radically shaping a more prosperous future.

Riding Growth Waves Webinar.

Good investing takes quick reactions as well as a long-term vision.

The university shaping global tech

Why so many tech founders and CEOs have emerged from the Indian Institutes of Technology.

Responsible Global Equity Income Fund.

Toby Ross and Diane Esson reflect on the past three years of the Responsible Global Equity Income Fund.

Managed Fund, Top Five US Questions.

Kirsty Gibson answers the key questions investors are asking of the Managed Fund’s US champions.

ESG data: Filling in the gaps

LTGG is making efforts to improve environmental, social and governance metrics.

Global Income Growth

Some people look at life as sustaining the now, while sowing the seeds for a better tomorrow. Global Income Growth think the same way. In this film we explore their philosophy and how when searching for a lifetime of income, they choose growth.

Baillie Gifford European Growth Trust AGM.

Moritz Sitte, co-manager of the Baillie Gifford European Growth Trust, gives an update on investment philosophy, portfolio activity and positioning, and outlook.

Nurobots: delivering with autonomous vehicles

Your pizza delivered by a driverless autonomous vehicle? That’s only the beginning for Nuro.

Diverse and disruptive.

The Monks Investment Trust’s growth-focused stock picking strategy.

Glasgow Climate Pact

For Global Stewardship, climate opportunities go hand in hand with climate challenges

Rules of the game

Regulation and what we look for in companies’ responses.

The ‘S’ of ESG: intangible value

ESG experts Marianne Harper Gow, Ed Whitten and Abhi Parajuli talk about the Social aspect of ESG in the context of investing.

Six reasons for Japan optimism.

Manager Matthew Brett offers six predictions for the Baillie Gifford Japan Trust’s fifth decade.

We need to talk about inflation.

Central banks may find it hard to tackle price rises, requiring fine-tuning to fund strategies.

China: Missing a Paradigm Shift.

Investment manager Sophie Earnshaw shares her latest thoughts on investing in China.

Four decades of lessons

Japan’s ability to anticipate technological change should see it through the ups and downs to come.

What’s a business for?

Today’s investment managers should support companies doing the most to benefit society.

Island Time.

Torcail Stewart wants those who are investing in bonds to slow down and take some tips from island living.

Resilient income, time after time

Planning for future income demands preparation for an unknown tomorrow. In this film we explore the philosophy of Sustainable Income and how they are seeking real income, time after time.

Towards Net Zero: Reflections on COP26

Tim Garratt, Michael Pye and Caroline Cook reflect on the investment implications of arguably the most significant meeting of world leaders this millennium, COP 26.

Investing in Japan: What’s changed and what’s next?

Over four decades Japan has seen 21 prime ministers come and go. Exporters such as Toyota and Toshiba have flourished but the country has also struggled with debt and deflation. Matthew Brett, investment manager, discusses what’s next.

Japan stocks: investing in growth.

As the Baillie Gifford Japan Trust turns 40, robotics and cosmetics are on its manager’s mind.

Actual Income: We need to talk about inflation

When discussing investing, it's hard not to hear concerns surrounding inflation. Watch this webinar recording to hear some of the thoughts and opinions on this hot topic direct from five of our fund managers.

Tomorrow’s world, here today

Investing in private companies applying today’s early-stage tech to create tomorrow’s world.

The Biological Revolution

The use of information science to unlock biology is revolutionising our health and wellbeing.

The real case for China

Willingness to change gives Chinese firms an innovation advantage.

How to surf the waves of growth

Good investing takes quick reactions as well as a long-term vision.

Managed Fund: Manager Insights.

Inflationary pressures and ESG opportunities are among matters on the fund managers’ minds.

Smarter insurance for a less risky future

The insurance industry is being transformed by technological change – from drones to driverless cars. Duncan Sutherland considers how this will shape the future.

Joining forces to achieve net zero.

Baillie Gifford signs up to an asset managers initiative as COP26 begins.

Mapping Veganville

Can plant-based foods save the planet? Investment manager Brian Lum explores changing attitudes.

Healthcare’s biotech revolution

A convergence of technologies is paving the way for advances in our understanding of biology.

The future of transport

Electric cars on the road and flying taxis in the air will change the way people commute and live.

The switch to sustainable food

Plant-based proteins, hi-tech tractors and vertical farms are set to disrupt agriculture.

Digital payments in a cashless future

Disruptive fintechs are paving the way to a world without physical money.

Inside and out

A focus on diversity and inclusion can result in competitive advantage.

China’s Generation Z.

The under-25s discuss their appetite for social shopping apps and home-grown cosmetics brands.

Seismic shifts.

Companies benefiting from explosive change brought on by the pandemic.

Green hydrogen’s promise.

Why using renewables to harvest the gas may be the best way for some industries to reach net zero.

Harnessing growth for the next decade

Investment manager Malcolm MacColl and Senior Governance and Sustainability Analyst Kieran Murray outline believed growth drivers and the development of Global Alpha’s ESG process.

Highlights Video: Harnessing growth for the next decade

Watch the highlights from the recent Global Alpha webinar: Harnessing growth for the next decade.

IDEAS Conference 2021.

With a focus on the future of mobility, the speakers discuss the ideas that will shape the way we live and work, and the companies that will drive disruption and innovation.

A conversation about sustainability

Our long-term investors know that investing sustainably is a plus for value creation.

A shot in the arm.

Moderna’s mRNA vaccines are all set to become the cornerstone of an efficient health system.

China’s gen Z+

How the digital natives’ wants and needs create opportunities for forward-thinking Chinese companies.

Lessons from Bessembinder

What a US academic taught us about the companies that outperform.

India’s ‘missing’ female workers

Women dropping out of employment should weigh on investors’ minds.

Supporting ESG improvers

Investors can have the most impact by focusing on sustainability laggards, not leaders.

Misguided metrics

Why emerging markets firms struggle to get high ESG scores

Time travel investing

Evaluating emerging market stocks by taking a mental leap into the future.

Disruptive Innovation.

Watch the recordings from our week-long 'Disruption Week' event, during which we covered the exciting topics of healthcare, transport, digital payment platforms and sustainable agriculture.

Microfinance for the masses.

Gojo’s founder explains his plan to serve 100 million of the world’s poorest people.

Thriving after adversity.

Why cyclical stocks such as Ryanair and Rio Tinto are comeback kings.

Looking back going forward

In this edition of Looking Back Going Forward we explain how environmental, social and governance (ESG) considerations have been deeply embedded in our Long Term Global Growth strategy.

Long-Term Return Expectations update.

Decarbonisation and baby boomer spending are set to drive asset prices over the years ahead.

An appetite for ordered chaos.

Why loosening control can help companies become more innovative.

Constructive Dissatisfaction: A conversation with the International Growth Team.

Nick Thomas is joined by James Anderson and Tom Coutts to discuss the current investment landscape and the evolving situation in China.

US Discovery: an American voyage into the future

Baillie Gifford launches a new offering seeking out America’s most entrepreneurial new companies.

Climate Change: Risk or Opportunity?

Alicia Cowley, member of the Asia Client Service Team, is joined by ESG specialists Marianne Harper Gow and Michelle O’Keefe to discuss the burning question: Does climate change pose a risk to investment returns or are we able to identify investment opportunities in this area?

Modern-day Explorers.

Our international investors are explorers: which of the disruptors and innovators will deliver?

The history of The Baillie Gifford Japan Trust

Launched in Japan's great economic boom, the trust thrived in the lost decades after the bubble burst. How do we save a planet? Paulina Sliwinska invests in the companies tackling climate change.

How do we save a planet? Paulina Sliwinska invests in the companies tackling climate change.

US Growth Trust Manager Insights.

Behavioural shifts caused by Covid prompt changes to Baillie Gifford US Growth Trust’s portfolio.

Disruption Week: Investing in Firms Shaping the World of Tomorrow

From futuristic wireless technology to healthcare innovation and new forms of food production, the Long Term Global Growth Team’s investment manager Michael Pye considers the advances that may define life in 2040.

Monks Investment Trust Manager Insights.

Monks Manager Spencer Adair looks beyond the noise of recent months to the longer term. Will the climate crisis response alter asset class returns? The Multi Asset Team investigates.

Will the climate crisis response alter asset class returns? The Multi Asset Team investigates.

Clusters, Computers and Classic Rock

Find out why small companies are one of the richest hunting grounds for long-term growth investors. Economist John Kay and investment manager James Anderson discuss how changing attitudes to known unknowns could make us better investors.

Economist John Kay and investment manager James Anderson discuss how changing attitudes to known unknowns could make us better investors. sennder’s co-founder explains how its software platform helps truckers carry fuller loads.

sennder’s co-founder explains how its software platform helps truckers carry fuller loads.

Staying focused in frantic times

In the midst of the pandemic, do Mercado Libra and Avantor's bond offer long-term value?

Baillie Gifford UK Growth Trust plc Manager Insights.

Investment manager Milena Mileva gives an update on the philosophy, positioning and activity of the Baillie Gifford UK Growth Trust portfolio.

Hyper-connected Networks

What’s left of exception growth companies? With the internet and the cloud, the sky’s the limit.

The past is a foreign country

High yield today might not mean resilient yield tomorrow for Emerging Market debt. Theo Holland reveals how Indonesia turned raw potential into a pathway for sustainable growth.

How harnessing chaos can make companies more nimble

Chaos is often associated with a failure of leadership. Gary Robinson, partner in the US Equities Team, argues that the best bosses don’t resist disorder but channel it to create ‘chaordic organisations’ in which innovation thrives.

Why Companies Should Embrace Chaos

The nimblest firms are often those that don’t fight disorder but embrace it, according to Visa founder Dee Hock.

Mind the Gap: Going on a De-risking Journey

Baillie Gifford’s multi asset funds aim to provide maturing pension schemes protection from whatever economic weather may arise.

Strategy Overview.

A brief summary of Baillie Gifford’s beliefs, purpose and strategy.

What Picasso can teach us about investing

Investment Specialist Christel Brodie speaks to Tom Coutts, Investment Manager on Baillie Gifford’s International Growth Strategy, about his recent thought piece ‘What Picasso can teach us about investing’.

Actual Income

Client Director Jan Oliver hosts a webinar on Baillie Gifford’s Income solutions. She is joined by James Dow, Torcail Stewart and Steven Hay, investment managers on our Global Income Growth Strategy, our Strategic Bond Strategy and our Multi Asset Income Strategy respectively.

The future is now, and it works

Innovation is the name of the game. Investment manager Torcail Stewart shares his enthusiasm for the growth companies of the future that we own the bonds of today.

The history of The Monks Investment Trust

Historian John Newlands outlines the story of the Monks Investment Trust hard-fought growth.

High Yield Bond

In a world full of noise and excessive choice, it helps to see things from a different perspective. In this film we explore the philosophy behind High Yield Bond and how seeking resilience is time well spent.

Highlights Video - The Small-Cap Effect: An Existential Debate.

This short video summaries the highlights from a recent webinar in which Richard Gall, Steve Vaughan and Brian Lum, members of the International Smaller Companies Portfolio Construction Group, discusses the small-cap effect, the team structure, and the investment approach to finding exceptional smaller companies.

Japan's digital transformation

Unique to itself and often surprising, the digital transformation of the world’s third largest economy offers exciting new openings for investors, writes Donald Farquharson, head of Baillie Gifford’s Japanese equities team and Thomas Patchett, Japanese Equity Specialist.

Baillie Gifford Shin Nippon Investment Trust Webinar.

Praveen Kumar, manager of the Baillie Gifford Shin Nippon Investment Trust, discusses how to approach high-growth investing in a country that has a low-growth economy, the economy in question being that of Japan. Praveen explains that as fundamentally bottom-up, long-term stock pickers, we try to ignore short-term trends and predictions, and focus on finding smaller cap Japanese companies with huge potential over the long term.

The Small-Cap Effect: An Existential Debate.

Richard Gall, Steve Vaughan and Brian Lum, members of the International Smaller Companies Portfolio Construction Group, discuss the small-cap effect, the team structure, and the investment approach to finding exceptional smaller companies.

History of Keystone Positive Change Investment Trust

Historian John Newlands looks back at the origins of the trust and its surprising connections.

Strategic Bond.

Thinking about long-term income means thinking about what ‘can be’, not what ‘is’. In this film we explore the philosophy behind Strategic Bond and how, when it comes to income, there’s no time like the future.

What Picasso can teach us about investing

Cubism changed art by depicting objects from multiple perspectives. Investors can learn from this approach by looking beyond the narrow confines of the financial industry and seeking a wide range of viewpoints rooted in the real world, argues Tom Coutts, partner at Baillie Gifford.

Baillie Gifford China Growth Trust Manager Insights.

Sophie Earnshaw, co-manager of the Baillie Gifford China Growth Trust, gives an update on the philosophy, positioning and performance of the portfolio since Baillie Gifford took over management of the trust in September 2020.

Positive Change - It's Not Obvious

Positive Change invests in businesses that can help solve global challenges. But, as Kate Fox explains, the impact that some of the most influential companies have on daily lives is hidden from view.

The history of Baillie Gifford China Growth Trust

In our special series on the histories of investment trusts managed by Baillie Gifford, John Newlands looks back at the Edwardian origins of the China-focused trust.

The responsible approach to ESG investing

Is our approach to environmental, social and governance (ESG) issues doing more harm than good? Stuart Dunbar, partner at Baillie Gifford, calls for investors to stop counting and start thinking.

The Monks Investment Trust PLC Webinar.

Spencer Adair, newly appointed co-manager of the Monks Investment Trust, explains why the investment approach will not change. He sheds light on the past and current positioning of the portfolio, the fundamental strategy of the team involved, and the core philosophy of Monks that has been largely unchanged throughout the trust’s history.

Investing in growth pays dividends

What does a high dividend yield actually tell you? Seb Petit explains why it’s important to bring a growth mindset to income investing.

Japanese Fund Update Webinar.

Investment Specialist Thomas Patchett is joined by Matthew Brett, Investment Manager of the Japanese Fund and Japan Trust, to discuss the last twelve months and the positioning and performance of the fund by exploring some of the main themes coming through in the portfolio.

How Are You Investing For The Next Decade?

Managed Fund Co-managers Iain McCombie and Steven Hay discuss growth versus value and what that means when looking at the decade ahead. They then cover governance and sustainability and why engagement in the topic is so important when investing over the long term.

Schiehallion Manager Insight.

Robert Natzler, investment manager of The Schiehallion Fund, gives an update on the team’s activities during a year of working remotely, followed by an overview of portfolio performance, transactions and IPOs. Natzler also takes the opportunity to reiterate the investment philosophy of The Schiehallion Fund and thank shareholders for their ongoing support in the fund’s first two years.

Global Alpha Paris-Aligned

The Global Alpha Paris-Aligned portfolio offers a pathway for clients to align their assets with the objectives of the Paris Agreement. Here, we provide some background to the Paris Accords and outline how we aim to implement its objectives.

Baillie Gifford European Growth Trust Webinar.

Richard Lander of Citywire hosts a webinar on the European Growth Trust and is joined by Stephen Paice, co-manager of the trust, who aims to answer the question: Are you investing in the right Europe?

On the grid

David McIntyre and Calum Holt summarise their thoughts on the potential transformation of the European energy industry and how this is being embraced in our Multi Asset funds.

Active Investment: Fuelling the Energy Transition

In this webinar, Product Specialist Alasdair McHugh talks to Caroline Cook, Senior Analyst in the Governance & Sustainability Team, about active investment, the energy transition, where we are now and how far we need to go.

Shin Nippon - Manager Insights.

Praveen Kumar, investment manager of Baillie Gifford Shin Nippon PLC gives an update on the performance of Shin Nippon over the past year and shares the team’s views on the long-term outlook for Japanese smaller companies.

The Baillie Gifford Managed Fund’s UK champions - five burning questions

The year 2020 felt somewhat surreal for UK investors. Not only was our local economy hit hard by the pandemic, but whole sectors of the stock market came under pressure, including many high-profile firms.

Injecting optimism into healthcare’s future

Could the messenger RNA vaccines deployed against Covid, help fight cancer and other diseases? After a year of crisis, Julia Angeles, co-manager of Baillie Gifford’s Health Innovation Fund, looks at the positive signs.

Breaking the biotech model

Could the messenger RNA vaccines deployed against Covid, help fight cancer and other diseases? After a year of crisis, Julia Angeles, co-manager of Baillie Gifford’s Health Innovation Fund, looks at the positive signs.

Japan from a distance