Overview

ISIN

GB0000485838SEDOL

0048583Investment proposition

The Baillie Gifford Japan Trust aims to pursue long-term capital growth principally through investment in medium to smaller sized Japanese companies, which are believed to have above average prospects for growth.

Share price and charges

Price

886.00pNAV at fair

990.05pPremium (+) or discount (-) at fair

-10.5%Ongoing charges*

0.69%Fund facts

Active share

84%*

Fund launch date

1981

AIC Investment Sector

Japan

Benchmark

TOPIX

*Relative to TOPIX. Source: Baillie Gifford & Co, Japan Exchange Group.

The Trust is the longest established existing Japanese investment trust, having survived the ebb and flow of corporate activity in the Japanese sector over the last 30 years.

Meet the managers

Meet the directors

Intermediary client contacts

If you’d like further information, please get in touch with the Intermediary Client Contact for your area.

Ratings

As at: 31 October 2025

Regulatory news announcements

Regulatory news announcements which are released to the London Stock Exchange can be accessed via their service.

The Association of Investment Companies

Further information on investment trusts and the investment trust sector can be found on The Association of Investment Companies website.

Risk Warnings

Risk Introduction

The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies. The value of their shares, and any income from them, can fall as well as rise and investors may not get back the amount invested. The specific risks associated with the Trust include:

Currency

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

Gearing

The Trust can borrow money to make further investments (sometimes known as "gearing" or "leverage"). The risk is that when this money is repaid by the Trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the Trust will make a loss. If the Trust's investments fall in value, any invested borrowings will increase the amount of this loss.

Liquidity

Values for securities which are difficult to trade may not be readily available and there can be no assurance that any value assigned to such securities will accurately reflect the price the Trust might receive upon their sale.

Derivatives

The Trust can make use of derivatives which may impact on its performance.

Smaller Companies

Investment in smaller companies is generally considered higher risk as changes in their share prices may be greater and the shares may be harder to sell. Smaller companies may do less well in periods of unfavourable economic conditions.

Single Country

The Trust's exposure to a single market and currency may increase risk.

Premium Risk

Share prices may either be below (at a discount) or above (at a premium) the net asset value (NAV). The Company may issue new shares when the price is at a premium which may reduce the share price. Shares bought at a premium may have a greater risk of loss than those bought at a discount.

Buy-backs

The Trust can buy back its own shares. The risks from borrowing, referred to above, are increased when a trust buys back its own shares.

Income Secondary

The aim of the Trust is to achieve capital growth. You should not expect a significant, or steady, annual income from the Trust.

Regulation of Investment Trusts

The Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

Index disclaimer

Fund performance

Periodic Performance

As at: 30 November 2025

1 Year | 3 Years | 5 Years | 10 Years | |

|---|---|---|---|---|

Share Price | 26.1% | 19.6% | -6.4% | 103.5% |

NAV | 20.5% | 26.0% | 4.8% | 128.2% |

Benchmark* | 19.3% | 47.1% | 46.3% | 142.7% |

Discrete Performance

As at: 30 September 2025

30/09/2020 – 30/09/2021 | 30/09/2021 – 30/09/2022 | 30/09/2022 – 30/09/2023 | 30/09/2023 – 30/09/2024 | 30/09/2024 – 30/09/2025 | |

|---|---|---|---|---|---|

Share Price | 16.3% | -29.0% | -2.5% | 8.4% | 26.6% |

NAV | 14.3% | -25.2% | 0.5% | 10.9% | 24.0% |

Benchmark* | 15.6% | -13.5% | 15.1% | 10.7% | 17.3% |

Performance

As at: 30 November 2025

Source: Morningstar, TOPIX.

Performance figures appear in GBP. Please bear in mind that past performance is not a guide to future returns. The value of your investment may go down as well as up, and you may not get back the amount you invested.

Comparative Index is limited to a 5 year period from the current date.

The graph is rebased to 100.

Discount/premium history at fair

As at: 30 November 2025

Source: Morningstar. Premium/Discount of share price to NAV at fair.

If the graph shows negative figures this means that the share price is lower than the NAV at fair – this is known as trading at a Discount.

If the graph shows positive figures this means that the share price is higher than the NAV at fair - this is known as trading at a Premium.

Active Share

As at: 30 November 2025

Relative to TOPIX. Source: Baillie Gifford & Co, Japan Exchange Group.

Fund portfolio holdings

The list of top 10 holdings that this fund invests in.

As at: 30 November 2025

| # | Holding | % of total assets |

|---|---|---|

| 1 | SBI Holdings | 5.4% |

| 2 | SoftBank Group | 5.2% |

| 3 | Rakuten | 4.7% |

| 4 | Sumitomo Mitsui Trust | 4.5% |

| 5 | GMO Internet | 4.1% |

| 6 | Sony | 3.9% |

| 7 | CyberAgent | 3.3% |

| 8 | GA Technologies | 3.1% |

| 9 | FANUC | 3.0% |

| 10 | Calbee | 2.4% |

Insights

Key articles, videos and podcasts relating to the fund:

Filters

Insights

Japan Trust: Manager Insights

Matthew Brett assesses the Japan Trust’s performance, highlighting new holdings and the portfolio’s growth potential.

Humanoid: Japan and the rise of the machine

Humanoids have been a long time coming, allowing Japan to build a world-class edge in robotic components.

Japan Trust: rethinking Japan

Matthew Brett explores how Japan's reforms and inflation are driving opportunities in AI, gaming and healthcare.

Tour de France: the Japanese connection

Bicycle parts maker Shimano is primed for a gear shift in performance.

The Next Chapter

Baillie Gifford trusts showcase private market focus and AI optimism at annual investment conference.

Healthy returns: Japan’s assault on old-age disease

Japanese medical firms are making advances that could help fight cancer and Alzheimer’s.

Japan Trust: Manager Insights

An update on the trust's performance, strategic shifts towards growth and AI-driven prospects.

Rakuten: rewiring Japan’s digital economy

Conglomerates can be clunky, but not so Rakuten. Matthew Brett and Colossus on how it is connecting the dots. Capital at risk.

Private investor forum: growth on sale

Why it pays to keep faith in the company fundamentals

Our best ideas in Japan

Thomas Patchett unwraps Softbank, Rakuten and Eisai, three companies driving new opportunities in Japan.

SWCC Showa: rewiring Japan

How an ultra-traditional Japanese engineering firm became key to Japan’s power overhaul.

Japan: opportunities in automation

Japan's automation revolution and its global leadership in robotics.

Japan: opportunities in healthcare

Japan’s innovation medical breakthroughs are combatting ageing.

Japan: opportunities in quality brands

Behind the success of Japan’s leading quality brands and what opportunities they present.

Japan: opportunities in entertainment

Japan's media giants: Sony and Nintendo's timeless influence.

Japanese changemakers shaping the future

The firms taking advantage of four transformational opportunities.

Japan: the next opportunity

Explore Japan's market evolution, digitalization, and investment opportunities in unique growth themes.

China through a Japanese lens

Japanese tech dominance is under increasing pressure in China from domestic challengers.

Japan Trust webinar 2024

Matthew Brett explores analysis of Japan's economic resurgence and market highs in the latest webinar.

Stock story: SoftBank

Matthew Brett discusses SoftBank and considers Japan’s exciting technological future.

Japan Trust: Manager Insights

Your annual update on performance, portfolio changes and the opportunities we’re excited about.

Spotting the stars amid a surge

Rising Japanese markets are flattering old-style companies: better to look for long-term growth.

Japanese Equities

Investment manager, Donald Farquharson, discusses the Baillie Gifford approach to Japanese Equities.

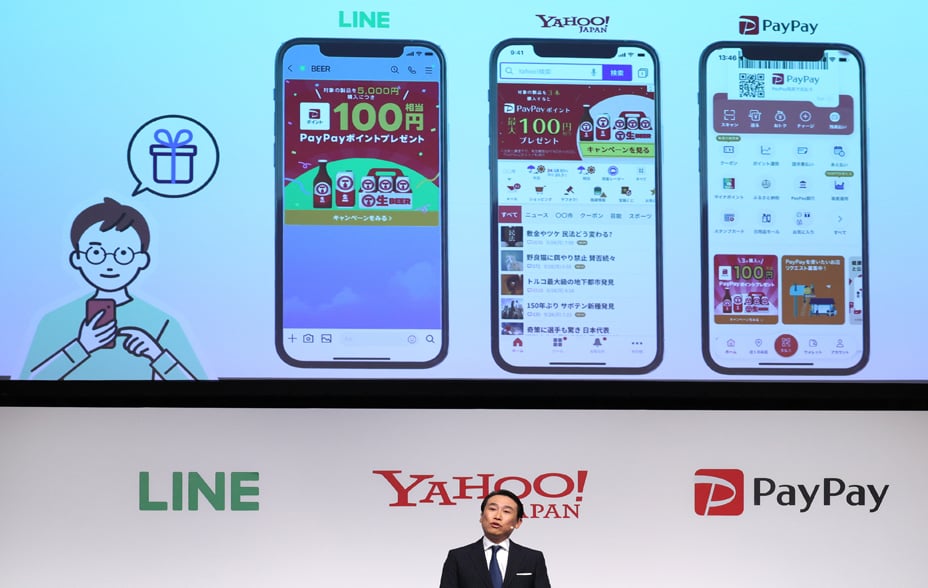

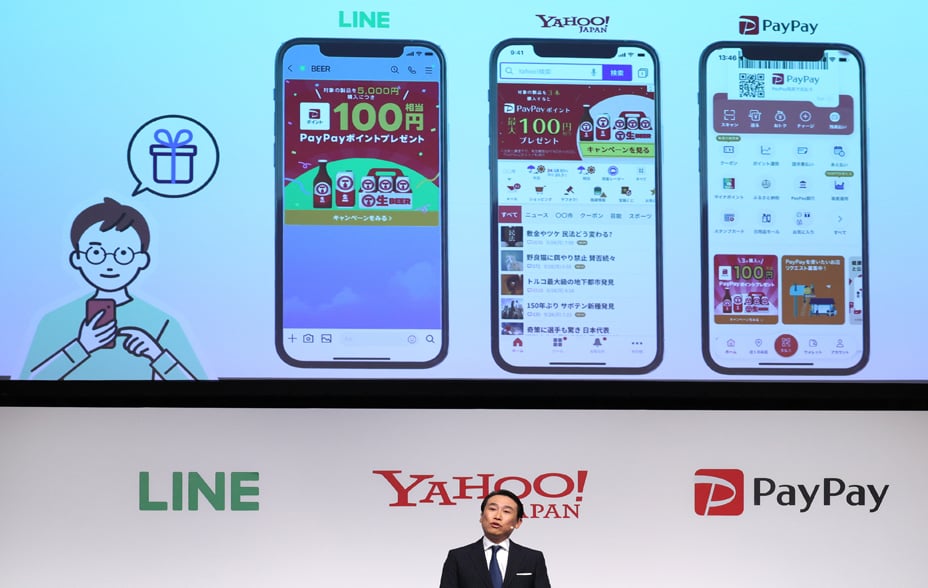

From Y to Z: Japan’s online powerhouse

How Yahoo! Japan and Z Holdings' conquest of the country’s internet realm unfolded.

Uncovering Japan’s economy

Matthew Brett explores analysis of Japan's economic resurgence and market highs in the latest webinar.

Japan Trust – Manager insight

Matthew Brett on the Trust’s 2022 performance and returns.

Japan trip reflections

Less foreign visitors, more cashless payments. Donald Farquharson reflects on post-Covid Japan

Kepler Research Report - Baillie Gifford Japan Trust

Kepler’s latest research report. Please note that this is paid for research.

Nintendo: investing in the home of Mario

Why Fusajiro Yamauchi’s business remains a fascinating opportunity for growth investing.

The Baillie Gifford Japan Trust PLC webinar

Join Matthew Brett, the Baillie Gifford Japan Trust Manager, as he outlines how the trust aims to capitalise on the country’s unique growth opportunities.

Pole position.

Tyre maker Bridgestone is poised to benefit from next-generation road vehicles.

Webinar with author and academic Ulrike Schaede.

Join Professor Ulrike Schaede and Japanese investment specialist Thomas Patchett to explore what makes Japan an economic leader within Asia, and how businesses are now responding to rising global competition and digitalisation.

Six reasons for Japan optimism.

Manager Matthew Brett offers six predictions for the Baillie Gifford Japan Trust’s fifth decade.

Four decades of lessons

Japan’s ability to anticipate technological change should see it through the ups and downs to come.

Japan Trust Webinar – Reflections on 40 years of investing in Japan.

Matthew Brett, investment manager of the Baillie Gifford Japan Trust, addresses some misconceptions about Japanese equities, the big changes in corporate governance, and shares the growth opportunity he sees within the Japanese economy.

Japan Trust Manager Insights.

Lead manager of The Baillie Gifford Japan Trust, Matthew Brett, talks about the past year, the current positioning of the portfolio and the opportunities ahead.

Investing in Japan: what’s changed and what’s next

Over four decades Japan has seen 21 prime ministers come and go. Exporters such as Toyota and Toshiba have flourished but the country has also struggled with debt and deflation. Matthew Brett, manager of The Baillie Gifford Japan Trust, discusses what’s next.

Japan stocks: investing in growth.

As the Baillie Gifford Japan Trust turns 40, robotics and cosmetics are on its manager’s mind.

The history of The Baillie Gifford Japan Trust

Launched in Japan's great economic boom, the trust thrived in the lost decades after the bubble burst.

Japan from a distance

Banned from travelling during the pandemic, Matthew Brett, manager of The Baillie Gifford Japan Trust, explains the advantage of perspective.

The beauty of Japanese cosmetics

Investment manager, Praveen Kumar explains why the Japanese cosmetics industry is in a period of rapid growth and how it could be set to continue for the long term.

Japan Trust: Manager Insights

Matthew Brett assesses the Japan Trust’s performance, highlighting new holdings and the portfolio’s growth potential.

Humanoid: Japan and the rise of the machine

Humanoids have been a long time coming, allowing Japan to build a world-class edge in robotic components.

Japan Trust: rethinking Japan

Matthew Brett explores how Japan's reforms and inflation are driving opportunities in AI, gaming and healthcare.

Tour de France: the Japanese connection

Bicycle parts maker Shimano is primed for a gear shift in performance.

The Next Chapter

Baillie Gifford trusts showcase private market focus and AI optimism at annual investment conference.

Healthy returns: Japan’s assault on old-age disease

Japanese medical firms are making advances that could help fight cancer and Alzheimer’s.

Japan Trust: Manager Insights

An update on the trust's performance, strategic shifts towards growth and AI-driven prospects.

Rakuten: rewiring Japan’s digital economy

Conglomerates can be clunky, but not so Rakuten. Matthew Brett and Colossus on how it is connecting the dots. Capital at risk.

Private investor forum: growth on sale

Why it pays to keep faith in the company fundamentals

Our best ideas in Japan

Thomas Patchett unwraps Softbank, Rakuten and Eisai, three companies driving new opportunities in Japan.

SWCC Showa: rewiring Japan

How an ultra-traditional Japanese engineering firm became key to Japan’s power overhaul.

Japan: opportunities in automation

Japan's automation revolution and its global leadership in robotics.

Japan: opportunities in healthcare

Japan’s innovation medical breakthroughs are combatting ageing.

Japan: opportunities in quality brands

Behind the success of Japan’s leading quality brands and what opportunities they present.

Japan: opportunities in entertainment

Japan's media giants: Sony and Nintendo's timeless influence.

Japanese changemakers shaping the future

The firms taking advantage of four transformational opportunities.

Japan: the next opportunity

Explore Japan's market evolution, digitalization, and investment opportunities in unique growth themes.

China through a Japanese lens

Japanese tech dominance is under increasing pressure in China from domestic challengers.

Japan Trust webinar 2024

Matthew Brett explores analysis of Japan's economic resurgence and market highs in the latest webinar.

Stock story: SoftBank

Matthew Brett discusses SoftBank and considers Japan’s exciting technological future.

Japan Trust: Manager Insights

Your annual update on performance, portfolio changes and the opportunities we’re excited about.

Spotting the stars amid a surge

Rising Japanese markets are flattering old-style companies: better to look for long-term growth.

Japanese Equities

Investment manager, Donald Farquharson, discusses the Baillie Gifford approach to Japanese Equities.

From Y to Z: Japan’s online powerhouse

How Yahoo! Japan and Z Holdings' conquest of the country’s internet realm unfolded.

Uncovering Japan’s economy

Matthew Brett explores analysis of Japan's economic resurgence and market highs in the latest webinar.

Japan Trust – Manager insight

Matthew Brett on the Trust’s 2022 performance and returns.

Japan trip reflections

Less foreign visitors, more cashless payments. Donald Farquharson reflects on post-Covid Japan

Kepler Research Report - Baillie Gifford Japan Trust

Kepler’s latest research report. Please note that this is paid for research.

Nintendo: investing in the home of Mario

Why Fusajiro Yamauchi’s business remains a fascinating opportunity for growth investing.

The Baillie Gifford Japan Trust PLC webinar

Join Matthew Brett, the Baillie Gifford Japan Trust Manager, as he outlines how the trust aims to capitalise on the country’s unique growth opportunities.

Pole position.

Tyre maker Bridgestone is poised to benefit from next-generation road vehicles.

Webinar with author and academic Ulrike Schaede.

Join Professor Ulrike Schaede and Japanese investment specialist Thomas Patchett to explore what makes Japan an economic leader within Asia, and how businesses are now responding to rising global competition and digitalisation.

Six reasons for Japan optimism.

Manager Matthew Brett offers six predictions for the Baillie Gifford Japan Trust’s fifth decade.

Four decades of lessons

Japan’s ability to anticipate technological change should see it through the ups and downs to come.

Japan Trust Webinar – Reflections on 40 years of investing in Japan.

Matthew Brett, investment manager of the Baillie Gifford Japan Trust, addresses some misconceptions about Japanese equities, the big changes in corporate governance, and shares the growth opportunity he sees within the Japanese economy.

Japan Trust Manager Insights.

Lead manager of The Baillie Gifford Japan Trust, Matthew Brett, talks about the past year, the current positioning of the portfolio and the opportunities ahead.

Investing in Japan: what’s changed and what’s next

Over four decades Japan has seen 21 prime ministers come and go. Exporters such as Toyota and Toshiba have flourished but the country has also struggled with debt and deflation. Matthew Brett, manager of The Baillie Gifford Japan Trust, discusses what’s next.

Japan stocks: investing in growth.

As the Baillie Gifford Japan Trust turns 40, robotics and cosmetics are on its manager’s mind.

The history of The Baillie Gifford Japan Trust

Launched in Japan's great economic boom, the trust thrived in the lost decades after the bubble burst.

Japan from a distance

Banned from travelling during the pandemic, Matthew Brett, manager of The Baillie Gifford Japan Trust, explains the advantage of perspective.

The beauty of Japanese cosmetics

Investment manager, Praveen Kumar explains why the Japanese cosmetics industry is in a period of rapid growth and how it could be set to continue for the long term.

AGM and voting

When you invest in an investment trust you become a shareholder and have a say on how the Company is run. You also have a right to attend the Company's annual general meeting (AGM).

How to vote

The following link will take you through to The Association of Investment Trusts' (AIC) website where there is information on how to vote your shares if you hold them via one of the major platforms.

How to attend the AGM

If you hold your shares through a platform, it is not always obvious how to attend an AGM. The following link will take you through to The Association of Investment Trusts’ (AIC) website where there is information on how your platform can help you attend this important shareholder meeting. If you do not see your provider listed, please contact your provider directly and ask them to assist.

Baillie Gifford Japan Trust corporate calendar

Our corporate calendar provides details of the regulatory events that occur over the year. This includes dates for reports, results, dividend payments and the AGM.

| Event | Month (each year) |

| Final results announced | October |

| Interim results announced | April |

| Financial year end date | 31 August |

| Annual general meeting | December |

| Dividends payable | December |

AGM

Japan Trust's annual general meeting (AGM) was held on Wednesday 11 December 2024. You can read a summary of the results of the voting on AGM resolutions here.

Voting

A breakdown of the votes cast by Baillie Gifford over the previous quarter on behalf of the investment trust is available in the Proxy voting disclosure.

Registrar

Computershare Investor Services PLC maintains the share register on behalf of the Company. Queries regarding shares registered in your own name can be directed to:

Computershare Investor Service PLC,

The Pavilions,

Bridgwater Road,

Bristol,

BS99 6ZZ

T: +44 (0)370 889 3221

Documents

You can access any literature about the Fund here.

To download any document you will need Adobe Reader. Please note that we can now provide you with Braille and audio transcriptions of our literature on request. It may take up to 10 days for the transcription to be completed dependent on the size of the document.