Key points

Rigorous review helps LTGG make sense of a company’s behaviour and decide if it is worth investing in. In an update to an article published in 2018, we explain how.

All investment strategies have the potential for profit and loss. Your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

“The key is to always fall back on what’s right. When in doubt, do the right thing. This always pays off in the end”

These noble sentiments were expressed by a renowned chief executive addressing a graduation ceremony in Boulder, Colorado. Strong ethics, he proclaimed, are conducive to long-term success. At the time his own company was riding high on a decade of colossal growth that had delivered an eight-fold rise in its share price.

Just two years later, the same business imploded and filed for bankruptcy. Investigations later revealed that management hadn’t been doing ‘the right thing’. Far from it. This was Lehman Brothers, and the CEO was Richard Fuld. The rest is history.

As investors, we can learn at least two important lessons from Fuld’s words, albeit not in the way he intended.

Lesson one:

Examining a company’s integrity, its ethical considerations and its sense of responsibility helps external shareholders understand how that company is run and how it may prosper in future.

Lesson two:

It’s easy to get ‘Lesson one’ wrong.

We know this first-hand. But while management platitudes are sometimes used to conceal impending catastrophes such as Lehman Brothers, the more common challenge facing long-term investors is to detect what is often a gradual, subtle atrophy in a company’s behaviour. For instance, we held the Brazilian oil company Petrobras on behalf of our clients from 2004 to 2011 – a period in which it grew to become one of the largest positions in the portfolio. During our holding period, the company was listed on the Dow Jones Sustainability Index, received the Global Reporting Initiative’s highest rating for transparency, and was ranked number one among the world’s oil and gas companies for sustainability. There was no catastrophe, environmental or otherwise, that led us to eventually sell the holding. Instead we grew increasingly concerned by the gradual creep of the Brazilian government into its affairs as the political backdrop changed. And matters later came to a head in a corruption scandal years after our exit.

Whether you call it corporate governance, corporate social responsibility, ESG, responsible business conduct or sustainability, the underlying concept is the same. It is simple: a company’s character matters. It matters to customers, employees, management, shareholders, stakeholders, society and the planet. But it is also qualitative. It is non-financial, imprecise, subjective and variable over time. No company is invulnerable to potential behavioural failings and no investor is immune to missing the warning signs. But the odds of making better judgements about a company’s character can be greatly enhanced, reducing – albeit never eliminating – the risk of mistakes.

We do this by doing what we do best: examining company fundamentals. We seek to ask the right questions and get to know companies deeply. We don’t apply simplistic ESG screens, rankings or elaborate quantitative models. We don’t feel they provide the full picture. They are dependent on the quality of their inputs, which can be lacking, and are inherently backward looking. Rather, our own firm’s structure, investment philosophy and processes are far more important to us.

Our decision not to outsource any of our decision-making allows us to assess every resolution on a pragmatic case-by-case basis

Our firm

Baillie Gifford is a private, unlimited liability partnership and has been since it was founded over a century ago. This rare structure underpins much of what we do today. Crucially, it means we are not beholden to external shareholders’ short-term interests. This means we can take a truly long-term view, with a minimum investment horizon of 5 to 10 years. Our average holding period is about a decade, and some companies have been held in the Long Term Global Growth portfolio since its launch. In our experience, the odds of a company achieving a successful combination of compelling growth and longevity are tied to its character. Good corporate behaviour increases the probability of exceptional payoffs. In the words of Georg Kell, founder of the United Nations Global Compact, which promotes sustainable corporate behaviour: “A company’s long-term financial success goes hand in hand with its record on social responsibility, environmental stewardship and corporate ethics.”

Baillie Gifford does not hold centralised ‘views’ on companies. Each investment team and each individual investor has the autonomy to voice opinions and share analyses, contributing to a culture of diverse thinking, healthy challenge and continuous dialogue. We accept that you never have the full picture, as companies are forever changing in terms of size, people, opportunity sets and regulatory environments. But through our research and a learning process built upon interaction and iteration, we remain vigilant to shifts in a company’s behaviour that may enhance or undermine our investment thesis.

Moreover, as owners of shares on behalf of our clients, we have certain responsibilities and rights. We must be good stewards of our clients’ capital. To achieve this our investment managers continually engage with companies’ leaders. And they do not simply accept ‘best practice’ principles, but recognise that the right governance structures for a company depend heavily on its age, stage of development and operating environment.

We also recognise that shareholder proposals are a common way by which environmental, social and governance issues are brought to bear on a company. Thus proxy voting is an important mechanism by which to exert influence. Examples include proposals to increase disclosures on sustainability reporting, diversity, and wider employee rights. Every proposal is scrutinised by a member of our dedicated ESG team. Our decision not to outsource any of our decision-making allows us to assess every resolution on a pragmatic case-by-case basis, in conjunction with our investment teams.

Going a step beyond proxy voting, our low portfolio turnover and our patient ownership provide opportunities to exert further influence on companies by engaging in discussions with their management.

Our LTGG philosophy and process

The investment philosophy of Long Term Global Growth revolves around optimism, long-termism, a global outlook and an obsession with growth. Our ambition is to find companies that will quintuple in value over a five to 10-year period. We consider business fundamentals such as a company’s market opportunity, returns, capital deployment and sustainability of competitive advantage. Important too are the intangible notions of culture, adaptability, and social and environmental factors affecting long-term growth. In other words, an analysis of corporate character is intrinsically built into our investment process. This is because in our search for the best growth companies in the world, we recognise that corporate character matters just as much as operational performance.

Our lens for analysing companies in this manner is our 10 Question Stock Research Framework. This is designed to be a robust and repeatable test. We use it before we invest, and then again over time. But it is not inflexible. For instance, we recognise that many companies in the portfolio have grown to such a scale and are driving technological change to such an extent that they have important societal consequences. So in 2016, we expanded Question 5 from simply “Why do your customers like you?” to also ask “Do you contribute to society?”. In 2021, we extended the question further to ask: “What societal considerations are most likely to prove material to the long-term growth of the company?”

Our research typically considers factors such as the nature of the product or service, tax, environmental impact and labour relations. Question 5, for instance, featured prominently in our analysis of the Chinese electric car manufacturer NIO. Its stated mission is to relieve China of its notorious air pollution. The company’s Chinese name Weilai literally means ‘blue sky coming’. Question 5 is also relevant for Beyond Meat, whose plant-based meat substitute products use 93 per cent less land and emit 90 per cent fewer greenhouse gases than traditional animal proteins. And it also helped us consider Dexcom, whose continuous glucose-monitoring devices improve the quality of life of diabetes patients.

Our holding in luxury brand conglomerate Kering provides an example of how a company’s response to this question can change positively over time. It has adopted a trailblazing approach to environmental sustainability, which is now a central pillar of its culture. Kering has published an environmental profit-and-loss account since 2015, and seeks to positively influence every step of its supply chain from raw material production and processing to manufacturing. In 2017, its largest brand, Gucci, implemented a fur-free policy throughout its range. And in 2019, Kering began engaging directly with investors through an ESG roadshow. Following our feedback, the firm altered its long-term incentive plan towards more ambitious targets while also including gender diversity and biodiversity metrics.

While Question 5 is the one most obviously related to a company’s sense of wider responsibility, considerations of a company’s character are also embedded into other questions. For example, Question 2: “What happens over 10 years and beyond?”

This was particularly relevant during Roche’s attempted takeover of Illumina in 2012. Though the offer was at a significant premium to the prevailing share price, we opposed the bid. We felt Roche’s valuation of Illumina did not reflect the immense potential for Illumina’s gene-sequencing technology to transform the healthcare industry and improve the lives of hundreds of millions of people. Fast forward to early 2020, and Illumina’s technology was instrumental in sequencing the genome of SARS-CoV-2, allowing biotech companies to develop innovative mRNA vaccines for Covid-19. The sequence took less than 48 hours to complete and another 48 hours were all it took to design the vaccine itself. We fought for Illumina’s independence to ensure it had the chance to reach its transformative potential. With its market capitalisation nearing 10 times what it was in 2012, we believe that Illumina remains at the start of its journey. Question 2 therefore helps us to look beyond the market’s short-term focus. In the case of Tesla, that means going beyond its electric vehicles and considering the vast potential for its energy generation and storage business, and what implications that might have on energy efficiency and the environment.

In 2021, we extended the question further to ask: “What societal considerations are most likely to prove material to the long-term growth of the company?”

Question 4 asks: “Is your business culture clearly differentiated? Is it adaptable?” For example, we think there is a lot to admire about Alibaba’s culture. It has a desire to move leadership down the generations, and says it has never supported the notion of a single leader. The firm employs a similar partnership structure to our own, and it recently took more than a year to decide on its six new core values. One of these is teamwork, as recently demonstrated when it sought to engage and educate regulators on the capabilities and implications of some of its developing business areas.

The Australian collaborative software company Atlassian has shown adaptability as it ended sale and support of its significant in-house data centre products, in order to migrate its business to the cloud. The move to a cloud-only option will dampen revenues in the short term, and it may even cause some adverse customer reaction, but it is the right long-term decision for the business.

Advertising tech firm The Trade Desk has also shown itself to be adaptable by launching a new web-tracking solution called Unified ID 2.0. This was a response to data-privacy challenges against the use of traditional third-party cookie trackers. The innovation not only enhances data privacy and control for users but also supports targeted advertising for the benefit of the entire digital advertising industry.

Netflix is an example of a company whose corporate governance policies are not considered ‘best practice’. However, our research and engagement with senior management and non-executive directors indicate that the TV streaming firm’s governance structure is both pragmatic and supportive of its long-term strategy. Its culture deck, created in 2009, is still revered as the model for corporate culture. But recent discussions suggest Netflix continues to look forward rather than stand still.

In contrast, a meeting with Trip.com in 2020 raised concerns over a lack of thought about the environmental issues of air travel over the next decade. An underwhelming answer on culture – suggesting the company had addressed the issue by matching its salaries to those of its rival Expedia – struck a further downbeat note. It didn’t help that we had just been impressed by Meituan, an innovative competitor, in meetings shortly beforehand. We sold our holding in Trip.com shortly afterwards.

We also sold Baidu in 2019 after a decade-long holding period because we noticed cultural atrophy over time. Baidu seemed less adaptable to competition from innovators like Bytedance, creator of the hugely popular video-sharing app TikTok, and super-apps like Tencent’s WeChat. We felt that Baidu’s management was becoming increasingly autocratic and our long holding period helped us notice subtle cultural deterioration.

Question 8, “How do you deploy capital?”, can also reveal much about a company’s character. For instance, in early 2021 Peloton announced that it would invest more than $100m in air and ocean freight deliveries after admitting that its product wait times did not meet its standards. Shortly afterwards, it announced plans to spend an additional $400m on a US manufacturing facility. This was a positive development as it highlighted the firm’s recent success and demonstrated a willingness to sacrifice near-term profit margins and share price to provide a better long-term experience to customers. Similarly, in early 2021 we supported Meituan’s deep investments in grocery shopping infrastructure and autonomous delivery. CEO Wang Xing told us before its IPO in 2018 that he was striving to create a business that would last a century. Meituan aims to deliver one hundred million orders per day by 2025. At present, it delivers close to 40 million. Investments like this will be key to achieving its long-term goals.

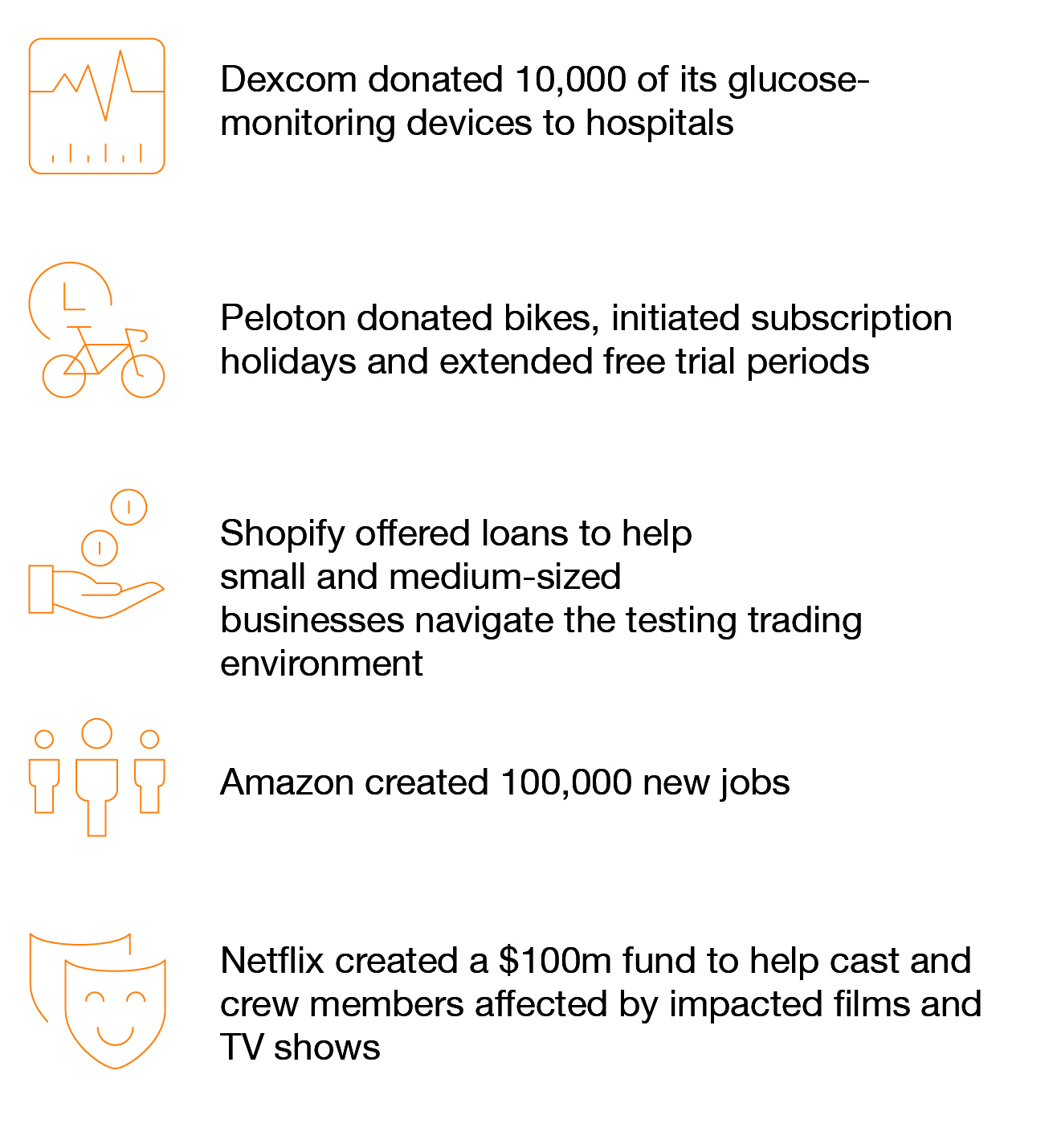

Gathering responses to our 10 Questions over time helps us to understand the fundamentals of a company’s behaviour. This built-up knowledge can be especially helpful during times when a company faces stress. For instance, we learned a lot about whether companies would ‘do the right thing’ during the Covid pandemic. We wrote to the management teams of each of our portfolio companies telling them that we supported any steps they took to help employees and society in the short term. Many companies did just that and more.

Covid responses:

A healthy dose of humility

We believe our approach provides us with valuable advantages in understanding companies’ attitudes and behaviours. This helps us distinguish empty rhetoric from sincere intent. But there’s one last aspect of our approach worth stating: being honest about the difficulties we face. While we have never had so much insight into aspects of company character, we face ever-increasing complexity at significant scale. There will always be unknowns and grey areas. We will inevitably make some investment mistakes. This may be because companies fail to execute as we would expect, or because there are negative behavioural shifts in their governance and stewardship. Often it is a blend of both. We accept that. That is being honest about our appetite for risk and reward. But going the extra mile to understand a company’s character as part of our fundamental analysis helps us to be broadly right in our assessment of corporate behaviour most of the time. And doing so can deliver enormous returns for clients and society alike.

Risk factors

The views expressed in this article are those of the LTGG Team and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in October 2021 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock examples

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This article contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated. The images used in this article are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs. Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/ Institutional clients only.

Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited (‘BGO’) neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 12220 10004043