Key points

- Markets are still volatile, but performance has steadied in comparison with last year’s figures

- As long-term stockholders, the focus is on finding companies and holding them for at least five years

- Innovation continues, regardless of macroeconomic factors. We ensure we pay attention to those companies that might be at the forefront of change

© ASML

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk.

At the turn of the century, in the town of Veldhoven in the Netherlands, a small team of researchers was quietly solving the impossible.

Like everyone everywhere, they were inundated with news headlines about the implosion of the Dotcom bubble. The collapse of stock market indices. The Fed’s tightening of interest rates. The looming economic recession. And, of course, the war on terror. Despite the tumult and tribulations of the period, nothing could dent the researchers’ resolve. Even some years later, when the world was mired in the bleakness of the Global Financial Crisis and Great Recession, the researchers forged ahead to ship their first product.

What they produced had previously belonged to the realm of science fiction. A laser hit droplets of tin 50,000 times per second, twice, to create a plasma 40 times hotter than the surface of the sun. That plasma emitted extreme ultraviolet (EUV) light, which was then reflected in a vacuum using a series of high-precision mirrors, flatter than any surface known to humankind, to etch the finest of patterns into silicon microchips. This entire process was housed inside a machine the size of a bus that, crucially, could be massproduced. Hence, after investing billions in research and development over 17 years, ASML’s EUV lithography system was born. It would enable billions more transistors to be packed onto chips, unlocking a new era of computing power. It would also help to catapult ASML’s valuation from around $10bn in 2000 to around $250bn at the time of writing.

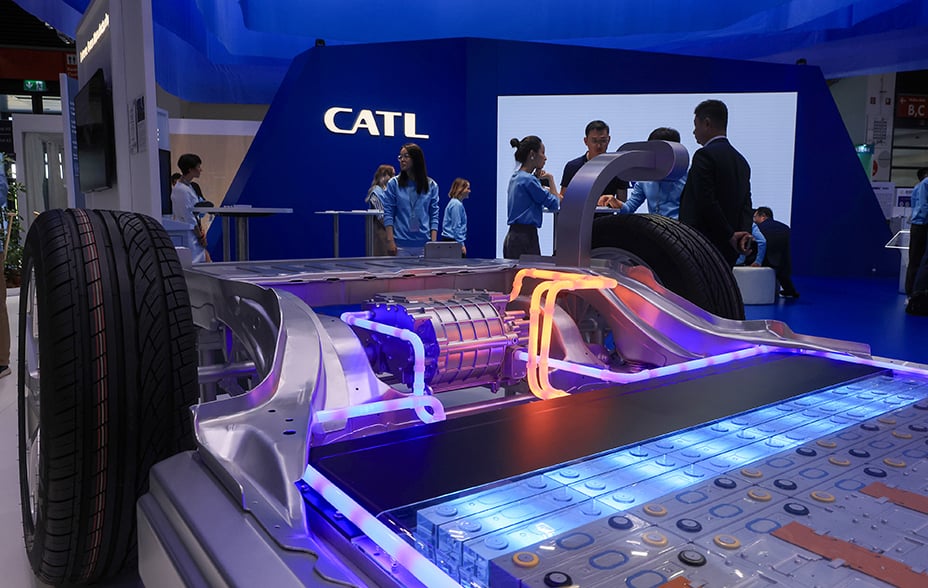

Meanwhile, over 5,000 miles away, a young Chinese engineer called Robin Zeng founded a company in Hong Kong in 1999. It would build batteries for laptops, music players and mobile phones. However, the unassuming entrepreneur had grander ambitions. Within a few years, he launched a research department to develop and mass-produce a type of battery that could do something entirely different: power an electric vehicle. For context, back then, Tesla was still years away from producing its first car. Moreover, macroeconomic conditions quickly soured: world trade collapsed in the wake of the Great Recession, sparking a whopping 40 per cent drag on China’s GDP growth in 2009. But still, the research and development continued.

In 2011, Zeng spun out the EV battery division into a new company called CATL, headquartered in the former fishing village of Ningde in Fujian province. A modest 1,000 EVs were sold that same year in China. Over the next couple of years, China’s economy was beset by a slowing property market, chronic manufacturing overcapacity, and a headline-grabbing slowdown in GDP growth. However, by the time of CATL’s public listing in 2018, Chinese customers bought one million EVs – more than the rest of the world combined. Forty per cent of those EVs’ batteries were supplied by CATL. With the EV revolution now in full swing, the company’s market capitalisation has surged from circa $20bn in 2018 to $125bn at the time of writing.

Common to the stories of both ASML and CATL is that despite macroeconomic shocks and market hysteria, both companies were pioneering wondrous transformations that would prove to be unstoppable, world-changing, and herald phenomenal multi-decade growth. These transformations – EUV lithography and the replacement of internal combustion engines by EVs – are, moreover, still early in their trajectories.

There are countless other examples. While the world was reeling from the Dotcom crash, Amazon launched Amazon Web Services, which would portend the era of the public cloud (and would go on to generate the vast majority of Amazon’s operating profit). Amid the Global Financial Crisis in 2008, Tesla released its Roadster EV sportscar, paving the way for its meteoric rise as the world’s EV leader. Looking further back in time, long before the launch of the Long Term Global Growth strategy, some of last century’s great growth companies arose during periods of extreme adversity. Hewlett Packard and Revlon were started during the Great Depression in the 1930s, for example, and FedEx and Microsoft during the oil crisis and recession of the 1970s. The list goes on.

It would, of course, be naïve to infer from all this that the macro context doesn’t matter to long-term growth investors. Since the inception of the Long Term Global Growth strategy in 2004, we have seen several instances where macro events undermine our investment thesis for a company. For example, shifts in Brazilian politics and economics gradually undermined our investment case for Petrobras, held in the portfolio from 2004 until 2011. China’s regulatory crackdown on the private education sector so severely affected TAL Education’s opportunity for profit growth that we sold the holding in 2021.

However, even in the darkest of times, someone somewhere is innovating, designing, building, and growing. As long-term stock-pickers, our role is to find those companies and hold them. If we are correct in our belief that these businesses are spearheading deep secular transformations (or at least disproportionately benefitting from them), the payoffs could be extreme and last for decades. Much of the inevitable tightening and loosening of interest rates, the ups and downs of industry cycles, and the warming and cooling of geopolitical relations will, over time, pale in their significance versus long-term transformations of leviathan scale and momentum.

LTGG transformations

It should, therefore, come as no surprise that the destinies of the innovative growth companies in the LTGG portfolio are closely intertwined with major structural shifts that they are pioneering and/or capitalising upon. Hence, the LTGG team devotes vastly more attention to analysing the direction and maturity of such secular phenomena than it does to the shorter-term ebbs and flows in macroeconomics and politics.

We have been using an Euler diagram since 2011 to help us appreciate the portfolio’s exposures to these transformations. As a reminder, the diagram groups stocks according to one or more transformations, which are represented in circles. The sizes of the circles are based on the aggregate stock holding weights in the portfolio. For us, the Euler presents a more meaningful understanding of LTGG portfolio diversification than the externally imposed and highly static sector and geography classifications. However, the themes in our Euler diagram circles historically fell short of expressing any directional specificity about such transformations. Today’s Euler diagram is, therefore, based on the following set of 14 falsifiable statements concerning the directions of major transformations (listed in no particular order):

- Demand for powerful chips will grow and translate into revenue

- Computing will shift to the cloud

- Businesses will allocate budget to software

- Renewable technologies will gain share in the transportation and energy markets

- Online retail will win share

- Fintechs will disrupt traditional financial service providers

- Penetration of financial services will increase in emerging markets

- Consumption of luxury goods will grow

- Streaming, on-demand entertainment will gain share

- Gaming will gain share of leisure budgets

- Traditional brand advertising will digitise

- Disruptive technologies will transform healthcare outcomes

- Local champions will emerge in Chinese biopharma

- Applications for synthetic biology will grow

The resulting Euler diagram is provided at the end of this commentary.

The purpose of the diagram is two-fold: (i) to examine the portfolio’s exposures to different drivers of secular growth for the decades ahead and, by the same token, (ii) to consider the portfolio’s vulnerability to potential loss if one or more of our contentions prove to be very wrong. For example, what if shopping habits change such that traditional brick-and-mortar retail experiences a resurgence while ecommerce goes into reverse? In such a scenario, nine holdings and a hefty 26 per cent of the portfolio by weight at the time of writing would be negatively affected. For context, that one secular exposure is alone much greater than the combined weight of the portfolio’s Chinese holdings (circa 16 per cent), but the market seems far more concerned about the latter.

There is also an implicit third purpose of our mapping exercise. The list of contentions does not pretend to be exhaustive, and they can each be rewritten in any number of ways. This means it will always be a source of discussion and debate with our team. We believe such ongoing debate is one of the most important portfolio management tools we have at our disposal. It reinforces why Baillie Gifford adheres to a team-based culture rather than one of star managers.

For the avoidance of any doubt, getting any of these long-term contentions ‘right’ does not necessarily mean that the companies exposed to such contentions will thrive over time. When we took a holding in eBay in 2005, for instance, it appeared poised to dominate the ecommerce market. It became a top 10 position in the portfolio, and its market capitalisation was several times greater than that of Amazon. But over time, Amazon’s innovative business model and Jeff Bezos’ founder-led vision demonstrated what online retail was truly capable of. As for eBay, following a spate of management churn and slowing innovation, we sold it from the portfolio in 2014. Its market capitalisation of just over $20bn today has fallen back to where it was some 20 years ago. Amazon’s has meanwhile soared to $1.3tn. As ever, individual company fundamentals are what matter most in the long run.

Our role as stock pickers is, therefore, our top priority. But where an exceptional company is aligned with one or more structural tailwinds, the returns for long-term shareholders can be nothing short of stunning. These growth opportunities are not to be missed for a portfolio like LTGG.

Let’s turn to a few examples.

Penetration of financial services will increase in emerging markets

Mortgage penetration as a portion of GDP in the Netherlands is 91 per cent, in the UK 69 per cent, in the US 52 per cent, in China 18 per cent, but in India a paltry 11 per cent. However, rising income levels and a growing middle class in India have been fuelling a structural shift to greater home ownership and, thus, mortgage growth. This transformation hasn’t gone unnoticed by HDFC, which has emerged as the country’s largest mortgage lender thanks in part to its prudent management and excellent customer service. Since our initial purchase in 2010, Indian mortgage penetration has risen significantly, and HDFC’s share price has grown over nine-fold.

During the summer, HDFC completed its merger with HDFC Bank. In a meeting with CEO Sashi Jagdishan at our Edinburgh offices, we learned more about his vision for how thousands of HDFC Bank’s branch staff will soon be trained to sell mortgages, helped largely by the company’s investments in digital infrastructure. While a merger at such a scale is not without risk, it could translate into a significant revenue uplift in the years ahead. We intend to spend some time in India later this year to explore this opportunity further.

In addition to the increasing financial penetration in emerging economies (which other holdings such as Sea and MercadoLibre are also benefiting from in Southeast Asia and Latin America), we believe that digital finance will increasingly disrupt traditional finance providers almost everywhere.

Fintechs will disrupt traditional financial service providers

There is no company that is as aligned with this transformation as the Dutch company Adyen.

Adyen provides its business customers with software for accepting and managing payments. This means a merchant can use Adyen to accept anything from Amex to Alipay, regardless of geography and irrespective of whether that payment is made via a mobile app, a desktop computer, or a physical store. As the merchant’s business scales, Adyen takes care of navigating the complex plumbing of the international payments system. Since taking an initial holding in 2020, the company has consistently been the source of some of the fastest growth in the LTGG portfolio. It processed over $800bn of payments volume in 2022, nearly 50 per cent greater than the year prior. From here, the growth. opportunity remains vast: the global consumer-to-business payment market is worth over $23tn annually, while an additional $12tn of cash and cheque transactions could also be up for grabs.

Growth is rarely ever in a straight line, however. In August, Adyen’s share price experienced a sudden and vertiginous 50 per cent decline, leaving the price barely above where we had initiated our holding in 2020. It appears the market was rattled by two main concerns following the company’s earnings release: (i) rising operational expenditure (namely headcount) and (ii) slower revenue growth in Adyen’s digital customer base in the US. This is a visceral lesson in what can happen when a company priced for perfection disappoints, even if only slightly. The first concern does not alter our investment thesis, nor should it have surprised the market – Adyen has hired exactly as they said they would this year. We believe this countercyclical hiring also strengthens the company’s competitive advantage. The second issue did, however, give us pause for thought. It corroborated our bear case that Adyen might have a harder time growing in the US digital market compared to elsewhere. Nevertheless, even if Adyen’s success in the US digital segment is far from a foregone conclusion, we don’t believe there is reason to extrapolate difficulties from that segment into Adyen’s other markets. We reached this view following a recent meeting with co-CEO Ingo Uytdehaage and after undertaking additional research. Even in a conservative scenario where Adyen fails to take substantial US market share, we believe there is attractive upside in the stock. We added to this holding this quarter, funded by a trim to Illumina1.

Online retail will win share

Over the past decade, ecommerce as a share of total US retail has nearly tripled, reaching over 15 per cent by June 2023. By the end of the year, it is estimated that US ecommerce will account for around $1tn in sales. Amazon, with a 38 per cent share of US ecommerce, and Shopify, with a 28 per cent share of the US ecommerce software market, have spearheaded and benefitted from the expansion of online retail.

In our view, this growth is far from over.

US ecommerce penetration is still early in its trajectory. For comparison, ecommerce in China has a market share of around 27 per cent of total retail, represents an estimated $2tn in sales, and is still expanding by around 9 per cent per annum. Holdings such as Pinduoduo, Meituan, Alibaba and Tencent continue to create and benefit from this growing market. Similar can be said for Coupang, which enjoys a comparable degree of online retail penetration in South Korea. Meanwhile, for MercadoLibre in Latin America and Sea’s online shopping platform Shopee in both Southeast Asia and Brazil, both companies operate in markets where ecommerce penetration is low and fast-growing.

Despite the strong structural tailwind of ecommerce penetration, our recent review of Amazon questioned why the company’s market share isn’t even higher. Beyond the regulatory scrutiny which has long been on our minds, it also seems that after a certain point, category expansion can become harder: apparel and grocery are tough long-term bets. Nevertheless, the company has an arsenal of tools to fuel growth, such as Prime membership, the roll-out of one-day delivery (even five-hour delivery in some large cities), and deeper expansion into other geographies.

1The opportunity set for genomics remains very large and we are particularly encouraged by the potential in clinical applications. However, Illumina’s core business in genome sequencing is facing unprecedented competitive intensity. Meanwhile, there has been more executive turnover and less clarity in strategic direction in recent times. Our decision to use Illumina as a source of funds for the addition to Adyen reflects our confidence in the former’s potential upside.

Beyond retail, Amazon has two other business segments which are growing rapidly: cloud (where Amazon is well-positioned to be a major beneficiary of demand for artificial intelligence) and advertising (most US online shoppers start their search on Amazon, not a search engine, making the platform increasingly attractive real estate for advertisers). Moreover, both these businesses are at the vanguard of other structural changes shown in our Euler that are early in their trajectories: i.e. computing will shift to the cloud, and traditional brand advertising will digitise. This provides the company with multiple options to benefit from future secular growth.

We have also recently reviewed our investment case for Sea. For a company that began as a gaming company, it is perhaps better known for its online shopping platform, Shopee. Following a period of massive geographic expansion, the worsening macroeconomic environment in recent times spurred the company to reverse course and exit several markets in Latin America, Europe, and India in a bid to reduce costs. The share price is meanwhile standing at only around 10 per cent of its November 2021 peak. Is this a case where macro factors are overwhelming our investment thesis for the company, regardless of the strength of the shift to online retail? We don’t think so. Shopee’s profitability has demonstrated its resilience. The commission that Shopee takes on every transaction is increasing and has miles to go before reaching anything like that of Amazon.

Beyond Shopee, Sea also has growth opportunities in its gaming and fintech businesses, tapping into structural transformations in our Euler, such as gaming, will gain a share of leisure budgets, and penetration of financial services will increase in emerging markets. There is still a wide set of potential outcomes for our investment thesis, and this is reflected in our small holding size. But we think the payoffs from here could be extreme. We, therefore, made a small addition to the holding during the past quarter, funded by a reduction to NVIDIA, which had been pushing up against the maximum 10 per cent holding size limit.

Future-proofing

During the past couple of years, financial markets have been gripped by concerns about rising inflation and tightening interest rates, Russia’s invasion of Ukraine, and mounting US-China tensions. Unsurprisingly, growth equities rapidly fell out of favour as investors attempted to find ‘safer’ assets. Between October 2021 and September 2022, the LTGG portfolio performance suffered its deepest drawdown since the Global Financial Crisis of 2008. While performance has rallied to some extent in 2023, market sentiment is still fragile and volatile for the time being. Nevertheless, the LTGG team continues to do what it was built to do: identify and hold exceptional growth stocks at the forefront of multi-decade transformational changes. The LTGG portfolio reflects what the world could look like a decade from now and beyond, thereby adding an element of ‘future-proofing’ for clients’ total portfolios. As ever, competition for capital in the LTGG portfolio remains intense. For example, the team is currently exploring a diverse set of new stock ideas in machine vision, robotics, luxury brands, biotechnology, cybersecurity, and Latin American fintech, to cite just a few.

With the future front of mind, and before closing this commentary, we invite you to join us in a little thought experiment. Imagine it is the year 2033.

You have just opened our Q3 2033 commentary. It begins by looking back at some of the names that were in the LTGG portfolio a decade earlier…

Back in 2023, in a building overlooking South Boston’s harbour, a team of coders were more concerned with the letters A, C, G and T (genetic base pairs) than the 1s and 0s of computer code. Around them, robots inserted droplets into well plates and analysed results before rinsing the plates clean and repeating again and again. While the EUV lithography pioneered by ASML at that time may well have been the closest thing to magic from human genius, the Boston coders were working on another seemingly impossible conundrum: how to code life. This was the mission of Ginkgo Bioworks, purchased for the LTGG portfolio in 2022. From humble beginnings in rewiring microorganisms to enhance crop protection and vaccine production, Ginkgo was early to see the potential for biology to transform all industries.

Meanwhile, in Mainz, Germany, a team of scientists was exploring how to genetically modify a patient’s own immune cells to seek out a solid cancer tumour while simultaneously using an mRNA vaccine to amplify the cells’ immune response. Though the stock market in 2023 still treated BioNTech as a Covid-19 one-hit-wonder, its mission to cure cancer – and the reason we invested 12 years ago in early 2021 – was just getting started.

Over 4,000 miles away at Dayton International Airport, near the former home of the Wright brothers, an empty 140-acre site was soon to be converted into a facility for manufacturing up to 500 electric vertical take-off and landing aircraft annually (think ‘flying taxis’). Just as Tesla had revolutionised the roads, this was the beginning of Joby Aviation’s revolution of the skies.

These were just a few examples of the growth stories underway in the portfolio a decade ago in 2023 – all of which have since become common household names. It is little wonder that the LTGG team remained so enthused about the transformational changes the coming decade would bring…

Important information and risk factors

Performance

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| LTGG Composite |

-6.4 | 102.9 | 25.9 | 48.8 | 19.9 |

| MSCI ACWI | 2.0 | 11.0 | 28.0 | -20.3 | 21.4 |

|

1 years |

5 years |

10 years |

Since inception* |

|

| LTGG Composite |

19.9 |

8.0 |

12.9 |

11.0 |

| MSCI ACWI |

21.4 |

7.0 |

8.1 |

7.5 |

*Inception date 29 February 2004. Source: Baillie Gifford & Co and MSCI. US Dollars.

Past performance is not a guide to future results. Changes in the investment strategies, contributions or withdrawals may materially alter the performance and results of the portfolio.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in October 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential

for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide

to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Financial intermediaries

This communication is suitable for use of

financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas

Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial

Conduct Authority.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act. This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC.

It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America. The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law,5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 licence from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong, Telephone +852 3756 5700.

MSCI Legal Disclaimer

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Ref: 74919 10037552