As with all investments, your capital is at risk.

For decades, robotics has delivered brawn without brains - machines capable of extraordinary precision, yet without comprehending what they were doing or why. Mechanical marvels, yes, but still prisoners of their programming. Now, we stand at an inflexion point.

The breakthrough is not in muscle or metal, but in the mind, in robots’ ability to think for themselves. The deep-learning revolution that transformed self-driving cars has given robots the capacity to perceive, reason and decide. Large Language Models (LLMs), such as those behind ChatGPT, have endowed machines with contextual understanding – the cognitive layer that complements their mechanical prowess.

Their successors, “vision-language-action models” (VLAMs), go further, fusing vision, speech and sensor data into a unified intelligence loop. For the first time, robots can interpret their surroundings, take natural-language instructions, and adjust their movements with purpose.

This marks a profound turning point, the moment when artificial intelligence steps into the physical world, transforming force without thought into intelligence in motion.

Why Japan

From an investment perspective, few nations are better positioned to seize this opportunity than Japan. The country already has a commanding lead – supplying almost half of all industrial robots worldwide – and an installed base at home exceeding 400 robots per 10,000 manufacturing workers, twice the global average.

That figure is set to rise as Japan faces an expected shortfall of 11 million workers by 2040, driven by demographic decline.

Therefore, the emergence of capable humanoids comes at a propitious moment for a nation that has spent decades building an industrial ecosystem where robots feel less like a leap of faith and more like a logical progression.

AI generated

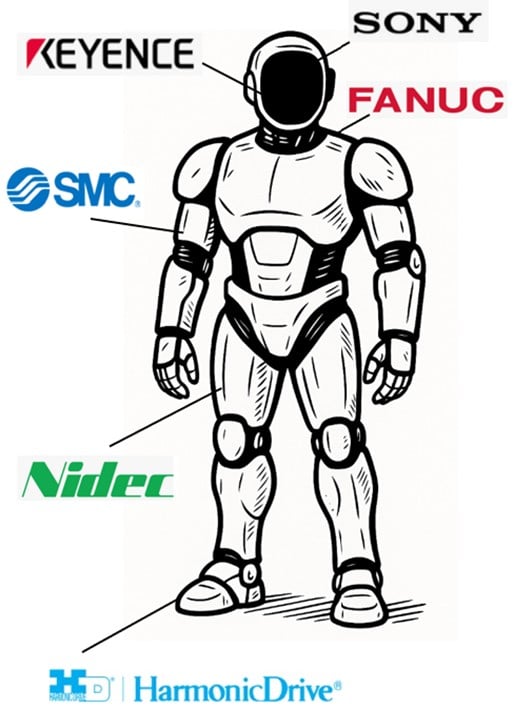

The humanoid ecosystem

As with many global technology themes, Japan provides the critical components – the vital organs and nervous system – of the humanoid era:

- Harmonic Drive Systems acts as the joints, enabling the finesse and precision of every movement;

- SMC supplies the muscles, delivering strong yet controlled motion;

- Nidec drives the limbs and maintains balance;

- Fanuc serves as the spinal cord, coordinating every reflex with industrial-grade accuracy;

- Keyence forms the eyes through its advanced vision and laser sensors; and

- Sony, with its world-leading image-sensing chips, allows robots to truly see and interpret their surroundings.

Together, these firms make Japan the beating heart of global robotics – providing the body through which artificial intelligence will move. This position is no accident, but the culmination of decades of expertise in precision engineering and mechatronic mastery.

The structural shift from factories to everyday life

While still in its infancy, the trajectory of this opportunity is unmistakable. The coming decade is likely to mirror the early evolution of electric vehicles – a period of steady iteration before an exponential rise. It is a path that Baillie Gifford knows well. We first backed Tesla in 2013, when it was a $4bn company, driven by the same conviction that long-term structural change often appears improbable before it becomes inevitable.

As artificial intelligence fuses perception with precision hardware, robots will move beyond controlled factory settings into everyday life, addressing structural challenges from labour shortages and elder care to logistics and manufacturing bottlenecks.

This is not a speculative vision but a structural inevitability propelled by demographic necessity, geopolitical fragmentation and rapid technological convergence.

A growing body of evidence

At Baillie Gifford, we have always believed that the most transformative opportunities emerge at the intersection of technological progress and long-term vision. Today, as artificial intelligence fuses with Japan’s world-leading robotics ecosystem, we see a similar inflexion point. Japan’s ecosystem of component specialists, automation leaders and long-term capital investors places it squarely at the centre of this unfolding industry.

Automation has long been a secular and central theme within our portfolios, with companies such as Fanuc held as early as the 1980s, when perception was shaped more by dystopian fiction (popularised by films such as The Terminator, 1984) than industrial foresight.

For us, innovation has always been less about fearing disruption and more about embracing the promise of progress. Today, automation is entering a new chapter. The recent SoftBank acquisition of ABB’s robotic division underscores that momentum – a strategic commitment not to a single company, but to the dawn of a new industrial epoch of physical AI, one in which intelligence finally meets motion.

The rise of humanoid robots is not just a technological leap but a structural response to demographic and economic realities, with the potential to reshape industries and societies. The age of intelligent machines is here, and at Baillie Gifford, we have long been backing the innovators that will define it.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in October 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.