All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk.

Charities with a long-term approach to investment can benefit from long-term transformations, of which we at Baillie Gifford see many today.

Over the last decade, growth has experienced unprecedented favourable conditions. There’s been globalisation, low interest rates and lots of ‘change’: technological advances, new business models and shifts in consumer demand.

Some factors have recently become more challenging, but change remains a powerful growth driver. We’re optimistic that over the long term, we'll continue to see change reflected in substantial share price growth for the few companies most successful at harnessing it.

As the economist Joseph Schumpeter described it, businesses and societies are in a constant state of innovation and transformation. He suggested that a process of ‘creative destruction’ is a natural and essential element of capitalism as it lets more efficient technologies and business models replace older ones.

Entrepreneurs drive the activity by introducing novel products, services and technologies that disrupt existing markets and industries. Through creative destruction, new industries and markets emerge, and the economy and stock market are constantly evolving.

Schumpeter said this creative destruction helps to keep businesses and markets competitive and allows for innovation and growth.

| 1980 | 2000 | 2020 |

| IBM | General Electric | Apple |

| AT&T | Microsoft | Saudi Aramco |

| ExxonMobil | ExxonMobil | Microsoft |

| Amoco | Walmart | Amazon |

| Schlumberger | Citigroup | |

| Shell Oil | Pfizer | |

| Mobil | Intel | Tencent |

| Chevron | BP | Alibaba |

| Atlantic Richfield | Johnson & Johnson | Tesla |

| General Electric | Royal Dutch Shell | Berkshire Hathaway |

Source: Forbes, Fortune500, Ycharts, company's annual report. 10 of the largest companies by market cap.

Humans, a species of innovation

Modern humans, or homo sapiens, evolved around 300,000 years ago in Africa and have since expanded onto nearly every type of climate and terrain on Earth. We're now comfortably the planet's apex species; these days, we're even dashing about in space. Impressive progress for a once unremarkable primate.

Thanks to our evolutionary journey, humans possess a unique physicality and intelligence. Our abilities to accurately evaluate our environment, conceive sophisticated ideas and create tools have led us to become a species of unparalleled problem solvers.

Another key aspect of our success is our curiosity, which has driven us to explore and invest in the future. Embracing our curiosity allows us to address all sorts of challenges and seek new solutions.

Our sociability helps, too. By working within societies and sharing knowledge, we've tackled problems and expanded our skills collectively, scaling up our individual achievements.

Catalysts for growth: Population growth, education standards and improved connectivity

Innovation has always been integral to our human nature. However, it is striking how much progress there has been recently, catalysed by population growth, improving education standards and connectivity.

In her book Transcendence, the science writer Gaia Vince cites evidence that human progress rapidly increases when our populations become larger, better educated, and better connected. This has to do with the frequency and dissemination of good ideas.

Historically, our global population was slow to increase. It took until 1804 to reach one billion. However, advances in medicine and agriculture have since helped spur rapid growth. By 1927, it was two billion, and today it’s around eight billion, showing a steep upward trend. The United Nations expects it to peak at about 11 billion people later this century.

Similarly, there has been rapid growth in global education standards. Through increased access to education, literacy rates have dramatically risen, from as low as 12 per cent in the 19th century to 86 per cent globally today. Global education in science, technology, engineering and maths has seen dramatic improvements, too. The increase in research articles from around 1,000 annual publications in the early 18th century to over 2.5 million yearly indicates a significant increase in knowledge production and dissemination.

Likewise, geography once limited human connectedness, but with technological advances in transportation and communication, global interconnectedness has risen dramatically. In the 20th century, the invention of the internet created an information revolution, allowing instant global communication. Today, there are five billion internet users worldwide, supporting our ever-increasing global connectedness.

Combining human physical and mental talents, with recent explosions in our population size, education and connectedness, it makes sense that our economic growth has exploded too.

Industrial revolutions

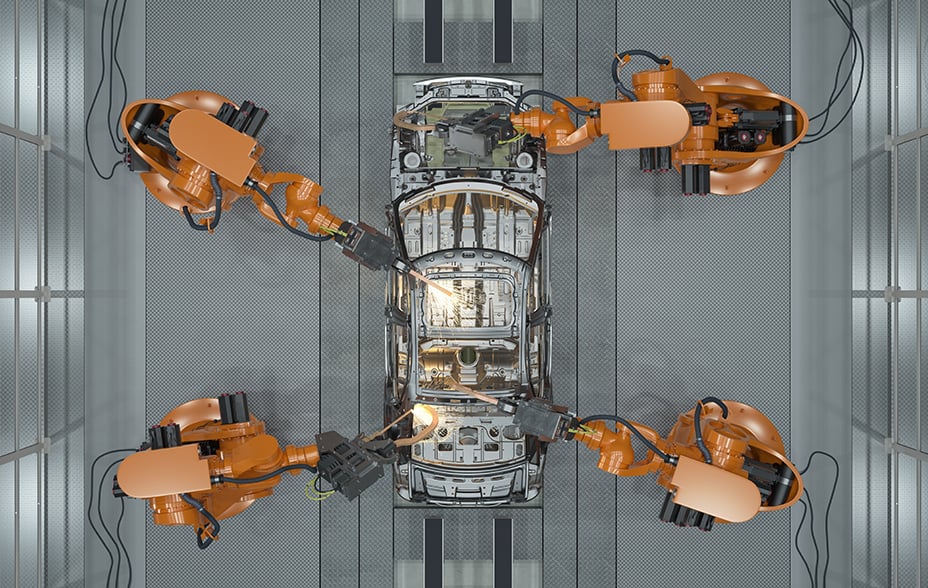

As global populations become increasingly large, well-educated and well-connected, humanity’s propensity for innovation has led to a series of industrial revolutions. They have included mastering steam power, electricity, radio communications, internal combustion engines, flight, assembly lines and computers.

An infographic published by the World Economic Forum illustrates how the compounding of generational knowledge has led each revolution to be more valuable than the last.

Six waves of innovation

Source: World Economic Forum. The history of innovation cycles.

The current ‘sixth wave of innovation’ represents the latest highly valuable era of change. Technologies – including artificial intelligence (AI), gene editing and advanced robotics – are coming together to break down barriers between the physical, digital and biological worlds.

These breakthroughs have created entirely new industrial opportunities for healthcare, which a new generation of growth companies are seizing. Moderna, for instance, is using humanity’s accumulated knowledge of genetics to build a new realm of treatments with messenger RNA. This marks an astonishing paradigm shift. The European company Genmab is another pioneer, making big leaps forward in immunotherapies for cancer.

You can also witness innovation’s progress in the development of renewable energy. Solar power is becoming more efficient, and its rapid price deflation makes it increasingly attractive to consumers and investors. Other advancements include electricity distribution and storage as batteries and other equipment come on leaps and bounds. Global electricity usage is expected to double by 2035 and triple by 2050, according to McKinsey & Company.

Other companies leading the energy transition include the Israeli solar inverters business SolarEdge, the Danish wind turbines company Vestas and the US manufacturer of electric vehicles and static storage Tesla.

© Genmab

The need for patience

Change does not come free. It requires investment and hard work. Spending on research and development is equivalent to charities taking a risk to gain potential future rewards.

Innovative companies also require a lot of patience. Henry Ford didn’t build his mass-production car assembly lines in a day. And ASML didn’t develop its ground-breaking machines to make computer chips overnight.

Growth investors recognise that the best-performing stocks over the long term are often the most volatile over the short term, so must be patient.

However, humans are not naturally good at being patient. We can see that impatience writ large on the stock market, where the average holding period for a company is less than a year – nowhere near long enough for a company’s competitive advantages to turn into substantial growth, nor to be aligned with charities’ time horizons.

The best solution for this is institutional patience. Business leaders need to instil a long-term perspective into company culture. This includes investment firms. Despite its challenges, backing transformational growth companies can be extremely rewarding when it results in significant share price growth.

The long tail of positive outcomes for companies allocating more capital to growth versus returning cash to shareholders shows that these companies can benefit from investing in innovation.

Take Intel in the 1970s as one example. It was an economically challenging decade: armed conflicts, oil crises, inflation, unemployment, slow economic growth and the struggle to transition from manufacturing to service-based economies. However, Intel’s share price grew nearly 20 times during the troubled period. It achieved this via creative destruction. Intel recognised the forthcoming revolution in personal computing and invested heavily to create its fantastic 8080 and 4004 microprocessors. It grew its profits rapidly, and its share price followed suit.

Although it is a 50-year-old example, it is analogous to today. The 2020s’ macroenvironment has become more challenging, but change remains a powerful growth driver thanks to our generation’s industrial revolution.

Interestingly, due to a lack of investment, Intel has now ceded ground to another disruptive growth company, Taiwan Semiconductor Manufacturing Company (TSMC), which spends heavily and patiently to lead the field. The deep cycle of creative destruction continues.

Innovative companies need capital, time and supportive shareholders to realise their potential, but the rewards can be profound, whatever the economic weather.

What is exciting about the modern industrial revolution is the sheer scalability of the factors involved. There will likely be enormous demand for things like accelerated computing, AI, drones, clean technology and biotech. Today’s industrial revolution is underway, and it is astonishing. And those of us who are growth investors need to be patient so that our clients, including those who are charities, can benefit from it over the long term.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited 柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 72303 10039939